Summary:

- Hyzon is a company that has its own hydrogen fuel cell technology and a production line in Illinois. It is receiving orders for trucks powered by its fuel cells already.

- Hydrogen has lots of advantages, and it’s an interesting prospect, but it is still challenged.

- The problem with Hyzon is that you can’t examine its filings because it’s stopped filing them with the SEC, as it apparently ‘burdens them unreasonably’.

- It’s possible they have insufficient internal controls and accounting.

- Picks like Hyzon are just not appropriate in the current environment despite the case for hydrogen. Avoid.

No-Mad

Hyzon Motors (NASDAQ:HYZN) is yet another renewable energy-based vehicle company trading on US exchanges. This one is focused on hydrogen, touting its fuel cell technology and assembly line in Illinois, as well as some credible orders from various companies who want to deploy hydrogen powered trucks in their fleet. They’ve done some test rides of trucks on their technology already and they seem to be fine, but the issue of broader hydrogen adoption is still an issue, as well as the green versus grey hydrogen problem, which goes unsolved and still relies on renewable energy. These are market level problems, but the issue with Hyzon is that in addition to an uncertain hydrogen future, it has stopped filing its 10-Qs and Ks with the SEC as of two quarters ago, causing sell-offs. While some recent co-investments with Chevron (CVX) are somewhat reassuring, we still don’t know their financials in a period where issues like cash burn are essential as capital costs rise. Hyzon is just not the kind of pick you want to look at in the current environment.

Our Notes on Hydrogen

Hydrogen depends on it being green for it to be an actual sustainable solution. Grey hydrogen ultimately solves nothing, as hydrogen production would be powered by non-renewable sources. Green hydrogen requires that renewable sources are effective enough on a large enough scale to produce hydrogen, which is then used in fuel cells to create power. Hydrogen is made through electrolysis, which requires electricity, and functions more or less as a reverse fuel cell, to be converted back into energy later in cars or wherever else.

There are myriad challenges here. Infrastructure to store and transport hydrogen are costly and mostly non-existent, and would rely on strategic resources like PGM metals that have the plurality of their reserves in Russia. Production of hydrogen will have to be near the uses of hydrogen, and that would have to coincide with regions where renewable energy production can also be sufficient to power green hydrogen production at all. If it’s not an area where the major sources of renewable energy can be useful, then green hydrogen production will still be costly even without the logistics effects. Things like waste-to-energy, part of the complex of solutions Hyzon are interested in as part of their vertical integration, could help out. The investment into Raven along with Chevron is part of this concept. The legitimacy lent to the venture by Chevron explains yesterday’s teen spurt in price.

Since hydrogen is much more energy efficient than other green sources for powering vehicles, conversion of green electricity into hydrogen should be sufficient in yield and theoretically effective. Still, cost is an issue, and would have to decline 80% to meet viability goals.

One intermediate advantage of hydrogen is that it increases the capacity factors of renewable installations by allowing peak production but perhaps periods of lower usage on the grid to be linked over time by the use of hydrogen fuel cells as energy storage.

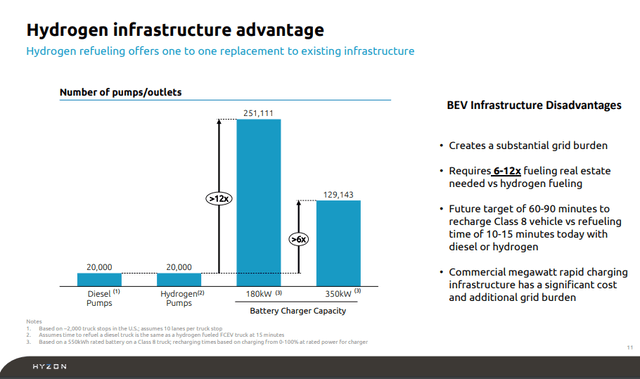

Infrastructure related to storage and transportation is still a concern, and green hydrogen ultimately rests on renewable energy production, which is dawning on investors as likely a more marginal source of energy for the long-term than expected. However, less real estate would be required to supply hydrogen than with electric stations. The time it takes to charge is also solved by hydrogen, which was a capacity problem for battery powered vehicles.

Hydrogen Infrastructure (Q1 2022 Pres)

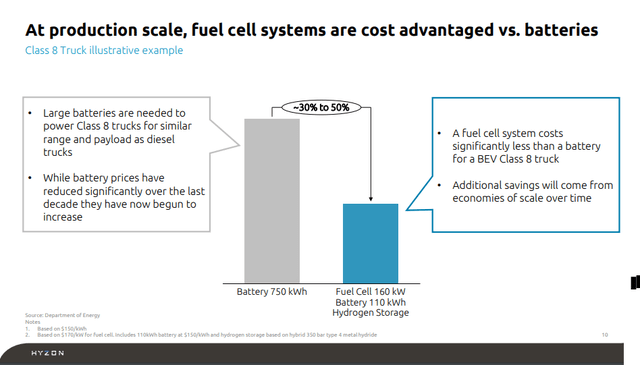

Hyzon is focusing on the truck market, where electrification is more limited due to the necessary weight of the batteries, which would actually monopolize 20-30% of the payload a truck could carry. Also batteries don’t scale well in terms of cost relative to their physical size, and have reached the trough in terms of cost, now beginning to rise with supply chain and sourcing issues.

In general, hydrogen outperforms it in terms of fuel efficiency and is seen as a longer term solution.

Glaring Issues with Hyzon Motors

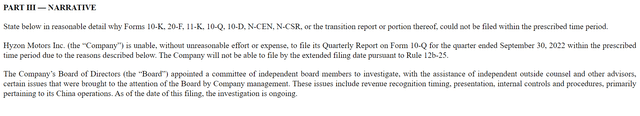

Moving on to Hyzon specifically, the first thing to note is that there is no Q2 or Q3 2022 presentation or SEC filing. They gave note of their late filing with the following reason.

When this first happened half a year ago, the stock tanked 40%. Continued late filing notices are a concern over internal accounting and control. We can also not track their cash burn, which is essential in the current market given costs of capital.

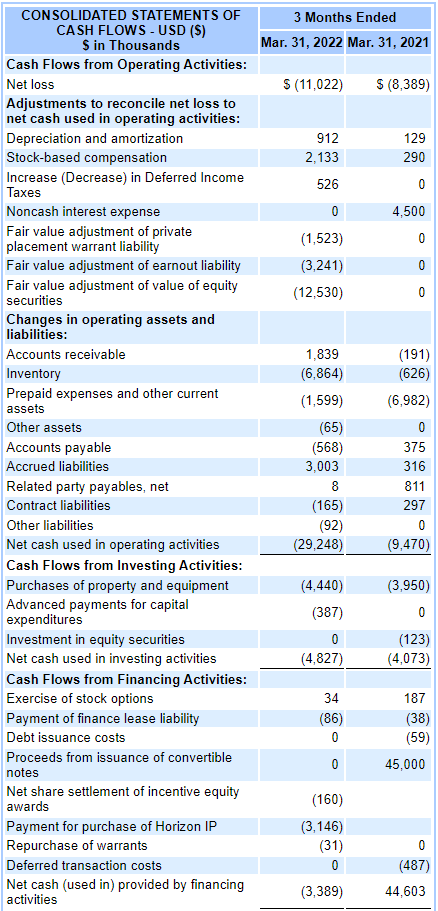

Q1 Cash Flow Statement (SEC.gov)

As of the last 10-Q given for the Q1, the cash burn was the following. They had started burning about $35 million per quarter. The company has about $400 million in cash as of last filing, so in about three years that cash would be gone at current run-rate. The thing is, the company had just started with trial trucks. Cash burn was likely inflecting upwards here, and is likely at a much worse run-rate. They could be running out of cash quickly, especially as they have to scale for the first dozen of orders they are getting from customers in Europe and elsewhere, after they pilot a dozen or so of their trial trucks. It could be until after Q2 2023 that they even start with commercial scaling, and with higher cash burns associated with early ramp-up and the current higher testing phase, there might be dilutions already in late 2023 of current shareholders.

We don’t know though, because we have no financials that are updated for after the Chinese and European economic woes, where initial market interest seems to have come from.

Bottom Line

The bottom line is that Hyzon is to be avoided. There is enough debate around the viability of hydrogen, but yet another bet on a renewable vehicle company would be among the many that have been ill-fated as of late for investors, especially in the current economic climate where financing has become a lot more expensive.

Shareholders will have to hope for a Fed pivot before equity raising would be necessary in order to save themselves from dilution. Reflexivity risks remain severe. HYZN should be avoided.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.