Summary:

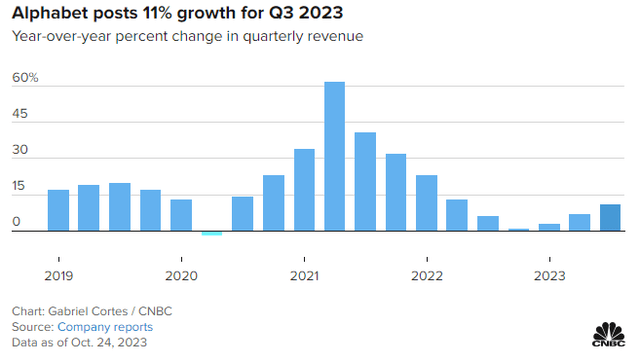

- Alphabet has reported solid Q3 earnings, delivering an 11.1% revenue growth after three consecutive quarters of single-digit growth, as the advertising business recovers.

- Google’s Cloud Unit has reported slower-than-expected growth of 22.4%, below the previous 28%, missing analysts’ expectations and sending the stock into correction territory.

- Google is projected to grow both its advertising business and cloud business, estimating a revenue growth of 7.8% and an EPS growth of 12% CAGR over the next decade.

- Google is currently trading at a discount despite its promising growth outlook, low debt, and recovering market conditions, making it a compelling investment opportunity.

400tmax

Alphabet Inc. (NASDAQ:GOOG)(NASDAQ:GOOGL), Google’s parent company, reported solid Q3 earnings at the end of October, demonstrating a significant 11.1% growth in its revenue. This marks a departure from the previous pattern of single-digit revenue gains and comes amidst a continuing recovery in the advertising market. The company’s revenue for the quarter reached $76.69 billion.

The operating income grew from $17.14 billion in Q3 2022 to $21.34 billion, driven not only by higher revenue but also through an operating margin expansion of 300 basis points.

The company reported $1.55 in GAAP EPS, surpassing analysts’ estimates by $0.10 and showing growth of 46.2% compared to the previous year.

Despite the positive results reported, the stock experienced a 15% correction from its recent high of $142, plummeting to $121. This decline caused the company to lose more than $180 billion from its market capitalization.

The drop in the stock price was primarily attributed to Google’s Cloud unit, which didn’t grow as rapidly as anticipated. It was the company’s only segment that failed to surpass Wall Street’s consensus expectations.

GOOG Stock Overview (Seeking Alpha)

Google’s Cloud Unit has been slowing for 10 quarters, but is it a reason for concern?

In the broader context, the company’s performance in this quarter stands out significantly compared to the last three quarters, which mostly saw single-digit growth rates.

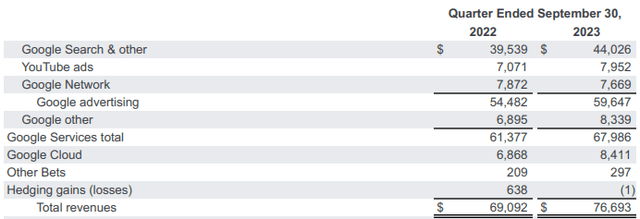

- Google Search & Other experienced notable growth of 11.3%, reaching $44 billion.

- YouTube ads exhibited even faster growth, soaring by 12.5% to $7.95 billion

- The Google Network segment was the only area that faced a decline, dropping by -2.5% to $7.67 billion

- Google Cloud delivered growth of 22.4% and generated $8.41 billion in revenue.

Q3 Earnings by Segment (GOOG IR)

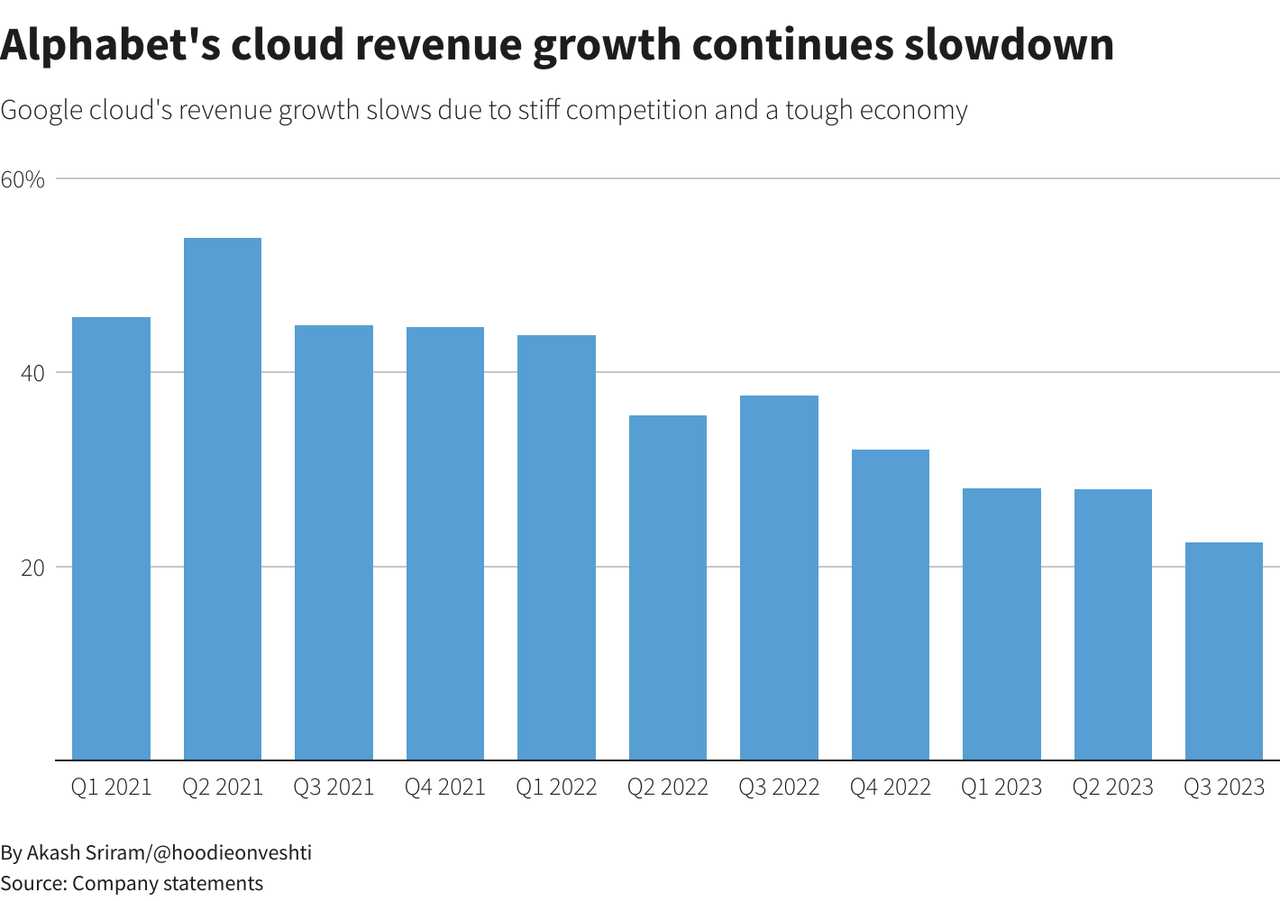

A significant factor cited as a catalyst for Google’s recent stock drop is the slowing growth of its cloud segment. In the third quarter of 2023, Google Cloud’s growth rate dipped to 22.4%, marking a decrease from its consistent performance of 28% growth in the first two quarters of the year.

However, it’s essential to consider the broader context of Google’s cloud unit. Despite the slowdown, it only contributed 10.9% to the Q3 revenue. Additionally, the cloud unit has been experiencing a deceleration in growth for the past 10 quarters.

Google Cloud Revenue Growth (Reuters)

When we assess Google’s cloud performance in comparison to industry giants like Microsoft (MSFT) and Amazon (AMZN), it’s evident that concerns about its growth are somewhat exaggerated. For instance, Amazon Web Services “AWS”, a dominant player in the cloud services arena, “only” managed a 12% growth rate in the quarter.

While Microsoft’s Azure revenue did experience a substantial increase of 28%, this marked a significant drop from the 35% growth in the same quarter last year.

As stated by Sundar Pichai, what strengthens the potential resilience and growth prospects of Google Cloud is its existing client base. Significantly, 60% of the top 1000 companies continue to rely on Google Cloud, highlighting the platform’s stability and reliability within the corporate sphere.

Furthermore, the influence of the cloud segment extends beyond established enterprises. Many generative AI startups also prefer Google Cloud as their foundation, setting the stage for impressive future growth in this innovative and rapidly expanding industry.

While it’s true that the cloud unit’s growth is slowing down, it’s essential to note that similar trends have been observed with both AWS and Microsoft’s Azure. Therefore, the slowdown in cloud growth shouldn’t be perceived as a loss of market share, but rather as slowing growth for most cloud products in what was a “difficult business environment”.

Naturally, Google’s primary domain is the advertising business, which remains crucial to the company’s success at present. Despite this, considering the improving economic landscape and the peak of the interest rate cycle, I anticipate Google Cloud to resume its growth in the upper 20%s.

However, it’s important to acknowledge that even if Google Cloud manages to grow at around 25% annually, it will take the unit at least 9.5 years to reach the size of the advertising business. This calculation doesn’t account for any growth in advertising, which is highly unlikely given Google’s dominant position in the market.

Strong Growth Outlook

Google has undeniably been one of the top-performing US equities over the past decade, and its remarkable results explain why. Over the last 10 years, Google has achieved an impressive 17.6% CAGR in both its revenue and operating income.

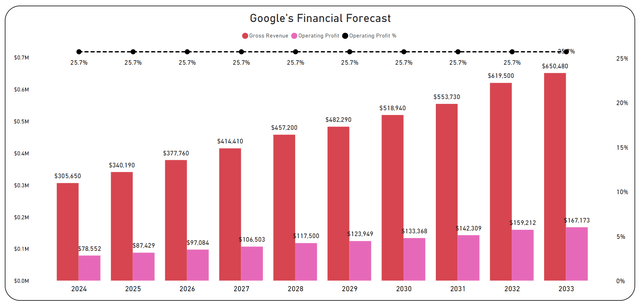

What truly stands out is the company’s operating margin, which has exhibited remarkable stability, hovering around 25.7% over the past decade. Even in the last four years, Google has sustained a 15% CAGR, showcasing its sustained growth.

Despite this exceptional performance, analysts anticipate a slowdown in Google’s growth, mainly due to its substantial size. Projections suggest a growth rate of around 7.8% CAGR over the next decade. If we assume this rate and maintain the historical average operating margin – a feasible assumption given Google’s quasi-monopoly status in the marketing realm – the company’s revenue could approach $650 billion by the end of 2033. Considering this, the operating income could more than double, reaching $167 billion.

Financial Forecast (Author’s Graph)

Favorable Valuation

The current valuation of Google appears quite favorable, especially when considering its untouched growth profile and the ongoing recovery in the advertising market. This compelling combination is precisely why I’ve been aggressively purchasing Google shares following its recent decline in stock price.

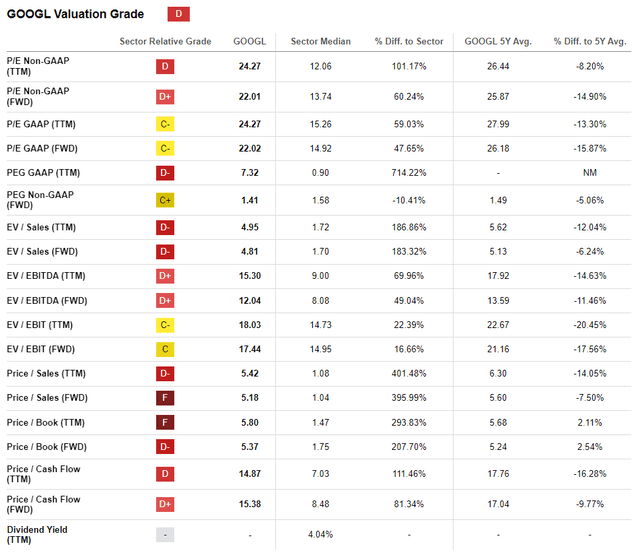

As of today, Google is trading at a Forward PE ratio of 22.01, which is 14.9% lower than its 5-year average.

Additionally, its Forward EV/EBITDA ratio stands at 12.04x, indicating an 11.5% discount compared to its historical average.

These metrics suggest that the stock is currently undervalued, making it an attractive investment opportunity.

Valuation Grade (Seeking Alpha)

For the full year of 2023, my expectation is that Google will achieve $305 billion in revenue and an EPS of $5.74.

Looking ahead, with a projected 7.8% CAGR in revenue over the next decade, I anticipate Google’s EPS to outpace its revenue growth as it matures.

This growth will primarily be fueled by stock buybacks; Google has already announced a combined $140 billion allocation for 2022 and 2023 representing 10% of the market cap, indicating a strategic focus on enhancing shareholder value through this method rather than solely relying on expanding profitability and revenue growth.

I further anticipate an EPS growth rate of approximately 12% CAGR between 2024 and 2030, resulting in an EPS of $14.60. Assuming a Forward PE Ratio of 23, the potential stock price could reach $336. This projection represents a 10% CAGR in the rate of return.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| EPS $ | 5.74 | 6.66 | 7.77 | 8.89 | 10.30 | 11.75 | 13.30 | 14.60 |

| EPS Growth | 26.0% | 16.0% | 16.7% | 14.4% | 15.9% | 14.1% | 13.2% | 9.8% |

| Forward PE | 26.0 | 26.0 | 25.0 | 25.0 | 25.0 | 25.0 | 24.0 | 23.0 |

| Stock Price $ | 149 | 173 | 194 | 222 | 258 | 294 | 319 | 336 |

Conclusion

Google’s Q3 earnings release showcased robust double-digit top-line growth, breaking a streak of three consecutive quarters of single-digit growth. Despite this positive momentum, the stock faced a significant setback due to the slowdown in Google Cloud unit growth, leading to a 15% correction in its price.

While the Cloud unit faced challenges, most of Google’s other segments performed exceptionally well, putting the company on track to achieve close to 9% YoY Revenue Growth by year-end.

I perceive the drop in the stock price as an excellent opportunity to acquire shares. With an expected future 7.8% CAGR in revenue and a 12% CAGR in EPS growth, this situation presents a compelling opportunity for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.