Summary:

- Meta Platforms, Inc. reported great third quarter results and could exceed analysts’ expectations going forward.

- Not only will the company be able to grow revenue from its “Family of Apps,” we still have the vision of the Metaverse that could be a potential cash cow.

- Although Meta Platforms is three times as expensive as one year ago, the stock is still a “Buy.”

Justin Sullivan

In my last article, I stated that Meta Platforms, Inc. (NASDAQ:META) is moving closer to its intrinsic value. And although Meta was trading for $305 back then – and therefore $25 lower than right now – we must take another closer look at Meta Platforms and our assessment of a fair, intrinsic price. Especially when considering the great results Meta Platforms reported this past quarter, many people might have to rethink growth assumptions for the years to come – and I will do the same and offer another intrinsic value calculation.

Quarterly Results

Meta Platforms reported impressive results for the third quarter of fiscal 2023. Not only did the company beat revenue as well as earnings per share estimates, but Meta Platforms also reported impressive growth rates – results we haven’t seen for several quarters.

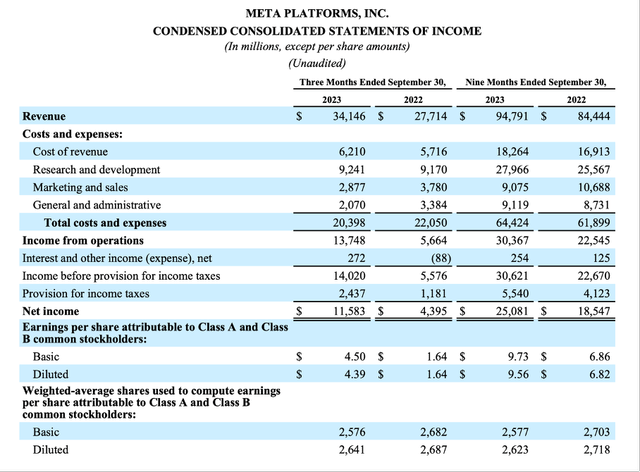

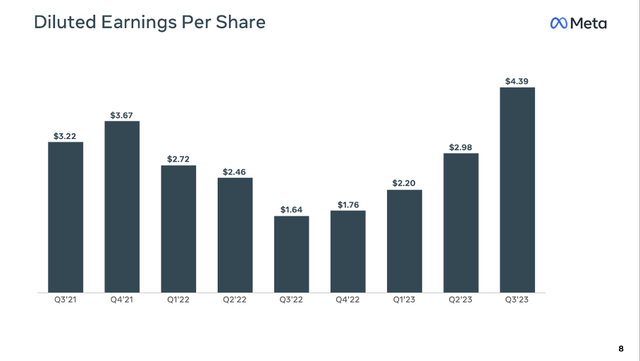

Revenue increased from $27,714 million in Q3/22 to $34,146 million in Q3/23 – resulting in 23.2% year-over-year top line growth. And due to lower costs and expenses – total costs and expenses decreased from $22,050 million in Q3/22 to $20,398 million in Q3/22 – income from operations increased 143% from $5,664 million in the same quarter last year to $13,748 million this quarter. And diluted earnings per share grew from $1.64 in Q3/22 to $4.38 in Q3/23, resulting in 167% bottom line growth.

Meta Platforms Q3/23 Earnings Release

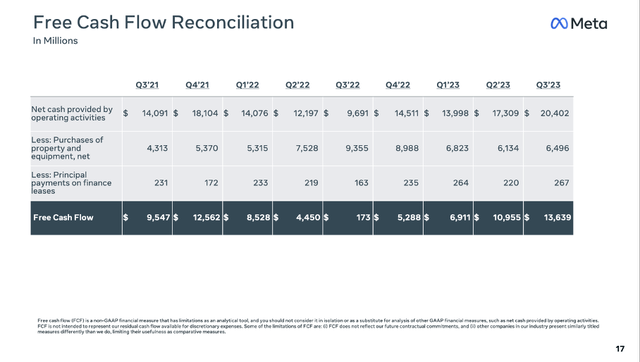

Not only earnings per share grew at a high pace, but free cash flow also jumped. While Meta Platforms generated only $173 million in free cash flow in Q3/22, the company generated $13,619 million in free cash flow this quarter. This extremely high free cash flow was the result of a combination of lower capital expenditures as well as higher net cash provided by operating activities. Meta Platforms also profited from a deferral of income taxes in this quarter.

Meta Platforms Q3/23 Presentation

And not only the income statement and cash flow statement were impressive, Meta Platforms also grew its daily and monthly active users with a solid pace. Facebook grew its monthly active users from 2,958 million in the same quarter last year to 3,049 million this quarter – resulting in 3.1% year-over-year growth. However, daily active users grew 5.1% year-over-year from 1,984 million in Q3/22 to 2,085 million in Q3/23 indicating that already existing users are using Facebook more often.

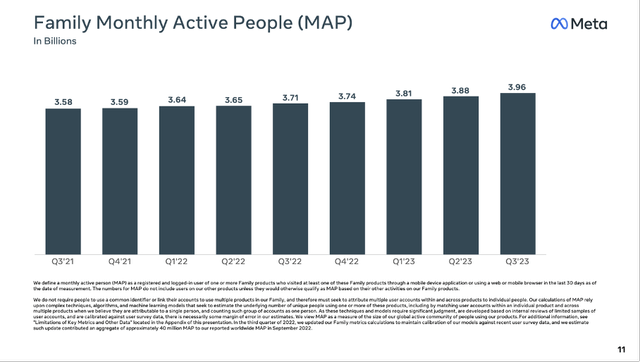

When looking at the Family of Apps, the picture is similar, and we see even higher growth rates. Monthly active users increased 6.7% year-over-year from 3.71 billion in the same quarter last year to 3.96 billion this quarter. And daily active users increased from 2.93 billion to 3.14 billion – resulting in 7.2% year-over-year growth.

Meta Platforms Q3/23 Presentation

And not only the number of daily or monthly active users is increasing, the ad impressions delivered across the Family of Apps increased by 31% year-over-year. On the other hand, the price per ad still decreased by 6% year-over-year (but this is also an improvement compared to previous quarters). Ad revenue growth was strongest in “Rest of World” as well as “Europe,” growing about 35% YoY in both regions.

Segment Results

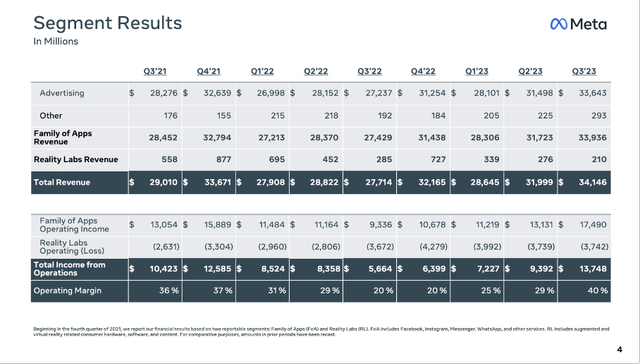

When looking at the segment results, the picture is the same as in the past. The biggest part of revenue once again stemmed from advertising as revenue increased from $27,237 million in the same quarter last year to $33,643 million this quarter.

Meta Platforms Q3/23 Presentation

When looking at the “Family of Apps” revenue, “Other revenue” increased from $192 million in the same quarter last year to $293 million this quarter. This growth was driven by strong business messaging revenue growth from the WhatsApp Business Platform. While the Family of Apps is continuing to perform well, Reality Labs is continuing to be a disappointment. Compared to $285 million in revenue in the same quarter last year, it only generated $210 million in revenue this quarter. And the segment is continuing to lose money. Operating loss increased even slightly from $3,672 million in the same quarter last year to $3,742 million this quarter.

Outlook 2023 and 2024

For the fourth quarter of fiscal 2023, Meta Platforms is expecting revenue to be in a range of $36.5 billion to $40 billion resulting in about 13.5% to 24.5% year-over-year growth. And with full year expenses being lower again (now in a range of $87 billion to $89 billion instead of $88 billion to $91 billion) we can also expecting the bottom line to grow with a high pace. Analysts are expecting earnings per share of $4.91 in the fourth quarter.

Management also provided an outlook for 2024. Meta Platforms is expecting higher infrastructure-related costs next year and is expecting total expenses to be in a range of $94 to $99 billion. And full-year capital expenditures in 2024 are expected to be in a range of $30 billion to $35 billion. Higher CapEx mostly stems from investments in servers and data centers. Overall, analysts are expecting revenue around $150 billion and earnings per share to be $17.29 on average.

Bigger Picture

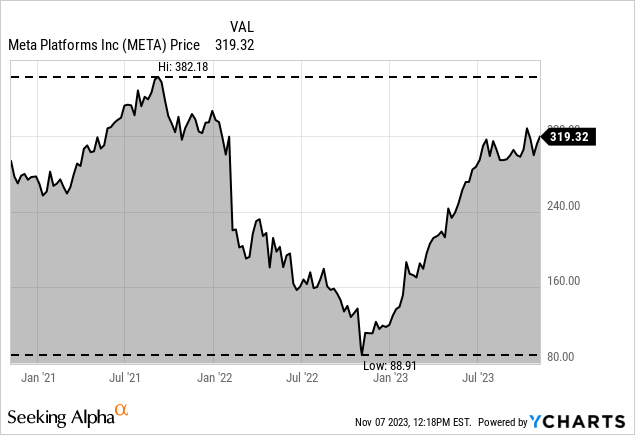

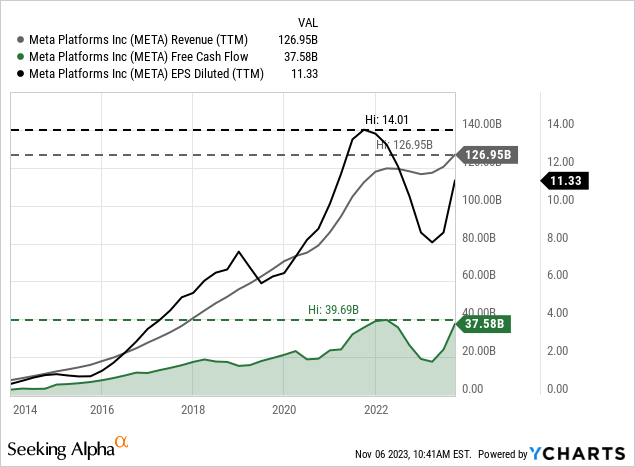

When looking at the bigger picture, we can see that the V-shaped recovery of the stock price is actually followed by a V-shaped recovery of the fundamental business. Meta Platforms saw a steep decline of its stock price from almost $400 to below $90, but also saw a quick recovery in the last twelve months.

Looking at revenue we see the top line increasing again after it stagnated in the last few quarters. When looking at earnings per share, Meta Platforms is not able to report $14 in earnings per share again, but we see a clear turnaround and higher earnings per share again. And the same is true for free cash flow: We see a clear turnaround and free cash flow is actually very close to its all-time high again.

The V-shaped recovery becomes obvious when looking at quarterly earnings per share. Due to a great performance and share buybacks in the last few quarters, Meta Platforms is already reporting higher quarterly earnings per share as before the “crash.”

Meta Platforms Q3/23 Presentation

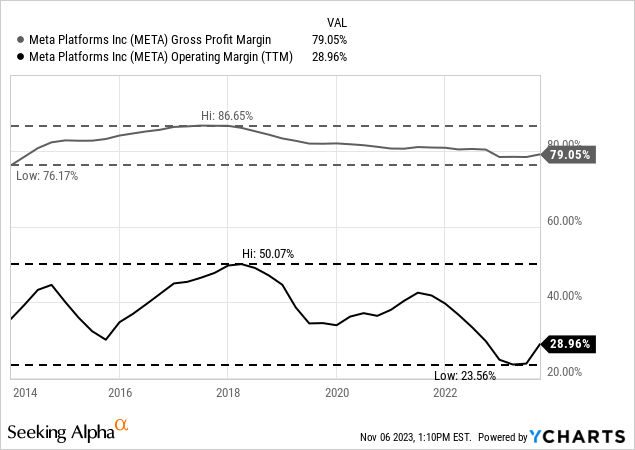

We can also see margins improving slightly again. Gross margin increased again after margins declined in the last few years from almost 87% to below 80%. And the company also increased its operating margin again. It hit a low of 23.56% a short time ago (TTM numbers) but improved again to 28.96% right now.

And Meta Platforms was clearly struggling in the last few years. Nevertheless, when looking at the last three years, Meta Platforms grew its revenue with a CAGR of 18.15%. And although operating income increased not with such a high pace, we still see a growth rate of 6.46% in the last three years and earnings per share grew with a CAGR of 10.14% in the same timeframe.

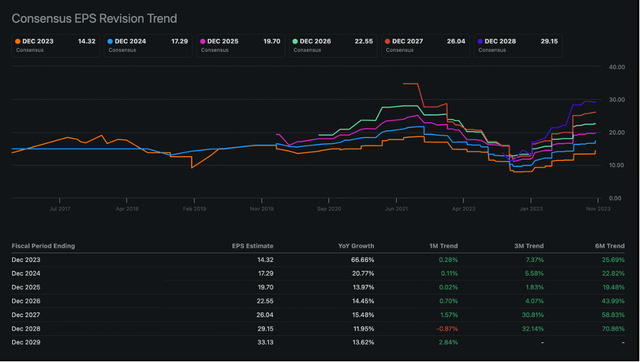

Meta Platforms: EPS Revision Trend (Seeking Alpha)

And when looking at the earnings per share revision trend, analysts are getting more and more optimistic for the years to come.

“Year Of Efficiency” Replaced By “Year Of AI”

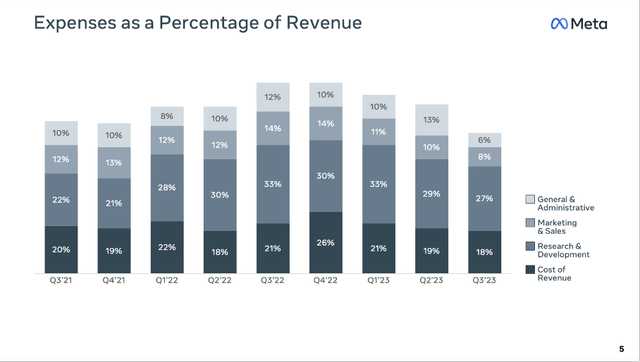

This turnaround was in part made possible by CEO Mark Zuckerberg focusing on efficiency in 2023. When looking at expenses as percentage of revenue, we can see how effective this “Year of Efficiency” has been so far. Since Q4/22 expenses (as percentage of revenue) decreased dramatically and are now below the levels of 2021. In the same quarter last year, total expenses were about 79.6% of revenue. In the third quarter of 2023, total expenses were 59.7% of revenue, which is a huge difference.

Meta Platforms Q3/23 Presentation

And during the last earnings call, management announced that the focus for 2024 will be artificial intelligence. Mark Zuckerberg stated:

Now, in terms of investment priorities, AI will be our biggest investment area in 2024, both in engineering and compute resources. But I want to avoid allocating a lot of new headcount. So we’re going to continue deprioritizing a number of non-AI projects across the company to shift people towards working with AI instead.

By the way, Meta Platforms did focus on efficiency and cut spending, but it did not stop to invest in its future. The company lowered its headcount in 2023 but will selectively allocate incremental headcount towards four key company priorities: AI, infrastructure, Reality Labs, and monetization (with AI being the largest area).

Growth: The Basics

In the following two sections I will look at the different ways Meta Platforms can grow its business – and we start by looking at the extremely successful “core” business of Meta Platforms – Facebook, Instagram, and WhatsApp. What I write in this section is nothing new or revolutionary – but it needs to be pointed out (especially as many people forgot it in 2022 and drove the share price below $100) and updated from time to time.

In the coming quarters, two primary factors will drive revenue performance: engagement and effectiveness of monetization. When looking at the numbers, overall engagement on Facebook and Instagram remains strong. Meta Platforms could report a 7% increase in time spent on Facebook and a 6% increase on Instagram as a result of recommendation improvements. And especially Reels and video content continue to grow and are driving engagement (Reels has driven more than 40% increase in time spent on Instagram since the launch of Reels). Meta Platforms will also invest heavily in AI to increase engagement by showing the content users actually want to see and that will keep them on the platform. The company is adopting the use of larger, more advanced ads models and is using AI to power ads products that provide increased automation to advertisers.

The second driver is effectiveness of monetization. After Reels was always a net negative to the company’s overall revenue in the last few quarters as Reels could not be monetized as well as former products, management is now estimating Reels to be net neutral to overall company ad revenue and for 2024 Reels will be a modest tailwind to revenue. Meta Platforms is also trying to improve the effectiveness of monetization by further improving Reels ads performance through ranking improvements and making the ads increasingly interactive. And Meta Platforms is making it easier for advertisers to connect their marketing data.

Additionally, Meta Platforms is more and more trying to monetize WhatsApp by expanding business messaging. In India for example, revenue from click to message ads has doubled year-over-year as more than 60% of the WhatsApp users are messaging a business account. Meta Platforms is still confident this will be the next major pillar of the business and overall, there are more than 600 million conversations between people and businesses every day on the platform.

Aside from looking at Facebook, Instagram or WhatsApp, Mark Zuckerberg mentioned several times how important AI will be in the future for the entire Family of Apps:

Generative AI will increasingly be important going forward. I outlined our product roadmap earlier. And on top of that, we’re also building foundation models like Llama 2, which we believe is now the leading open source model with more than 30 million Llama downloads last month. Beyond that, there was also a different set of sophisticated recommendation AI systems that powers our feeds, Reels, ads, and integrity systems. And this technology has less hype right now than generative AI, but it is also very important in improving very quickly.

Growth: The Vision

So far, it became quite obvious that Meta Platforms is a great investment, and the company is being able to deliver high growth rates – even without the vision of the Metaverse. Meta Platforms will continue to grow by focusing on the aspects mentioned above. But we should not ignore the vision with the potential to generate billions of dollars in revenue.

So far, Reality Labs is just expensive and generating a huge operating loss. But Mark Zuckerberg is hanging on to the vision. And the next big step is the Quest 3, which was just launched. It is the first mainstream mixed reality device and Zuckerberg explained:

And that means that when you put on the device, you see your physical room around you, and you can bring digital objects and games into your physical space, whether that’s a ping pong table, your workstation, a big screen TV to play Xbox games on, or your friends as holograms.

It seems like Zuckerberg has high hopes for the Quest 3 generating much more revenue compared to its predecessors. Nevertheless, analysts seem to be more cautious and estimates are 2.0 million to 2.5 million units being solid in H2/23 resulting in about $1.25 billion in revenue (assuming about $500 selling price). And although estimates were already lowered it does not seem like Quest 3 had the best start.

We simply don’t know if the Metaverse will be a success, but we do know the following: If it will be a success, it will generate billions in revenue for Meta Platforms, and if it fails, the company spent billions of dollars on a failed project, but we still have an extremely profitable core business.

Intrinsic Value Calculation

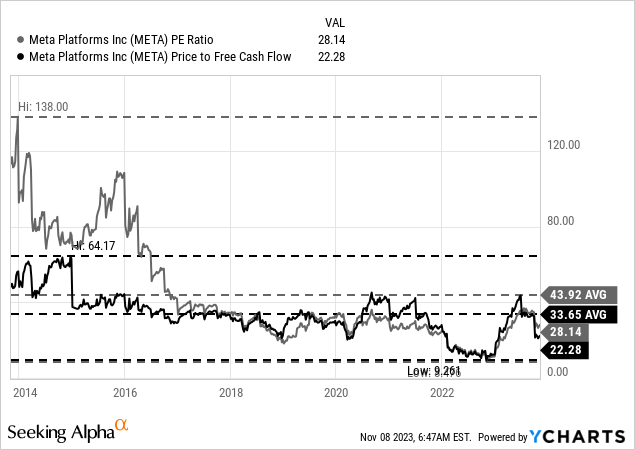

Meta Platforms is still far away from the bargain the stock was about a year ago. But with earnings and free cash flow increasing, the P/E ratio as well as the P/FCF ratio are declining again. Right now, Meta Platforms is trading for 28 times earnings as well as 22 times free cash flow. And as long as we can assume Meta Platforms growing in the high single digits or even double digits (which seems likely), trading for 22 times free cash flow seems like a bargain and is actually one of the cheaper valuation multiples Meta Platforms was trading for in the last ten years.

When calculating an intrinsic value by using a discount cash flow analysis and using similar assumptions as in my last article, Meta Platforms is clearly undervalued. We are calculating with the free cash flow of the last four quarters ($37,580 million) and 2,641 million outstanding shares as well as a 10% discount rate. And similar to my last article, we will calculate with 8% growth for the next 10 years followed by 6% growth till perpetuity. Using these assumptions leads to an intrinsic value of $409.89 for Meta Platforms and the stock would therefore trade for a 22% discount.

In my opinion, we could also be a little more optimistic and calculate with 10% growth for the next ten years followed by 6% growth till perpetuity. All other assumptions staying the same, this would lead to an intrinsic value of $472.16 for Meta Platforms. And we certainly can make the case for Meta Platforms being able to grow in the low double digits. In the last 3 or 5 years, Meta Platforms could report an EPS CAGR of 10% and analysts are also expecting double-digit growth rates for the years to come.

Conclusion

Meta Platforms remains a “Buy,” and although a bigger correction is not unlikely, I assume that the stock will trade for a much higher stock price in five or ten years from now. And although one might regret not buying Meta Platforms for under $100, the stock is still a “Buy” at this point and a great long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.