Summary:

- Earlier this month, Hyzon Motors reported another zero-revenue quarter with sizeable cash burn eating further into the company’s rapidly deteriorating liquidity.

- While cash usage has decreased in recent quarters, the company will be required to raise a sizeable amount of additional capital by the second half of next year.

- The issue required Hyzon to include a going concern warning into the company’s quarterly report on form 10-Q.

- During the quarter, the company entered into a $25 million fraud charges settlement agreement with the SEC.

- Given the high likelihood of major dilution next year, I would strongly advise against an investment in Hyzon Motors Inc.’s shares at this point.

Scharfsinn86

Note:

I have covered Hyzon Motors Inc. (NASDAQ:HYZN, NASDAQ:HYZNW) previously, so investors should view this as an update to my earlier articles on the company.

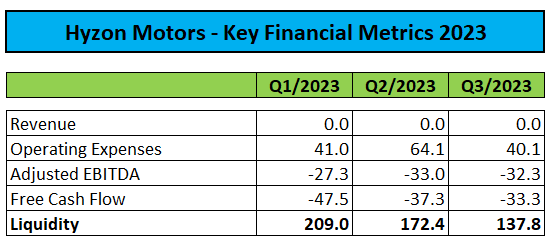

Earlier this month, Hyzon Motors Inc., or “Hyzon,” reported another zero-revenue quarter with a sizeable cash burn eating further into the company’s rapidly deteriorating liquidity:

Company Press Releases and Regulatory Filings

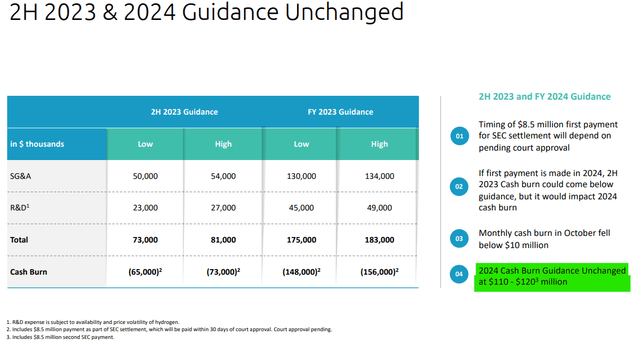

While management celebrated another sequential decrease in cash usage and reiterated previously-communicated expectations for full-year 2023 and 2024 cash burn, Hyzon will be required to raise additional capital in the second half of next year at the latest point.

In fact, the issue required management to include a going concern warning in the company’s quarterly report on form 10-Q for the first time (emphasis added by author):

The Company has concluded that at the time of the filing, substantial doubt exists about its ability to continue as a going concern as the Company believes that its financial resources, existing cash resources and additional sources of liquidity are not sufficient to support planned operations beyond the next 12 months. (…)

The Company’s business will require significant funding to execute its long-term business plans. As of October 31, 2023, unrestricted cash, cash equivalents, and short-term investments were approximately $129 million.

The Company plans to improve its liquidity through a combination of equity and/or debt financing, alliances or other partnership agreements with entities interested in our technologies, and the liquidation of certain inventory balances. If the Company raises funds in the future by issuing equity securities, dilution to stockholders will occur and may be substantial. (…) If the Company cannot raise additional funds when needed or on acceptable terms, the financial condition, business prospects, and results of operations could be materially adversely affected.

On the conference call, management remained optimistic on the company’s ability to raise additional capital, particularly after a recent $25 million settlement with the SEC removed a long-standing overhang:

The Securities and Exchange Commission today announced settled fraud charges against Hyzon Motors Inc., an upstate New York-based company that builds hydrogen fuel cell electric vehicles (FCEVs), for misleading investors about its business relationships and vehicle sales before and after a July 2021 merger with a publicly-traded special purpose acquisition company, or SPAC. (…)

According to the SEC’s complaint, Hyzon misrepresented the status of its business dealings with potential customers and suppliers to create the false appearance that significant sales transactions were imminent. The complaint alleges that Hyzon also falsely stated that it had delivered its first FCEV in July 2021, even going as far as posting a misleading video of the vehicle purportedly running on hydrogen, when the vehicle was not equipped to operate on hydrogen power. The complaint further alleges that Hyzon later falsely reported that it sold 87 FCEVs in 2021, when in fact it had not sold any vehicles that year.

With the SEC investigation now behind the company, new management can focus on raising additional capital and executing on the company’s revised business plan.

In recent months, the company has taken measures to rationalize its global footprint, implement a shared service model for procurement and engineering and transition to third-party vehicle assembly.

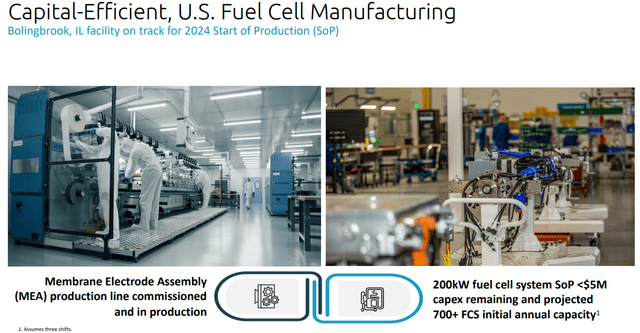

The restructuring program is expected to be completed by the end of Q3/2024, very much in line with the anticipated production start of Hyzon’s new domestic fuel cell manufacturing facility in Bolingbrook, Illinois:

With less than $5 million in capital expenditures remaining, the new facility will provide annual capacity for the assembly of more than 700 of the company’s new 200kW fuel cell systems designed for Class 8 truck applications.

Subsequent to quarter-end, Hyzon completed its first fuel cell truck sale in the U.S., with revenue expected to be recognized in the current quarter.

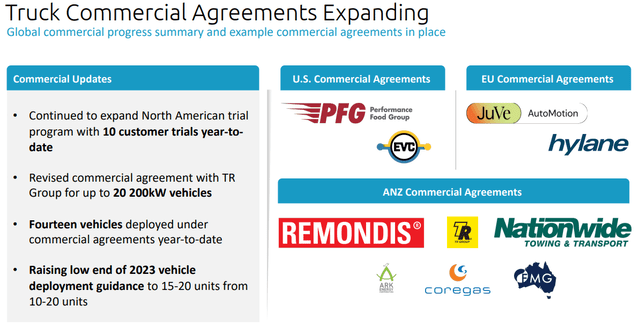

The company also managed to revise terms of a legacy agreement with New Zealand’s TR Group for up to 20 truck upfits with Hyzon’s new 200kW fuel cell system:

The first two trucks are scheduled to be ready for commercial trial beginning in March 2024, and will be deployed for up to three months. Following the initial commercial trial, TR Group has an option to purchase the two trial trucks as well as to upfit another 18 trucks with Hyzon’s 200kW fuel cell systems to be assembled at Hyzon’s Melbourne, Australia facility.

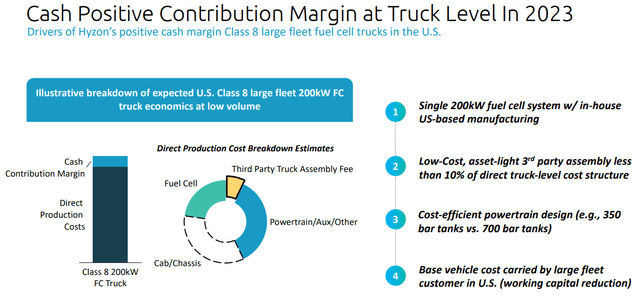

Please note that Hyzon expects to generate a positive cash contribution margin at the truck level from vehicles delivered to large fleets going forward:

Following the deployment of fourteen vehicles under commercial agreements year-to-date, the company raised the low end of 2023 vehicle deployment guidance to 15-20 units from the original range of 10-20 units:

Last month, Hyzon amended its intellectual property agreement with affiliates of the company’s controlling shareholder, Horizon Fuel Cell Technologies (“Horizon”), to facilitate expansion into the stationary fuel cell power applications market:

Under the amendment, Hyzon expands its market access to stationary fuel cell power applications in North America, in addition to its existing access to global fuel cell mobility markets. (…)

Hyzon is targeting its existing fuel cell IP, production technology, and manufacturing facilities to commercialize stationary products, including near-term demand in end-use applications such as data centers, the entertainment industry, battery electric vehicle charging and remote industrial power needs. (…)

The amendment also covers the option for Hyzon and Horizon to pursue joint development of a single stack 300kW fuel cell system, which Hyzon previously announced as part of its product roadmap. (…)

As amended, the IP agreement will remain in effect until September 2030. This is intended to ensure both companies retain the flexibility to adapt to the evolving hydrogen ecosystem while building on the foundation of their collaborative efforts, and opening the global stationary power market outside of North America to Hyzon at that time.

However, expanding the company’s product offerings will require additional funds.

So far, management has abstained from providing the amount of capital required to achieve cash flow breakeven under the revised business model but with commercialization of the company’s Class 8 truck fuel cell offerings still hampered by customers requiring extensive trials and the availability of green hydrogen, it’s difficult to envision Hyzon scaling up production to required levels anytime soon.

While the company continues to have no debt, I would expect any near-term funding agreement to provide for the issuance of equity or equity-linked securities, very similar to competitor Nikola Corporation (NKLA).

Consequently, existing equity holders will likely have to prepare for major dilution next year.

Bottom Line:

While Hyzon Motors Inc. has reduced cash burn in recent quarters, the company’s remaining liquidity deteriorated to a level that raises substantial doubt about the company’s ability to continue as a going concern.

With commercialization of the company’s Class 8 fuel cell truck offerings still in its very early innings, I would expect annual cash burn to remain above $100 million going forward.

As a result, Hyzon Motors Inc. will be required to raise additional capital in the second half of next year at the latest point.

With no visible path to cash flow breakeven, the company won’t be able to access the traditional corporate debt markets, thus, leaving the issuance of equity or equity-linked securities as the only viable option.

Given the high likelihood of major dilution next year, I would strongly advise against an investment in Hyzon Motors Inc.’s shares at this point.

In fact, existing equity holders should consider stepping to the sidelines until the company has raised sufficient funds to execute on its revised business model.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.