Summary:

- Hudson Technologies, Inc. faces pricing headwinds in 2024, but management is strategically purchasing lower-cost inventory, setting up for a stronger eFY25 and eFY26.

- Despite the near-term market headwinds, Hudson is focusing its attention on strategic acquisitions to scale regional growth.

- Hudson’s business model depends on the phase in of the EPA’s ruling on recycled refrigerants, with states like California taking the initiative to phase out virgin production.

sturti/E+ via Getty Images

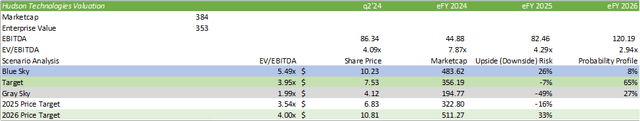

Hudson Technologies, Inc. (NASDAQ:HDSN) is currently undergoing a trough year as refrigerant prices decline with offsetting volume sales. Despite the pricing headwinds, management is being opportunistic in purchasing inventory at a lower cost and is setting up the firm for a stronger eFY25. Given the EPA policy phase-in for recycled refrigerants, I believe eFY26 will be a strong growth year for Hudson and expect shares to reflect this upswing in CY25. Given these factors, I am downgrading my recommendation to a HOLD rating with a 2025 price target of $6.83/share at 3.54x eFY25 EV/EBITDA and a 2026 price target of $10.81/share at 4x eFY26 EV/EBITDA.

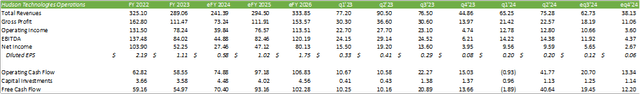

Hudson Technologies Operations

Hudson has faced significant pricing headwinds in 2024. In Q2 ’24, certain refrigerants experienced a -25% price decline, with HFC experiencing a -6% decline. Despite this challenge, prices are being offset by volumes demanded, with a 17% increase in volume sales in Q2 ’24 on a year-over-year basis. Management suggested in their Q2 ’24 earnings call that refrigerant prices will likely remain suppressed through the duration of the buying season.

At the current refrigerant pricing level, management anticipates eFY24 revenue to come in at $240-250mm with a gross margin of 30%. This would result in a -14% to -17% decline in total revenue from FY23. For reference, gross margin was 50% in FY22 and 39% in FY23. Though this would render a significant drop in profitability for eFY24, I believe that the firm will remain net positive for the duration of eFY24.

Forecasting Q3 ’24 & Q4 ’24 using these presumptions, I believe revenue will come in at $62mm & $38mm, respectively, with gross margins of $18mm & $11mm. With these expectations, I’m forecasting eFY24 revenue to come in at $241mm with a gross margin of $73mm. I’m expecting net income for eFY24 to come in at $27.5mm as a result.

Despite the short-term headwinds, the long-term strategy remains intact. Hudson’s positioning for recycled refrigerants remains strong and is poised for a major upswing as regulations phase down virgin refrigerant use. Essentially, Hudson is aiming to create a closed-loop system of refrigerant recycling.

Hudson brought on Brian Bertaux as CFO as announced in Q2 ’24. Mr. Bertaux was previously at Trex Company (TREX), where he helped grow the firm from generating $100mm per year to over $900mm through both organic and inorganic growth.

As part of its growth goal, Hudson is planning to further engage in M&A. In June 2024, Hudson acquired USA Refrigerants for $20.7mm.

USA Refrigerants generated around $20mm in revenue per year for the last 3 years, roughly 7% of the scale of Hudson in terms of revenue generation. Though this is a relatively small acquisition, USA Refrigerants should add to Hudson’s total network bandwidth and allow for further reach for refrigerant reclamation and recycling. These types of deals are relatively common in the industrials/materials industry, as seen with firms like CRH (CRH) and Rush Enterprises (RUSHA) where fragmentation of the industry creates an opportunity for multiple, small, regional acquisitions. Accordingly, small acquisitions like this have become part of Hudson’s growth strategy; management has created a dedicated team to focus on sourcing deals similar to USA Refrigerants to accelerate this process.

One major component to Hudson’s growth strategy is the final ruling for refrigerant reclamation. More stringent rules for the use of recycled refrigerants will provide a tailwind for Hudson’s reclamation business, as fewer virgin refrigerants are produced and utilized. California has already adopted a mandate for the use of reclaimed refrigerants that will be enacted in 2025.

Hudson Technologies’ Financial Position

I have reason to believe that eFY24 will be a trough year for Hudson given the pricing and margin headwinds. Management suggested that even if prices remain flat in eFY25, margins should experience an expansion given the firm’s inventory accounting.

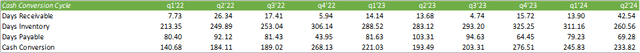

Despite the challenging 1h24 and headwinds going into e2h24, I believe Hudson will be well-positioned for the eFY25 buying season. The firm is currently cycling out its higher-cost refrigerants in inventory as it reports on a first-in, first-out basis, allowing for cheaper inventory to cycle in as the firm replenishes reclaimed refrigerant. Though management doesn’t go into the pricing details, I have reason to believe that the next buying cycle can be margin-accretive.

This factor can also positively impact free cash flow generation, as working capital investments for the needed inventory levels may create an appealing cash outflow as inventories are replenished. This means that the firm will have a lower cash outflow to build inventories, given the price of reclaimed refrigerants. Looking through eFY25, this factor can positively impact free cash flow generation through both margin improvement and lower working capital investments. This factor is likely one of the reasons days inventory outstanding reduced from 311 days in Q1 ’24 to 260 days in Q2 ’24.

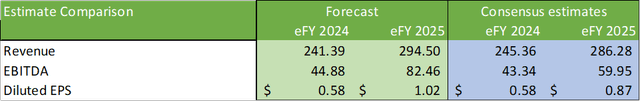

Comparing estimates, I’m forecasting a stronger eFY25 when compared to consensus estimates, with revenue coming in at $294.5mm and a diluted EPS of $1.02/share. Given the margin-accretive pricing for inventory experienced in FY24, I believe Hudson can anticipate an upswing in margins that will trickle down to EPS improvement. Assuming pricing for recycled HFC improves in states like California, Hudson may experience some revenue accretion as other states adopt more stringent regulations for recycled refrigerants.

Valuation & Shareholder Value

Hudson enacted a share repurchase program in Q2 ’24 for $10mm. At the current share price of $8.12, this can remove 1.2mm shares from the float, or roughly 2.6%.

Despite this factor, Hudson has some exogenous factors that must play out in order for the firm’s business model to successfully scale. Given that public policy is the biggest hang-up for future growth, I believe that Hudson may be a 2025-2026 story.

Valuing HDSN shares, I believe that the shares may continue its declining route throughout the duration of eFY24 to reflect the challenging economic conditions, with a strong upswing in 2025 as the firm exits the trough and experiences growth in eFY26. Given these factors, I am rating HDSN shares with a HOLD rating with a 2025 price target of $6.83 and a 2026 price target of $10.81/share. I believe that 2024 & 2025 will be a great time for investors to begin building a position in HDSN shares, anticipating the upswing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.