Summary:

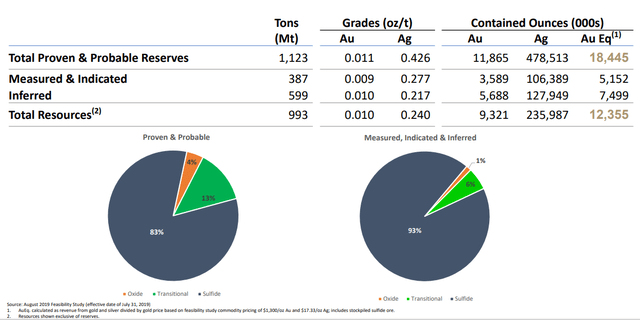

- The company’s flagship project has reserves of 11.9 million ounces of gold and 478.5 million ounces of silver.

- The after-tax net present value is $2.1 billion at $1,300 per ounce of gold and more than $4 billion at today’s gold prices.

- However, the grades are very low and most of the remaining material is sulfide, which could lead to a lot of technical issues.

- Hycroft Mining also had a $116.8 million net debt as of March 2021 and the red flags seem too many.

- I think that the company is heading to a funding shortfall, which likely means stock dilution. I’m bearish.

Investment thesis

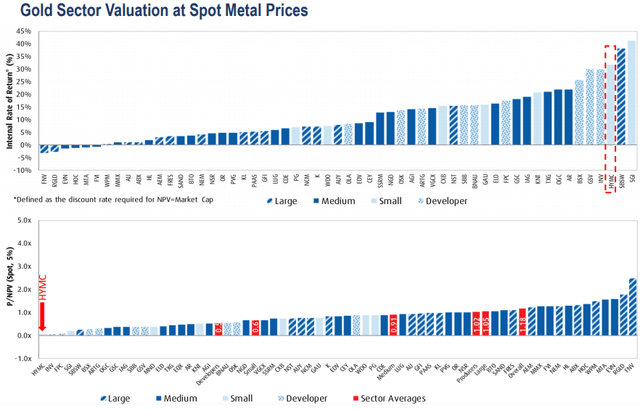

Hycroft Mining (NASDAQ:NASDAQ:HYMC) owns a gold and silver project under the same name in the U.S. state of Nevada. At the moment, its reserves stand at 11.9 million ounces of gold and 478.5 million ounces of silver, making it one of the best gold-silver projects in a Tier 1 jurisdiction in the world. Yet, the market values Hycroft at less than 0.1x the project’s after-tax net present value (NPV) and there are several reasons for this. The grades are low and almost all of the material is sulfide, which means that designing a good flow sheet could be tricky and recovery rates could be an issue. It’s an old mine that has been shut down several times in the past and I think the risk is just too high. Best to avoid or sell this one.

Overview of the Hycroft deposit

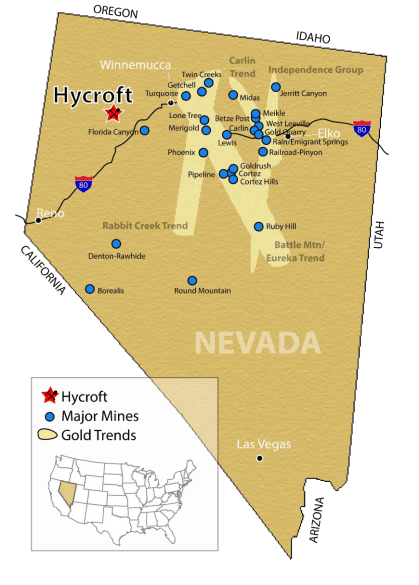

The project is located near the Florida Canyon gold mine of Argonaut Gold (OTCPK:ARNGF) and started out in 1983 as a small heap leach operation known as the Lewis Mine (page 16 here).

(Source: Hycroft Mining)

The project has historical production of around 2.1 million ounces of gold and 7.5 million ounces of silver and was shut down several times over the years, usually due to low gold prices. The most active period was from 1983 to 1998, when the mine produced 1.2 million ounces of gold and 2.5 million ounces of silver.

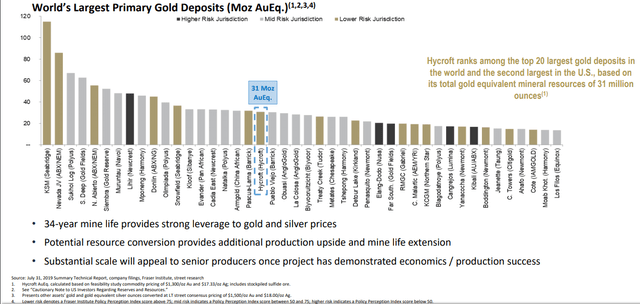

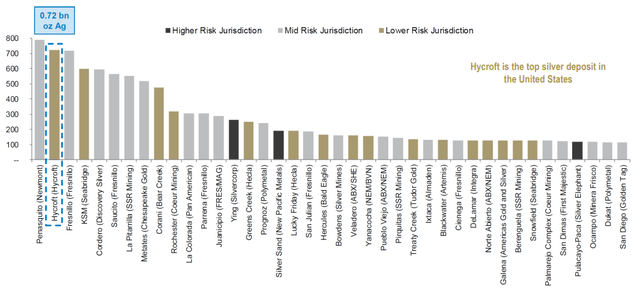

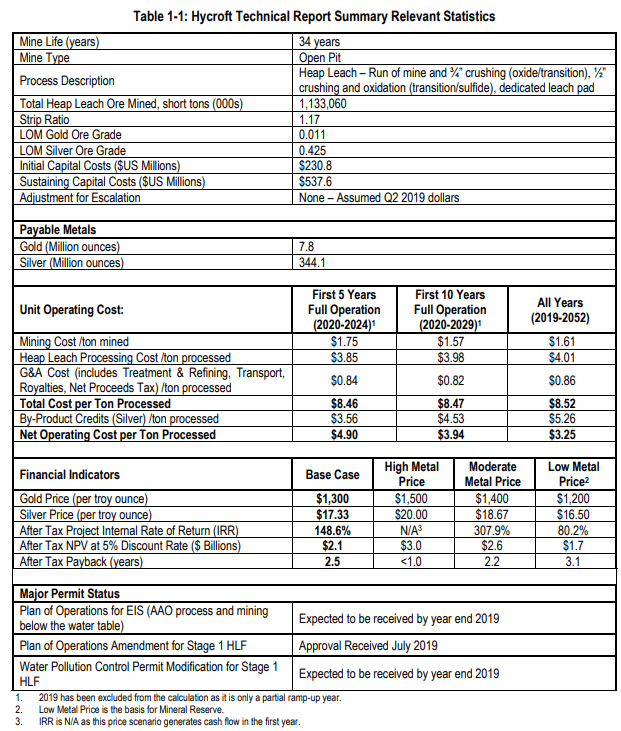

According to a 2019 heap leaching feasibility study, there is still a lot of gold and silver left in the Hycroft deposit. Enough, in fact, to rank it among the best low-risk jurisdiction gold and silver deposits in the world in terms of reserves.

(Source: Hycroft Mining)

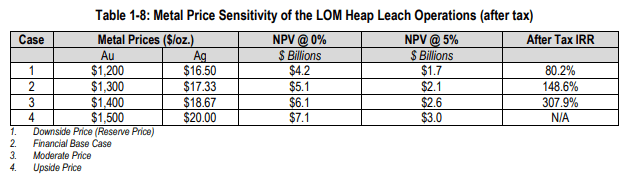

According to the feasibility study, the initial capital cost for a heap leach operation is estimated to be $230.8 million and the after-tax net present value of the project stands at $2.1 billion at a 5% discount rate. This is a compelling NPV number, especially considering that the study was based on gold prices of just $1,300 per ounce of gold.

The price of gold stands at over $1,800 per ounce as of the time of writing, which means that Hycroft’s NPV should be over $4 billion at the moment.

(Source: Hycroft Mining)

The mine life is expected to be over three decades and the strip ratio stands at just 1.17. Both of those are very good numbers for a gold mine.

(Source: Hycroft Mining)

(Source: Hycroft Mining)

However, you might’ve already started noticing some of the issues and red flags. The grades are very low and there is barely any oxide material.

(Source: Hycroft Mining)

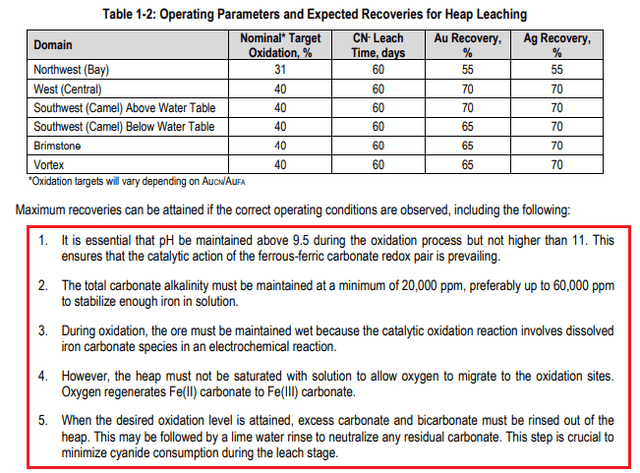

Leaching gold and silver from oxides is relatively easy, but processing sulfidic ore is challenging. The latter is refractory, which means that the gold particles are ultra-fine and this requires more sophisticated treatment methods in order to achieve oxide-ore recovery rates. According to the feasibility study, Hycroft plans to add iron (as ferric chloride) to the oxidation solutions but even then, there are numerous challenges to achieve adequate gold recovery rates.

(Source: Hycroft Mining)

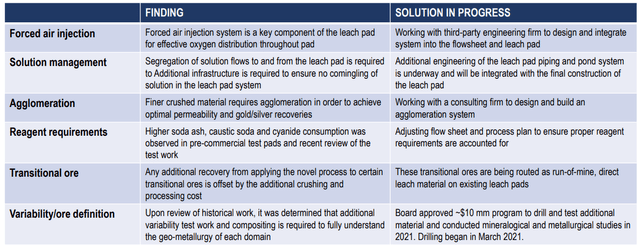

The company has ideas on how to deal with some of the technical challenges of this operation but I’m skeptical as these are technologies and methods that haven’t been proven on a commercial scale. There are a lot of things that can go wrong here.

(Source: Hycroft Mining)

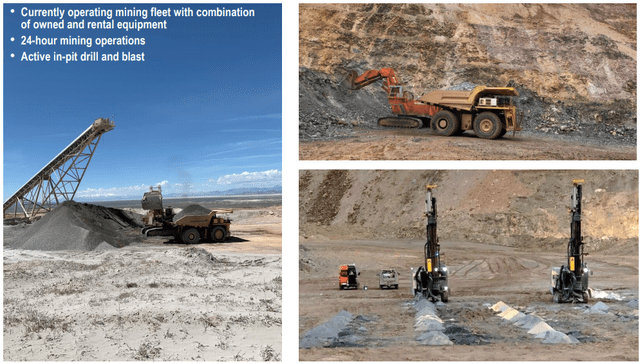

Another red flag for me is that Hycroft Mining plans to use a significant part of the old mining infrastructure. Sure, such a move can significantly decrease CAPEX, but there are operational risks involved. The nearby Florida Canyon mine used the same approach when it was owned by a company named Rye Patch Gold (the company no longer exists, the SA profile is here). SA contributors including me were optimistic about the prospects of the latter, but some of the refurbished equipment kept breaking down or underdelivering and the project still hasn’t lived up to its potential. The point is that using old equipment is risky and can result in higher costs down the line. At the moment, Hycroft Mining has a mining fleet, a crushing circuit, and a North Merrill-Crowe plant. As you can see, not all of them seem to be in a good condition.

(Source: Hycroft Mining)

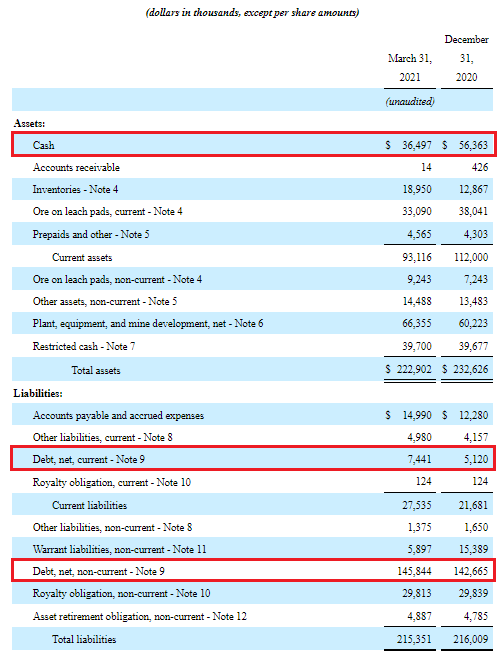

Looking at the financials, the picture doesn’t look good as the net debt stood at $116.8 million as of March 2021.

(Source: Hycroft Mining)

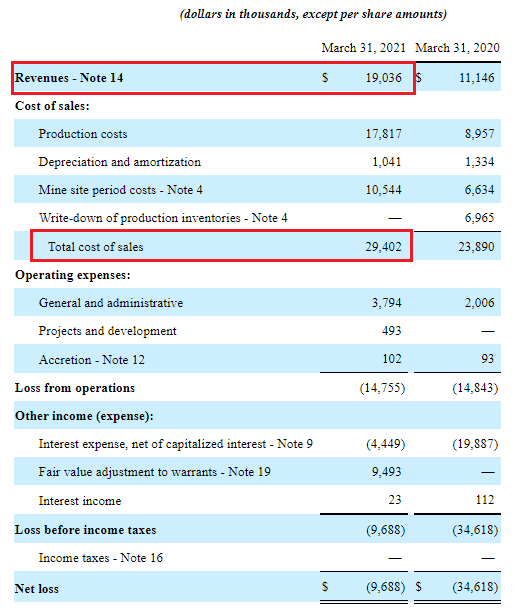

The company has decided to direct leach its run-of-mine ore, but this is proving to be unprofitable at the moment. In Q1 2021, Hycroft Mining booked a $14.8 million loss from operations.

(Source: Hycroft Mining)

Still, Hycroft Mining aims to develop a 3-5 year ROM plan to generate positive cash flows. It remains to be seen if this is possible.

Investor takeaway

The Hycroft gold and silver project looks great at first glance thanks to its high reserves and NPV. However, grades are low and most of there is almost no oxide material left to mine. Overall, I doubt that the Hycroft project will be able to reach commercial production without encountering significant technical or operational issues. This is set to lead to a funding shortfall for Hycroft Mining, which likely means stock dilution.

Hycroft Mining is pretty cheap compared to peers at the moment, but I think its valuation could fall lower due to the high debt load as well as the stock dilution risk. It’s possible this one is close to worthless.

(Source: Hycroft Mining)

According to Fintel, the short borrow fee rate stands at 16.37% as of the time of writing. This is relatively high.

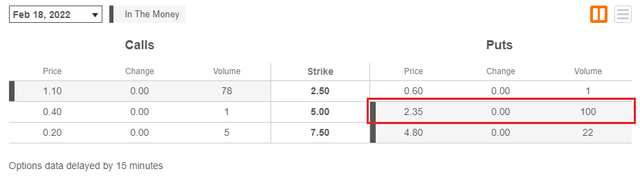

In case you prefer to protect the downside, I think long-dated put options are a good idea.

(Source: Seeking Alpha)

Or you could just avoid this one.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion – they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.