Summary:

- Hudson Technologies’ stock has experienced a significant correction due to lower-than-expected margins and the market’s uncertainty for future recovery.

- I think the company’s long-term prospects remain positive, with a dominant position in the U.S. reclamation market and strong regulatory support.

- Despite risks and uncertainties, the stock is attractively priced and has a potential upside of over 76% in the next 12-15 months.

sergeyryzhov

Introduction

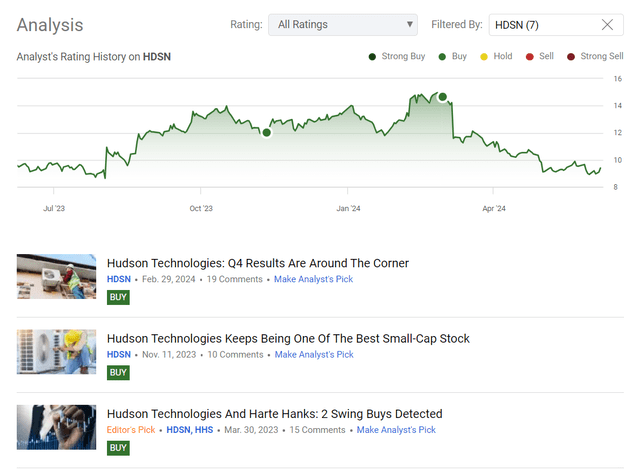

I started covering Hudson Technologies (NASDAQ:HDSN) stock in late 2021 when it was trading at ~$4 – since then, I’ve written about HDSN 6 more times, and each time I’ve updated my thesis, I’ve come to similar conclusions that the company is undervalued and has good operational growth prospects. For a long time, those bullish calls were perhaps the most successful in my “career” here on Seeking Alpha, until the stock started to crash:

Seeking Alpha, my coverage of HDSN stock

In today’s article, I will try to answer the following questions:

- Why is HDSN falling like a rock?

- Is the correction HDSN is still in today a temporary and natural phenomenon that will most likely end soon?

The Reason Behind HDSN’s Correction

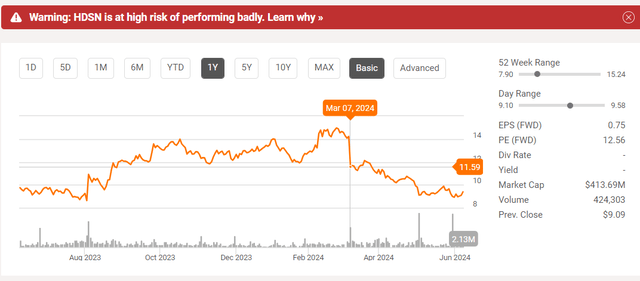

If you open a chart of Hudson Technologies’ stock prices, you will see that a correction began in early 2024. After a significant drop on March 7th, 2024, from $14.22 to $11.68 per share in just 1 trading session, the downward trend continued (today, the stock is trading at just $9.39/sh).

Seeking Alpha, HDSN

That stock price drop stock was clearly a reaction to the Q4 2023 report released on March 6. The company reported EPS of $8 cents, which was in line with expectations, while the revenue exceeded estimates by >$4.5 million. One visible reason for the fall might be “market fatigue”, as investors might have been hoping for a quicker recovery in the company’s margins. For example, in Q4, HDSN’s revenue fell by 5%, and the gross margin decreased to 31%, which was below the long-term goal of 35%. Operating income also dropped by 33.8%, leading to a similar decrease in EPS.

The refrigerant market is not very transparent, making it difficult for investors to assess its condition. We can’t easily track the price changes of the products the company sells and can only speculate based on seasonality and management comments. From what I understand, at that time, HDSN’s management wasn’t quite convincing during the Q&A session with analysts about the short-term market outlook – I believe this lack of confidence likely contributed to the ongoing correction in the stock price. It’s important to note that this trend was reinforced by the Q1 FY2024 results. Hudson was again able to beat estimates, but with prices for certain refrigerants down ~20% year-over-year, gross margins again disappointed investors and fell short of the long-term target.

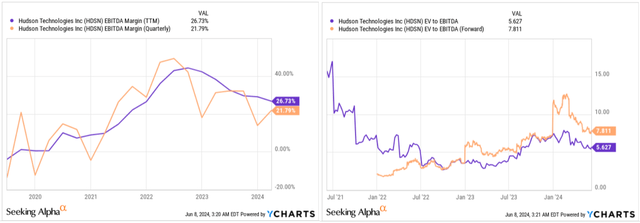

I think the problem here is precisely the margins because the valuation of the company had already risen significantly at the end of 2023 and the beginning of 2024 against the backdrop of rising gross margin (and not only gross) and expectations of its stability. As margins shrank, valuation multiples continued to fall.

YCharts, the author’s notes

Okay – Is It Time To Buy HDSN Stock Again?

Based on the firm’s IR website, Hudson Technologies offers environmentally sustainable solutions for HVACR, promoting energy efficiency, and sustainability through recovery, reclamation, and reuse of refrigerants, emergency repairs, and responsible disposal of carbon trading offsets. What initially attracted me to the company back in 2021 was its dominant position in its niche U.S. reclamation market. Holding the lion’s share of ~35% of the total market, HDSN has established a genuine moat, a competitive advantage setting it apart from competitors.

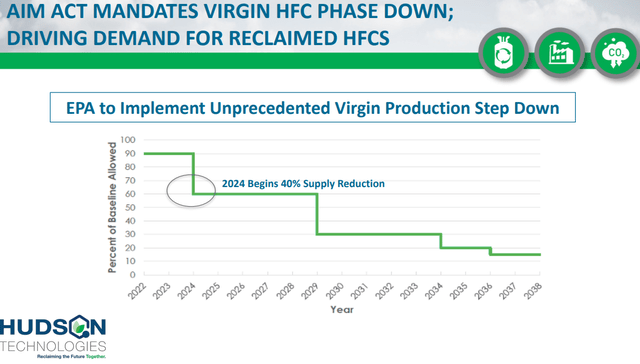

What also impressed me was the strong federal support the company receives – this support allows Hudson to secure exclusive government contracts and benefit from tightening regulations. For instance, the push to replace old refrigerants with new ones and initiatives like the AIM Act that creates a 40% reduction in HFC virgin supply this year to combat climate change significantly bolster Hudson’s business, providing a long-lasting tailwind and revenue visibility, in my opinion.

HDSN’s IR materials

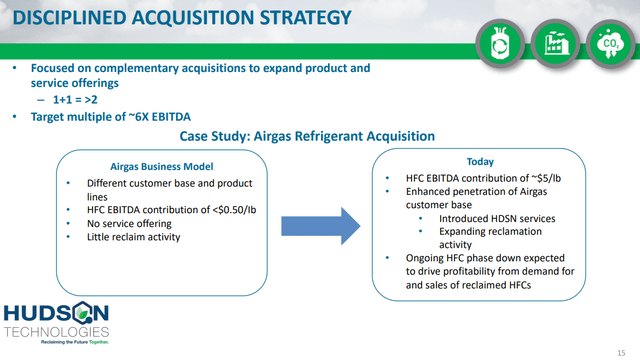

In case you haven’t heard about it before, the AIM Act mandates a reduction in new HFC production and encourages recovery, consistent with Hudson’s ability to service and convert over 125 million installed HFC units (based on the IR materials). In addition, the circular economy of refrigerants and the fragmentation of the market offer Hudson significant growth opportunities: the stricter regulatory environment and compliance will put pressure on smaller operations, creating strategic acquisition opportunities for Hudson to strengthen its market position and expand through acquisitions by leveraging its expertise and scale. As confirmation of these words, we can see the recently announced acquisition of the leading national refrigerant distributor USA Refrigerants for $20.7 million. Knowing that HDSN has been able to turn around the businesses of acquired companies in the past, I think this acquisition will further increase Hudson’s sales and profitability in the long run.

HDSN’s IR materials

All these positive factors remain relevant for the company. Although management doesn’t have a precise timeline for when these will impact refrigerant prices, there’s clear optimism in what I read from the most recent commentary:

Given the ongoing step down in virgin HFC production, as supply tightens, we do expect to see an increase in the sales price for certain refrigerants, but the timing is difficult to predict.

In the meantime, the lower pricing dynamic provides us the opportunity to replenish our inventory with lower cost refrigerants that we could then sell later this year and certainly next year. To be clear, we view the current pricing dynamic to be temporary in nature, and our longer term expectation of higher prices similar to the prior phase-outs remains the same.

Source: Q1 FY2023 Earnings call, emphasis added by the author

In my opinion, uncertainty is driving some investors to the desperate act of selling off their shares in the company. However, I think these investors should consider the future potential of the end market in which the company is the largest player. Given the current regulatory environment and the unique characteristics of this niche, the prospects are still looking good, in my opinion.

According to a recent study by Verified Research Reports, the refrigerant recycling market was valued at $25 billion in 2023 and is expected to reach $46.78 billion by 2030, with a CAGR of 10% over the forecast period. So assuming that Hudson Technologies maintains its ~35% market share, this represents a significant opportunity for further expansion as refrigerant prices normalize over time.

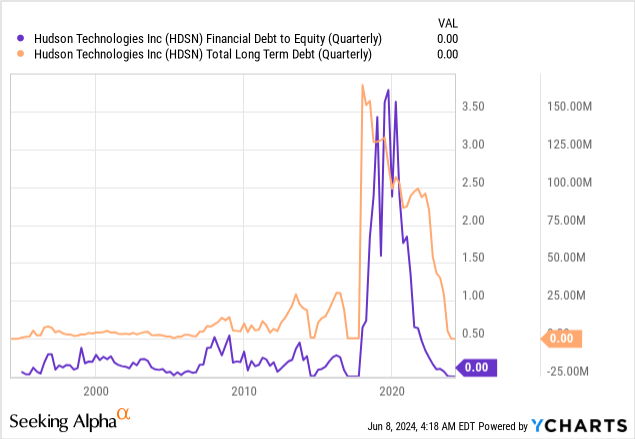

Yes, Q1 numbers weren’t actually that strong as Hudson experienced a notable decline in revenues (-15% YoY) and gross profit margins (39% to 33% YoY), but it seems temporary because the main reason is pricing issues. What caught my eye is that Hudson managed to nearly eliminate its interest expense due to achieving a zero long-term debt status, moving from $1.85 million to just $214,000 – this financial restructuring is a positive indicator of Hudson’s improved financial health amid all the challenges it faced recently.

Also, Hudson’s balance sheet still looks robust, with over $10.5 million in cash and a slight reduction in inventories from $154 million to $148 million. Given the lack of debt on the balance sheet, I think we can expect significant operating leverage to emerge once refrigerant pricing stabilizes. In other words, the forwarding company’s EPS should grow much faster than before because HDSN will not have to spend money on interest payments.

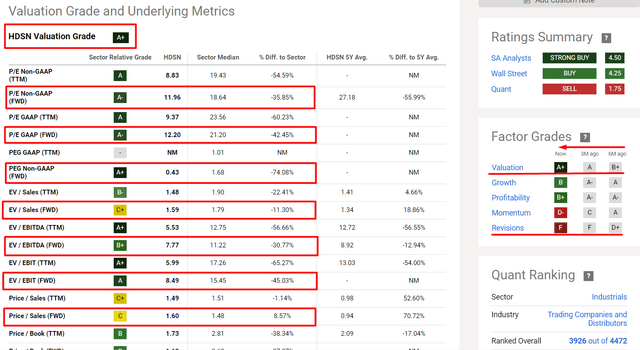

However, it’s noteworthy that the market apparently expects a longer recovery period for the company’s EPS, which has resulted in a substantial valuation discount relative to the sector’s median figures. For instance, HDSN’s valuation discount reaches about 74% compared to the sector’s median in terms of forwarding PEG ratio, according to Seeking Alpha’s Quant Rating. This rating currently assesses the company at a “A+,” a level it hasn’t reached in many months.

Seeking Alpha, HDSN’s Valuation, the author’s notes

Also, over the past 3 months, earnings estimates for EPS (and revenue) have been revised downward 4 times. At the end of February this year, analysts expected the company to make $1.58 in EPS for FY2025, but this estimate has since decreased by 36.7% (to $1). This significant reduction is likely due to the temporary pricing difficulties I noted above, so again, once these pricing issues subside, I anticipate that the same analysts will revise their forecasts upward, which should theoretically lead to an increase in the company’s valuation multiples.

HDSN’s end market selling prices are very opaque because, as I said, it’s a very specific niche – there are no reliable sources or data series that I can refer to for accurate information. As a result, I can’t do a simple regression analysis (or any other type of analysis) to predict HDSN’s future performance and, in the end, EPS numbers. Therefore, I’m simply assuming that selling prices will be higher in the future because management is talking about a supply shortage (and taking into account the persistent regulatory tailwinds). On May 1, 2024, Wall Street analysts predicted that FY2025 EPS would fall to $1.23 per share – I’m assuming their estimates were correct, so I’m getting a 23% premium to the current FY2025 EPS estimate. If the company’s market position is strengthened by the acquisition of competitors and selling prices increase as I suggested, the P/E could reach 15x by 2025. That would mean a fair value of around $18.45 per share, which is a bullish forecast, but quite feasible if my assumptions hold true. If only some of these assumptions hold true, e.g. the multiple remains at 12x but earnings per share are ~$1.23, then the fair value would be ~$14.76 per share. So my range for the fair value of the company today is between these two numbers, which suggests a growth potential of about 76.8% over the next 12-15 months, which is substantial.

Risks Are Still There

As I said earlier, Hudson Technologies operates in a niche market with significant growth potential, particularly in the area of HFC recovery. However, this potential is clouded by significant market uncertainties. You could see for yourself, that I couldn’t base my assumptions on any particular reliable data set as this kind of thing is likely non-public to date.

The cyclical nature of the refrigerant industry adds another layer of risk for Hudson. Sales are very sensitive to fluctuations in refrigerant prices, as demonstrated by the impact in Q4 FY2023 and Q1 FY2024, with similar trends probably expected in Q2. Economic downturns or recessions can exacerbate these revenue fluctuations by slowing the growth of the installed base of HFC systems. In addition, the high volatility of the company’s stock is not suitable for all investors: While some may see high beta stocks as an opportunity, others may find the wide price swings unsettling.

Hudson also faces risks related to regulatory changes, competition, and inventory management. The refrigerant industry is highly regulated, so Hudson must constantly adapt to comply with new environmental regulations, such as the AIM Act (the main growth driver right now). Failure to do so could result in fines, increased operating costs, or loss of market share. Effective inventory management is also crucial, especially given the fact that price fluctuations can lead to inventory write-offs.

The Verdict

Despite the above risks, Hudson’s strong market position and adaptation to regulatory trends offer promising prospects for those willing to deal with the uncertainties of the industry.

In my opinion, the company has taken a hit on its valuation due to a series of negative comments and actual figures that, while better than forecasts, were not very impressive in absolute terms. This has resulted in multiple revisions to future EPS and revenue forecasts. However, I believe that today’s forecasts are underestimated. The valuation rations have already fallen below the sector medians, making the stock look quite attractively priced. I see an upside potential of more than 76% in the next 12-15 months if the current cycle of lower refrigerant selling prices turns around and HDSN improves its financial performance by 2025 thanks to its high operating leverage.

All these factors make me optimistic so I believe the stock is worth buying at today’s levels. Moreover, the stock has fallen to its support level on the weekly chart – although I’m not a big fan of technical analysis, I think this is also worth considering.

TrendSpider Software, HDSN weekly, the author’s notes

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!