Summary:

- Healthcare costs in the U.S. are projected to reach $6.8 trillion by 2030, with various factors contributing to the increase.

- Factors include payment for quantity over quality, increasing chronic diseases, expensive healthcare technology, and reduced competition leading to higher prices.

- UnitedHealth Group Incorporated stands out, benefitting from a strong growth outlook, a fantastic dividend growth profile, and M&A/AI opportunities.

esolla/iStock via Getty Images

Introduction

One of the things I’m worried about is future medical costs.

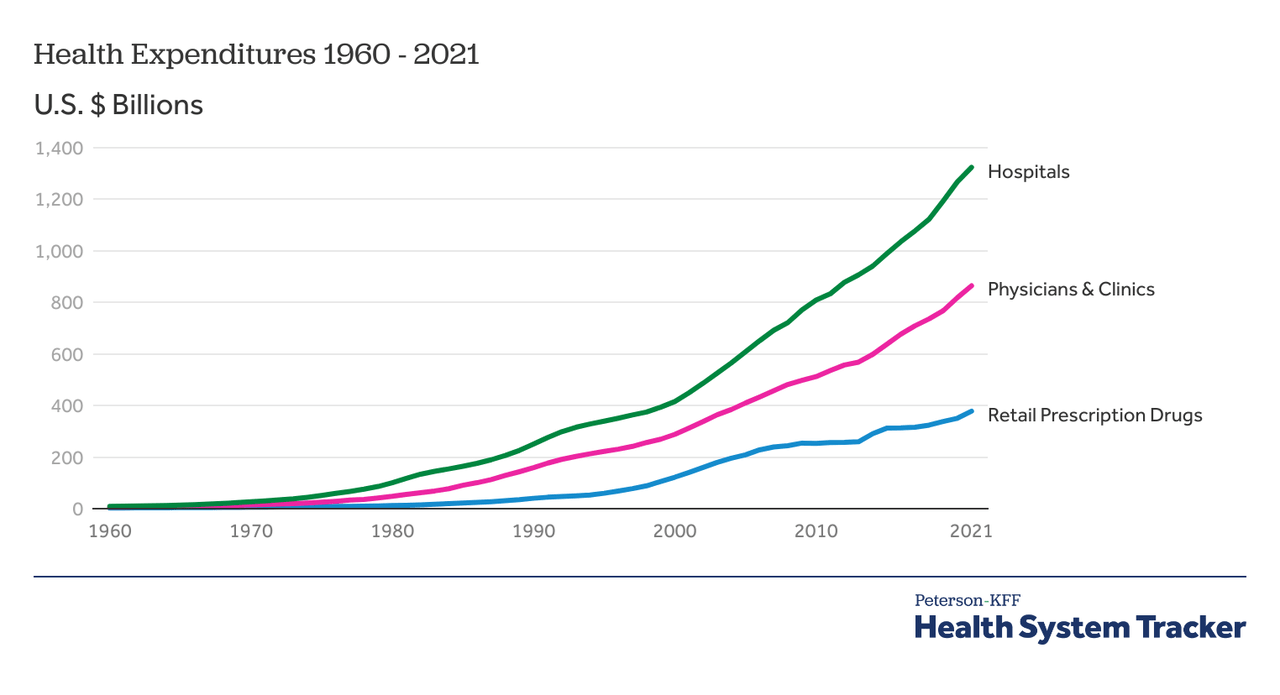

According to the Centers for Medicare & Medicaid Services(“CMS”), in 2022, healthcare costs skyrocketed to $4.4 trillion. Despite decreased health services during the COVID-19 pandemic, CMS expects national health expenditures to reach $6.8 trillion by 2030. – PeopleKeep.

According to PeopleKeep, there are a few reasons for this (I picked a few that stood out):

- Medical providers are paid for quantity, not quality. Doctors, hospitals, and others get paid for each procedure. Simply put, the higher the volume, the higher the pay.

- The U.S. population is becoming more unhealthy. According to the CDC, roughly six out of ten adults in the U.S. have at least one chronic disease.

- Newer healthcare technology is more expensive. As much as I love medical innovation, it’s expensive and needs to be paid for.

- Hospitals and providers are well-positioned to demand higher prices. The American healthcare landscape has seen a number of mergers and major deals. While this allowed companies to increase service offerings (which is great!), it also reduced competition, increasing pricing power.

- Inflation’s impact on the economy. Higher inflation has increased costs for supplies, administration, facilities, and other items.

- The U.S. population is growing older. Although it’s a great accomplishment when people get older, the share of Americans aged 65 or older will be almost 25% of the population by 2060.

Moreover, health insurers are being pressured by stripped Medicaid benefits after the pandemic.

Centene Corp. said Friday that having fewer people in its Medicaid business has reduced the pool of money the company has to pay for medical expenses, which are going up. “We are seeing pressure in our Medicaid book of business in April results,” Chief Executive Officer Sarah London said at Bernstein’s Strategic Decisions Conference.

[…] At the same time, the Biden administration ratcheted back payment policies that had helped make Medicare a driver of growth and profits across the industry. Large insurers including Humana Inc. and CVS Health Corp.’s Aetna have signaled that they plan to raise prices, cut benefits and shed members to recover profits on their Medicare plans. – Bloomberg.

This brings me to UnitedHealth Group (NYSE:UNH). On August 30, I called it “One Of The Best Defensive Dividend Stocks Money Can Buy” in the title of my most recent article.

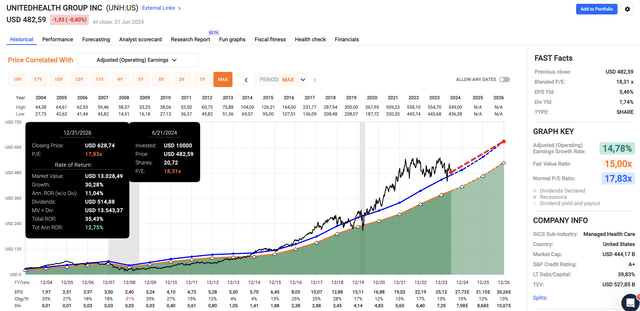

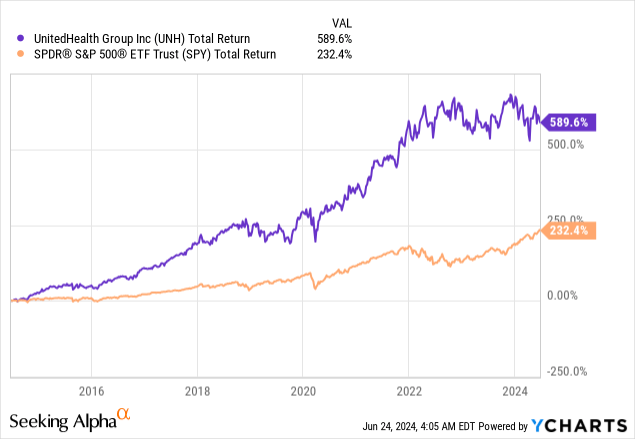

Since then, the company has returned roughly 0%, lagging the S&P 500’s 21% return, as represented by SPDR® S&P 500 ETF Trust (SPY), by a huge margin.

This is uncommon, as UNH investors are used to outperforming the market. Over the past ten years, UNH stock has returned 590%, beating the S&P 500’s 232% return by a margin that can be seen from space.

In light of this disappointing performance, I’m taking a closer look, as the company revealed some promising comments during recent conferences, which could bode well for its future performance.

So, let’s get to it!

Where’s The Value In UnitedHealth?

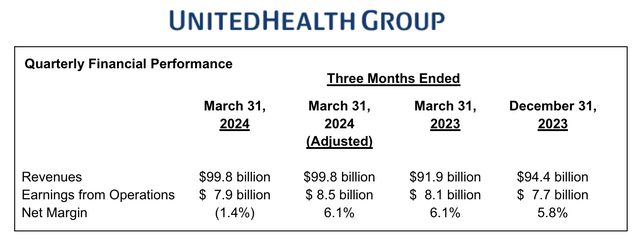

UnitedHealth continues to perform well.

For example, in the first quarter, the company’s UnitedHealthcare segment reported $75.4 billion in revenues, which is an increase of almost $5 billion and accounted for 63% of the total $8 billion surge in revenues to $99.8 billion.

This growth is driven by expansions across various customer segments, adding 2.1 million new consumers in the first quarter alone. Additionally, Optum Health and Optum Rx reported significant revenue growth, with increases of 16% and 12%, respectively.

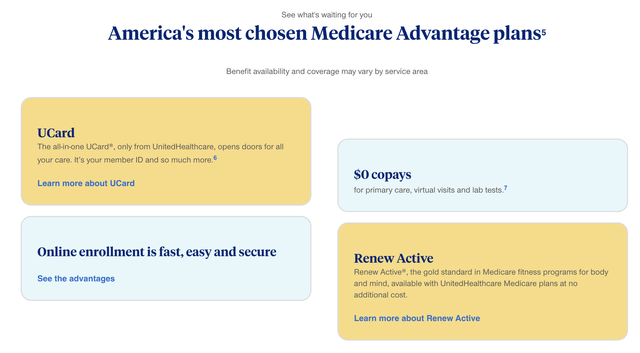

According to the company, its Medicare Advantage program remains a key driver of growth, as it offers better health outcomes, comprehensive benefits, and significant cost savings for seniors.

To add some details here, UNH makes the case that customers enrolled in Medicare Advantage spend, on average, 45% less on premiums and out-of-pocket costs compared to traditional Medicare. This translates to almost $2,400 in annual savings.

Hence, the popularity of this program is rising, with more than half of seniors choosing these plans today, up from 30% a decade ago.

In general, the company has found a perfect balance between offering value and growing a massive business.

Not only is the company the largest health insurance company in the U.S., but it is also the largest physician organization and the third-largest pharmacy benefit manager.

Even better, despite generating close to $400 billion in annual revenues, it is a business with a history of 13-16% annual EPS growth, which is usually something we only witness in smaller companies.

During the recent Bank of America Health Care Conference, the company noted that its biggest advantage is “value-based” care, meaning finding a great mix of lower costs and higher quality.

According to the company, this model has matured significantly over the past years, and it is now operating at a scale that allows for a repeatable and sustainable performance.

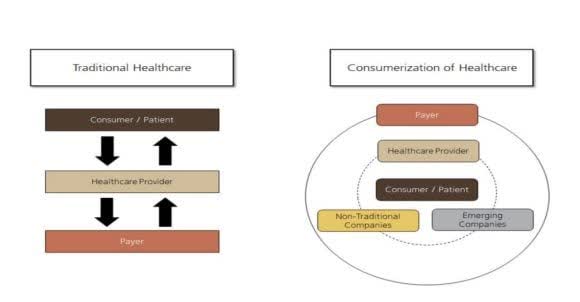

Going forward, the company is looking to benefit from the trend of healthcare consumerization.

Essentially, it aims to become the number one choice for healthcare consumers by enhancing engagement and providing more personalized care options.

This move involves moving from a traditional business-to-business (“B2B”) model to a more direct consumer engagement approach.

[…] as you think about consumerization of this marketplace and the need for businesses to move from what has historically been more kind arm’s length or B2B or a little bit less engaged with the patient as a consumer, a little bit less engaged with the healthy individual prior to being a patient, those are all great opportunities for us to modernize and strengthen going forward. And those 2 elements of value-based care powered by a shift towards being the #1 choice in health care consumer, those are really going to be the things that drive us forward. – UNH Bank of America Health Care Conference.

In 2020, the UBS Investment Bank wrote that consumerization of healthcare is “the trend of people influencing and controlling their medical & wellness care.”

UBS Investment Bank

Back then, the company estimated that this was a $600 billion addressable market with a 5.5% annual compounding growth rate.

We est. the addressable market for the CoH was ~$600 bn in 2019 and will increase at a 5.5% CAGR through 2025. Further, we believe that CoH already represents “at least” $50 bn (this number is likely conservative). In our base case, we assume that this amount grows 10% per year, increasing to $90 bn by 2025. Still, at that point, CoH would represent just over 10% of the total projected addressable market, suggesting room for upside. – UBS Investment Bank.

Moreover, UNH is using AI to increase efficiencies.

Although the company did not reveal clear cost-cutting targets, its comments during the Bank of America conference were highly upbeat.

As you start to look at the ways in which AI allows us to really modernize a lot of that in light years faster than we could ever have conceived of previously, that starts to drive a tremendous new lever on SG&A at an extremely timely moment in terms of how to compete in the marketplace. And so I’m 100% with Brian in terms of we’ve made, I think, very good progress this year on SG&A across the business. We have very robust plans on further management of that over the next few years. And then I think we have an AI turbocharger which is just kicking in as we speak. – UNH Bank of America Health Care Conference (emphasis added).

During the Bernstein Strategic Decision Conference, the company noted there are currently around 500 AI applications in use within its organization.

Great News For Shareholders

I believe everything we have discussed so far is great news for shareholders.

That said, there are some additional details that paint a rosy picture for the healthcare giant.

This includes M&A. UnitedHealth believes healthcare remains extremely fragmented, allowing it to use acquired growth to fuel EPS growth. Historically, M&A has added between 3-5 points to annual earnings growth, which is a huge deal.

As a result, the giant sticks to its 13-16% annual EPS growth target.

So just to reiterate from a UHG perspective, as I think many of you will be familiar, we have a long-term goal of delivering earnings per share — adjusted earnings per share at a rate of between 13% and 16%. Historically, we’ve done very well at that. Of course, it doesn’t happen every single year in years where there are different events going on. But as a pattern, that’s something we continue to be very much guided by in terms of the ambition of the organization. – UNH Bernstein Strategic Decisions Conference.

This bodes well for its dividend and valuation.

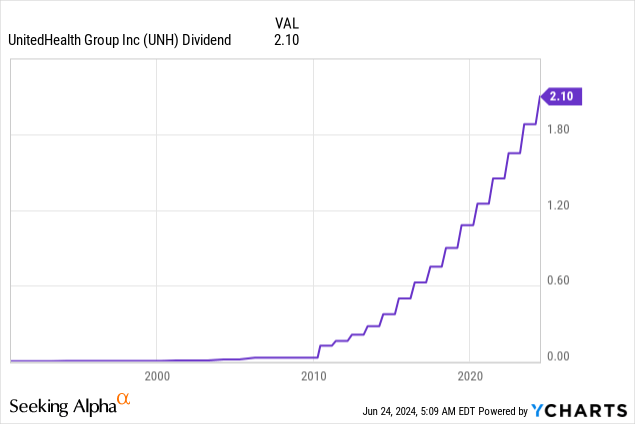

Currently, UNH yields 1.7%. This dividend comes with a sub-30% payout ratio and a five-year CAGR of 15.4%.

While 1.7% may not be an exciting yield, please bear in mind that a five-year CAGR of 15.4% is truly impressive and fully backed by the company’s 13-16% annual EPS growth history – supported by a subdued payout ratio.

The only reason why its yield is still somewhat low is that capital gains kept up with dividend growth, which explains the impressive longer-term total return.

It also helps that the company has a 2024E net leverage ratio of 0.7x with an A+ credit rating, one of the best ratings in the world.

Using the FactSet data in the chart below, analysts agree with the company, as they expect EPS growth to increase from 10% in 2024 to 13% in 2026.

As UNH currently trades at a blended P/E ratio of 18.3x, it trades a bit above its longer-term normalized multiple of 17.8x. This implies an annual return of 12.8% going forward.

While this is a purely theoretical outlook, I believe the company is in a good spot to achieve its EPS growth targets, supported by efficiency gains and a bigger focus on growth markets – with further tailwinds from a healthy balance sheet that enables M&A.

Hence, I’m currently thinking about adding UNH to my portfolio. For now, my healthcare focus is mainly on biotech and suppliers like Danaher (DHR). These companies also have pricing power. If I were to further diversify my healthcare holdings, UNH would make a lot of sense in my dividend growth portfolio.

Takeaway

Healthcare costs are on the rise, with expenditures expected to hit $6.8 trillion by 2030.

This trend is driven by factors like quantity-based payments, a growing elderly population, and high costs of new healthcare technologies.

In light of these challenges, UnitedHealth Group stands out as a resilient player in the dividend growth realm.

The company continues to grow, driven by strong revenue from key segments and a popular Medicare Advantage program.

Moreover, with impressive historical EPS growth and strategic use of AI and M&A, UNH is well-positioned for future gains.

Meanwhile, its solid dividend growth and low payout ratio make it a compelling choice for dividend-focused portfolios.

Pros & Cons

Pros:

- Strong Financial Performance: UNH has consistently shown strong revenue growth.

- Impressive Dividend Growth: With a five-year CAGR of 15.4% and a low payout ratio, UNH offers reliable and growing dividends.

- Strategic Positioning: As the largest health insurance company, physician organization, and third-largest pharmacy benefit manager in the U.S., UNH has significant market influence.

- Value-Based Care: UNH’s focus on value-based care and consumerization positions it well for future growth.

- AI Integration: The company’s use of AI to enhance efficiencies and reduce costs is a promising driver for future margin growth.

Cons:

- High Healthcare Costs: Rising healthcare costs and inflation could impact profitability and increase operational expenses.

- Regulatory Pressures: Changes in Medicare payment policies and reduced Medicaid benefits could be potential challenges.

- M&A Dependence: Although its core business is strong, the company likely needs M&A opportunities to achieve 13-16% annual EPS growth.

- Low Yield: Although the dividend growth is impressive, the current yield of 1.7% might not be very appealing to income-focused investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.