Summary:

- I was wrong about Nvidia Corporation in my most recent article. The company put out the best earnings report I’ve seen in my 20-plus years of investing.

- Instead of selling the news, investors bid up Nvidia’s stock by another 25%, equating to about $200 billion of market cap value.

- AI changes everything, and Nvidia is in a prime position to capitalize on the upcoming revolution.

- Better than anticipated revenues and higher profitability should drive Nvidia’s stock price higher long term, despite the possibility of a near-term pullback.

- Yes, I sold my Nvidia stock too early and want back in, preferably in the $300-350 range (buy-in target).

Sundry Photography

Nvidia Corporation (NASDAQ:NVDA) has been one of my most successful investments in recent years, as its stock skyrocketed by approximately 1,000% from its post-COVID-19 low of around $30 to its blowoff top of nearly $350 in November 2021. Nevertheless, Nvidia’s stock price cratered by a staggering 69% in the epic tech crash before finally bottoming in my $100-120 bear-market-bottom buy-in zone in mid-October last year. I used this extraordinary opportunity to purchase Nvidia’s stock, and I reiterated my bullish long-term outlook for the stock in my November 2022 article here.

However, I did not expect Nvidia to skyrocket by an additional 50% or, let alone, 100% in such a short time frame. Unfortunately, I made the mistake of taking short-term profits by cutting Nvidia from my All-Weather Portfolio after the quick 100% gain. In retrospect, this may have been an impulsive decision, and I missed out on some spectacular gains. Nonetheless, I have made some takeaways from the Nvidia-induced rollercoaster ride, and several factors to consider include:

- Don’t underestimate Nvidia or the company’s power to demolish revenue and earnings expectations.

- Nvidia remains a one-of-a-kind, revolutionary company with incredible revenue growth and substantial earnings potential.

- Never underestimate the market’s appetite for Nvidia’s stock (a company with massive potential).

- Nvidia’s “problems” are transitory, and there was too much negative emphasis on Nvidia’s cryptocurrency segment and its ability to influence Nvidia’s bottom line.

- Don’t underestimate the power of AI and Nvidia’s leading position in the segment.

- Don’t get tempted by near-term profits when there is immense long-term potential for Nvidia’s shares.

Moving forward, Nvidia is a stock I want to own. The company has tremendous long-term potential in several lucrative segments like data centers, gaming, AI, and more. Despite the plausibility of a near-term pullback, Nvidia’s stock price should move significantly higher in the coming years.

Nvidia Earnings: What Just Happened?

I’ve been investing in stocks for more than 20 years, and I’ve seen a lot of crazy things. However, I have never seen a high-profile “mega-cap” company crush analysts’ estimates like Nvidia did. Nvidia’s recent earnings announcement was beyond excellent, and it helped the company add about $200 billion in market-cap value the next day.

For fiscal Q1 2024, Nvidia announced EPS of $1.09 vs. the 92-cent estimate. Nvidia’s revenues came in at $7.19B for the quarter, smashing the consensus estimate of $6.52B by 10%. Nvidia’s data center revenues came in at $4.28B vs. estimates for $3.9B, a 14% YoY increase. Nvidia’s solid performance in its data center segment illustrates that Nvidia’s AI chips are becoming increasingly important for cloud providers and other companies running large numbers of servers.

While these reports are excellent, Nvidia’s forward guidance was nothing like I have ever seen. Looking ahead, Nvidia expects Q2 revenues of $11B (plus or minus 2%). The guidance for revenues of $11B is shocking, as the consensus analysts’ estimate was around $7.18B. Therefore, Nvidia’s guidance is more than 50% above estimates.

Nvidia’s stock was priced for perfection before the earnings came out. However, the results were beyond perfect, stellar territory, and there is no wonder the stock skyrocketed by 25%. Furthermore, Nvidia added it is “significantly” increasing its supply of products related to its data center business amid the rapid increase in interest surrounding AI.

What’s The Big Deal With AI?

In prior analyses, I’ve maintained that AI would be a massive growth opportunity for Nvidia. Did you know that Nvidia has more than 370 partnerships in self-driving cars alone? Nvidia’s automotive division (including chips and software to develop self-driving vehicles) revenues surged by a massive 114% YoY. Nvidia has tremendous long-term revenue growth and profitability potential with AI, and we see increased improvements in the performance of its growing data center segment.

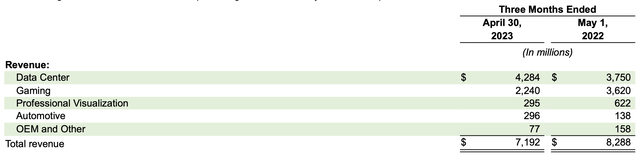

Segment Revenues

Revenues by segment (investor.nvidia.com)

Despite the economic slowdown, Nvidia’s data center revenues increased by about 14% YoY. The company’s data center business now eclipses its gaming segment, providing significantly more revenues than the gaming side in recent quarters. As the AI revolution continues picking up steam Nvidia’s revenues should continue rocketing in this segment. Moreover, Nvidia’s secondary segments, like automotive, OEM, and others, should grow into substantial revenue-generating pipelines in the coming years. Furthermore, Nvidia’s gaming segment is going through a transitory slowdown due to a macroeconomic slide and other temporary factors. Thus, we should see Nvidia’s gaming side recover and produce substantial revenue growth and increased profitability as the company advances in future years.

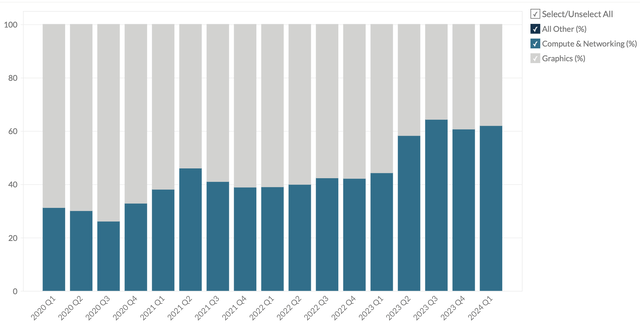

Nvidia Revenues %

Let’s break down Nvidia’s revenues into two segments. The computing and networking side of its business is gathering significant momentum and should continue growing as a percentage of total revenues long term. The computing and networking side of the company accounted for 62% of Nvidia’s total revenues vs. 44% in Q1 of last year.

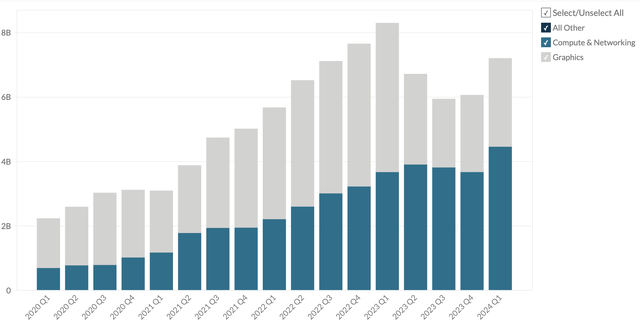

Nvidia’s Revenues $

Nvidia’s revenues (businessquant.com )

Breaking down the company’s revenues into two primary segments enables us to see that the company’s computing and networking side provided $4.46B in revenues last quarter, a 22% YoY increase. Also, don’t let this chart deceive you. I realize that Nvidia’s total revenues were down by approximately 13% last quarter. However, next quarter will be a completely different story, and the company should continue putting up stellar results as we advance in the coming years. Nvidia’s revenues should surge to roughly $11B next quarter, providing record-setting quarterly results and delivering about a 64% YoY surge in sales. Incredible, yes, this is Nvidia.

Now, Let’s Look at the Valuation

While Nvidia’s valuation is very high, we should consider the company’s leading market position in several critical segments and its ability to demolish analysts’ projections. Nvidia could continue surprising consensus figures, providing better-than-anticipated or higher-end projected figures in the coming years.

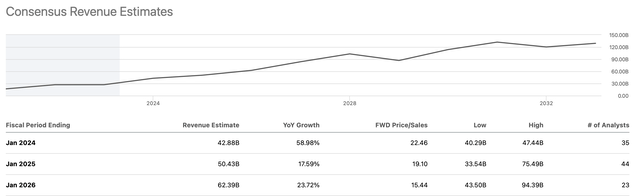

Revenues Could Explode

Revenue estimates (Seekingalpha.com )

We’ve seen revisions toward higher revenues and EPS projections after the recent blowout quarter. However, higher revisions should continue as the trend for more sales and better profitability solidifies as the company advances. The current fiscal 2024 consensus revenue estimate of $42.88B may need to be higher, and Nvidia could deliver around $45 – 47B in revenues this year. Also, next year’s estimate of $50B appears low, and Nvidia revenues could come in the $60-70B range in fiscal 2025.

Nvidia’s valuation is around $1T, and according to consensus figures, the stock is trading around 20 times forward sales. While this valuation is expensive, Nvidia’s revenue growth prospects and profitability potential may be better than the current estimates suggest, implying the stock could continue outperforming in future years.

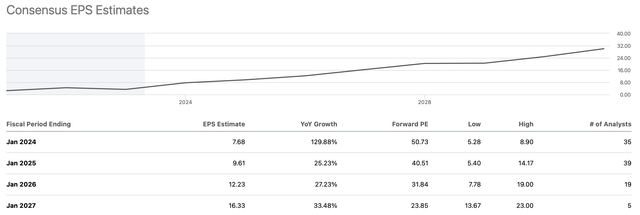

EPS Potential – “Significant”

EPS estimates (Seekingalpha.com )

Consensus estimates adjusted higher after Nvidia’s stunning earnings announcement, and the trend should continue as Nvidia proceeds to outperform in the coming years. Consensus EPS figures are for $9.61 next year, but Nvidia will likely beat the estimate. Nvidia’s EPS could come in toward the higher-end range of estimates ($12-14). If we put a forward P/E multiple on a $13 EPS estimate, the company’s stock is trading around 30 times forward EPS now. Thirty times forward earnings is not tragically expensive for a company in Nvidia’s advantageous position. If the company can achieve higher-end EPS estimates, the stock looks attractive in the $300-400 range.

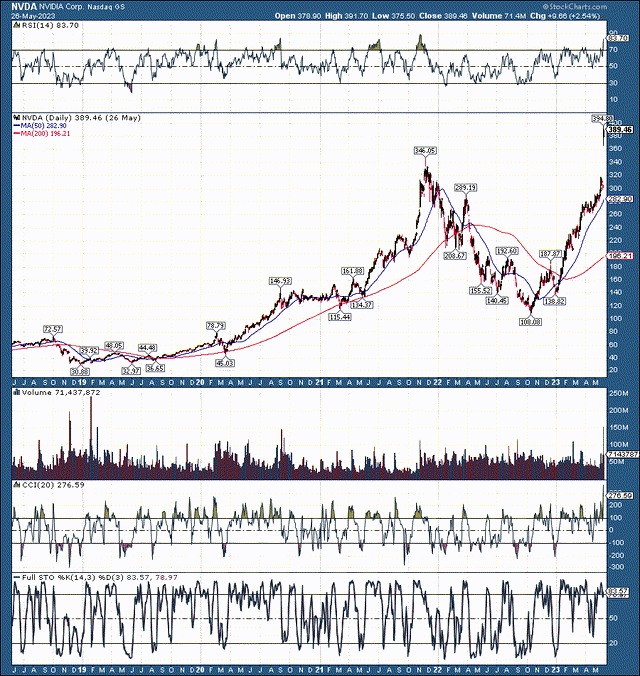

When I Plan to Reload My Nvidia Stake

I hate to point to the technicals, but Nvidia’s stock is tremendously overbought right now. The RSI is approaching 85, almost on par with the level Nvidia topped out at before the epic drop began in November 2021. The stock is more than 100% above its 200-day MA and about 50% above its 50-day MA. The CCI also hit a level not seen even as the bubble popped in the 2021 tech top. We see unprecedented signals of an overbought stock here, and (strictly from a technical standpoint) there is a high probability of seeing a sharp short-term technical correction in the coming weeks.

Therefore, I want to take advantage of the upcoming buying opportunity, as I want to remain an investor in Nvidia long-term. The open gap in the $320-360 range could get filled, implying that Nvidia’s stock could experience a correction, providing a buying opportunity in the $300-350 range. I plan to initiate a partial position for around $350 and DCA in the $320-300 range if the stock drops to my buy-in level. If I were long the stock here, I would either hold my shares or realize 50% profits with the intent to rebuy my 50% stake in the $350-300 range. Due to Nvidia’s remarkable growth and profitability potential, the company’s stock should appreciate considerably in the coming years.

Here’s where Nvidia’s stock price could be in future years:

| Year (fiscal) | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $46 | $60 | $78 | $97 | $119 | $145 |

| Revenue growth | 70% | 31% | 30% | 24% | 23% | 22% |

| EPS | $8.50 | $13 | $18 | $23 | $29 | $34 |

| EPS growth | 155% | 53% | 38% | 28% | 25% | 20% |

| Forward P/E | 31 | 32 | 31 | 30 | 29 | 28 |

| Stock price | $400 | $576 | $713 | $870 | $986 | $1,050 |

Source: The Financial Prophet.

Risks to Nvidia

While I am bullish on Nvidia Corporation in the intermediate and longer term, technically, we could see a correction in the near term. Therefore, we may see the stock pull back to my $300-350 buy-in range or lower. However, near-term declines should be transitory and not affect my intermediate/long-term price target on the stock. Nevertheless, Nvidia could face increased competition in the GPU sector, data center business, and other areas the company operates in. Moreover, the company could face margin pressure due to higher costs associated with inflation, leading to decreased profitability.

Ultimately, Nvidia Corporation could deliver less growth and worse EPS than my estimated forecast. Investors should scrutinize these and other risks before committing any capital to an investment in Nvidia Corporation shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NVDA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!