Summary:

- Hyzon Motors Inc. reported another set of quarterly results without any product revenue recognition and sizeable cash burn.

- As of July 31, liquidity was down to $158 million. Based on management’s cash burn projections, Hyzon would be required to raise additional capital in H2/2024.

- Following the receipt of a previously undisclosed Wells Notice in June, the company has accrued a $22 million loss contingency to account for a potential settlement.

- Adding insult to injury, Hyzon also disclosed a new supplier lawsuit which has resulted in the suitor obtaining an attachment covering Hyzon Europe’s bank accounts.

- While market participants’ increased risk appetite has resulted in Hyzon recently regaining compliance with Nasdaq’s $1 minimum bid price requirement, I would strongly advise investors to avoid the shares until the company has raised sufficient capital to execute on its plans.

Scharfsinn86/iStock via Getty Images

Note:

I have covered Hyzon Motors Inc. (NASDAQ:HYZN) previously, so investors should view this as an update to my earlier articles on the company.

Two months ago, I discussed Hyzon Motors Inc.’s recent efforts to revitalize the company following severe disruptions caused by short report allegations and a related SEC investigation as well as an internal investigation into revenue recognition, corporate governance, and internal control issues.

On Tuesday, August 8th, Hyzon released second quarter 2023 results and subsequently filed its quarterly report on form 10-Q with the SEC.

Company Presentation

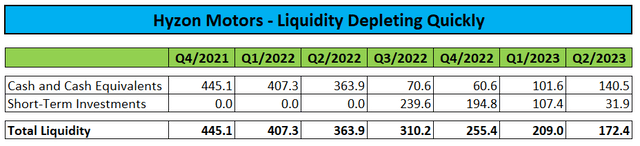

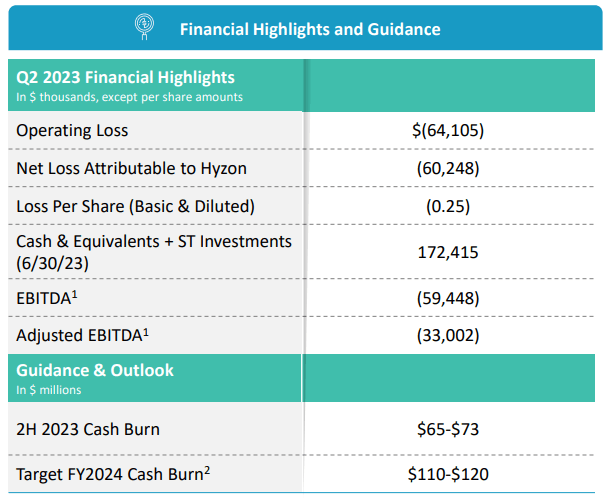

As it has been the case for several quarters now, Hyzon did not recognize any product revenue but continued to burn sizeable amounts of cash:

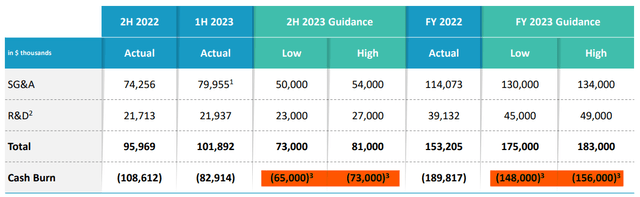

As of July 31, liquidity was down to $158 million. Based on management’s cash burn projections, the company would be required to raise additional capital in the second half of next year:

Keep in mind that expectations for cash usage do not include a likely, material settlement payment to the SEC following the previously undisclosed receipt of a Wells Notice in June (emphasis added):

On June 13, 2023, the Company received a “Wells Notice” from the SEC Staff, informing the Company that the SEC Staff had made a preliminary determination to recommend that the SEC file a civil enforcement action against the Company alleging violations of certain provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. (…)

Discussions with the SEC Staff regarding a potential resolution of the SEC investigation have been and remain ongoing. Based upon management’s assessment of the SEC investigation, the Company has accrued a $22.0 million loss contingency in the second quarter of 2023, of which $7.0 million is recorded in Accrued liabilities and $15.0 million in Other liabilities in the unaudited interim Consolidated Balance Sheets.

There is no assurance that this $22.0 million loss contingency will be adequate to resolve matters covered by the SEC investigation. (…)

The resolution of the SEC investigation or other regulatory proceedings could have a material impact on the Company’s liquidity and the Company’s ability to continue as a going concern if a significant monetary payment is agreed and paid or if the matter proceeds to litigation and a judgment is rendered against the Company.

Adding insult to injury, Hyzon also disclosed a new supplier lawsuit (emphasis added):

On July 28, 2023, Worthington Industries Poland SP.Z.O.O, a Hyzon Europe supplier, filed a complaint in the Amsterdam District Court in the Netherlands, against Hyzon Europe for breach of contract and obtained an attachment covering Hyzon Europe’s bank accounts. The complaint seeks damages from Hyzon Europe totaling €4.6 million (approximately $5.0 million in USD). The Company is awaiting receipt of the formal complaint from the Dutch court. The Company intends to vigorously defend itself against this claim.

On the conference call, management stated that it continues to work with a financial advisor on potential options for raising additional capital. However, considering the state of the company’s operations and current market environment, I am having a tough time envisioning Hyzon raising a material amount of new capital in a non-dilutive manner.

As a result, I would expect the company to pursue some sort of equity-linked offering in case market conditions improve sufficiently going forward.

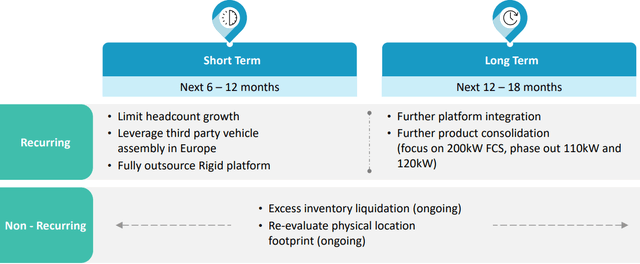

Management also outlined a number of strategic initiatives to reduce cash usage going forward by limiting headcount growth, using contract manufacturers, consolidating fuel cell platforms and reducing excess inventory:

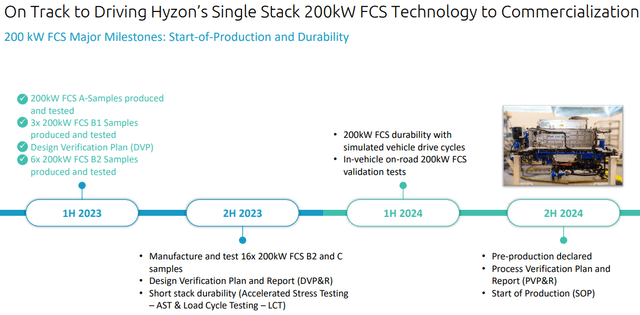

From an operational perspective, Hyzon continues to focus on executing on its recently revised business plan by preparing for the commercial launch of the company’s new 200kw single-stack fuel cell systems currently expected for H2/2024:

Bottom Line:

While new management has done a good job addressing a host of legacy issues and becoming current in the company’s regulatory reporting requirements, the company still lacks the capital to execute on its new business model even when considering a projected reduction in cash usage going forward.

Given the company’s stated intent to raise additional capital, investors will likely have to prepare for meaningful dilution going forward.

While market participants’ increased risk appetite has resulted in Hyzon recently regaining compliance with Nasdaq’s $1 minimum bid price requirement, I would strongly advise investors to avoid Hyzon Motors Inc. shares until the company has raised sufficient capital to execute on its plans.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.