Summary:

- Robert Friedland is a highly respected figure in the mining industry and was a key player in several of the world’s Tier 1 mines.

- In a recent conference interview, he tore apart the viability of the current lithium-ion battery in a wholesale energy transition.

- Friedland claims disruption is coming soon because Pure Lithium has the technology to produce lithium metal from low grade resources within oil & gas reservoirs.

- Exxon Mobil is a dark horse candidate that could potentially benefit from such a development.

- Lithium aside, I explain why shares of Exxon are headed to $200 within 1 to 3 years.

jroballo

Considering Robert Friedland

Robert Friedland is a legend in the mining industry. He is a member of the Canadian Mining Hall of Fame (2016) and the American Mining Hall of Fame (2021). He was involved in the discovery of the Voisey’s Bay nickel discovery (later purchased by Inco for CAD $4.3 billion and is now part of Vale (VALE)). He was involved in the discovery of the Fort Knox gold mine in Alaska which is now owned and operated by Kinross Gold (KGC). He was the founding President and CEO of the original Ivanhoe Mines which discovered the giant Oyu Tolgoi mine in Mongolia, now operated by Rio Tinto (RIO). He is currently the Founder, Executive Co-Chairman, and Non-Independent Director of Ivanhoe Mines (IVN:CA; OTCQX:IVPAF) where he is involved in the development of 3 large mines across Central and Southern Africa, namely the giant Kamoa-Kakula copper mine in the DRC. Recently, in 2022, he became the Executive Chairman of Ivanhoe Electric (IE). Finally, his Ivanhoe Capital group is a backer of Pure Lithium, an emerging company focused on producing lithium metal batteries from oilfield brines. Needless to say, with a resume like this, Robert Friedland’s views are highly respected.(Here is a link to an extensive biography of Mr. Friedland.)

In a recent interview at a mining conference, Friedland went on the following extensive rant about the lithium industry:

Friedland:

But batteries of the future, what we call the cathode or one side of the battery, will be lithium metal. There won’t be lithium-ion. There’ll be lithium metal. Out of MIT, a startup has found a way to go directly from low-grade brine directly to the metal in one step. So we don’t need lithium carbonate or hydroxide.

What the mining industry is doing today is mining huge amounts of the earth’s crust to make lithium via the carbonate or hydroxide route. So the problem is that you have to get 99.999999% of the impurities out of that lithium because if there is any impurity in your battery as you charge it and discharge it, you grow little stalactites. And if they grow from one side of the battery to the other, you’ve got a bomb. I mean, your cell phone battery can take down a 747, let alone an electric hummer coming at you with 3,000 pounds of batteries. You’re driving with your wife and kids, and you get the smell of burning metal. You slam on the brakes, grab the dog, grab the kids, and run like hell. Because you can’t put the fire out. If you put water on a lithium-ion battery fire, water is dihydrogen monoxide, you’re just adding more oxygen to the fire. So firemen just stand back and let it burn a hole in the road. The only way to stop that fire is to put 30 or 40 meters of sand on top of that burning car and deprive the reaction of oxygen.

So people don’t understand where we’re headed with energy density or fundamental chemistry, but we are gonna kill this lithium hydroxide and carbonate business. So we’ll start with this depressing message for all you lithium miners.

If we’re gonna have a transition, we have to use very common materials. We can’t use expensive and rare materials like nickel. Just there isn’t enough of it. There’s zero chance of having 8 billion people driving around with the nickel [indiscernible] battery. I hope you’re following me. I hope I’m not saying anything beyond the limits of your comprehension, because I’m looking right at you. Somebody has to tell you the truth.

So what we want is, in the old paradigm in mining, high grade is good, and low grade is bad, right? But there’s so much lithium in brines in oil fields. If you go to Saudi Arabia, they drilled a well, and they, they would, they would open up the production horizon for gas or oil, the salt water horizons they would leave behind the drill pipe. Now they’re opening up those salt water horizons. They’re loaded with lithium. Same thing in the Canadian oil fields. I mean, they’re just loaded with lithium. So you can go from that lithium in that brine directly to lithium metal in one step. You don’t have to build a refinery.

Moderator:

Do you hazard to guess how far away we are from commercial application?

Friedland:

This is opening soon at a theater near you immediately—this is called disruption. Don Sadoway who was Head of Material Science at MIT. You’re gonna argue with him, 40 years there? And, and, uh, Stan Whittingham got the Nobel Prize for inventing the lithium-ion battery. And these two are cooperating at Pure Lithium. And for disclosure, my family office was an angel investor.

But the battery they’re making now is made from low grade brine to lithium metal on one side of the battery. Once you have lithium metal on one side of the battery, you don’t need nickel, you don’t need cobalt, you don’t need graphite. All you guys are dead: nickel, cobalt, graphite out the window. You can, you can use, iron phosphate, which is common as chips, and that’s what you want. You want a battery to be made out of common material so that 8 billion people can have one or you can use other metals, soon to be announced too. They’re making a phenomenal battery. This startup has a battery that has charged and discharged 500 cycles at Pure Lithium, 500 cycles with no measurable diminution in capacity. Cheap battery, easy to manufacture, American ingenuity. American. American. The Empire strikes back because the Chinese control the lithium hydroxide chain. They go to Indonesia, they’re just nuking all this tropical jungle and nickel laterite, and then just copious amounts of global warming gas generated to make these batteries. And those are the batteries you are finding at a BMW. That won’t work. That, that’s obscene. That, that’s just silly. Like we’ve really gotta look at this whole situation. …

Friedland makes many, scientifically backed, valid points here that are important for lithium investors to consider. I think many lithium investors, or just investors in general who have been observers but not involved in the space, have consciously or sub-consciously doubted the viability of a large scale conversion to electric mobility under the current lithium-ion technology regime. Friedland’s talk shined light on this. Investors don’t have to agree with him but we should respect the fact that few, if anyone else, understands more the capital, trials, and time required to actually mine these metals in an environmentally reasonable way.

The current state of lithium supply is mainly derived from:

(1) a handful of South American brines that took decades to get right

and

(2) massive spodumene earth movement in Western Australia that is shipped to China or part of uncertain, difficult to scale, hydroxide processing in Western Australia.

Now, mostly junior miners (Friedland’s reference), are racing to find and develop large spodumene deposits to produce concentrates that will mainly be refined according to point #2 above. We must consider that this entire situation is on shaky ground, not only because of the West’s over-reliance on China but also because this situation hasn’t truly come about from market dynamics, but rather governmental initiatives. Sure, Tesla makes nice cars that the upper-middle class and wealthy want to buy at high prices and are okay with the lithium-ion technology–that is the true market dynamic at play here–but mass adoption in the midst of a real market environment has yet to be thoroughly vetted. This reality seems to have been behind Toyota’s hesitancy to follow its peers headlong into this. Where there is an over-reliance on government funding and incentives, there are risks of mal-investment. Friedland is emphasizing this point from the angle of what is actually required to procure these metals in a mostly anti-mining world.

This leads me to a couple of key investment takeaways:

#1 – When it comes to lithium investing, stay producing or close to it, with an emphasis of technological capabilities, and don’t bet the farm on the current lithium framework.

The point that Friedland made that I would push back on is that this lithium metal technology is imminent. It is a general axiom of mine that anything a miner says will typically take at least twice as long. So this lithium metal could be a serious threat to lithium-ion but not immediately. It will take capital and scale and, if it becomes a reality, we’ll probably see it in a public market security before lift-off. North America has almost no lithium carbonate or hydroxide production at all, so how about we actually get a material amount first before we worry about technological displacement.

I like a handful of lithium companies that are either producing now or soon will be, especially in the Western Hemisphere. And with these I place a strong emphasis on the technological process capabilities of the management teams. This is a topic that I covered in a recent article and I won’t revisit it here. I also own Albemarle (ALB) but only because it is the only left-handed kid in town that can play that one left-hand only role.

Companies with strong technological process capabilities may be able to pivot as new lithium battery technologies emerge (there will be time to do this) or perhaps be acquired if they hold the right kinds of assets.

That said, I’m not going to bet the farm on what is still a deeply cyclical industry on shaky (lithium-ion) technology ground (when it comes to vehicles) mainly reliant on China. This whole situation in lithium just screams for a technological displacement like Friedland is talking about with Pure Lithium, and I suspect, probably why we haven’t seen a lot of Western Major energy or mining producer capital move into the current lithium-ion technology framework.

I do think investors holding quality lithium companies still stand to benefit from the next up-cycle in lithium, however, if Friedland is right, a shakeup could come after that.

#2 – Keep an eye on E3 Lithium, Imperial Oil, Exxon Mobil, and Ivanhoe Electric/Saudi Arabia

This leads me to Exxon Mobil (NYSE:XOM), one of my largest holdings simply on its oil & gas prospects alone. Exxon is the majority owner of Imperial Oil (IMO) which will have a 4.5% stake in E3 Lithium (ETL:CA; OTCQX:EEMMF) if they exercise their warrants (interesting side note: Google Bard errantly told me they own 100%; some “intelligence”).

E3 Lithium’s 2022 Annual Report highlighted the following strategic partnerships:

Pure Lithium has used concentrate from E3’s Leduc Aquifer in Alberta. Leduc is large and a potential future source of lithium for lithium metal at scale.

It is not clear to me that Imperial’s involvement in E3 has anything to do with the Pure Lithium potential. That said, Exxon spent $100+ million this year to acquire lithium brine rich acreage in the Smackover formation of Southern Arkansas. Interestingly, this was not in their official Press Releases and the Wall Street Journal noted that Exxon quietly made this acquisition.

To be clear, I’m not saying investors should keep an eye on the hyped-up Direct Lithium Extraction (DLE) projects that have so far done nothing and I don’t have an investment view on E3 either. I’m saying that we should look out for the potential of Pure Lithium’s technology to be used to produce lithium metal from oil and gas reservoirs in possibly Alberta, the US, or in Saudi Arabia where Friedland’s Ivanhoe Electric has also been making significant inroads. Moreover, Saudi Arabia’s Energy Capital is also an investor in Pure Lithium.

Exxon Mobil

In my mind, Exxon would ultimately be the dark horse candidate to dominate the production of lithium through such a technological partnership with the likes of Pure Lithium. The acquisition of E3 by Imperial could signal the start of such a move.

Exxon has the (1) technical expertise in well, water, and reservoir management, (2) the impetus to lead in “energy transition” and “green”, and (3) most importantly, the capital.

What I like best about this setup is that I see Exxon as a home run as is, without it becoming a major lithium player. Let’s examine my core bullish thesis on Exxon.

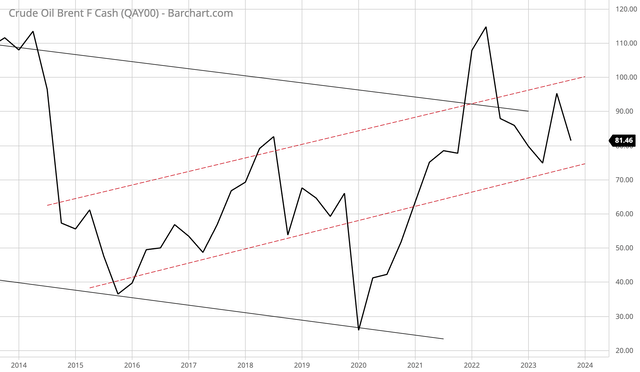

Consider the following quarterly log chart of Brent crude oil:

Here we can see Brent crude—the global benchmark—structurally moving toward the $90 per barrel average long-term price.

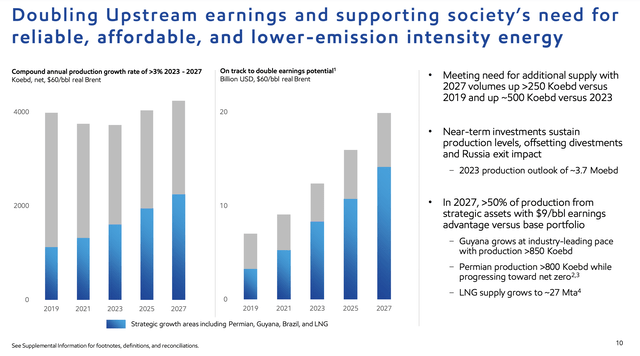

Exxon is currently producing about 3.7 million barrels of energy (“BOE”) per day and management is guiding for 3% production growth out to 2027. Growth is mainly coming from its investments in the Permian and offshore Guyana. Consider the following slide from Exxon’s 2022 Corporate Plan Update:

Exxon Mobil 2022 Corporate Plan Update

In 2027, greater than 50% of production will come from these strategic growth areas which are more profitable.

Exxon is playing it conservative with its current share repurchase program which is retiring about 4% of shares outstanding annually. I think this rate could double in 2024 – 2025 in a $90 per barrel average oil price regime.

Assuming:

(1) 3% average annual production growth,

(2) $270 of revenue per BOE produced in a $90 crude regime,

(3) ~17% operating margins (probably conservative as 2023 margins are here now and more profitable growth barrels are coming), and

(4) 5%+ annual reductions in shares outstanding,

I think Exxon can earn $14 per share in the 2024 to 2025 timeframe and I see the stock closing in on $200 per share within 1 to 3 years. (Note: these financial targets do not consider the Pioneer (PXD) acquisition which I essentially see as giving Exxon more of the same).

My target multiple for Exxon is 13 assuming a Moderately Bullish outlook. Any significant advancements in lithium could ultimately support or increase the multiple that Exxon trades at, potentially at the expense of the rest of the lithium industry.

The major risk for Exxon is a severe recession, however, the company has little or no net debt so the foundation is solid. Moreover, the current fiscal situation points to more electronic money printing down the road and a higher inflationary regime which is just another reason to own a stock like Exxon.

Strategic Conclusion

The potential for a game-changing technology for lithium metal to be produced from oil & gas reservoirs could turn already attractive Exxon into a grand slam home run. This is clearly a long shot at this stage in the game but definitely bears watching. More immediately, lithium investors or potential lithium investors need to seriously weigh Robert Friedland’s advice.

Additional Final Note:

A few hours after I wrote this article, Reuters reported that Exxon plans to begin producing a meaningful amount of lithium (10,000 tonnes annually) in Arkansas in 2026. The article does not specify what type of lithium. Based on what I have covered in this article, this might be more meaningful if this is not lithium carbonate, chloride, or hydroxide. Exxon’s management will be hosting a corporate plan update in less than a month, so I would expect to see more details come out at that event. This bears watching as it could have significant implications for the energy and lithium industries.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, ALB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information presented here is general in nature and designed for do-it-yourself and professional investors. It does not have regard to the investment objectives, financial situation, and the particular needs of any person who may read this. Recommendations are not personalized investment advice specific to the situation of any one individual, family, or organization. In no way should it be construed as personalized investment advice. True Vine Investments will not be held responsible for the independent financial or investment actions taken by readers. This content is never an offer to buy or sell any security. This content includes a disclosure of any relevant securities held by Joshua S. Hall or his immediate family. Client portfolios managed by True Vine Investments may hold positions in securities covered here. Securities in these portfolios may be bought or sold at any time in order for True Vine Investments to satisfy its fiduciary obligations to clients. All data presented by the author is regarded as factual, however, its accuracy is not guaranteed. Investors are encouraged to conduct their own comprehensive evaluation of financial strategies or specific investments and consult a professional before making any decisions. Positive comments made regarding this content should not be construed by readers to be an endorsement of Joshua Hall’s abilities to act as an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.