Summary:

- On Wednesday, Hyzon Motors Inc. filed its previously delayed annual report on Form 10-K with the SEC as part of its ongoing efforts to become current in its regulatory filings.

- Remaining liquidity is depleting quickly with cash and short-term investments down to $196 million by the end of April.

- At the current pace of cash usage, the company will have to raise additional capital by mid-2024 at the latest point.

- The company remains out of compliance with the Nasdaq’s $1 minimum bid price requirement. A reverse stock split later this year might be in the cards.

- With the stock price down almost 80% from the time of my last article, I am raising my rating by one notch but would continue to advise investors avoiding the shares.

Scharfsinn86/iStock via Getty Images

Note:

I have covered Hyzon Motors Inc. (NASDAQ:HYZN) previously, so investors should view this as an update to my earlier article on the company.

Eighteen months ago, shares of emerging fuel cell electric vehicle (“FCEV”) producer Hyzon Motors Inc. or “Hyzon” were hit hard by a report from shortseller outfit Blue Orca Capital which essentially asserted the company being a sham.

Fellow contributor Stephen Tobin provided a short overview of the key allegations last year, readers looking for more detail should consider starting with his article.

While the company was quick to refute the report, the allegations not only resulted in multiple shareholder lawsuits and a SEC subpoena but also impacted the business quite meaningfully as stated in Hyzon’s 2022 annual report on Form 10-K filed with the SEC after Wednesday’s market close:

Because of these events, certain of the Company’s potential suppliers and partners indicated that they were suspending negotiations with us concerning supplying us with key components necessary to produce our vehicles. (…) The negative publicity stemming from this article has adversely affected our brand and reputation as well as our stock price which makes it more difficult for us to attract and retain employees, partners and customers, reduces confidence in our products and services, harms investor confidence and the market price of our securities, invites legislative and regulatory scrutiny, and has resulted in litigation and governmental investigations.

As a result, customers, potential customers, partners and potential partners have failed to award us additional business or cancelled or sought to cancel existing contracts or otherwise, directed or may direct future business to our competitors, and may in the future take similar actions, and investors may invest in our competitors instead of us.

On August 8, 2022 Hyzon disclosed an investigation related to “revenue recognition timing and internal controls and procedures, primarily pertaining to its China operations, that were brought to the attention of the Board by Company management”.

In addition, the audit committee determined that the company’s annual report on Form 10-K for the year ended December 31, 2021 and quarterly report on Form 10-Q for the period ended March 31, 2022 should no longer be relied upon.

Furthermore, Hyzon decided to withdraw “all financial and operational guidance it has previously issued for all periods, including for the year ended December 31, 2022 and subsequent years”.

The findings of the investigation were issued in March and resulted in the requirement to amend a number of quarterly reports as well as the company’s 2021 annual report on Form 10-K to reflect “adjustments to correct errors related to the recognition of revenue and associated balances for China FCEV transactions, adjustments to correct errors related to the recognition of revenue and associated balances for European FCEV transactions, and adjustments to its prior allocation of transaction costs incurred in connection with the Business Combination to reflect the allocation of the correct balance of Company incurred transaction costs between the liability classified earnout arrangement and the newly issued equity instruments in the Business Combination in the third quarter of 2021.”

In recent months, the company has filed a number of previously delayed quarterly reports followed by the 2022 annual report on Wednesday.

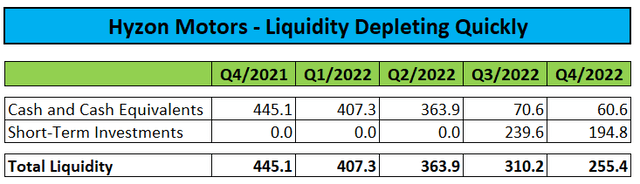

As shown in the table below, the company’s remaining liquidity is depleting quickly with cash and short term investments down by approximately $190 million year-over-year:

Based on disclosures made in Hyzon’s annual report, cash and short-term investments at the end of April were down to $196 million.

At the current cash burn rate, the company would be required to line up additional financing by mid-2024 at the latest point.

Not surprisingly, Hyzon’s annual report warns of the requirement to raise additional capital “in the near future“.

Please note that the company’s 2022 results missed previously stated expectations by a mile as the company only recognized a paltry $2.5 million in sales from the delivery of 62 FCEVs in China in the first quarter. Since then, Hyzon hasn’t recognized any vehicle sales as compared to the company’s original expectations for the delivery of up to 400 FCEVs in 2022.

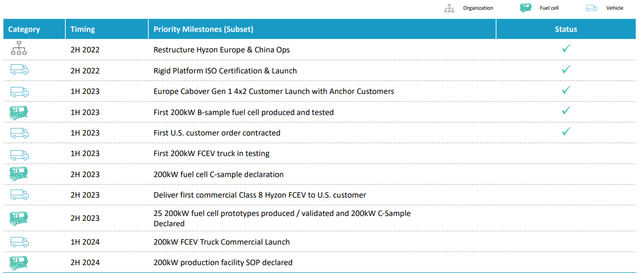

In addition to the company’s ongoing efforts to become current in its regulatory filings, Hyzon has appointed new senior management and recently released a corporate presentation with the title “HYZON Revitalized” including a list of near- to medium-term commercialization milestones:

Lastly, the company expects to report Q1/2023 results next week with a conference call scheduled for 8:30AM EDT on June 8.

While I would expect the company to become current in its regulatory filings next week, Hyzon remains out of compliance with the Nasdaq’s $1 minimum bid price requirement. Despite the company having been provided the usual 180-day grace period until November 6, a reverse stock split later this year might be in the cards.

Bottom Line

While Hyzon Motors Inc. has appointed new management and is about to become current in its regulatory filings, the company’s remaining liquidity is depleting quickly.

At the current pace of cash usage, Hyzon will have to raise additional capital by mid-2024 at the latest point.

In addition, the company will likely require a reverse stock split later this year to regain compliance with the Nasdaq’s $1 minimum bid price requirement.

But with the stock price down almost 80% from the time of my article last year and shares trading below the company’s remaining cash and short-term investments, I am raising my rating by one notch from “Strong Sell” to “Sell“.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.