Summary:

- Apple announced a multi-year agreement with Broadcom yesterday.

- This announcement does not come as a surprise to investors who have been closely monitoring Apple’s efforts to shift the manufacturing process back into the United States.

- This multi-billion-dollar deal could be the first of many deliberate steps by Apple to limit its exposure to China.

Scott Olson

Yesterday, Apple Inc. (NASDAQ:AAPL) announced a multi-year agreement with Broadcom Inc. (NASDAQ:AVGO), a leading supplier of wireless components and chips. This multibillion-dollar agreement is for the development of 5G radio frequency components in the United States and is a part of Apple’s commitment to invest a staggering $430 billion in the U.S. economy. The new agreement builds upon the existing relationship between Apple and Broadcom, following the wireless component provider’s previous announcement of selling $15 billion worth of components to Apple in 2020. As a result of this collaboration, Apple intends to invest in critical automation projects and facilitate upskilling opportunities for engineers and technicians.

One of the significant implications of this deal is that Apple is taking steps to secure its supply chain and reduce its reliance on other vendors, particularly Qualcomm Inc. (QCOM). Apple has been embroiled in legal disputes with Qualcomm concerning patent royalties and licensing fees. In 2017, Qualcomm filed a lawsuit against Apple, alleging that Apple’s suite of devices, encompassing iPhones, iPads, and Apple Watches, violated a range of patents relating to mobile technology. In response, Apple opted to challenge the validity of these patents and took the matter to the U.S. Patent and Trademark Office’s Patent Trial and Appeal Board. Although the two companies settled in 2019, enabling Apple to continue deploying Qualcomm chips in their iPhones and granting Apple access to a multitude of Qualcomm patents, the patent-board proceedings lingered on.

In 2020, the board upheld the validity of the patents, prompting Apple to pursue an appeal before the specialized U.S. Court of Appeals for the Federal Circuit, which is dedicated to patent matters. Apple argued that it possessed legal grounds to appeal due to the potential for Qualcomm to instigate future lawsuits once the license expired, potentially as early as 2025. However, last year, the Federal Circuit three-judge panel rendered a 2-1 ruling, ultimately dismissing the case on the grounds of a lack of standing. The panel concluded that Apple’s apprehensions of future legal action from Qualcomm were speculative in nature, and the outcome of the appeal would bear no effect on its obligations to fulfill the terms of the settlement agreement.

Furthermore, in 2020, Apple broke its 15-year partnership with Intel Corporation (INTC). Apple CEO Tim Cook has already emphasized the company’s long-term strategy of owning and controlling the primary technologies behind its products. The company believes it can innovate at a faster pace by independently developing chips rather than relying solely on Intel or Qualcomm for chip development. Since introducing its first in-house designed iPhone processors in 2010, Apple has steadily expanded its endeavors in chip development, including chips for Macs, AirPods, and Apple Watch. Qualcomm anticipates that the initial iPhones without its 5G modems will be available as early as the coming year.

With the growing importance of 5G technology, Apple is making substantial financial commitments to spearhead its development within the United States. According to Research & Markets, the global 5G technologies market will reach $44.71 billion in 2023, exhibiting a robust compound annual growth rate of 46%. Looking ahead, the market is projected to continue its upward trajectory, reaching $125.27 billion in 2027, growing at a CAGR of 29.4% from 2022.

While Apple has also been working on developing its own wireless components to replace those provided by Broadcom with in-house designs by 2025, the complexity involved in designing and manufacturing Broadcom’s radio frequency chips suggests that they are unlikely to be replaced in the near future. Apple is Broadcom’s largest customer, accounting for approximately 20% of the chip group’s annual sales in the previous year, and this deal is a strategic move by both companies to strengthen their positions in the wireless technology market. The partnership will allow Apple to save costs on complex chip development and gain more control of its hardware and software stack development. Additionally, since Apple is one of the major customers of Broadcom, the company will gain a stable supply and more flexibility amid a challenging industry outlook. On the other hand, Broadcom, which faces increasing competition from Qualcomm and other rivals, will gain access to Apple’s huge customer base and innovation capabilities.

Boosting Domestic Sourcing, Reducing Reliance on China

As part of a broader strategic vision, Apple is intensifying its investments in domestic production, marking a deliberate shift away from its reliance on manufacturing in China. The company has faced scrutiny over its heavy reliance on Chinese manufacturers and components, particularly due to the escalating tensions between the United States and China. Over 90% of Apple’s products are assembled in China. To mitigate this reliance, Apple has been diversifying procurement by expanding its sourcing network to countries such as India, Vietnam, and the United States itself.

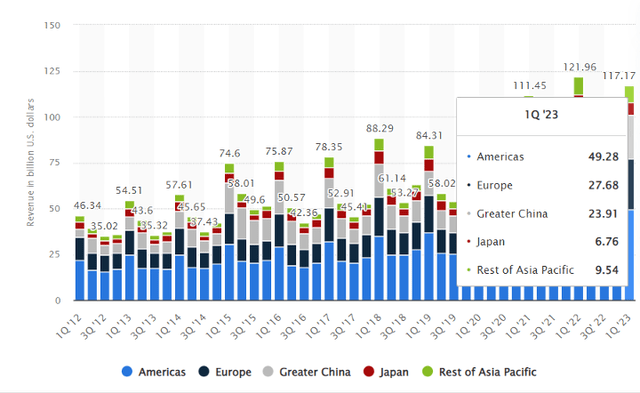

Apple has built a vast manufacturing and assembly operation in China, collaborating with numerous business partners. Mainland China alone boasts over 40 Apple stores, and the “Greater China” region, including Taiwan and Hong Kong, contributes nearly 20% of Apple’s revenue. However, recent tensions have strained Apple’s reliance on China, prompting the company to seek alternative options when it comes to supply-chain operations.

Exhibit 1: Apple’s revenue breakdown by country

In response to heightened trade tensions between the U.S. and China, Apple has been actively exploring avenues to reduce its dependence on Chinese manufacturing. The company has initiated efforts to expand procurement from India, where it has already achieved significant milestones. In 2022, Apple produced more than 6.5 million iPhones in India. The company has set an ambitious target of producing 10 million units in India in 2023, with some insiders suggesting that the number could surpass 15 million units next year. Analysts predict that if Apple adheres to its most aggressive timeline, it could potentially relocate up to 25% of its iPhone production to India by 2025.

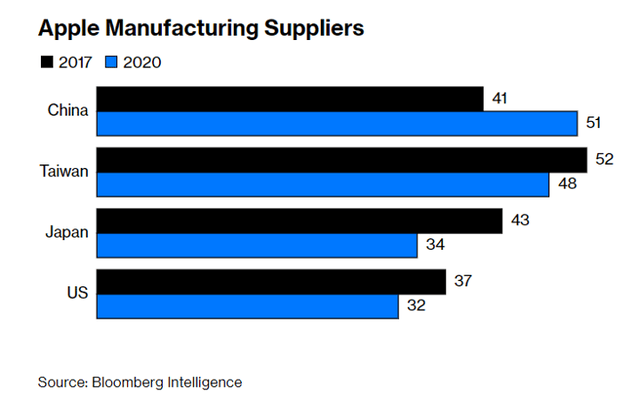

Furthermore, Apple has also recognized the need to decrease its reliance on Taiwan, where Taiwan Semiconductor Manufacturing (TSM), a prominent chipmaking giant, produces crucial semiconductors for Apple’s products. Geopolitical tensions centered on Taiwan have prompted Apple to take measures to mitigate potential risks. While progress in this regard has been gradual, Apple plans to commence chip production at a TSMC plant in Arizona, starting next year.

By diversifying its supply chain and expanding its manufacturing footprint in emerging countries like India and Vietnam as well as strengthening its manufacturing capacity in the domestic market, Apple aims to enhance its resilience in the face of geopolitical uncertainties and potential disruptions.

Exhibit 2: Apple’s suppliers by country

Apple said that Broadcom’s wireless connectivity components will be meticulously designed and manufactured in American manufacturing and technology hubs, notably Fort Collins, Colorado. Tim Cook emphasized the criticality of technology engineered and built within the United States for all of Apple’s products and expressed the company’s unwavering belief in America’s future and its commitment to further bolster investments in the U.S. economy.

Takeaway

Apple’s heavy reliance on China and the scrutiny it has faced regarding this relationship have compelled the company to undertake a slow and deliberate journey toward diversifying its manufacturing capabilities. The Broadcom deal represents a significant step towards boosting Apple’s domestic presence and reducing its dependence on overseas production. However, the ultimate impact and success of Apple’s efforts will be revealed over time as the company navigates the complexities of shifting production back to the United States.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.