Summary:

- I previously ignored the stock due to the low growth rates, but I was missing the bigger picture.

- Apple continues to take market share and can continually reinvest in adding new products and services to its ecosystem.

- The company has maintained resilient fundamentals in spite of tough macro conditions.

- The stock is reasonably valued at 26x forward earnings.

grinvalds

Apple (NASDAQ:AAPL) is a stock which I have not been bullish on since 2018. In the years since then, the valuation had consistently puzzled me – how could the stock trade at such rich multiples relative to mega-cap peers in spite of slower growth? That question continued to keep me on the sidelines even as the stock soared – until now. In this article I explain what changed in my thinking including my long-term thesis for the stock. This isn’t about supercycles – this is about super-moats. At 26x forward earnings, AAPL remains highly buyable for long term investors.

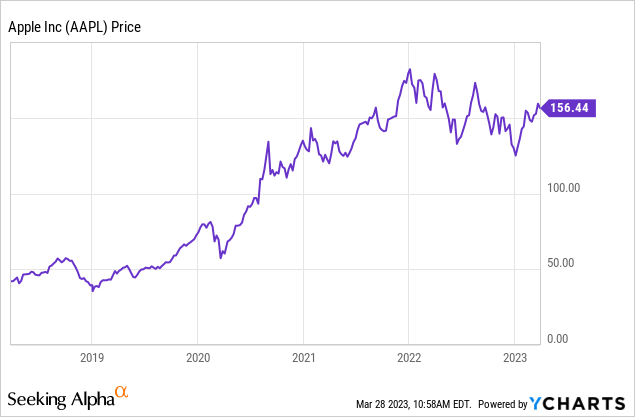

AAPL Stock Price

AAPL stock has been such a strong performer since the pandemic and over the past few years that you’d think it’d be down more amidst the weakness in the tech sector. Yet in the grand scheme of things, AAPL still trades close to all-time highs.

I last covered AAPL in January where I explained my reservations about their decision to repurchase shares even as tech stocks crashed. The stock has since delivered double-digit returns since then – but remains highly buyable at present levels.

AAPL Stock Key Metrics

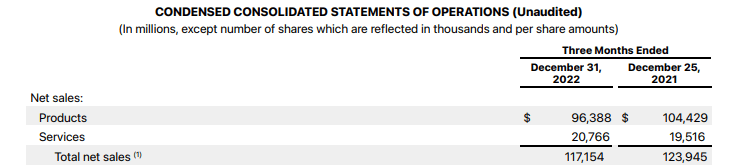

In its most recent quarter, net sales declined 5.4% but that number was negatively impacted by 800 basis points due to currency fluctuations. On the conference call, management also noted that they experienced iPhone 14 supply issues due to COVID-19 in the quarter and that production “is now back where we want it to be.”

Given the size of this company and macro backdrop, these should be considered strong results.

2023 Q1 Press Release

That decline in revenue as well as the fact that AAPL hasn’t joined tech peers in doing layoffs led net income to decline 13.3% to $30 billion.

On a segment by segment basis, iPad sales were a bright spot, growing 30% to $9.4 billion. That outperformance was largely driven due to the company having experienced supply constraints in the prior year’s quarter. Due to the aforementioned supply issues, iPhone revenue came in down 8% YOY (or roughly flat constant currency).

Services revenues grew by only 6.7% in the quarter, reflecting the same macro headwinds faced by other tech companies.

2023 Q1 Press Release

AAPL ended the quarter with $165 billion in cash versus $111 billion in debt and management continues to target a leverage-neutral position. The magnitude of the net cash position has dwindled over the past several years but is arguably not so important in the long term thesis.

The company repurchased $19.5 billion of stock in the quarter and I expect share repurchases to continue even under current market conditions.

Looking ahead, AAPL expects the following quarter to see similar YOY sales growth – implying around 5% declines in revenue (assuming 5% of negative foreign exchange impact). Services is expected to continue facing macro headwinds in digital advertising and mobile gaming but still grow nonetheless. With the iPhone supply issues behind them, management expects iPhone sales to be a bright spot in the quarter. Mac and iPad sales are expected to show weakness mainly due to tough comps.

Is AAPL Stock A Buy, Sell, or Hold?

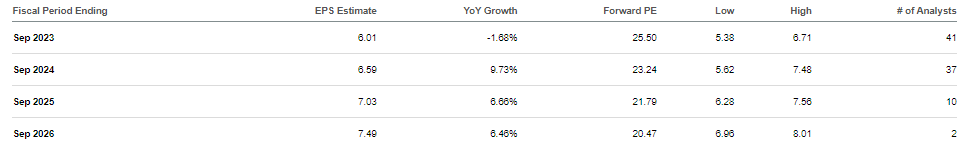

At recent prices, AAPL was trading at around 26x forward earnings. For a name expected to grow at a mid to high single-digit clip moving forward, such a multiple does not look obviously cheap, especially when faster-growing peers like Meta (META) or Alphabet (GOOGL) are trading around 20x earnings or lower.

Seeking Alpha

What I previously failed to appreciate was the strength and optionality in AAPL’s business model, and how that impacts valuation multiples. Sure, AAPL is not growing that rapidly right now. But the company has been steadily taking smartphone market share in the United States over the past decade and that makes you wonder: what comes next? I can see AAPL investing aggressively in new and existing services like search, maps, video streaming and more with great success. The company is clearly taking its time in rolling out such features, if ever, and in the meantime the stock is generating enough profits from selling products that it trades at 26x earnings. It may be hard to imagine a world in which Google is not the default search engine – but I wonder if iOS users will switch over based on convenience (it may be quicker to swipe down for Apple search than to open the mobile browser and search for Google first). That innovation, together with ongoing market share gains and further digital adoption may help the company sustain high-single-digit growth for the next decade if not longer. The key to this stock thesis is that the company’s potential for constant reinvestment in its ecosystem – and perhaps more importantly the perceived long term growth potential of that investment – should be enough to help support a consumer-staples kind of valuation multiple. The Vanguard Consumer Staples ETF (VDC) recently traded at an average 24x P/E ratio. Compared against this benchmark, AAPL offers a stronger balance sheet (many consumer staples companies retain net leverage) and stronger growth rates. I can see AAPL eventually earning a more premium multiple than current levels, perhaps even to as high as 35x earnings.

What are key risks? Given that this thesis in part is based on AAPL being deserving of multiple expansion as a consumer staples stock, there is the risk that consumer staples valuations come down. There is also the risk that if AAPL begins to make progress on the long term thesis discussed above that the company may draw greater regulatory scrutiny, which may cause it to face similar valuation overhangs as GOOGL or META. There is the risk that consumers begin to prefer cheaper Android products and the company eventually needs to sacrifice on margin to maintain market share. While AAPL is not trading at “dirt cheap” valuations, the stock offers a sturdy anchor-type of position that can deliver solid returns as hopes for multiple expansion play out.

Disclosure: I/we have a beneficial long position in the shares of AAPL, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!