Summary:

- Hudson Technologies is a leader in the niche market of refrigerant reclamation.

- Thanks to strong tailwinds and secular trends, the company should see strong results.

- However, Mr. Market didn’t like one piece of news during the last earnings call, leading to an overreaction.

- In this article, I want to explain why the drop is an opportunity.

J2R/iStock Editorial via Getty Images

Introduction

Hudson Technologies (NASDAQ:HDSN) is one of my three top picks for 2024, together with Canadian National (CNI) and Dell (DELL). In fact, in 2024 the legislative context around Hudson has changed, creating the right conditions for the company to flourish. However, after Hudson reported its Q4 2023 earnings, the stock dropped 18.50%. Let’s then take a look at the report and see what is going on with this company and its stock

Hudson Technologies: Business Overview

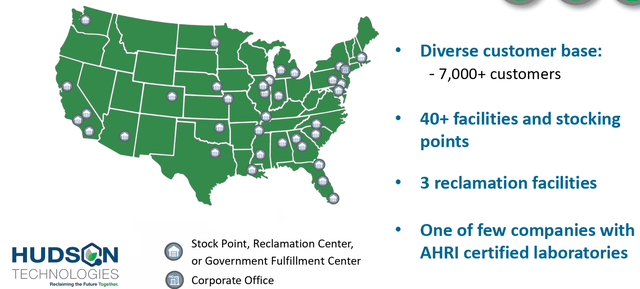

Hudson Technologies is the largest EPA-certified refrigerant reclaimer in the U.S. In other words, thanks to its patented ZugiBeast, it has the technological know-how to reclaim used refrigerants, clean them, and resell them to the end user. In the U.S. it holds approximately 35% of the market, with the rest of the pie being fragmented between many local and smaller players. Hudson, in fact, is the only company with a national scale, having more than 40 facilities and stocking points and three reclamation facilities in California, Georgia and Illinois. It also owns two of the only four AHRI (Air-Conditioning, Heating, and Refrigeration Institute) certified laboratories in the country.

HDSN Investor Presentation

Apart from operating in a very special niche, where the company is a leader, there’s also a regulatory landscape that’s set to greatly benefit Hudson.

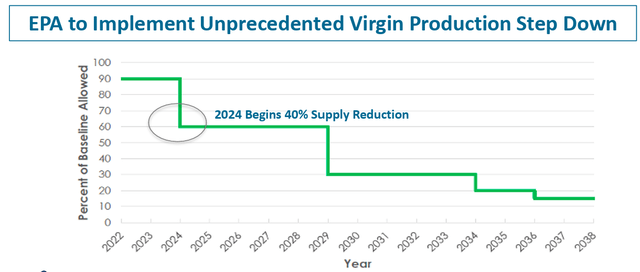

Starting in 2024, the EPA mandated a 40% baseline reduction in virgin HFC production and consumption allowances until 2028. This implements the AIM Act legislated byCongress, which already asked for a 10% baseline reduction in 2022 and 2023. While virgin HFC production and consumption are capped, there’s no such limitation on reclaimed refrigerants. According to Hudson’s management, there are around 125 million stationary units in the country using HFC and legacy refrigerant systems. Over the next two decades, these systems will be gradually replaced, but, in the meantime, their need for refrigerants will be high, and virgin refrigerant supply will be scarce.

HDSN Investor Presentation

These regulations help Hudson because the company is positioned at two strategic points in the supply chain since it operates both as a distributor of virgin refrigerants and as a producer of reclaimed refrigerants.

HDSN Investor Presentation

So, with all these tailwinds, why did the stock tank after the last earnings release?

Refrigerant prices

Before we dive into the results, we need to be aware of two risks Hudson faces: Inventory and refrigerant price volatility.

The first one is inventory risk with reclaimed refrigerants. Hudson buys used refrigerants from end users. Since Hudson uses a FIFO approach, we have on its balance sheet an inventory value close to the current market value. At the same time, the disadvantage is that Hudson matches its revenue to the sale inventory purchased at an old – and perhaps outdated – cost. So, if refrigerant prices suddenly drop, Hudson may be clearing its inventory at a loss. If refrigerant prices quickly surge in price, Hudson will sell at huge margins.

This is why, during the last earnings call, Hudson’s management was clear about its primary use of cash: “Our primary focus as far as the use of cash is concerned is inventory. In other words, if prices do go up later on in the year, we have to govern that first and foremost.”

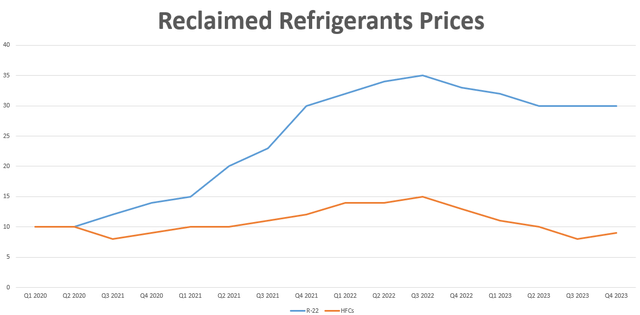

Unfortunately, even though I have researched a lot to find a refrigerant gas price index, I haven’t been able to find one yet. As a result, the only data I have is what Hudson quarterly reports during its earnings calls. I put together the available data shared by Hudson’s management and here’s a chart – more unique than rare, as far as I know – where we see the quarterly prices of R-22 and HFC refrigerants. It starts from the prices reported in Q1 2020, when the ban on the production of R-22 was completed and R-22 systems could rely only on recycled gases.

Author, with data from HDSN earnings calls

As we can see, once the ban on the production and import of R-22 was complete, R-22 prices more than tripled, moving in two years from $10 to $35 a pound, to then settle back to around $30 per pound.

HFCs have not yet shown such a trend because the reduction in virgin supply has just started. In 2022, we see a quick uptick in price, which now has settled once again around $10. However, as supply becomes scarce, I see no real reason why HFC prices should not track, more or less, what R-22 did.

Now, with HFCs touching $15/lb, Hudson was running at a 50% gross margin. With HFCs hovering between 8$-10$/lb, the company’s gross margin is closer to 35%.

Hudson’s Q4 2023 Earnings

Hudson reported some pricing pressure of certain refrigerants, mainly explained as early season customer purchasing patterns. We will have to see how HFC demand unfolds, but we will either see HFC price go up, or we will see demand for new AC systems soar due to a strong replacement cycle. The former outcome is more likely because AC systems are costly to substitute.

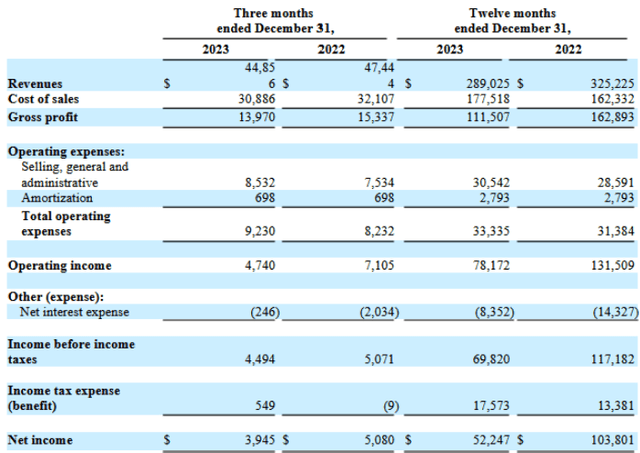

Looking at Hudson’s financials, we see a decrease of 5% in quarterly revenue and of 11% in yearly revenue, which came in just above $289 million. Gross profit for the full year was 39%, against 50% achieved the year before.

HDSN Q4 2023 Financial Report

As a result of lower gross margins, Hudson reported a significant decrease in operating income and net income. At the same time, the company was still able to report over $50 million in earnings.

Even though the cash flow statement has not yet been released, we know that Hudson’s strong free cash flow generation has been wisely used: The company is now debt free.

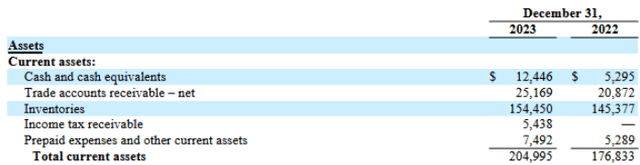

This makes the company’s balance sheet very strong and the fact that we are seeing inventories increase – though not at a fast pace – is quite less concerning than in the past. Moreover, we are seeing Hudson rapidly increase its cash pile.

HDSN Q4 2023 Financial Report

Speaking of cash and its uses, now that the company has no interest expense to face, it can more easily look for interesting M&A opportunities. In a highly fragmented market where Hudson has a different size and status than all its peers, it’s more than natural to expect Hudson to buy out some of its competitors and consolidate the industry. It will be important to see at what price Hudson will do this and what types of benefits these acquisitions can lead to.

Hudson aims to reach $400 million in revenue by 2025. Considering that 2024 should see higher refrigerant prices, I’m inclined to believe we should not be disappointed. With a 35% gross margin as the minimum goal, we are talking about gross profit of $140 million and a net income that should come in above $100 million.

So, once again, if everything seems working fine, what is wrong with the stock?

The catalyst making the stock fall

What concerned Mr. Market was the news that Hudson signed a contract with the Defense Logistics Agency serving the Department of Defense. In fact, DLA Aviation awarded an industrial gas support contract to Hudson to supply industrial compressed gases to military and federal activities worldwide.

Last year, this contract generated $53 million in revenue. But Hudson’s CEO disclosed that:

We believe that approximately $20 million of the 2023 DLA revenue was related to increased DLA-specific program activities that may not be repeated in 2024. Consequently, we may see DLA annual revenues return to more historical levels in 2024.

This means that around $20 million of the $289 reported could have been the outcome of a one-off event. As a result, investors’ growth estimates for 2024 should start from a top-line of $269 million. Since this goes along with some uncertainties about future developments of refrigerant prices, I think many investors just took their gains after the stock had a very nice run-up.

Valuation

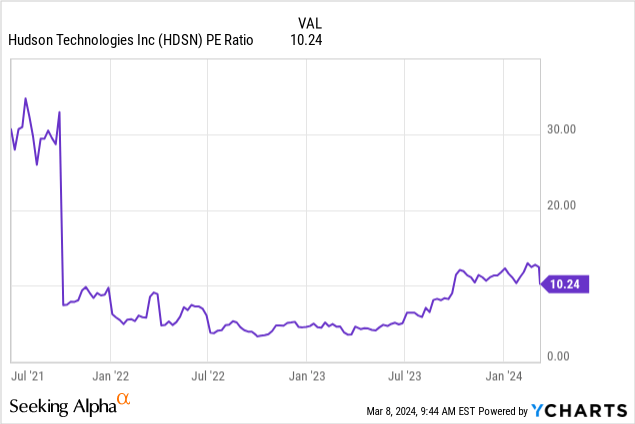

After Hudson’s price drop, its valuation grade is once again an A, with a PE of 10 and an EV/EBITDA of 7.3. Since we don’t have the new cash flow statement, we don’t have a new P/FCF metric. The TTM is 12.4.

If Hudson is to achieve $400 million in revenue by 2025 and $100 million in net income, considering a flat count of outstanding shares (currently at 45 million), we’re talking about 2025 EPS of $2.22. This is actually a fwd PE of 5.2, which is very low considering the stock’s PE in the past five years.

Moreover, the chart I showed above with refrigerant prices leads me to expect an increase in HFC prices in the next two years. In case this happens, revenues and margins will be quite higher.

I think a 2025 fwd PE of just above 5 shows a good risk/reward opportunity, considering the strong tailwinds that won’t just be wiped out from one day to the next.

As a result, after a few months where I have found it hard to buy new shares of any stock due to very high valuations, I finally see an opportunity. I rate Hudson as a buy and I’m buying more shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.