Summary:

- Snap Inc. operates the Snapchat app, a leading social media platform with strong user engagement and innovative features.

- The investment thesis surrounding Snap is relying on its consistent user growth, but I believe this is a flawed metric.

- Snapchat’s ARPU is misleading, and looking deeper highlights how the growth story may be weaker than investors initially realized.

- Snap Inc.’s long-term growth relies on waiting out net income losses, requiring heavy financing that increases risks.

John Nacion/Getty Images Entertainment

Introduction

Snap Inc. (NYSE:SNAP) is a social media company that operates the Snapchat app, one of the most used social media apps in the world, boasting over 432 million daily active users (“DAU”).

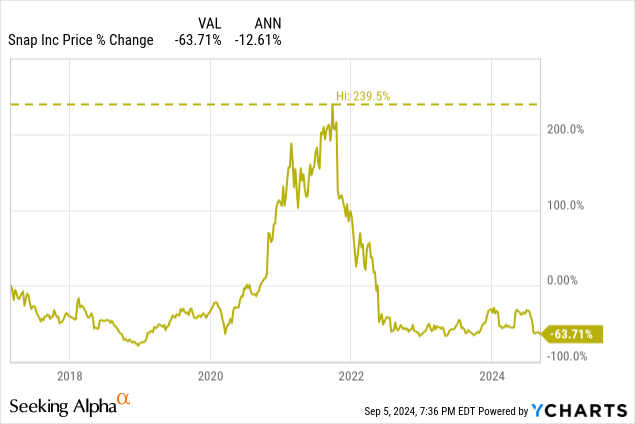

For its shareholders, it’s been a wild few years, with massive swings and very sudden movements. This is not a stock for the faint of heart. From IPO to now, it’s sustained an annualized return of -12.61%.

Snapchat has a lot of issues, from my perspective, that are very difficult to address and will cause the continued underperformance of SNAP in the markets and as a product. For these reasons, I am issuing SNAP a sell rating and will be avoiding exposure to it as much as possible.

Monetization Failures

Social media companies like SNAP are evaluated on fairly straightforward metrics:

- Daily Active Users (“DAU”) or Monthly Active Users (“MAU”)

- Average Revenue Per User (“ARPU”)

Gaining Daily Active Users

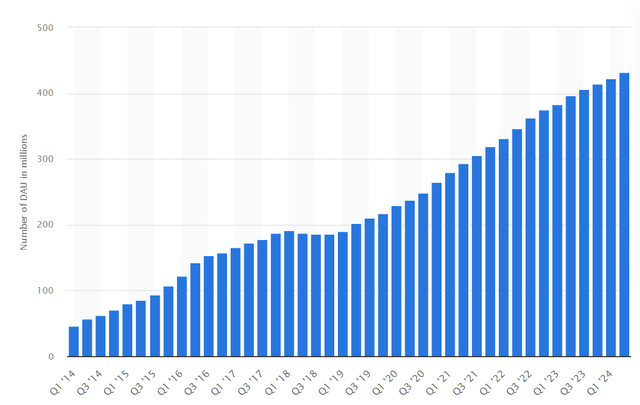

As far as DAU is concerned, Snap is still growing at a fairly steady rate. There was a slump about five years ago, but since 2020, DAU has been up consistently. This is, at first glance, a very positive sign.

Snapchat DAU (Snap Inc. via Statista)

I say “at first glance,” because I believe this data is a little misleading. Snapchat is growing in users, but where it is growing is important context. Here is the same chart, but split by region.

Snapchat DAU by Region (Snap Inc. via Statista)

One of the things I’ve learned over the course of researching SNAP and social media companies more broadly is that user monetization varies tremendously by region. This chart is going to be important context for the next section.

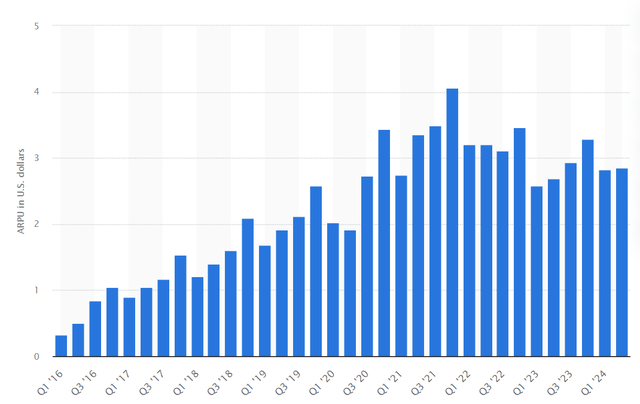

Stagnating Average Revenue Per User

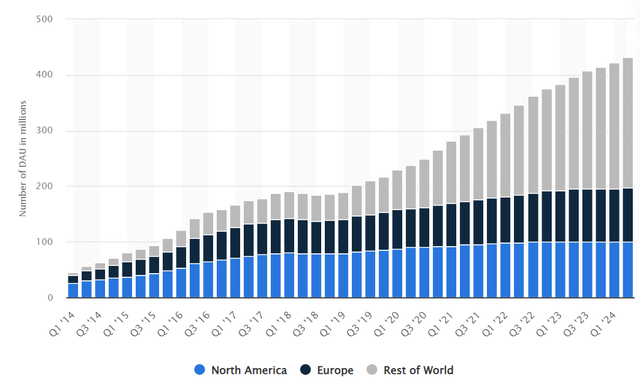

Snapchat has not been able to hold on to any growth momentum in this metric for the last few years, falling to below 2021 highs of over $4/user.

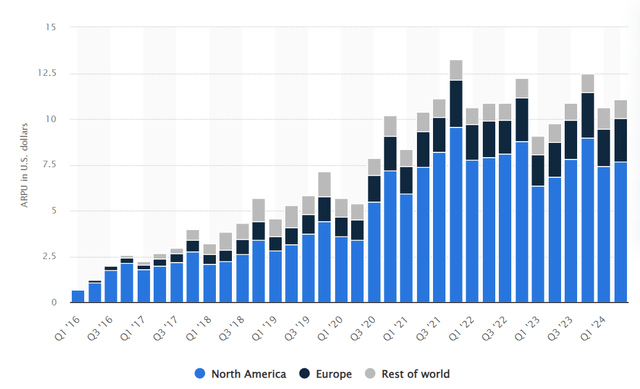

Snapchat ARPU (Snap Inc. via Statista)

Let’s break this one down by region, too. Here, we see almost a reverse in color scheme from the regional chart in the last section. In the first chart, most of the users and growth came from outside North America and Europe. However, in this next chart, we see that the vast majority of Snapchat’s revenue comes from these North American and European users.

Snapchat ARPU by Region (Snap Inc. via Statista)

This trend holds up with other companies as well. Compared to Facebook, Snapchat’s ARPU ratio between developed and developing markets is normal.

| Snapchat | Facebook* | |

| North America ARPU | $7.67 | $68.44 |

| European ARPU | $2.36 | $23.14 |

| “Rest of World” ARPU | $1.02 | $4.50 |

*As of Q4 ’23.

Snapchat wasn’t built with the same marketing abilities at Facebook, so we’ll go easy on the sheer gap between their monetization rates here. It’s far easier to serve ads because of Facebook’s scrolling format. Snapchat has to be creative when it shows ads, putting them between short-form content that they advertise in the app through the “stories” page.

I’m not a social media guy and was never interested in any of the stories. I don’t know who they are for. Please leave a comment if there are some you like; I want to know who these things appeal to and why.

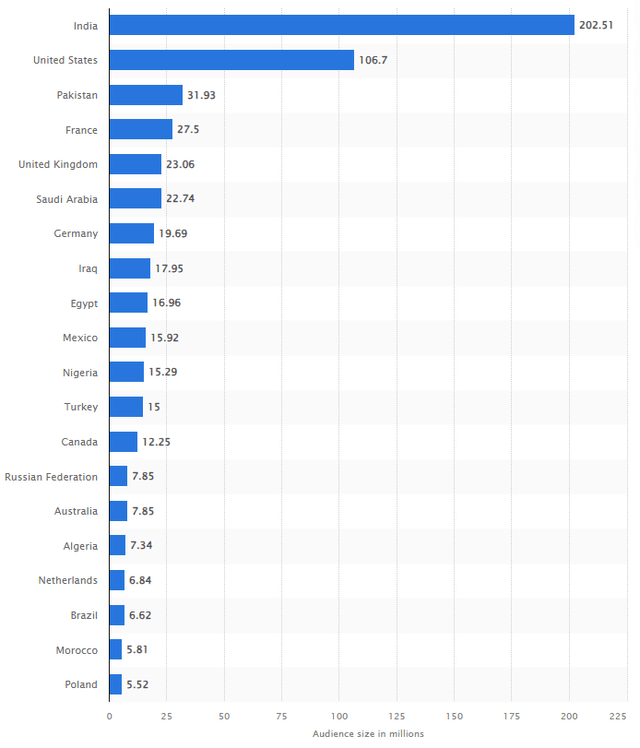

The issue here is that Snap isn’t growing the user base with users that pay the bills at Snap Inc. They are building tons of users that generate very little revenue. This means more strain on their services and more investment needed in data infrastructure in the places they are moving into, like Pakistan and Iraq, for less return.

Snapchat Users by Country (Snap Inc. via Statista)

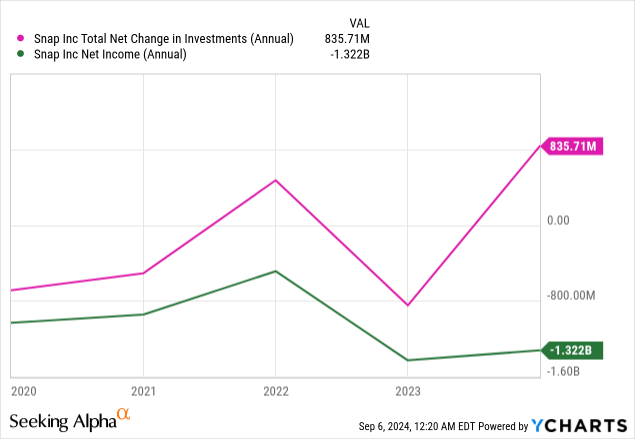

When we take a look at the actual metrics behind those figures, money spent on investment and profits, we see this trend materializing. Investments are up, income is down and rising very, very slowly.

Snapchat missing out on the most profitable markets is what gives me pause, as I don’t believe that it is a prudent user acquisition strategy to go after volume like Snapchat does.

Perhaps, Snapchat is banking on the fact that they run a fairly low overhead operation, especially compared to its competitors, to churn volume into profits. I don’t believe they will be able to do it before the cash runs out. This is mostly due to the fact that I don’t believe it has a good product.

Product Woes

My primary issue with SNAP and its main product, Snapchat, is that the product itself isn’t very good. From using it myself for the past ten years (and yet I’ve never given them money, so they’ve only profited off of my data), my opinion is that Snapchat isn’t the best messaging or social media app. It’s a little of both, which makes it a master of none.

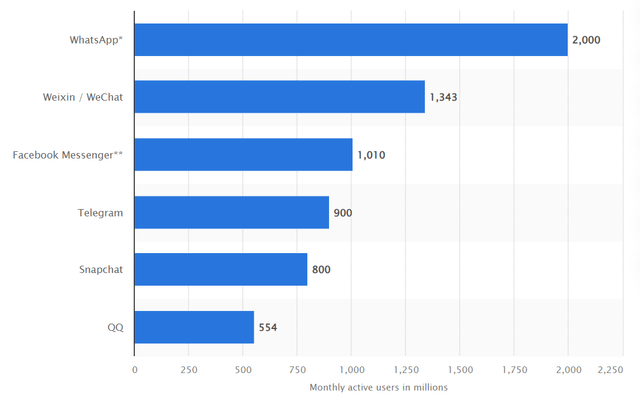

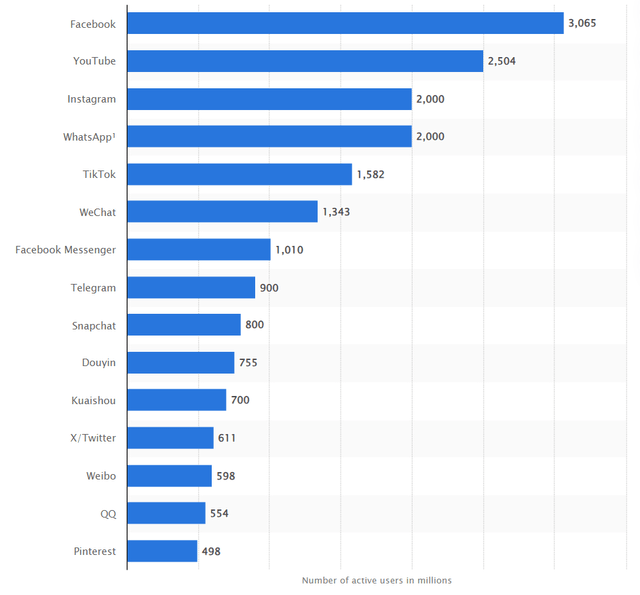

Other people seem to feel this same way, as there are clear titans in both categories that dwarf Snapchat’s userbase.

Messaging App DAU (Statista) Social Network DAU (Statista)

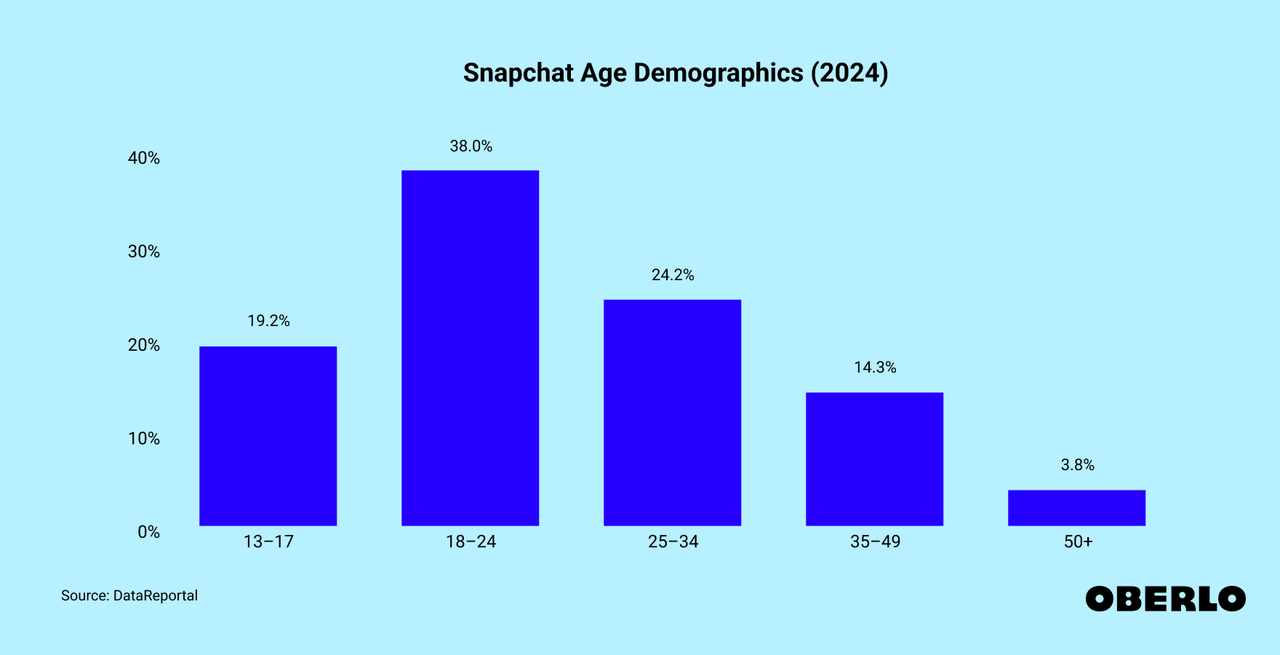

Young people have been Snapchat’s base since its launch, and are still its bread and butter user.

Snapchat Users by Age (Oberlo)

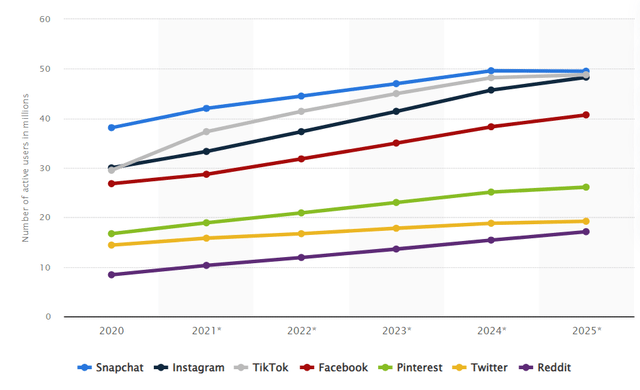

The issue is that young people are increasingly moving away from Snapchat, as TikTok, Instagram, and (to my surprise) Facebook grow rapidly among Gen Z users in the US.

Social Media Apps Used by Gen Z (Statista)

Beginning to fall out of favor with your target audience is a bad sign.

The AI Mishap

One of the big moments in Snap’s recent history was the launch of its personal AI chatbot. It was a massive flub, mostly because the public is becoming distrustful of AI chatbots.

One big issue is that the bot would openly lie to you about how much data it was tracking.

This went viral, even in India (remember this is where Snapchat’s largest userbase is), which was very bad PR for Snapchat at the time, and remains controversial as the AI bot stays at the top of your chat log to this day.

A Slowing of Growth

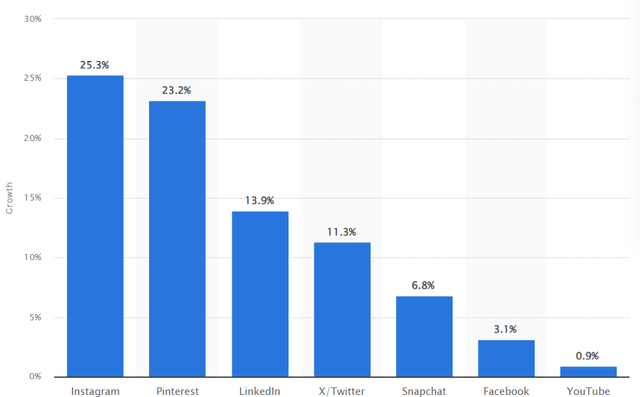

Snapchat’s growth among worldwide users has been positive, but is still far lower than other platforms. From 2023 to 2024, Snapchat grew its global userbase by 6.8%, but this pales in comparison to Instagram’s 25% and Pinterest’s 23%. Both of those companies also grew their US users, unlike Snapchat, which has stagnated in North American users for the last two years.

Social Media Apps by User Growth (Statista)

Valuation

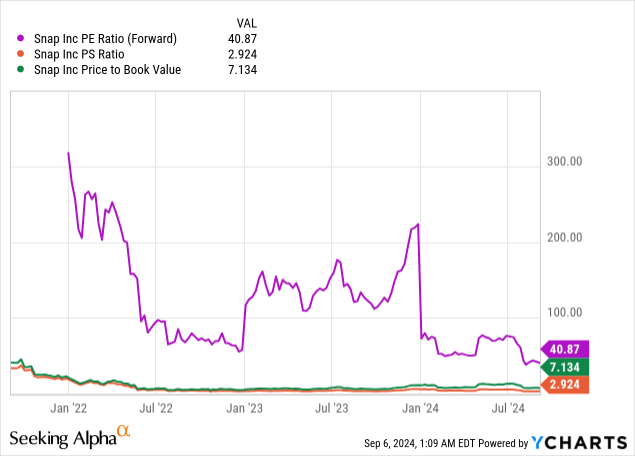

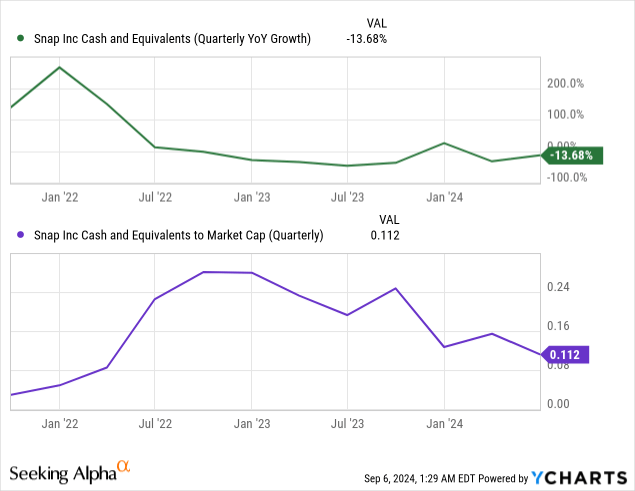

Snapchat has been beaten down, but its valuation is still rather rich since it has a net negative income.

This means that it has even further to fall from here, especially in comparison to its more successful social media peers like META and GOOGL.

Risks to the Sell Thesis

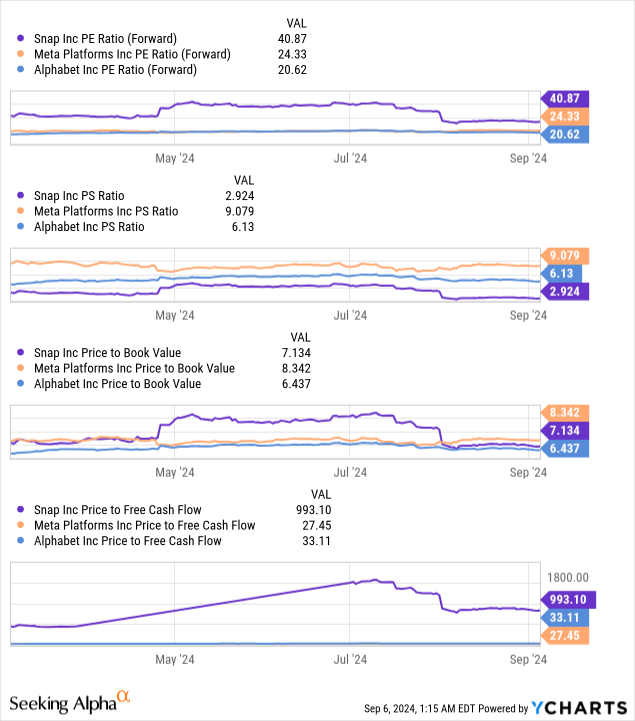

The major risk and counter-point to my thesis that I think I should mention is the growing popularity of Snapchat’s paid service, Snapchat+. This is an independent revenue generator outside of advertisements that is a flat fee to users, which means that if it catches on and continues its trajectory, could bridge some of the missing monetization gap.

Snap Inc. has been able to grow its paying users consistently over the last few quarters, and may continue to do so beyond current estimates.

Snapchat+ Subscribers (Snap Inc. via Statista)

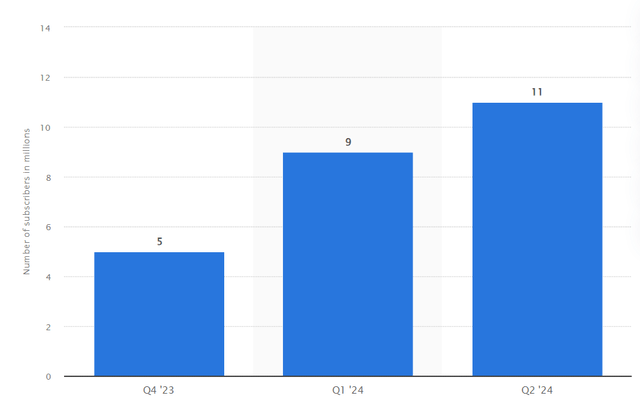

Another risk to the sell thesis is that Snap Inc. does have the money to burn. They may be able to stay operational for a very long time with the money they have on hand, potentially long enough to realize greater monetization in developing economies, or ride a trend in the US to increased popularity in the future.

The treasury is bleeding out, but slowly, and Snapchat has been able to finance itself out of holes before, and is still issuing convertible notes. This financing, and other deals like it, may be able to keep Snap Inc. going for some time.

Conclusion

Snap Inc., the operator of the Snapchat app, is an unimpressive operation to me that, in my opinion, has proven itself unable to acquire users in the most profitable markets, profit off its existing users, and is burning cash at a rate that is faster than makes me comfortable.

The product itself has issues and may be falling out of favor with its target audience, giving me further pause.

I recommend that investors stay away from Snap Inc. and do not consider it for a place in an equity portfolio. Aggressive investors who want to take a venture capital approach to this (throw spaghetti at the wall and see what sticks) are recommended to invest in Snap’s debt rather than its equity.

Thanks for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.