Summary:

- I have turned increasingly bearish about Big Tech names since early summer, and believe Adobe is due for a sizable correction.

- Rising interest/dividend yields available from bonds and income-related securities now offer serious competition to richly-valued growth stocks.

- Recession risks for 2024 are real, and Adobe’s stock trading pattern is showing fading momentum.

- I am flipping my 12-month rating from the Buy to Sell column.

grinvalds

I have been a little lucky in my Adobe (NASDAQ:ADBE) stock trading calls over the years, nailing the wide share price swings since 2021 (both tops and bottoms). I suggested investors liquidate their holdings at $624 a share in July 2021 here, because of a clear overvaluation problem.

My only other full-length article was a Buy proposition posted right at its cyclical bottom of $295 in September of last year here. Below is a screenshot of the story title, summary, and performance achieved over the last 13 months.

Seeking Alpha – Paul Franke, Adobe Article, September 17th, 2022

I will now press my luck and reverse course, again. Why? I have been quite leery about Big Tech shares since the summertime, with interest rates still rising and a slowing economic outlook arguing the whole group of stocks leading Wall Street higher in 2023 is due for a sizable correction. Adobe is definitely one of this subset of top performing names. In my view, trailing earnings and free cash flow yields under 3% make little rational sense vs. “risk-free” Treasury rates now well over 5%. I think it prudent to cut and run from Adobe trading at $514 today.

In addition, the momentum trading pattern is looking tired. So, forecasting some sort of decline in price, perhaps in the -20% to -30% range into the spring of 2024 is not rocket science in my opinion. For traders and portfolio allocators, I would now consider selling or avoiding Adobe shares. Patiently waiting for better quotes to engage in new purchases may be the smartest decision of all. My intermediate view is Adobe’s quote will trade lower 12 months down the road.

I am also sad to say the investment story is showing many parallels to the year 2000 Dotcom Tech Bubble peak. So, a multi-year span of price decline cannot be ruled out. Let me explain why.

The Valuation Problem

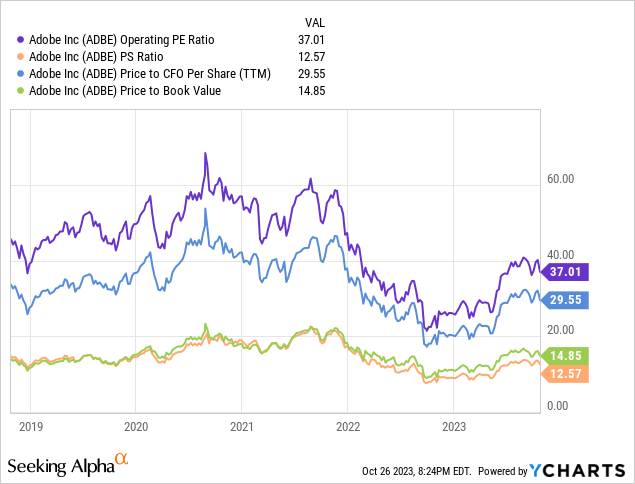

Adobe’s +75% price gain since my last article has taken place against a less aggressive +15% rise in sales and income generation. What this means in adjusted terms is the valuation is roughly 60% above the lows of last autumn.

On top of this setup, even higher interest rates from bonds and cash savings vs. 13 months ago is producing stiffer competition for investment capital. When business returns (earnings or free cash flow yields for example) are better than available interest and dividend rates elsewhere, you should buy stocks. When the opposite is true, like today, it is more reasonable to take on less risk holding bonds and cash, while capturing a higher return on your investment.

Finally, if Adobe business growth stalls or actually shrinks in a recession, much lower pricing and valuations may be in order. Since I am firmly in the camp expecting a recession soon from sharply contracting credit and money supply creation in the financial system vs. a year ago, we have 3 major knocks against owning Adobe that did not exist in late 2022 (at least to the same extent).

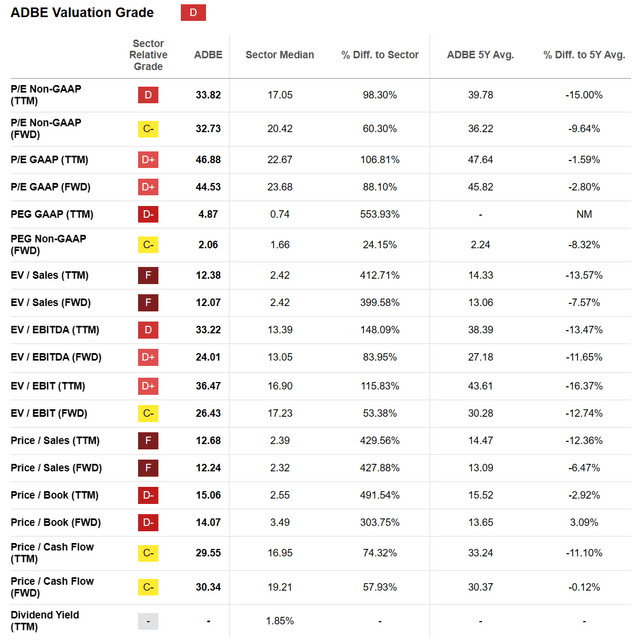

Basic fundamental valuations are running about DOUBLE the equivalent S&P 500 average today. Bulls will argue high profit margins, a strong balance sheet, and steady business growth deserve the premium. Plus, Adobe’s ratio analysis on earnings, sales, cash flow, and book value are relatively normal vs. recent history, at least on 5-year comparisons.

YCharts – Adobe, Basic Fundamental Valuations, 10 Years

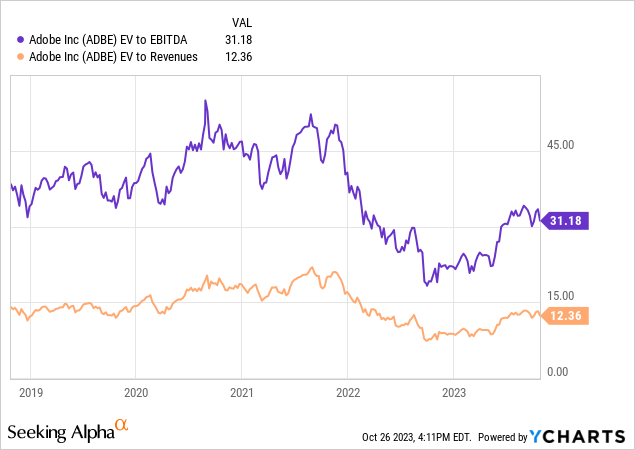

Likewise, when we review enterprise valuations (including changes in debt and cash on the balance sheet), Adobe’s underlying business results are priced around 5-year averages. Yet, I would note, the overall valuation picture is nowhere near as positive as last year’s autumn bottom. So, investors can draw different personal conclusions on Adobe’s desirability, using basic ratio analysis. I will say EV to EBITDA of 31x and revenues of 12x are still DOUBLE the equivalent S&P 500 averages.

YCharts – Adobe, Enterprise Valuations, 10 Years

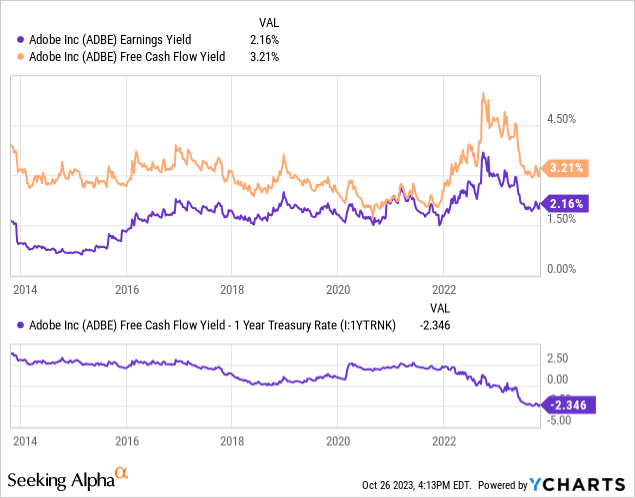

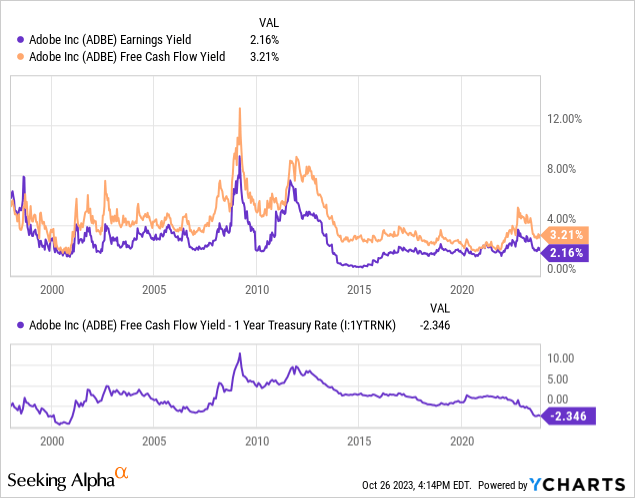

Perhaps of greater importance, free cash flow and earnings yields should beat the prevailing 1-year Treasury investment rate, as the minimum threshold to consider owning any business, unless amazing growth is taking place.

Looking at GAAP accounting, the Adobe earnings yield is running at only 2.16% on a trailing basis. When we include the effect of stock-based pay to Adobe employees ($1.6 billion over last 12 months), the resultant free cash flow yield is a tad more attractive return on investment to research.

Nevertheless, even this optimistic return on investment is far, far short of the 5.5% risk-free government debt rate for 12 months. In fact, today’s -2.34% adjusted number is the WORST reading since the 2000-01 Dotcom Bubble peak valuation for the stock. (You will notice this relative return has been a positive number 21 of the last 25 years).

YCharts – Adobe, Earnings & Free Cash Flow Yields, FCF Yield vs. 1-Year Treasury Rate, 10 Years YCharts – Adobe, Earnings & Free Cash Flow Yields, FCF Yield vs. 1-Year Treasury Rate, Since 1998

Seeking Alpha’s quant ranking system places a “D” Valuation Grade on Adobe, which may be on the generous side if a recession is next. Any unexpected downturn in operating results at the company means the stock quote is susceptible to an oversized price downdraft, pure and simple.

Seeking Alpha Table – Adobe, Valuation Grade on October 25th, 2023

Trading Momentum Exhausted?

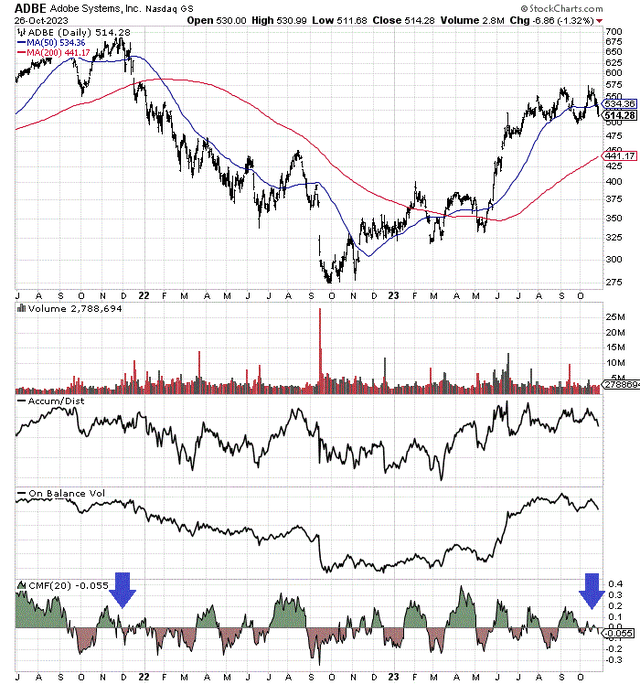

Of particular shorter-term concern for shareholders is upside trading momentum appears to be fading fast. Indicators like the Accumulation/Distribution Line and On Balance Volume topped between June and August. Price appears to be rolling over as measured by the 50-day moving average, while a minor -3% drop would bring a 4-month low.

The trading picture during October also includes a very weak 20-day Chaikin Money Flow number on the 52-week price high reached days ago (marked with a blue arrow below). This CMF pattern is very scary considering it last took place during November 2021, weeks before price began a -60% slide into late 2022.

StockCharts.com – Adobe, Daily Price & Volume Changes, Since July 2021, Author Reference Points

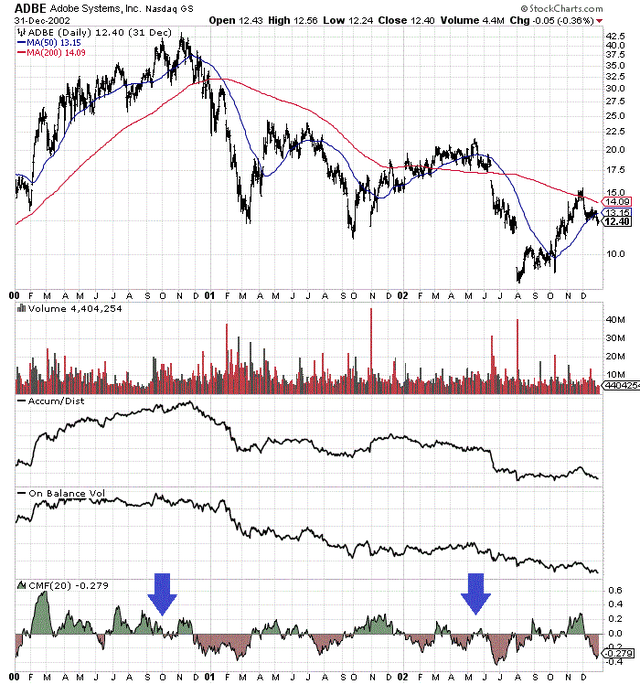

Don’t laugh, but this trading pattern is very reminiscent of its October 2000 peak, one of the best times to run away from technology names.

StockCharts.com – Adobe, Daily Price & Volume Changes, 2000-02, Author Reference Points

Final Thoughts

Believe it or not, a number of characteristics line up quite well with the original Tech Boom peak in the year 2000. The current combination of an extended overvaluation, hard to quantify profit potential of AI (artificial intelligence) optimism, quite high interest rates historically in the general economy, and a looming recession smells a lot like the Adobe top and decline of 2000-2002.

Adobe’s overvaluation and trading condition setup is also strikingly similar to Microsoft (MSFT) today. I just published a bearish take on Microsoft yesterday here, downgrading this security from a Hold over the past year to a Sell.

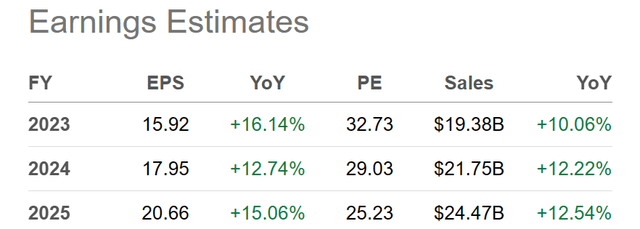

For Adobe, I am thinking a retest of $400 a share may be approaching, at a minimum. Using the steady, but not outstanding growth projections for sales and income in the 12%-15% range for 2023-25, a trailing cash operating P/E closer to 25x (delivering a 4% earnings yield) makes better sense to me. When investment alternative interest rates are above 5%, and a recession might be right around the corner, Adobe is no longer a rush to own proposition. Wall Street could decide to rerate the valuation lower without any warning.

The consensus analyst summary of non-GAAP adjusted EPS and sales projected over the next couple of years is listed below.

Seeking Alpha Table – Adobe, Analyst Estimates for 2023-25, Made October 25th, 2023

Plus, given flat to negative EPS growth during a recession, the non-GAAP cash P/E (approximating free cash flow) could again approach 20x, just like last year’s September bottom valuation. $16 in EPS for 2024 multiplied by 20 translates into downside all the way to $320 as a possibility over the next 12 months (-38% price drop from $514 now, as a worst-case scenario).

For the bull run in Adobe shares to continue, either AI-related growth has to show up in coming quarters, or interest rates need to fall back dramatically. On my slide ruler, vastly improved EPS and/or a different investment discount rate could inflate the underlying worth of the business.

Until then, high interest rates and a slowing economy will be the primary concerns for investors. I now rate Adobe shares a Sell, using a 12-month yardstick.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may purchase a long position in UGL over the next 72 hours. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.