Summary:

- Palantir, with a P/E near 150, seems like poison to a value investor… but it doesn’t have to be.

- In all walks of life, we expect to pay up to buy great things, and that holds true for stocks too.

- Palantir, a superstar at the third stage of what Seeking Alpha analyst Joe Albano calls the AI Revenue Funnel, is worthy of a premium price.

- Palantir is way ahead of many end-user-oriented AI companies that are still finding their footing… PLTR’s multi-decade prowess in advanced mission-critical analytics is already making its AI genuinely valuable too.

- As one who was there for every step of the circa-2000 dot-com crash, I know PLTR has nothing in common with the yesteryear’s corporate dregs.

BlackJack3D

“Oops I did it again,” according to the pop song released by Britney Spears on 4/11/20… and now according to me with this article.

I’m a value guy. Always was. Always will be.

I described my value bona fides in a 10/26/24 article on WAB. I did it under the sub-heading that began “I Take This Situation as a Cue….”

Wearing my lawyer hat… I hereby repeat, reiterate, and restate all those paragraphs as if fully set forth herein.

I’ll add something now. I had a terrific front-row seat to the turn of the century dot-com crash. And I actually did well at the time.

Many around me were piling into hyped up corporate garbage. I didn’t do that.

Instead, I fiddled with Market Guide for Windows (a now defunct CD screener). I created and used value screens to hold my head over water and even make some money.

So why, why, why do I now seem unable or unwilling to resist stocks with insanely high valuation metrics! The Analysis section of my Profile links to such articles.

My two recent and spectacular defiance of low P/E etc. were Snowflake (SNOW) on 10/20/24 and Informatica (INFA) on 11/5/24. I gave further explanations of my approach when I wrote on NVIDIA (NVDA) on 5/26/24 and Amazon.com (AMZN) on 7/13/24.

It’s OK if you don’t feel like reading them right now. Maybe I should self-publish a tiny (and cheap — I swear) Kindle book. But in case I never get around to that, here’s a TL;DR (slang for “too long, didn’t read”):

- Value is like fire… extremely beneficial if used properly, but a dangerous (a returns killer) if misused.

- Stocks are like everything else; you get what you pay for.

- If you want great companies, you need to pay more.

- Numerical valuation models are great for school and companies that make “widgets.”

- But if you can’t confidently predict, the models can’t work… especially discounted cash flow which requires a grotesquely absurd and fake inputs (especially an infinite terminal value).

- Serious GROWTH investing requires us to stride more boldly than usual into the unknowable future. (Statistically speaking, we aim for the positively skewed tail.)

- We need conviction around the BUSINESS, not unknowable unpredictable numbers.

- Numbers are useful only to tell us if a particular company is commercially and financially viable.

My bullishness on Palantir Technologies (NYSE: PLTR) emerges from these principles.

I’ll definitely discuss numbers and risk. But let’s start with the business.

A Star Player at the Last Stage of the AI Revenue Funnel

I wish I coined the revenue funnel idea.

I didn’t.

That was Seeking Alpha Analyst Joe Albano. He spoke brilliantly about it at Seeking Alpha’s 4/15/24 New York City event. Here’s a transcript of a Seeking Alpha Investing Experts Podcast interview he did that day.

Albano uses the funnel to explain why some AI-oriented companies are prospering before others.

Hoping I don’t screw this up (and apologies in advance to Joe if I state it less perfectly than he does):

- Ti starts with necessary components. Chipmaker Nvidia is among those at the beginning of the funnel. Its GPU chips are among the most basic things we need for AI.

- Next come companies that put the basic components together. Hyperscalers fit here. So, too, do server makers like Dell (DELL) and the business (non-accounting) side of Super Micro Computer (SMCI).

- Then, finally, we get to the retail end of the funnel. Albano cites Alphabet (GOOGL), as an example. But we’re not just talking consumers. We’re talking end users, the folks who actually make use of AI. This includes government and commercial enterprises.

PLTR is among those at Stage 3 of the revenue funnel. It implements AI for end users.

Sometimes, the end user uses AI for its own business.

AMZN, for example, uses it to help get customers to the right products. Meta Platforms (META) uses it to keep customers engaged and show them relevant ads. Alphabet uses it for ad targeting.

Microsoft (MSFT), as an investor in ChatGPT and a proprietor of its Copilot, uses it to enable regular folks to do things with AI. And lots of others are in or getting into the “generative AI” arena.

Stage three companies haven’t been winning universal praise.

On 8/9/24, Ben Tercha, Chief Operating Officer at Omega systems, wrote in Forbes that…

Seemingly, everywhere you turn, the dominant conversation topic is generative AI. Discussion groups, webinars, conferences, email newsletters—it’s the subject everyone wants to talk about.

While the excitement and hype seem to be glaringly present in these virtual forums, it’s a sharp contrast to the level of interest and utilization we’re seeing in the real world. For example, within our own customer base, we’ve had requests from less than 1% of eligible customers to enable Microsoft Copilot.

On 8/30/24, Salesforce (CRM) CEO Marc Benioff said, “Microsoft’s artificial intelligence products and strategy”’ disappointed so many customers….’”

CRM is instead pushing its own version for its own use.

Jared Spataro, MSFT’s AI chief responded to Benioff:

Every customer is at a different place in their journey, but overall we are hearing something quite different from our Copilot for Microsoft 365 customers.

I lean more toward Spataro. Every new technology we’ve seen has taken time to become universally revered. And let’s face it… AI remains in its infancy.

All this is consistent with what Albano’s AI Revenue Funnel suggests. End users, retail as Albano refers to it, is the last stage. We shouldn’t be surprised to see it lagging today.

That said, PLTR is a glaring and powerful exception. To say it’s AI is humming would seem to be a major understatement.

I don’t say this based on personal use of PLTR offerings compared with those of rivals. I say it because of what I see from users who vote with their dollars. (See below.)

Palantir was co-founded in 2003 by Peter Thiel, who also co-founded PayPal (PYPL), and Alex Karp, who is PLTR’s CEO. (It went public on9/30/20.)

People in the early 2000s weren’t saying AI.

Instead, they wanted super-duper analytics. They wanted a tool that would see hard (for humans) to notice patterns in big data.

Thiel experienced such activity at PYPL, to detect fraud. He thought PLTR could apply it to national security to detect terrorist threats.

While working at Reuters in the mid-2000s, I attended a PLTR pitch. They were looking to apply its analytic tool outside of national security. The offering, as I recall, was breathtaking.

Meanwhile, “AI” remained absent from the PLTR chatter. It was about “analytics.”

More recently, when I first noticed the phase AI becoming popular, my mind went directly to analytics. I thought of computers making human-like choices better and faster!

I, personally, consider things like stock screening and quant models, like the one offered at Seeking Alpha, to be AI with non-fancy output.

But that’s not the way most define AI today. The communication aspect, input-output, based on human-like language is in the spotlight. So seeking Alpha does not refer to its quant model as AI.

I don’t want to get caught up in rhetoric or definitional controversies.

Here’s what’s important: There has to be a ton of analytic stuff going on under the hood before ChatGPT or any such tool can tell us anything.

So I’ll avoid saying PLTR was AI from day one. Instead, I’ll say PLTR did the heavy grunt work upon which what we now know as AI must stand.

PLTR apparently presents itself the same way. It describes its business segments in terms of analytics. And it says it expanded into the visible presentation linguistic aspect of generative AI.

While PLTR’s peaceful commercial use was happening almost behind the scenes, it went on to become a vital tool for the military. And it expanded among other government users seeking serious analytics.

It eventually got the Reuters deal it sought in 2010. (The tool today is known as Thomson Reuters QA Studio, Powered by Palantir.) And it kept adding commercial users.

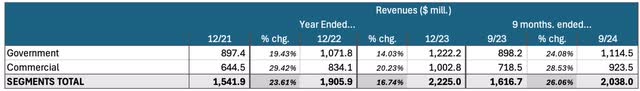

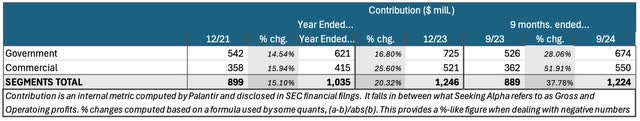

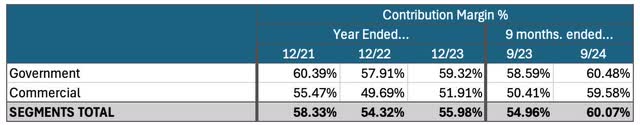

Here is the current Government-Commercial business breakdown:

Analyst Compilation and Calculations based on data from page 111 of latest 10-K and page 21 of latest 10-Q Analyst Compilation and Calculations based on data from page 111 of latest 10-K and page 21 of latest 10-Q Analyst Compilation and Calculations based on data from page 111 of latest 10-K and page 21 of latest 10-Q

Seeking Alpha Analyst Investor’s Compass summarizes some recent examples. I suggest you check its 11/6/24 article to see examples of how PLTR saves businesses time and money.

Many may not appreciate PLTR as a true AI company. After all, many don’t see it directly. PLTR isn’t writing terms papers for college students or composing Shakespeare-like sonnets.

But today, it’s a serious commercial AI company. Its analytics heritage, as opposed to LLM et al., deprives it of mass awareness as such.

But that same heritage is how and why it’s proving to be so successful at Stage 3 of Albano’s AI Revenue pipeline. The core (the computing and analytics) is PLTR’s heritage. The fancy stuff is the recent add-on.

Maybe Benioff might have spoken differently about AI had Salesforce worked with PLTR instead of the less-mature Microsoft Co-Pilot. (We may never know, given that CRM is pivoting to do its own AI thing.)

Some Palantir Nuts and Bolts

The company today has four business segments.

Gotham, according to page 5 of the latest 10-K, “enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants. It also facilitates the hand-off between analysts and operational users.”

Foundry serves as central operating system for organizational data. The 10-K tells us “[t]he speed with which users can experiment and test new ideas is what makes the software stick.” Also…

Data projects often fail because the steps and methods used to build data pipelines are difficult to understand and recreate. We built Foundry’s backend to solve the root of this problem. The platform’s graphical interface does the rest, allowing users to track and trace their pipelines so they know what the rows and columns in their tables represent and why they are there. All of our commercial customers now use it, as do several of our government customers.

I offer this 10-K quote because of personal experience.

Throughout my many years building investment models, this describes something that drove me crazy on day one. It flummoxed me every time afterward and right up until the last quant project I did on my last full-time job.

PLTR is speaking the truth!

AIP applies that which most folks think of when the topic is AI.

It provides unified access to open-source, self-hosted, and commercial LLMs that can transform structured and unstructured data into LLM-understandable objects and can turn organizations’ actions and processes into tools for humans and LLM-driven agents. AIP can allow organizations to power operational use of AI and LLMs….

Apollo is the mechanism through which PLTR delivers its “software wherever our customers are: in the cloud, on-premises, or even more rugged environments.”

Many others on Seeking Alpha very effectively described PLTR’s excellent 2024 third quarter.

Rather than repeat it all here, I’ll just offer some noteworthy visual highlights from the company’s 3rd Quarter Earnings Deck.

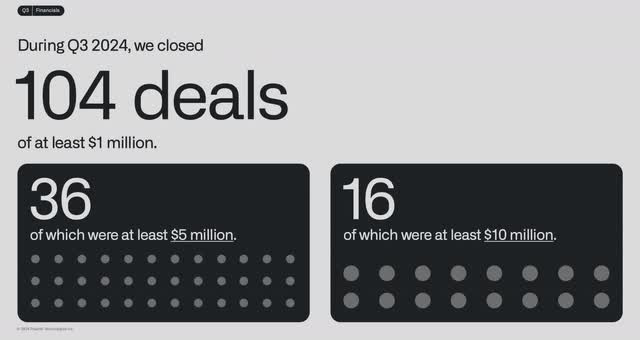

The quarter was powered by a bunch of big deals.

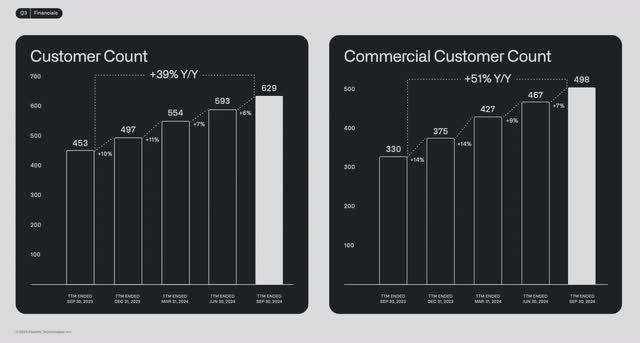

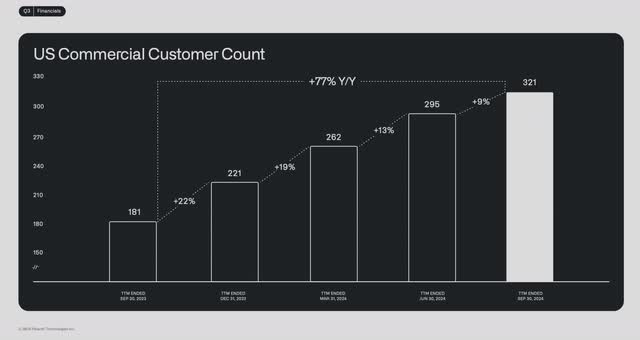

Here’s how customer counts have been growing.

In the following image, RPO stands for Remaining Performance Obligation. It shows how much PLTR stands to book on existing contracts.

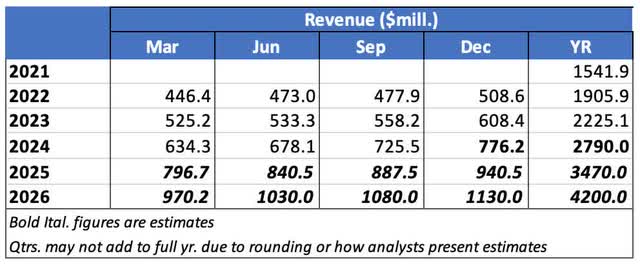

Here’s a summary of quarterly trends in Revenues and EPS.

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

Risks

There are five important subcategories of risk.

- (1) Paying a Super Premium Price for the Stock

High stock valuation was magnified by the stocks 23% gain on 11/3/24. That was the day after PLTR reported 3rd quarter results.

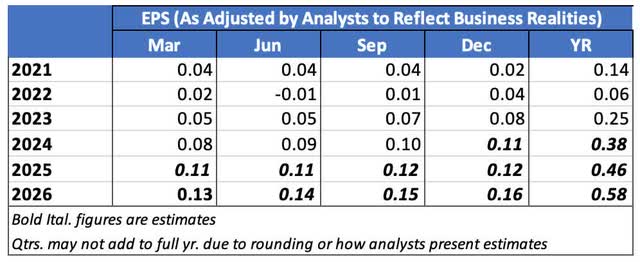

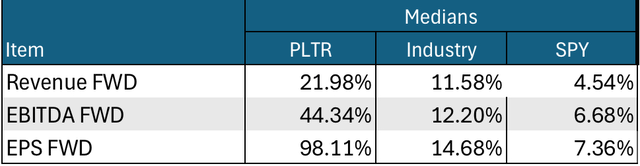

Here’s where the valuation metrics, already extreme before PLTR reported earnings, now stand.

(I compare PLTR to medians for companies in the SPDR S&P 500 ETF Trust (SPY) and the Application Software industry. I use medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

As discussed earlier, I won’t even try to pass PLTR’s price tag off as anything but exceptionally expensive.

But don’t take the P/E or PEG ratios too seriously.

PLTR has only recently broken into the black on an EPS basis. So naturally, the numbers remain very low.

Even EV/Sales is hard to evaluate. High numbers are ok depending on revenue growth, margin, and margin growth. (Remember, earnings are just revenues times margin.)

As we’ll see below, PLTR’s operating margin just broke above zero. It’s still at a stage where operating leverage (fixed cost coverage) can drive it much higher very quickly.

All in all, PLTR remains a situation in which inputs we needed for valuation models are just wild guesses.

Valuation, as I see it, isn’t about low ratios. It’s about alignment between what you pay for a stock, and the company you get in return.

I concede we’re paying a super-premium price. So now, let’s consider the merchandise we’re getting…

- (2) A Super Premium Company

Many may not fully appreciate PLTR yet. The investment community remains focused on the first two parts of the AI Revenue Funnel.

And that which most have seen in the third part — consumer-oriented generative AI — is yet to demonstrate serious economic value. It’s young. It’ll get there.

But PLTR taps its multi-decade experience in highly sensitive mission-critical analytic work. Often that’s been for military and national security operations. Adding commercial to that, PLTR is already where the rest of the funnel-stage 3 industry needs to go.

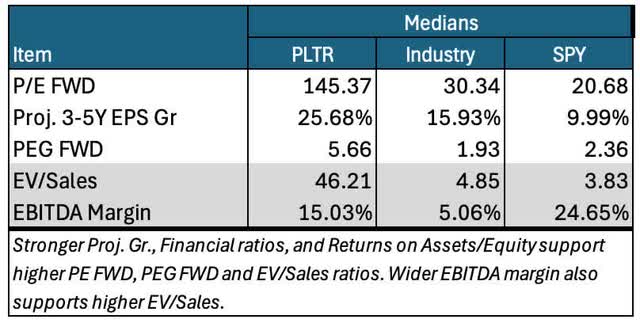

And PLTR making money doing it.

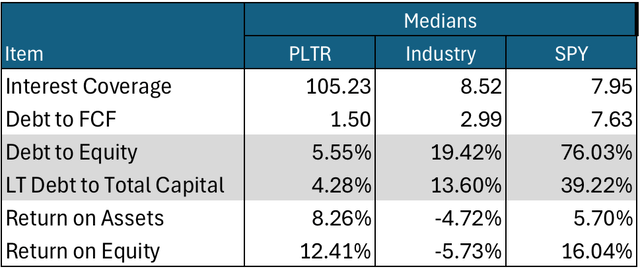

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

Notice the much stronger growth rates for profit measures than for revenues. That’s operating leverage in action!

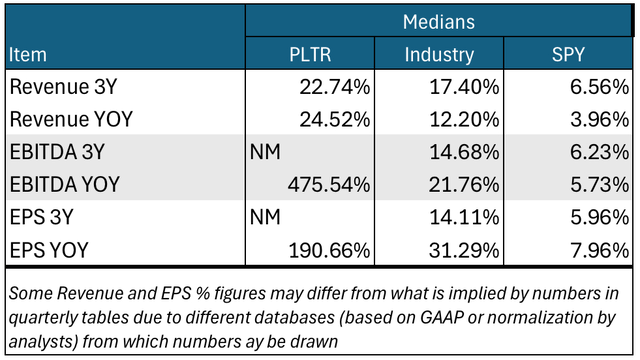

This table is especially informative.

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

As young as it is, PLTR is already topping its industry in returns on assets and equity.

That alone might not excite. The industry medians are negative. The group includes a lot of very young, unprofitable companies.

However, PLTR is also beating the S&P 500. That universe includes many of the best companies around. It includes all of the Magnificent 7. (And PLTR itself entered the S&P 500 in September. Maybe the Magnificent 7 can evolve into the Great 8.)

- (3) The Dark Cloud of the Circa 2000 Dot-Com Crash

A 10/31/24 Markets Insider article blares a warning. Here’s its lengthy headline: AI hype is a bubble set to burst as it follows the path of tech manias throughout history, legendary investor Jeremy Grantham says.

Even outlets that don’t explicitly forecast a crash ask the question and debate the answers. See, for example, a 9/6/24 Investor’s Business Daily article with this headline: Why AI Stocks Bring Back Memories Of The Dot-Com Boom — And Crash.

PLTR’s valuation ratios make it a prime candidate for such bubble talk.

But as noted above, I was there for the crash. And PLTR is nothing like the companies that imploded.

I can understand memories having faded over nearly a quarter-century. But mine hasn’t on this topic. I remember exactly what set off the crash. And I remember when it happened.

It started with a 3/20/20 Barron’s article by Jack Willoughby. (He interviewed me once back in the day. I’d be shocked if he remembers — I can’t even remember the topic. I’m guessing it had to do with stock screening. But I remember him as the smartest journalist with who I spoke back then.)

The article was headlined Burning Up. The sub-headline was “Warning: Internet companies are running out of cash — fast.” He followed up by discussing a study by a firm named Pegasus.

I felt a massive “uh oh” when I read it.

The last trading day before the article came out, what we now refer to as the Invesco QQQ Trust ETF (QQQ) closed at $110.81 (split adjusted). That was just a whisker below its 3/9/00 then-all-time high of $115.

The day after the article, QQQ dropped to $107.69. That wasn’t a disaster.

Barron’s back then was well respected by certain kinds of mainly value-oriented investors (including me). But in the Wall Street community at large, it took time for Willoughby’s message to catch on. By 3/27/00, QQQ recovered and climbed to $117.

Then it became time to cue the final curtain …

Seven days later, QQQ closed at $100.125. The phrase “cash burn” was starting to spread like wildfire.

And then, look out below.

QQQ finally stopped falling on 10/9//02. It closed that day at $20.06.

Make no mistake about it… the dot-com crash wasn’t due to high P/E per se.

Willoughby lit the fuse by having pointed out that which many refused to acknowledge. Many dot-com stars were cash-burning garbage.

Turning now to PLTR, go back to the last table in the preceding section. Not only does it have good returns on assets and equity, but it also has close to zero debt.

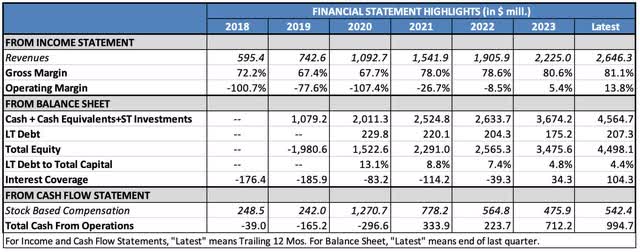

Now look at this financial statement summary.

Analyst compilation based on data from Seeking Alpha Financials presentations

Look at the trend in Cash+Cash Equivalents+Short-Term Investments. Look, too, at the trend in Cash from Operations.

And how about that operating margin trend!

I’m not inside of Willoughby’s head. Nor do I know anybody from Pegasus.

But I’m darn sure that if the companies they examined were anything like PLTR (not to mention many of today’s AI stars), the “Burning Up” article would never have been written. And the QQQ would not have crashed.

The bubble was a bubble because the companies stunk. And the bubble burst when it became impossible to deny the smell.

We’re not there today. And PLTR is definitely not that.

- (4) The Quarterly Game (Surprises, Guidance, the Usual Stuff)

Yes, PLTR… and everyone else … is vulnerable.

If PLTR disappoints on a future occasion (many companies do that from time to time), its stock will get hammered. And you’ll probably look back at this article and laugh at the Buy recommendation (or curse me if you bought).

That’s part of the process of pursuing high returns from transformative companies. Make sure you correctly assess your risk tolerance.

- (5) Alex Karp, Palantir’s CEO

Relative to many CEOs, Karp seems a bit out there.

I noticed something of an iconoclastic tone when I studied the last earnings call transcript. Karp said:

Given how strong our results are, I almost feel like we should just go home. But we — we made — we’ve been saying since we went public in a DPO that we would build infrastructure to make America and its allies the dominant force in the world. We claimed to too much skepticism that this would be done in a software product, that defense and commercial industry would be driven by software, hardware, hybrid technologies that there were very few companies in the world that could actually do that, that these companies are basically only built in America that the companies that have tried to do this that aren’t Palantir are built by ex-Palantirians.

That the financials of Palantir would flow from our products and our culture and our way of implementing that we would bring violence and death to our enemies, while making targeting and general issues of safety better for our allies and for Americans, that we would stand by our values in thick and thin, including that the west and America are superior ways of organizing and that this is a great country and historically anomalous in its greatness and that we would build a company with the best people from all over the world, but primarily from America to power America and its allies.

That’s an eyebrow raiser!

Looking further, I see that Karp is, let’s say, distinct. And he’s not shy about expressing political views.

Wikipedia’s well-sourced page describes him as a socialist and progressive.

But he differs from many who are thusly labeled. He despises “woke” thought.

He boldly supports Israel’s war. He says pro-Palestinian protesters are “an infection inside our society.” He also suggests they should be sent to North Korea.

He compares short sellers to cocaine addicts. He says they “just love pulling down great American companies.”

His views caused some PLTR employees to quit. Karp is unperturbed.

If you have a position that does not cost you ever to lose an employee, it’s not a position.

I’m OK with outspoken, controversial CEOs. For example, I have a “Buy” on Tesla (TSLA).

Controversy isn’t inherently good or bad in a CEO. But that brings up one of the benefits of public reporting.

An objective company track record can help us see when odd personalities may reflect special genius.

Elon Musk seems like one example. Alex Karp looks to be another. And Apple (AAPL) fans have to appreciate the “uniqueness” of the late Steve Jobs.

Still, I do have to list this as a risk element.

What to do About PLTR Stock

Having a value investor’s soul should not compel one to be bearish on shares of great, transformative companies.

It’s never value OR growth. For equities, it must be value AND growth. (For those who don’t want growth, there’s fixed income… emphasis on “fixed.”)

Every serious valuation model includes a growth input. But sometimes, history doesn’t give you enough to formulate a credible forecast. If you want transformative companies, you have to cope with it.

In doing so, I prefer to go sensibly qualitative.

Am I relying here on faith? Yes. We invest for the future. Faith is always part of the deal.

But I’d rather base faith on the merits of a business I can see than on a model that stands on nonsensically pretentious efforts to predict the unpredictable.

Putting it all together, I’m a PLTR bull.

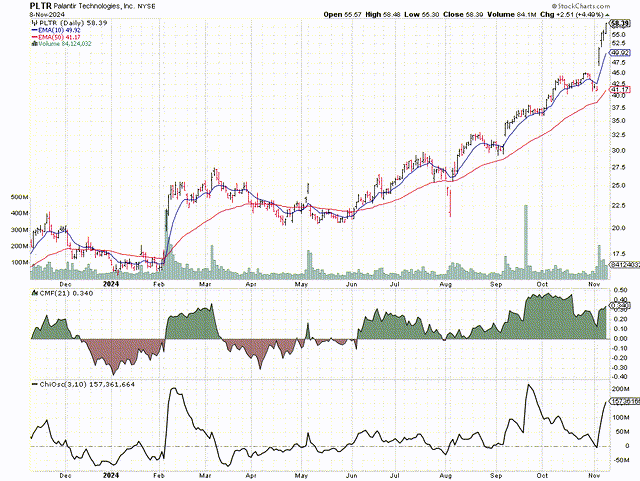

Here’s the stock’s price chart.

Looking at the price action, the 10-day exponential moving average (EMA), and the 50-day EMA, it’s obvious that momentum is strong.

Seeking Alpha’s Momentum Grade (A+) agrees.

Look, too, at Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO). Both measure which party to trades is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both indicators are very bullish.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market, but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market, but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating PLTR as a “Buy.”

I know the stock won’t go straight to the moon. It’ll have periodic corrections and sideways periods. But as a long-term position, I believe it will succeed… for those with the necessary risk tolerance. (I don’t own it because I’m too old for the necessary investment horizon.)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.