Summary:

- Macroeconomic factors, such as changing consumer trends and digital advancements, support Nike’s growth potential.

- Nike’s products are among the most wanted gifts this holiday season.

- There are several tailwinds leading to margin expansion.

- In this earnings preview, we will go over Nike’s estimates to see if it is still a compelling buy.

Wirestock

Introduction

Just three months ago, NIKE, Inc. (NYSE:NKE) was trading well below its 10-year average, having dipped once again below $100. At that time, I judged the stock once again a good buy because of these elements:

- Strong franchise value.

- High ROIC (above 45%).

- Strong compounding effect.

- The growing demand for athletic gear for physical activities.

- The casualization of fashion is another driver of new demand.

- Its constant appeal to younger consumers and its pricing power coming from it.

- Unlevered balance sheet (net debt/EBITDA of 0.15 at the end of FY2022).

On the other hand, Nike has dipped a few times in the past two years because of concerns regarding margin compression as a consequence of high inventories. In addition, share buybacks were partially offset by increasing SBC (stock-based compensation), which has skyrocketed in recent years moving up from $325 million at the end of FY 2019 to $755 at the end of FY 2023 (Nike ends its fiscal year in May). This means around 20% of the company’s FCF is actually used to pay Nike’s employees.

Buying Nike is buying into a stock I want to hold for many years to come. With its compounding strength, it is not absurd to believe this stock will double or triple in a decade, as I tried to explain in my previous research. Now, as we approach Nike’s Q2 earnings report, the stock is seeing strong momentum and is back at $115. As holiday shopping shows strength, with record Thanksgiving shopping, it is time to go over Nike’s bull case and see if there is still an opportunity or if it is better to wait for another dip.

The Company

First of all, most people know Nike’s brand, since it is the most valuable brand in apparel and ranks 54th among the Global 500 most valuable brands.

Nike is the largest seller of athletic footwear and apparel in the world, but this doesn’t necessarily mean everyone is aware of how the company structures itself. Nike divides its product offerings into six categories: Running, NIKE Basketball, the Jordan Brand, Football (Soccer), Training and Sportswear.

Besides the Nike brand and the Jordan Brand, Nike owns a subsidiary brand, Converse, which designs, distributes and licenses casual sneakers, apparel and other accessories. Within this product line, we find trademarks such as Chuck Taylor, All Star, and One Star.

Now, as strong as Nike’s brand may be, I find it hard to consider the company as one with a moat. For sure, we have a strong franchise. But Nike operates in an industry where trends and shifts in consumer preferences happen all the time. After all, apparel is part of fashion. True, there is a strong trend towards a casualization of fashion and Nike benefits from that, but in any case, Nike faces stiff competition and always will because of the nature of the apparel market.

This is why Nike aims at establishing relationships with professional athletes, sports teams as well as other figures both to develop and to promote its products. These relationships are costly.

Just to get an idea, in FY 2023, demand creation expense reached $4 billion compared to total revenues of $51.2. This means around 8% of Nike’s revenues are deployed for sponsorships and marketing.

So, those investors looking for stocks whose underlying business is well-protected by a moat, should not be mistaken when researching Nike. Here we are before a very strong brand, and a high-quality company, but not before a wide moat.

Nike’s Ten-Year Financial History

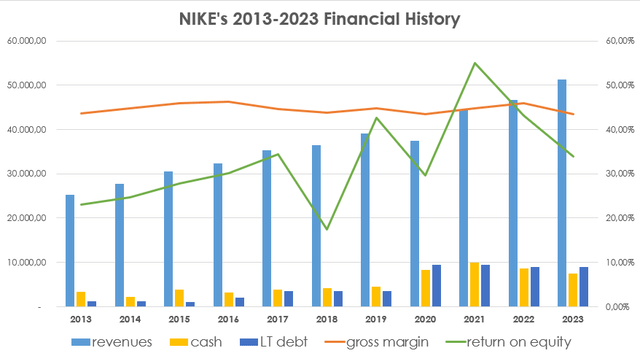

Nike shares with its investors an easy-to-read-page summarizing its recent financial history to enable anyone to get an idea of how the company performed starting in 2013. Selecting a few data to paint an overall picture of the company’s performance, I put together this graph.

Author, with data from Nike’s financial

The light blue columns show Nike’s revenues. In 2013 Nike’s top line came in at $25.3 billion. At the end of FY2023, the company had more than doubled it, generating $51.2 billion in revenue. At the same time, the orange line shows Nike’s gross margins, which have always been stable between 43% and 46%. Pretty good performance. Nike’s profitability has always been best-in-class, as the green line shows, highlighting Nike’s return on equity which is trending upwards with the last few years always seeing a result above 30%. Remarkable.

At the same time, the balance sheet has been credit-worthy. Nike currently has LT debt ratings of AA- and A1 from S&P Global Inc. (SPGI) and Moody’s Corporation (MCO). If we look at the yellow and dark blue columns, which respectively show Nike’s cash and LT debt, we see how generally speaking, the company holds as much cash as the LT it carries, derisking the company to a zero-leverage level.

Macroeconomics

While some were forecasting the end of the luxury super cycle with not so rosy outlooks due to overextended recent growth rates, well above longer-term averages for companies in this category. Now, Nike is not exactly a luxury goods producer, but its products are still top-tier in its market.

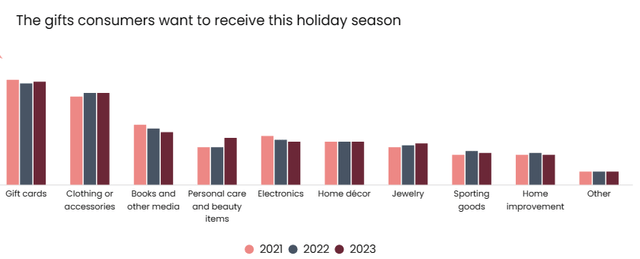

In this holiday season, according to the National Retail Federation, clothing and accessories are the second gift category consumers want to receive. Sporting goods are also desired and rank in 8th place. Demand for Nike’s products lies mostly within these two categories.

National Retail Federation – Holiday By The Numbers Slideshow

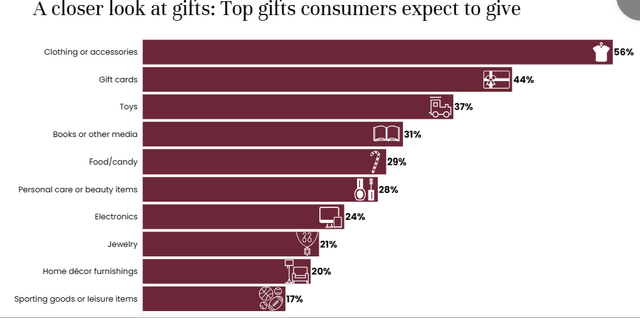

Let’s also look at what consumers expect to give. Well, here clothing and accessories ranks first with 56%, surpassing gift cards. Once again, sporting goods or leisure items still make the top 10, with 17%. No doubt, these are encouraging data points for Nike’s performance.

National Retail Federation – Holiday By The Numbers Slideshow

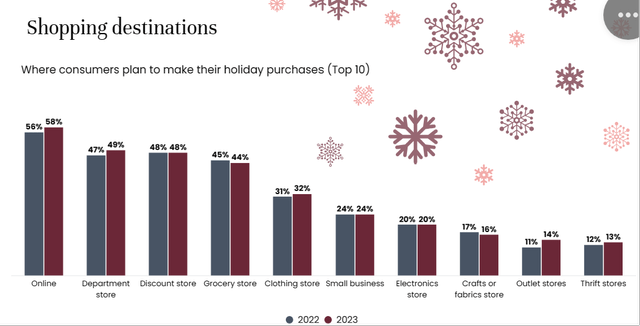

The NRF also shared its research on consumers’ favorite shopping destinations. Consumers are expected to buy mainly online, but department stores and clothing stores are seeing YoY growth among consumer preferences. Once again, Nike will benefit from both trends because of its digital platforms and its owned retail stores, 369 of which are in the U.S. while another 663 are non-U.S.

National Retail Federation – Holiday By The Numbers Slideshow

Given this outlook, Goldman Sachs gave a buy rating to the stock, with a $139 price target. At the same time, UBS recently held a conference in NYC on the impact of generative AI on fashion retail. Needless to say, Gen AI is expected to help fashion companies make gains in product development, innovation, marketing and many other internal operations. Moreover, Gen AI is making the online experience frictionless. The Nike mobile app is seeing strong traffic growth, in the high single-digit:

When we look underneath the momentum that we saw in our NIKE mobile app, we saw strong growth, high single-digit growth in traffic. We saw member activity continue to increase both in terms of engagement and buying behavior and a higher basket size, a higher AOV. And so we continue to be focused on creating the best-personalized experience for our members from a digital perspective. And we believe that that’s going to continue to fuel growth in our digital business over the long term. (1Q24 Earnings Call).

Q2 Earnings Preview

Brace yourself for impact. Yes, with record-high consumer spending and a holiday shopping season going full steam ahead, we can expect a strong Q2. Moreover, traditionally Q2s have been among the strongest quarters for Nike, followed by Q4s.

My expectation is actually countertrend: current consensus sees Nike’s earnings down YoY by half a percentage point and in the last three months we only had one upward EPS revision against 20 downward revisions. True, the company is cycling tough comparables, but it seems to have finally solved its inventory problem which weighed on margins.

In Nike’s last earnings call, we found its management talking about “very, very strong consumer demand” with a strong movement “towards athleisure, [where] there doesn’t need to be a trade-off between what you wear on the pitch and at work between comfort and performance and style”.

Moreover, ocean freight costs have come down, and the company pointed out this will benefit its margins going into the second half of 2023.

Current estimates see Nike posting $13.42 billion in revenue (0.82% growth) and EPS at $0.85 (-0.56% YoY).

But considering the recent macroeconomic news we received, coupled with strong consumer spending, I am expecting Nike to grow revenues by 2% YoY, reaching $13.6 billion. I see margins improving to 44%, and I expect a gross profit just shy of $6 billion. I am also expecting Nike to once again have a double-digit net income margin at 10.5%. This leads to net income of $1.43 billion. Considering Nike had 1.524 billion shares outstanding at the end of Q1, we can expect EPS of $0.93, at least. Since Nike has a buyback program that purchases around $1.3 billion worth of stock per quarter, it is reasonable to expect EPS a little above $0.93. In fact, the company probably bought back another 12 million shares, reducing its shares outstanding to 1.512 billion. This could add another penny to our EPS forecast.

In Q1 we were before the same scenario: analysts were forecasting EPS of $0.76, while Nike delivered EPS at $0.94. I am a little surprised by the fact current estimates still seem out of line with recent economic data. In any case, if my forecast is correct, we could project Nike’s FY2024 EPS somewhere around $3.85-$3.90 which means the stock is trading at a fwd 2024 PE multiple just below 30. The 10-year average for Nike is 37 so the stock is still trading at a discount compared to its history. Assuming Nike’s PE will reverse to the mean, we could expect the company’s multiple to expand to 33-34, putting Nike’s fair value around $128-$130. This leaves some upside, but perhaps it is too little to consider a big buy at current price levels.

Since my last buy rating, the stock is up 21.4%, not counting dividends. Therefore, the margin of safety is thinner. Considering strong momentum in the stock and reassuring consumer spending data, I would not be surprised to see Nike’s stock go up after earnings, especially in the case of a strong beat. Yet, while I keep my buy rating, I would like to add we are in “cautious buy” territory. Investors who hold a big stake should just hold. Investors who are considering stepping in, could make a little purchase to initiate their position and keep some cash on the sidelines to dollar cost average in. Nike is in fact a stock with some volatility and does provide dips that create compelling buying opportunities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.