Summary:

- Hudson Technologies has major secular tailwinds at its back.

- Despite revenue and gross margin declines, Hudson is poised to benefit from growth in the refrigerant reclamation market.

- The acquisition of USA Refrigerants strengthens Hudson’s position in the market, and increases its potential for increased sales and margins.

- HDSN stock is considered a Strong Buy for long-term investors.

alacatr/E+ via Getty Images

Investment Thesis

Hudson Technologies (NASDAQ:HDSN) stands to benefit from potentially massive growth in the refrigerant reclamation market. Not only is this market expected to grow between 10.0% and 10.5% annually, but the AIM Act could act as an accelerant to that growth outlook by phasing out the production of virgin refrigerants and increasing the supply of recycling of existing refrigerants and the sales of reclaimed refrigerants. In my first article on Hudson, I explained how this market could double that growth rate. However, the supply impact of the AIM Act has been delayed by stockpiled refrigerants, which I explained in my second article. Since then, the stock has fallen further on fears of lower growth. My sales ratings are underwater, but I believe I am early to the party, rather than showing up at the wrong door.

Since my last article, Hudson has lowered near-term expectations, seen revenue and margins decline further, made a change at CFO, and acquired USA Refrigerants for $20.7 million. I believe the USA Refrigerants deal might be the perfect bolt-on acquisition for Hudson, and that the near-term weakness is creating a great opportunity for long-term investors.

My investment thesis hinges on increased demand for and sales of reclaimed refrigerants and increased prices of both virgin and reclaimed refrigerants. I believe the long-term opportunity still exists, but Hudson must weather a rocky period before returning to expanded margins. In my opinion, HDSN is still a buy.

Financial Discussion

During the conference call, management gave some insight into the Q2 results. Revenue declined 17% YoY due to two main factors: lower revenue realized from Hudson’s DLA contract and because refrigerant prices declined significantly. On a positive note, the company reported a 17% increase in volume, following a flat Q1. All told, volume has been up in the high single digits throughout H1 of 2024. Inventory decreased 16.2% QoQ, from $147.8 million at the end of Q1 to $123.7 million at the end of Q2. As compared to Q2 2023, some refrigerant prices fell 25%, and HFC prices fell 6% since Q1. Lower selling prices were the main reason for Hudson’s gross margin contracting to 30% from the prior year period of 40.5%. Normally, a significant decline in gross margin would be worrisome, but in this case, it’s largely due to the nature of a commodity cycle and low refrigerant prices.

On the expense side, SG&A increased from $8.3 million in Q2 of 2023 to $9.0 million this quarter. However, this increase was mostly a result of $700,000 in non-recurring expenses relating to the acquisition of USA Refrigerants and some IT improvement investments. For the remainder of the year, management stated that SG&A should roughly align with what it saw in 2023. With the decline in revenue and lower gross margin, Hudson saw a strong operating deleverage effect. EPS fell to $0.20, less than half of the $0.41 per share that it achieved in Q2 of 2023.

Here is a summary table of Q2 results for the last three years:

Q2 Financials (Author-generated table)

Looking ahead, management expects that the company can generate an FY 2024 revenue of about $240 to $250 million, with a gross margin of about 30%, if refrigerant prices remain where they are today. This signaled a reduction in the previous full-year expectations of $250 to $265 million in revenue, laid out by management following Q1 earnings. Worse yet, the company appears to have lowered gross margin expectations from below 35% to roughly 30%. Given that this decrease is a result of lower-than-expected refrigerant prices, this should pass. The company expects prices to rise due to the long-term phase-down of virgin supply and for margins to return to their long-term goal of 35%.

Inventory reductions were a significant reason that Hudson nearly quadrupled operating cash flow (“OCF”) to $41.8 million during the quarter. With no plans to increase inventory in the coming quarters, this isn’t necessarily going to reverse. As this inventory continues to turn over, the company will see the benefits of accrual accounting kick in, and earnings will rise as its higher-cost inventory is sold off first due to the FIFO method of accounting for inventory. This should improve gross margin and earnings, especially if refrigerant prices increase.

The balance sheet remains robust, with no debt, $30.5 million in cash on hand, and an additional $59.5 million available through its revolving credit facility. Hudson has the cash it needs to maintain operations, invest in growth, and fund other shareholder-friendly practices, such as buybacks. The strength of Hudson’s balance sheet might act as a significant advantage during the current times of low selling prices; it has enabled the company to make a strategic bolt-on acquisition by acquiring USA Refrigerants during Q2 and makes the company very anti-fragile. This balance sheet strength could allow Hudson to make more strategic acquisitions if accretive and cheap enough. The company also stated it plans to initiate a $10 million share repurchase program that could take advantage of a cheap stock price and return some capital to shareholders.

USA Acquisition

With the acquisition of USA Refrigerants for $20.7 million plus the potential for additional earnouts, Hudson intends to strengthen its position in the refrigerant reclamation market. USA is said to be very skilled at sourcing reclaimed refrigerants, which Hudson’s management admitted the company lacked. By bringing USA on board, Hudson says it can establish a dedicated refrigerant acquisition group, significantly boosting its ability to source and ultimately sell reclaimed refrigerants. With over 25 years of operation in the industry, specializing in the recovery, reclamation, and distribution of various refrigerants, USA also brings its customer base into the fold, adding to Hudson’s market-leading position in U.S. reclaimed refrigerant sales. USA generates roughly $20 million in revenue each year and was acquired at no greater than a 6x EBITDA multiple, based on Hudson CEO Brian Coleman’s statement in the press release announcing the acquisition.

As the phase-down of virgin refrigerants begins to take shape, gaining access to reclaimed products may be a very important factor in Hudson maintaining its position in the market. I think the ability to tap into the USA’s expertise to solve a problem that Hudson wasn’t effectively addressing could help protect the company’s market share position by preventing larger HVAC/R players from making easy inroads deeper into the market by exerting their force and purchasing up reclaimed supplies and limiting Hudson’s ability to scale.

CEO, Brian Coleman, had this to say about the USA acquisition.

“We are excited about the potential of this acquisition to help scale our capabilities related to sourcing recovered and reclaimed refrigerants, enabling us to drive increased sales of these higher margin refrigerants as current and future phase downs of virgin refrigerants create supply/demand imbalance in the marketplace.”

From the outside looking in, this appears to be a smart move by Hudson. At 6x EBITDA, the acquisition could pay for itself in 6 years or less. Considering the potential benefits of integrating the two companies and the fact that it was an all-cash transaction, the potential benefit for Hudson is high. Hudson is now a larger and more skilled company, which should strengthen its position as its opportunity grows. The USA should help Hudson source more recovered refrigerants than it was able to prior to the acquisition, which will allow the company to rely more on its own capabilities. On the flip side, the USA was almost completely reliant on sourcing its own recovered supply, as it was unable to gain access to virgin refrigerants. It’s potentially a perfect match.

CFO Change

Hudson announced that Vice President and Chief Financial Officer Nat Krishnamurti left the company to pursue other opportunities, and that Brian Bertaux would take Nat’s place in the CFO role. Bertaux has extensive finance experience, having filled various roles throughout his twenty years with Trex Company (TREX). His stay at Trex culminated in his role as Interim President of Trex Commercial Products. There do not appear to be any accounting-related problems leading to the departure of Krishnamurti. Still, the appointment of a new CFO is always something that needs to be monitored in the quarters ahead.

Free Cash Flow Growth

Despite revenue stalling and declining in recent quarters, Hudson has continued growing free cash flow (“FCF”). The company significantly improved working capital in the most recent quarter, boosting operating cash flow (“OCF”) from $10.6 million in Q2 2023 to $41.8 million in Q2 2024. This was a huge increase over the negative OCF in Q1 of 2024. Excluding the cost of USA Refrigerants, Hudson has generated $73.3 million in FCF over the trailing twelve-month period, a record amount despite revenue declining.

Hudson Growth Profile (Author-generated chart w/ data from SEC filings)

Hudson will have to get revenue growth and gross margin expansion back on track to maintain FCF growth, as working capital can only be optimized so much. As soon as Hudson can realize higher refrigerant prices, this should happen. I don’t doubt that the FCF will grow over the long run but believe we might see a pullback in TTM FCF before seeing it accelerate. This is modeled in my valuation below.

Valuation

Hudson has experienced impressive growth since 2014, growing revenue at a 17.7% CAGR, OCF at a 49.6% CAGR, and FCF at a 57.4% CAGR.

Hudson Growth Profile (FinChat)

In past articles, I have laid out my market growth expectations. The refrigerant market is expected to undergo long-term changes from the AIM Act. The supply impact of the act is being delayed due to larger-than-expected stockpiles of refrigerants, so the benefit to Hudson’s business is also delayed. However, the impact is expected to come in due time. Until then, the company appears to be trading at a significant discount.

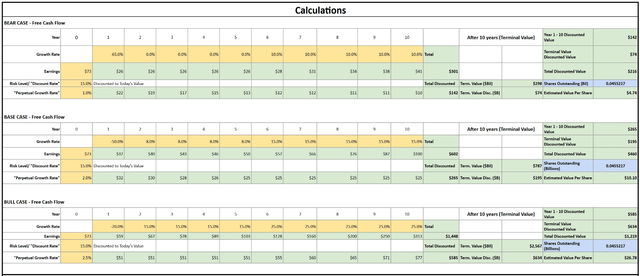

For my DCF model, I have created three scenarios: a bear case, a base case, and a bull case.

The base case implies a 50% decrease in FCF in year one, which is justified, in my opinion, due to the decline in revenue and gross margin experienced. The FCF growth rates for years 2-5 and 6-10 are 8.0% and 15.0%, respectively, which may be conservative considering the past growth rates. A terminal rate of 2.0%, roughly in line with GDP growth, and a 15.0% discount (or hurdle) rate to account for the risk in investing in a small-cap stock. My bear case implies a lower FCF growth rate in each period and a lower terminal rate. My bull case, implies a higher growth rate (lower decline in year 1), and a 2.5% terminal rate. I have weighed the probability of each scenario to 60% for the base case, 25% for the bear case, and 15% for the bull case.

Based on what I believe to be conservative assumptions, Hudson appears to be significantly undervalued, trading at a roughly 40% discount.

DCF Model (Author-generated DCF Model) DCF Calculations (Generated by Author)

Bear in mind that DCF models are inherently flawed. However, any time conservative assumptions are used, the model shows a tremendous potential for upside and less downside risk, and the company appears to be close to the bottom in commodity prices for the cycle; the model holds value.

Risks

The first risk is that Hudson is at the mercy of refrigerant prices. Any reduction in the long-term outlook for refrigerant pricing will dampen the potential for growth and, thus, stock returns. The AIM Act has yet to impact supply in the market, and the total impact is unknown now. However, it is designed to limit the new production and thus supply of virgin refrigerants, increasing the demand for reclaimed refrigerants. As the market leader in reclaimed refrigerant sales, Hudson stands to benefit over the long term.

An additional risk is not letting the thesis play out. Many investors are prone to selling stocks too soon. I believe in Hudson’s long-term potential. As long as Hudson’s results and the AIM Act continue to support my thesis, I will hold my shares. It could take several quarters or even a year or two to see any impact on the refrigerant market before Hudson sees a growth inflection. For impatient investors or those who don’t have high conviction in this thesis, it may be better to stay on the sidelines and look for confirmation of this growth first.

Conclusion

Hudson believes that the USA integration will help the company scale its recovery and reclamation capabilities and allow it to leverage the AIM Act-mandated phase-downs of virgin refrigerants. I agree with what management is doing. I believe this acquisition supports my thesis that Hudson can benefit from the rise in reclaimed gases and the increased prices from the future limited supply of virgin gases. Bolt-on cash acquisitions that help solve a problem and gain access to new customers are the perfect additions for Hudson.

Hudson’s strong balance sheet, market-leading position, and the AIM Act still make a strong case for accelerated free cash flow growth over the long run. With a good valuation, HDSN appears to be a good investment idea for investors willing to hold through volatility and slowly build a position over time. I maintain my opinion that HDSN is a strong buy, but caution investors that it may take time for this thesis to play out.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.