Summary:

- A Fed rate cut in September may ignite a monster rally in industrial-related commodities like base metals.

- Vale is the clear valuation winner in the diversified mega-cap mining group, opening up tremendous upside if iron ore, nickel, and copper climb appreciably and unexpectedly in price.

- The trailing 12% dividend yield and 14% free cash flow yield proposition, from one of the world’s largest and lowest-cost metals miners, is hard to pass up.

Shutter2U/iStock via Getty Images

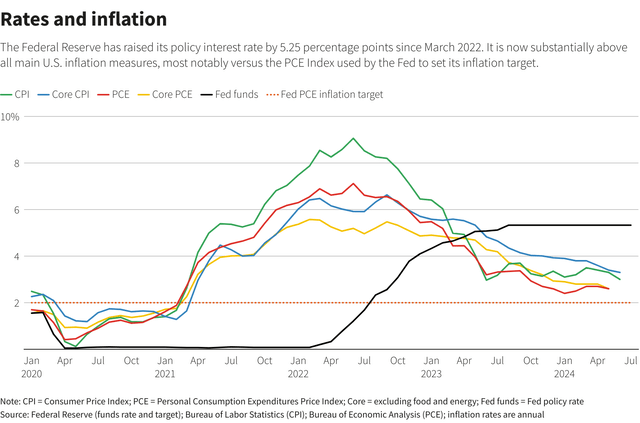

I have been quickly warming up to Vale S.A. (NYSE:VALE) ADRs, the largest iron ore and nickel producer in the world, with sizable copper mining operations, based in Brazil. The main argument is I am worried Federal Reserve Chairman Jay Powell has all but guaranteed a September rate cut for U.S. banks is coming (current futures trading odds are 93% for quarter-point rate cut vs. 7% for half a point), before a recession appears or inflation has been licked. It shouldn’t be a shock, as many of the world’s central banks have started cutting rates already.

The Vale buy thesis is demand for industrial metals both from investor’s looking to hedge an untick in inflation (a weaker U.S. dollar reaction to an easing Fed) and manufacturers/users witnessing better-than-anticipated consumer spending could flip supply balances from minor surpluses to major shortages rather quickly. And, with base metals underperforming other commodities since 2012, rather sizable price upside could be the end result in 12-18 months for Vale’s mined product.

The impetus for the Fed’s change of heart has been the slow pullback in inflation rates, which still remain well above the Fed’s 2% annual target rate. My issues are the target rate is not ZERO, while 2% is supposed to be counted over the whole economic cycle. 2% for a handle over just a few months, with higher rates at all other times, will not be acceptable to U.S. bond investors.

Reuters July 15th Article – Howard Schneider

Follow my logic: if inflation now “bottoms” in the 2.5% to 3% range, a new cost-of-living upturn could easily be in the works, assuming we completely skip the recession part of the traditional economic cycle. Without a sustained period of GDP contraction, different problems will appear in the financial system. Yes, the profit (loss actually) incentive and supply/demand forces that rebalance the economy are important parts of the process of capitalism. It’s akin to your local forest skipping the natural wildfire experience, allowing a raging inferno to show up and burn it all down eventually. Basically, RISING inflation could be our future again, perhaps with 5%+ CPI a possibility during 2025.

I have talked about the risk of resurging inflation for more than a year in my articles. It’s one of the reasons I have pushed gold/silver investments, and why I now believe increasing your exposure to oil/gas names makes sense. Two of my latest articles were on Texas/Oklahoma company Vital Energy (VTLE) here, and the global oil services firm NOV Inc. (NOV) here.

Today, I want to explain the unusually positive investment case for Vale, given we avoid recession in the second half of 2024, or experience a very shallow one focused on a Big Tech crash (similar to the 2000-02 period).

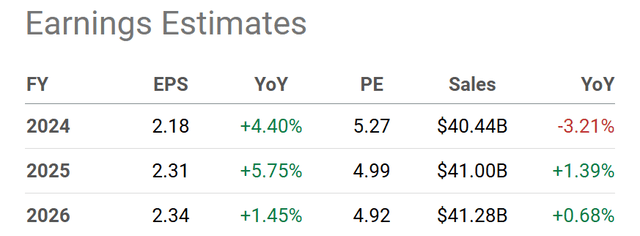

My summary bullish view looks at Vale’s $2 in projected EPS as a cycle bottom, not the top Wall Street seems to be anticipating. If we avoid a serious recession, why not buy a 5x P/E with high margins and considerable income growth potential? On the flip side, paying 50x earnings for Tesla (TSLA), Amazon (AMZN), NVIDIA (NVDA) could prove quite foolhardy under a rising inflation background.

Seeking Alpha Table – Vale, Analysts Estimates for 2024-26, Made July 16th, 2024

Let’s review the undervaluation rationale for ownership, under the lens that income and cash flow levels are bottoming and may be ready to jump dramatically during 2025-26.

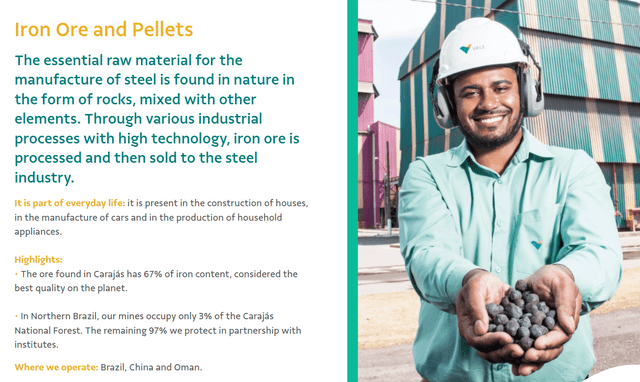

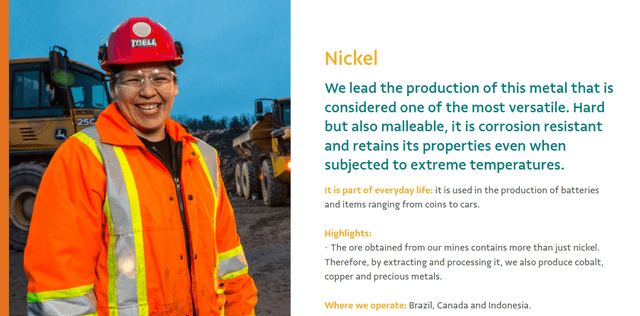

Vale Website – July 17th, 2024 Vale Website – July 17th, 2024 Vale Website – July 17th, 2024

Cheapest Large Miner

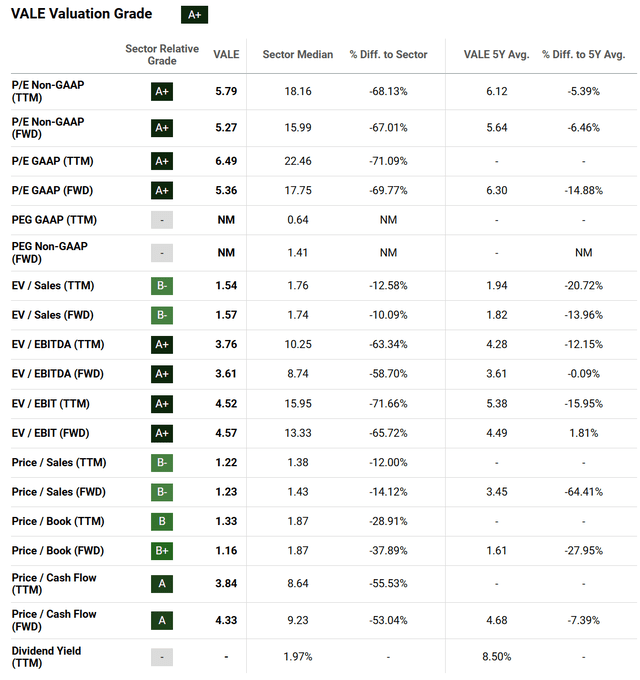

An important reason to be bullish on Vale is it appears to be best prepared to leverage an upturn in base metals pricing. The valuation is almost at a giveaway level, IF iron ore, nickel, and copper zigzag higher from today.

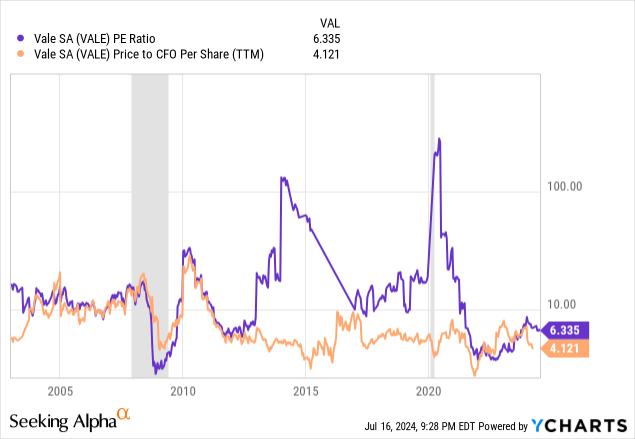

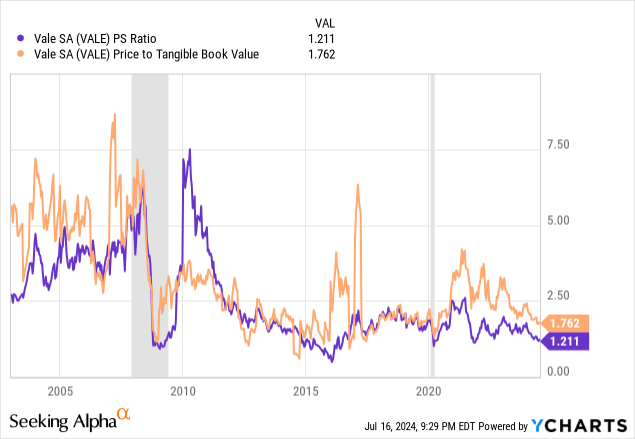

Reviewing basic fundamental ratios of share pricing to earnings, cash flow, sales and tangible book value, Vale is clearly sitting on the low-end of its long-term valuation range. It’s already approaching recession-era valuations.

YCharts – Vale, Price to Earnings & Cash Flow, Since 2003, Recessions Shaded YCharts – Vale, Price to Sales & Book Value, Since 2003, Recessions Shaded

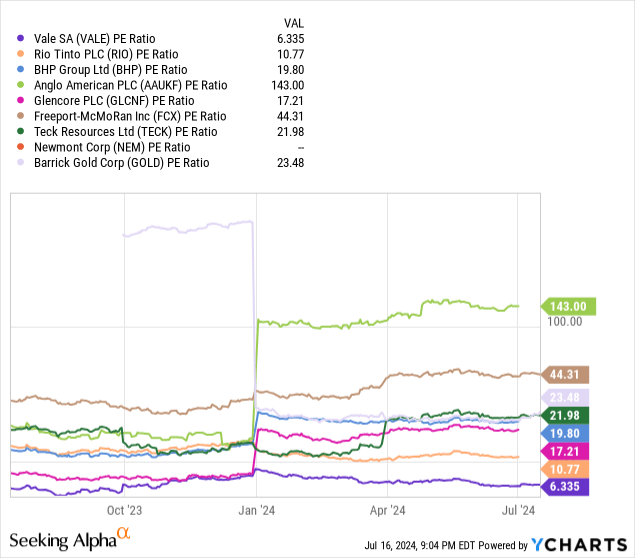

Using price to earnings multiple analysis, none of the largest metals mining concerns (by equity market capitalization) you can own are valued like Vale. Compared to Rio Tinto (RIO), BHP Group (BHP), Anglo American PLC (OTCQX:AAUKF), Glencore PLC (OTCPK:GLCNF), Freeport-McMoRan (FCX), Teck Resources (TECK), Newmont Mining (NEM), or Barrick Gold (GOLD), Vale’s 6.3x trailing ratio is a 70% discount to the median average! (Note: Newmont has reported losses over the last 12 months on one-time integration costs for its Newcrest Mining merger.)

YCharts – Vale vs. Major Mining Peers, P/E Ratio, 1 Year

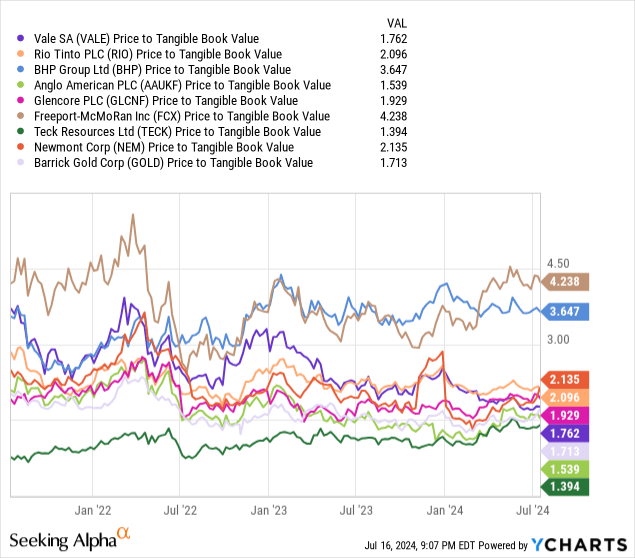

I like to look at price to tangible book values in the mining sector also, especially when debt levels are under control, like the majority of mega-miners currently. On this measure, 1.7x is again on the bottom (better) half of the valuation scale.

YCharts – Vale vs. Major Mining Peers, Price to Tangible Book Value, 1 Year

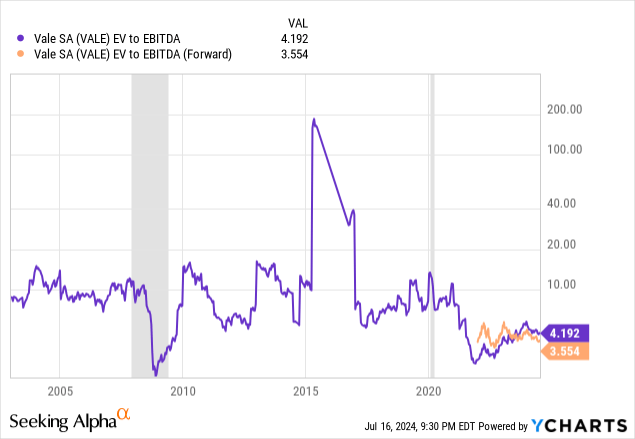

When we include total debt minus cash holdings, enterprise value calculations appear even cheaper for Vale shareholders. Actually, EV to EBITDA numbers (3.5x forward, 4.2x trailing) are close to the modern-record lows of 2021 and the Great Recession bottom of 2009. Vale’s 20-year average is closer to 8x, meaning the current ratio is a 50% discount to historical setups.

YCharts – Vale, EV to EBITDA, Since 2003, Recessions Shaded

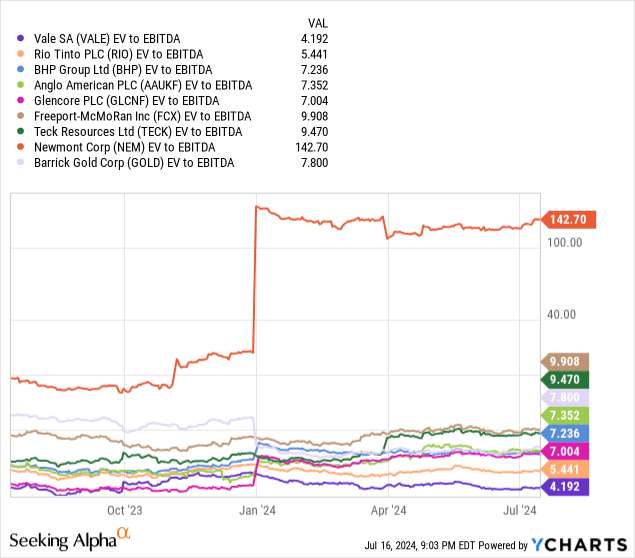

Reviewing raw EV to cash EBITDA, Vale is the standout winner of its peer group, a 40% discount to the median average of 7.35x.

YCharts – Vale vs. Major Mining Peers, EV to Trailing EBITDA, 1 Year

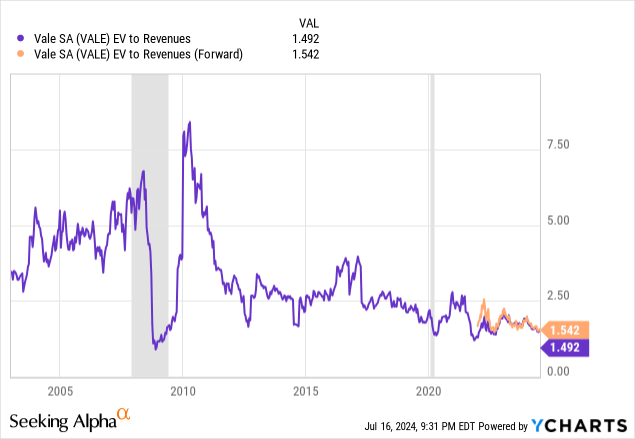

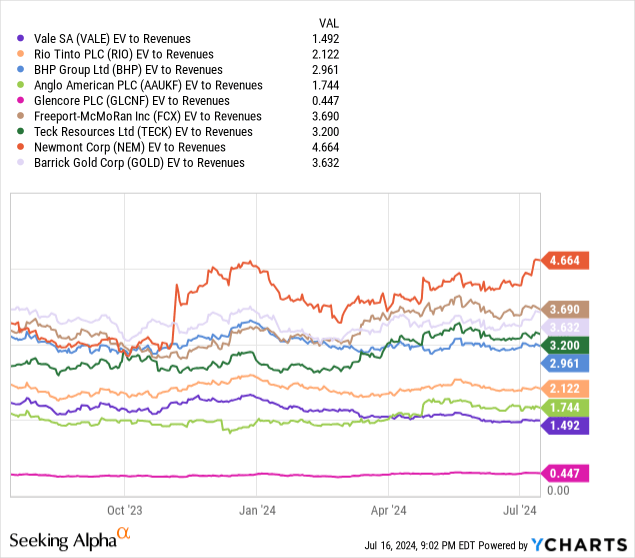

On EV to Revenues, Vale looks like a blue-light special (an old K-Mart retailing term for youngsters, meaning run to the blue light to get a special deal). The current ratio around 1.5x has only been lower 2% of the time since 2003.

YCharts – Vale, EV to Revenues, Since 2003, Recessions Shaded

The EV to Revenue ratio is also a 50% discount to the nearly 3x median average of this sort group. So, if sales march higher with base metals pricing, plenty of room to grow exists for the share quote.

YCharts – Vale vs. Major Mining Peers, EV to Trailing Revenues, 1 Year

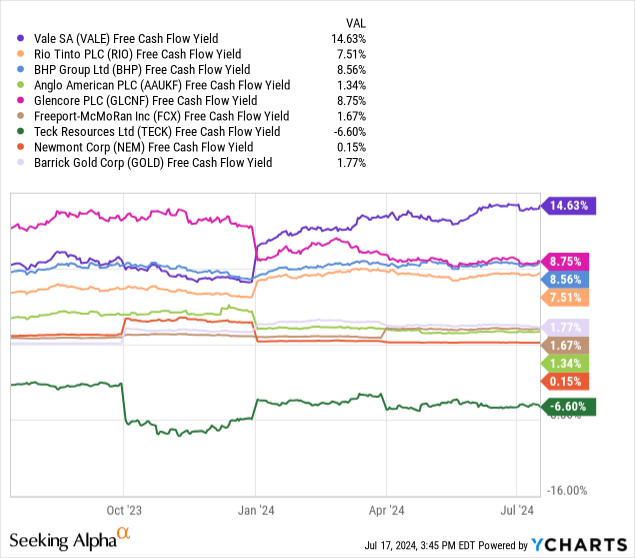

Perhaps the easiest to understand and most important data point (encompassing costs of production, necessary capital expenditures, and balance sheet safety) is the free cash flow yield. At 14.6%, none of the major diversified miners is in the same neighborhood (3.9% is the mean average).

YCharts – Vale vs. Major Mining Peers, Free Cash Flow Yield, 1 Year

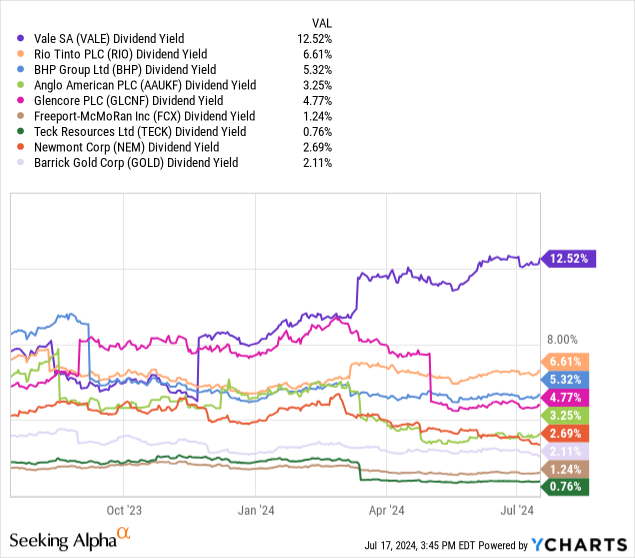

Of course, it’s interesting to point out the company traditionally pays out a big chunk of free cash (in recent years) as a cash dividend distribution to shareholders. The 12.5% trailing yield is an amazing distance from the 3.25% median average.

YCharts – Vale vs. Major Mining Peers, Dividend Yield, 1 Year

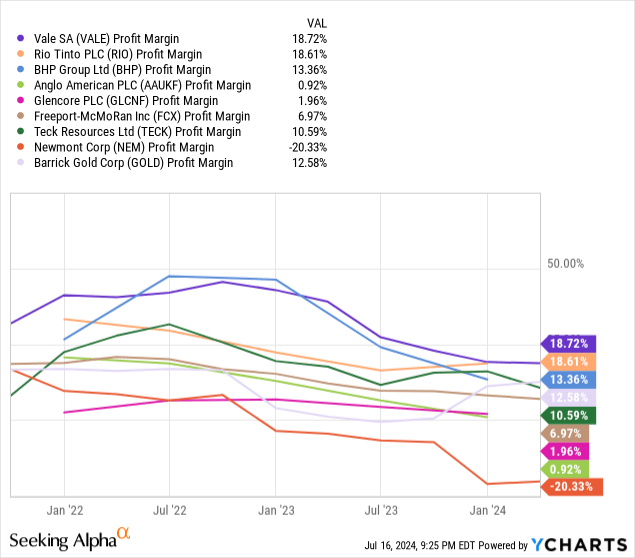

What about profit margins? They must very low to encourage investors to put such an undervaluation on shares? Nope. Vale’s 18.7% margin is the highest of the group, more than double the median or mean average.

YCharts – Vale vs. Major Mining Peers, Final Profit Margins, 3 Years

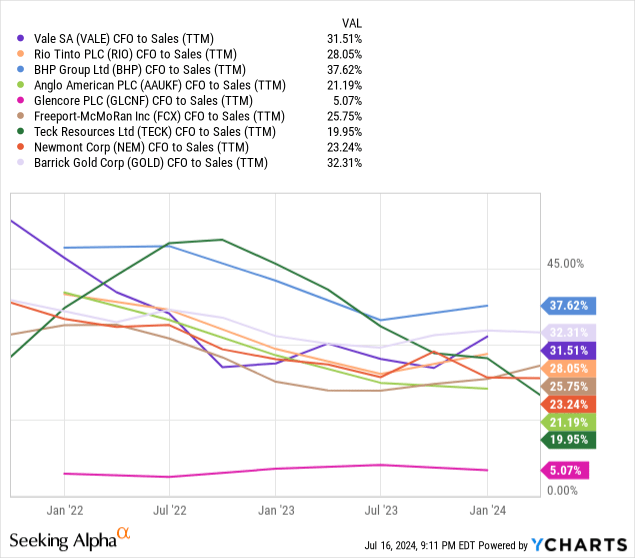

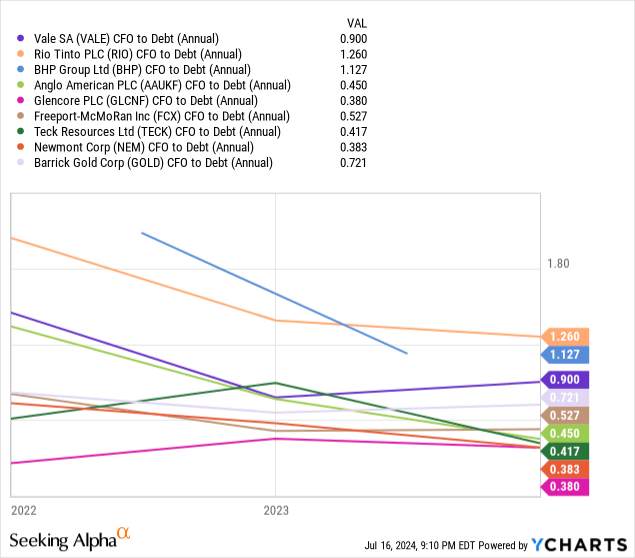

On top of industry leading profit margins, cash flow as a percentage of sales, alongside the ratio of cash flow to total debt, both highlight Vale as an asset to own out of the diversified mining group.

YCharts – Vale vs. Major Mining Peers, Cash Flow to Sales, 3 Years

YCharts – Vale vs. Major Mining Peers, Cash Flow to Debt, 3 Years

Putting together all of the positives, it is easy to understand why I consider Vale the bargain pick of the mega-cap miners globally. Seeking Alpha’s computer-sorting Quant Valuation Grade of “A+” concurs with my appraisal of what is backing up your investment dollars.

Seeking Alpha Table – Vale, Quant Valuation Grade, July 16th, 2024

Technical Trading Momentum Upturn?

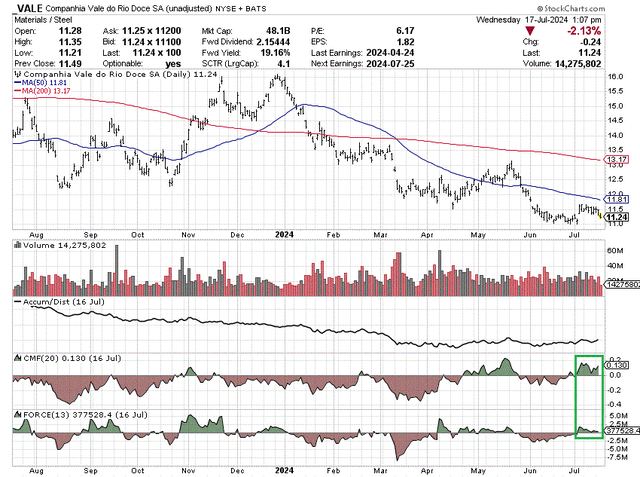

The June share price was the lowest since November 2020, almost four years ago, meaning most weak-hand holders have likely exited their positions. I prefer to buy value stocks, right before they become growth stocks. This is perhaps the best risk/reward formula to make money in the stock market. The trouble is it’s hard to identify durable bottoms.

For Vale, intraday and weekly “volatility” numbers have tailed off dramatically since early June, on relatively high volume. This may be telling us a better share supply/demand balance now exists vs. the regular selling pressure experienced from $16 in late December.

The Accumulation/Distribution Line was falling almost weekly into April, where it appears to have bottomed (pictured below). In addition, the 20-day Chaikin Money Flow reading and 13-day Force Index have been quite positive during July (boxed in green). This condition is somewhat similar to the April-May rise in price, but today’s instance is better backed by Fed governor statements that rate cuts are almost reality.

My technical action view is Vale may have already bottomed in price or will do so shortly (absent a stock market crash or because of one). I will say both Rio Tinto and BHP are showing similar technical signs in my momentum formulas that a bottom is near.

StockCharts.com – Vale, 12 Months of Daily Price & Volume Changes, Author Reference Point

Risk Discussion

Vale is not a slam-dunk winner, void of investment risks. Obviously, the primary driver of the stock quote is rising/falling metals pricing for iron, nickel, and copper. Economic booms globally are a positive for business results, while slowdowns and recessions prove problematic. (Roughly 90% of sales are made in countries outside the U.S.)

A second major risk to consider is Vale has an operating history of lax environmental oversight, with two major dam collapses killing hundreds of people over the last decade. The release of contaminated tailing waters has proven devastating, both immediately and over time.

In 2019, the Córrego do Feijão mine experienced a tailings dam failure, in Brumadinho, Brazil, killing 270 people and severely damaging the ecosystem. Vale quickly signed a reparation agreement with the government in 2021 for $7 billion in damages to the community, and has contracted to pay claims to over 16,000 individuals to date.

Another 2015 dam break disaster saw Samarco (Vale and BHP own the mine 50/50) pay billions in compensation and create the Foundation Renova, to help victims and restore the Rio Doce river environment. Hundreds of thousands of claimants in existing lawsuits for harm from property damage, health issues from contamination, personal injury and lost pay, remain unresolved. In January 2024, a judge ruled Samacro, Value and BHP were jointly liable for $9.7 billion in damages.

For Vale shareholders, the silver lining is damages will be paid out over many years, and can easily be absorbed by current operating cash flow of $12 billion annually. Yet, any future catastrophes (if they occur), will undoubtedly knock the stock quote for a loop.

A third risk is the vast majority of company assets are located in potentially unfavorable jurisdictions. With a concentration of assets in Brazil, Oman, Indonesia, and China, only its Canadian mines are considered to reside in a safe jurisdiction. Safe from political turmoil, potential asset seizures, new taxes and tariffs added without warning, labor unrest, etc. would be preferable for owners. So, heightened geopolitical risk is one excuse for Vale’s lower than industry-typical valuation.

Lastly, a new CEO search is underway, with early December as a goal for announcing the next top manager. Current CEO Eduardo Bartolomeo (since 2019) has mentioned the idea of possibly breaking up Vale into separate trading vehicles (dividing its assets). If management direction changes from maintaining a relatively conservative mining balance sheet, while witnessing only limited asset shuffles yearly (focused on accretive investor returns), Wall Street may push its valuation even lower. Specifically, if the new CEO goes on a buying spree, overpaying for additional assets with extra debt, I would not be as bullish on Vale as I am today.

Upside Potential

What’s possible for upside if we skip a recession in 2024-25? That’s the concept I am grappling with this week. The closest cousin might be the 2002 experience (near a mild recession bottom). Back then we experienced an official contraction in GDP, but it was almost entirely focused on the negative effects of the original 1990s Dotcom boom turning to bust.

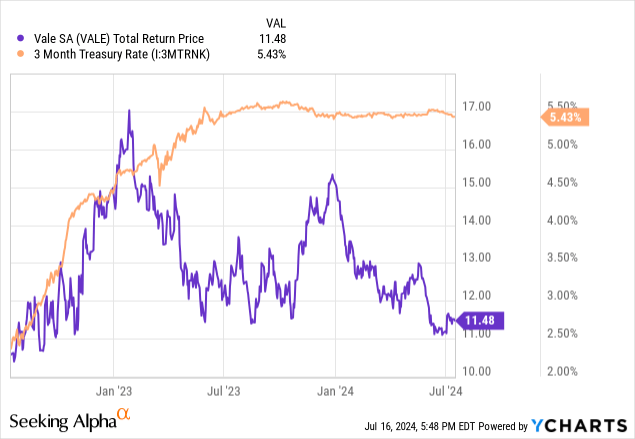

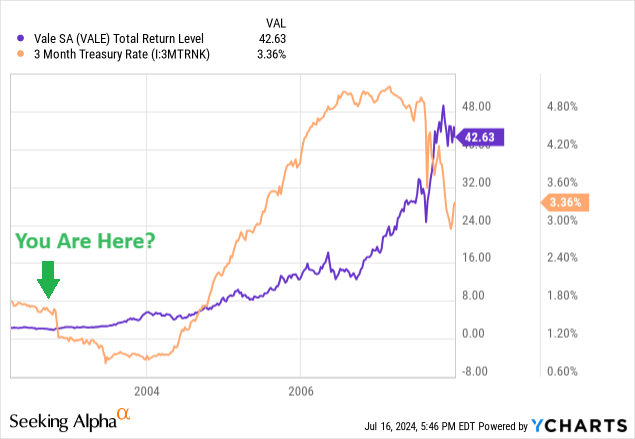

I have written on all of the 2024 similarities to this period, including the likelihood value stocks and small caps would eventually start to outperform Big Techs (like they have done in recent weeks). Below are chart comparisons for Vale total returns matched against changes in 3-month Treasury rates, both from the last two years and between 2002-07. Vale gains over this 5-year span were quite spectacular (approaching +2,000% from a smaller company size crossed with an extraordinary metals advance), although I would only expect a double or triple in its quote today (for upside potential through 2026) because of much larger total asset size vs. 2002.

a YCharts – Vale Total Return vs. 3-Month Treasury Rate, 2002-07

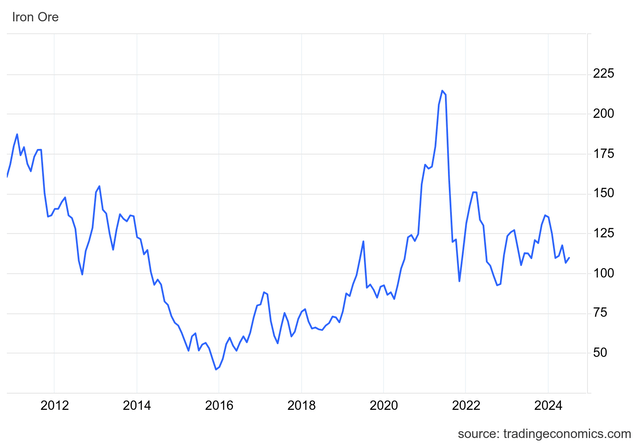

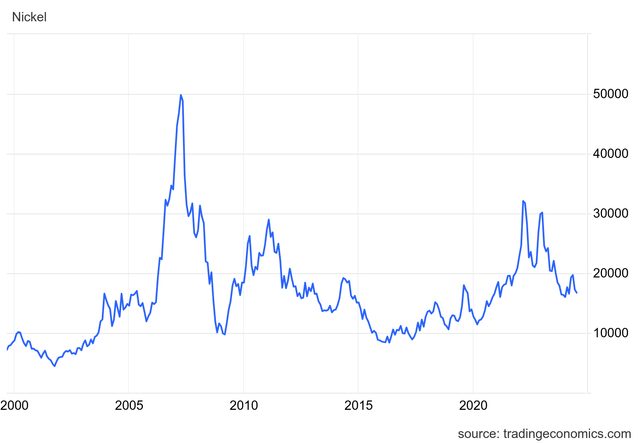

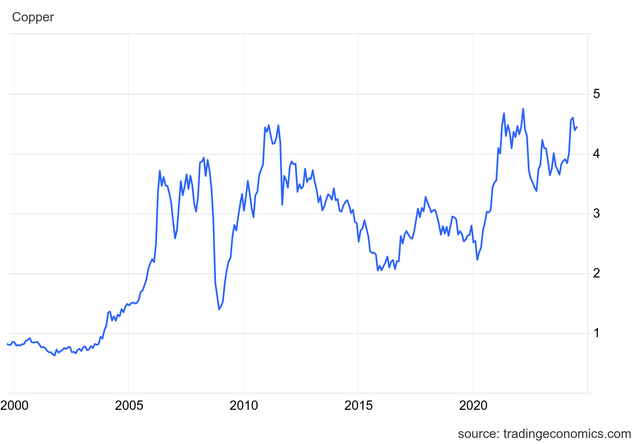

In addition, industrial metal prices have not risen as a group since 2012, far underperforming other commodities, money supply growth, general inflation rates, etc. If you are searching for an investment overdue for a nice price advance, base metals (especially those focused on EV and electricity demand growth) are definitely a sector to research further.

Tradingeconomics.com – Iron Ore Prices, Since 2011

Tradingeconomics.com – Nickel Prices, Since 1999

Tradingeconomics.com – Copper Prices, Since 1999

While iron ore demand is projected to be somewhat subdued vs. past years, mostly on weak expectations for Chinese economic growth, Vale remains one of the lowest cost producers in the world.

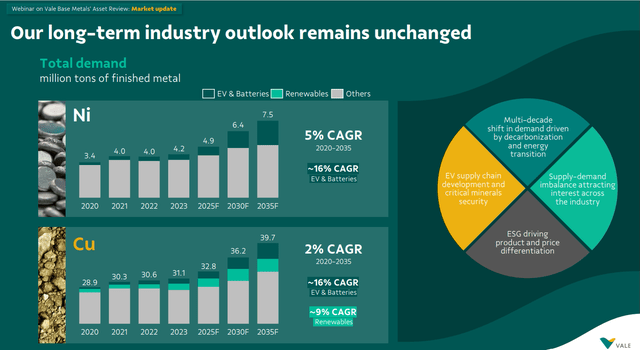

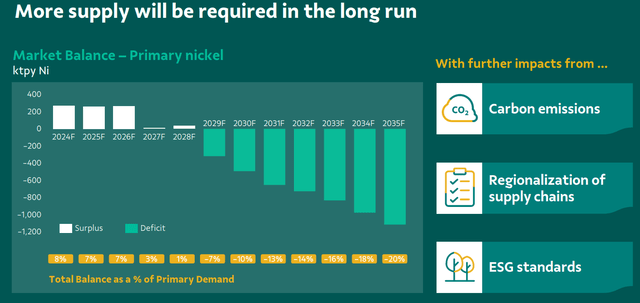

Yet, copper and nickel demand growth is projected to be quite robust over the next decade.

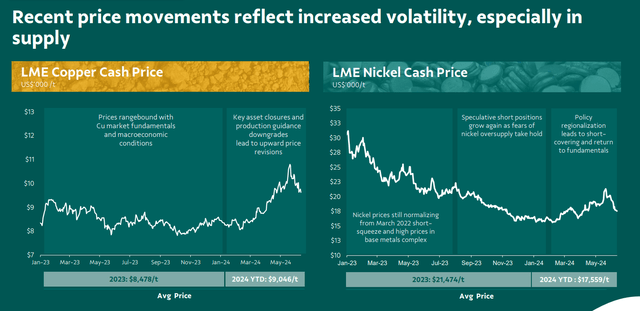

Vale – June Investor Presentation, LME Nickel & Copper Prices

Vale – June Investor Presentation, Projected Nickel & Copper Demand Growth

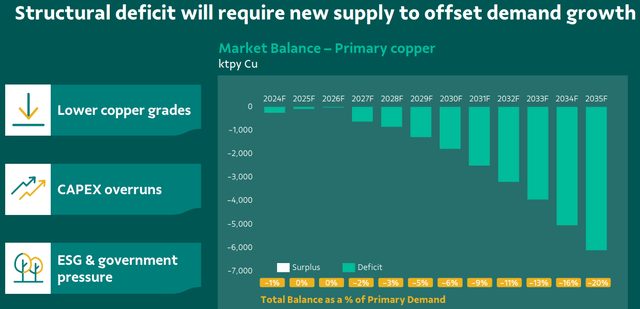

Electric vehicle usage (manufacture and regular driving) plus new data centers built to feature artificial intelligence are expected to spike electricity usage substantially going forward. Estimates of copper consumption to meet these tasks are getting to mind-blowing levels.

According to commodity trader Trafigura in April (through a Reuters article),

Flourishing activity in the electric vehicle, power infrastructure, AI and automation sectors will lead to at least 10 million metric tons of additional copper consumption over the next decade… Technological developments such as artificial intelligence and automation, and the energy transition, which includes electric vehicles and renewable energy, have already driven up demand prospects for copper cable used to conduct electricity.

Vale – June Investor Presentation, Projected Copper Shortage

Nickel is today a critical component in most lithium battery production, especially for EVs. Industry estimates of rapid 5% to 7% compounded growth in annual nickel consumption over the next 7-10 years are quite common.

Vale – June Investor Presentation, Projected Nickel Shortage

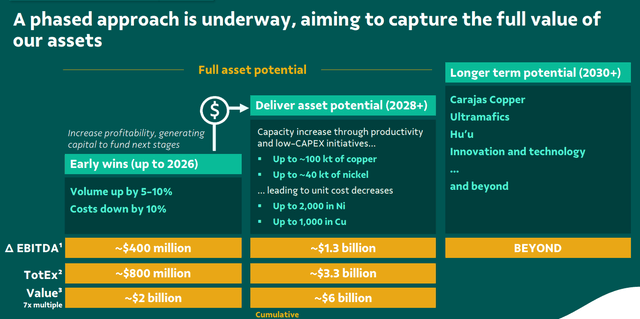

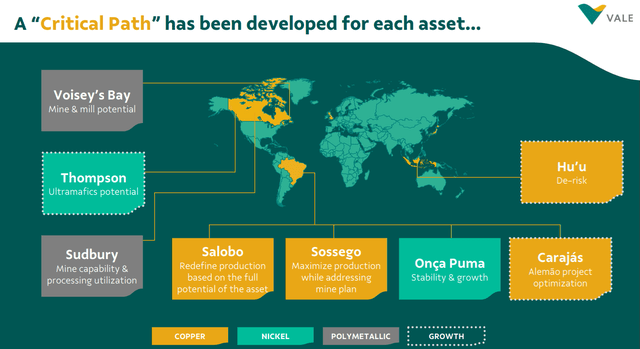

The good news is Vale owns mining assets with projected production/reserve ranges of 10 years to 40+ years. So, if/when metals prices do increase materially, the company will be able to increase mining rates (through CAPEX) when its profitable to do so.

Vale – June Investor Presentation, Phased Production Growth Vale – June Investor Presentation, Phased Production Growth

Final Thoughts

A bullish long-term outlook for Vale is focused on steady demand increases overall for its mined metals, which should underpin sales and earnings years into the future.

However, an unexpected increase in demand for base metals could swiftly reverse the stock quote from a position of undervaluation (discounting a recession) to one forward looking to tighter supply/demand balance into 2025.

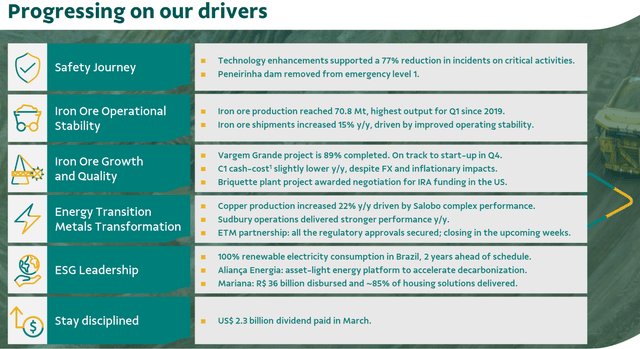

More good news came out yesterday (July 16th in its Q2 production report), explaining ore mining levels should hit the top end of its previous guidance for 2024.

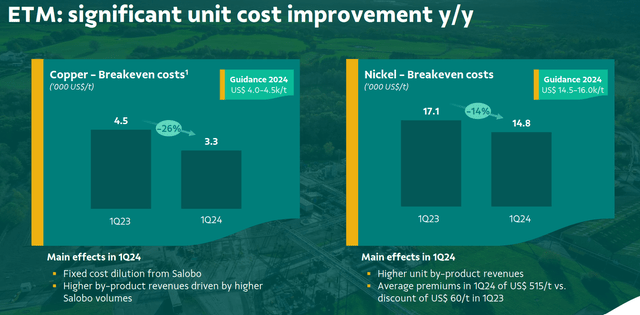

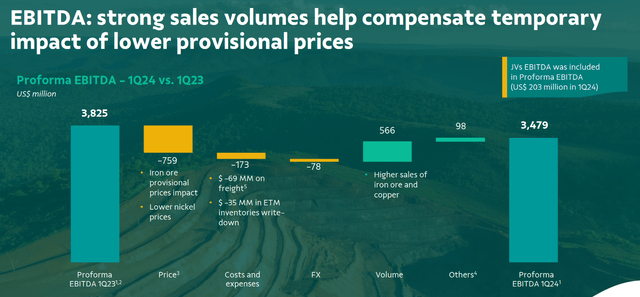

Plus, Q1 results were quite favorable, with unit mining cost actually declining.

Vale- Q1 2024 Earnings Presentation Vale- Q1 2024 Earnings Presentation Vale- Q1 2024 Earnings Presentation

As always in the stock market, timing is everything for Vale investors. If we skip a major recession and move straight into a stronger worldwide economic advance in 2025, the stock will be a H-U-G-E winner. However, if we follow typical recession patterns, I can see the stock falling back to book value readings (equal to another -40% of price downside), on breakeven results, with little for dividends. At that point, an economic recovery in 2025-26 would help investors to even better long-term compounding gains (from a lower price and valuation level).

I am coming up with 10-year cycle “valuation” average for Vale shares in the $15-17 range today, using analyst estimates for 2024-25, and financial data from the company. If iron ore, nickel, and copper prices begin to advance, a $20 fair value target will be easy to figure. Given a large jump in metals pricing, a $25 to $30 share target in 12-18 months will be within reach (2x $50+ billion in sales and 8x $3.00-$3.50 EPS for a valuation yardstick), which would be marginally above 2021’s high quote of $23.

I rate Vale shares a Buy under $12, and own a small position, just in case the Federal Reserve is about to pump commodity inflation to new heights. If a recession hits, driving the quote below $10, my plan is to raise my position sizing.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

qu

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VALE, NEM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.