Summary:

- Meta Platforms held its Meta Connect 2024 live event on Wednesday, and I’m initiating the stock with a buy in light of that.

- Meta’s competitive pricing on Quest 3S headsets versus Apple’s Vision Pro positions it as a leader in the AR/VR market. When mass adoption happens, Meta will have the upper hand.

- Impressive ad revenue growth and AI ad tool adoption, coupled with cost-cutting measures, should also boost Meta’s financial performance in 2025.

- Meta’s valuation is attractive as well with a P/E ratio lower than peers, strong sales growth, and bullish sentiment from analysts, indicating further upside potential.

- I share my positive sentiment on Meta Platforms here and why I see more upside into 2025.

We Are

I’m initiating Meta Platforms (NASDAQ:META) with a buy rating after Wednesday’s Meta Connect 2024 live event. After tuning in to the event, I am now more confident in Meta’s AI capabilities, particularly the new AI translation tools’ ability to potentially surge engagement with content that appeals to a wider audience range. I believe this will add new daily and monthly active users to their family of apps (WhatsApp, Instagram, and Facebook). Management emphasized their goal of making Meta AI

The most used AI assistant by the end of the year.

I think they’re uniquely positioned, with their heavy investors in Reality Labs and its sticky Family of App platforms, to use AI to increase engagement. Meta’s reach goes well beyond its Family of Apps to its AR/VR headsets.

In fact, the new Quest 3S headset price leads me to believe Meta has pricing power in the market, especially in comparison to Apple’s Vision Pro, which is priced at almost 7x Meta’s offering. The affordability and heavier investment in the market also make Meta the go-to AR/VR company. Meta has a market cap of ~1.3 Trillion and over 3.3 billion daily users and is now promising to use AI to boost its engagement and financial performance. I think the company has all it needs to make this happen and show more upside into 2025.

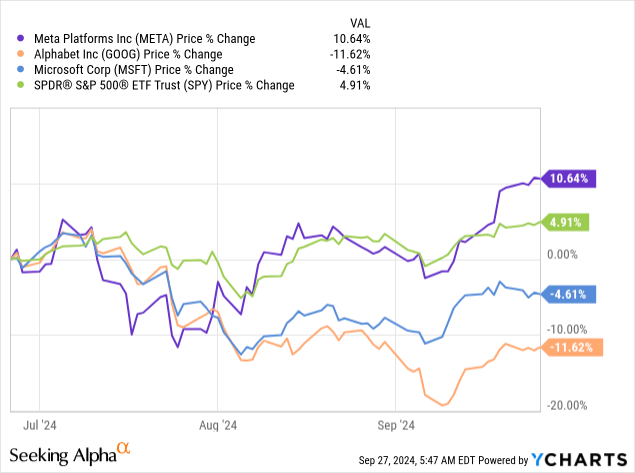

YCharts

Meta is up 10.64% on the 3-month chart, against the S&P500, up 4.9%, Microsoft Corporation (MSFT), down ~5%, and Alphabet Inc (GOOG), down 11.6%. The company’s outperforming arguably its biggest competition on the AI front on the three-month and six-month charts, and I expect to see the same trend when I write about the stock next. Meta can outperform the peer group into 2025 on AI tailwinds and better economic conditions. The stock is up ~63% year to date against the S&P500, up ~20%.

Meta VS Apple: AR and VR

I’m just going to come out and say it: the price difference is ridiculous. And yes, Apple’s Vision Pro headsets have eye-watering hardware specs, but I don’t think the starting price tag of $3,499 is affordable to many, even after rate cuts. Meta’s new Quest 3S and its prices were introduced during the event as a cheaper, more affordable version of Quest 3 from earlier this year, with a price tag that starts at $200.99 for the base model. Management also slashed the 512GB Meta Quest 3 VR headset by $150, with the price tag now at $499.00.

You can get at least 10 of the new Meta Quest 3S for the price of one Vision Pro. Some might argue that the comparison isn’t fair, considering that Quest 3S explicitly targets a wider audience while Apple’s Vision Pro is on the high end and targets a specific market, but I think Meta’s product will sell better. Meta’s CEO, Mark Zuckerburg, is making big strides in the future through his Metaverse, but he is also monetizing the products to the fullest in a market hungry for such innovations. According to insider data, Quest unit sales across Quest 3, Quest 2, and Quest Pro came in at a 13% increase in 2Q24, mainly backed by 64% of the sales in Quest 3. Now that an even more affordable alternative exists, I expect sales to pick up into 2025. The rate cuts should also give consumers leeway to spend on luxury items.

Valuation:

I think the company is fairly valued at current levels. Price/Earnings for C2024 is at 26.7, lower than the group average at 33.7, and its biggest competitors, Microsoft at 34.7 and Apple at 32.8. Ev/Sales for C2024 is at 8.6, slightly higher than the group average at 7.6 and in line with Apple’s at 8.7. Meta Sales year over year were up 21% from 2023-2024, comfortably higher than the peer group average at 14% and its competitors Alphabet at 13%, Microsoft at 15%, and Apple at 4%, according to data from Refinitiv.

Street Analysts’ sentiment on the stock is bullish, and over 30% of street analysts give the stock a strong buy, and over 57% of street analysts give it a buy. Only 8.8% are a hold, and ~3% are a sell. After the Meta Connect event, Jefferies analyst Brent Thill said the keynote left the firm “more bullish” on Meta’s AI opportunities on the consumer side and the enterprise side as well. Regarding the former, the firm is optimistic about Meta’s AI traction, reaching around 500 million monthly active, and expects the new AI capabilities to boost core engagement. On enterprise, the firm believes Llama is a serious contender, making Meta one of their “top AI picks” and leading them to maintain a buy rating of $600 for a price target.

The PT median was at $525 in late June and went up to $537.5 in July. It jumped to $570 in August and is currently at $575. The PT mean witnessed the same trend, at $516 in late June and $530 in July. In August, the PT mean went up to $563, currently at $574.8. USB analysts reaffirmed their buy after 2Q24 earnings and raised their price targets on the stock to $635 per share. I believe the overall sentiment on the stock is now more optimistic. Although many of the positives have been priced in, I see the company outperforming expectations in 2HFY24. I also think that with more certainty around the macroeconomic situation, more rate cuts to come by the end of the year and into 2025, and slashed prices for AR VR products will make the company better positioned for a wider consumer reach as spending power is slowly but surely expanding.

Three things on my radar

Last quarter –

Meta’s significant spending on cutting-edge tech through AI and virtual and augmented reality technology has been a point of concern for investors, with Meta’s Reality Labs investments generating $16.7 billion in operating losses over the last year. According to Wedbush, the Reality Labs investments are now more “synergistic” with the company’s core business, with AI taking up the spotlight in both existing and new hardware products, as previously discussed. I share the sentiment and think the market does, too, which was apparent when shares jumped ~7% in extended trading after the company reported a 2Q24 double top and bottom line beat. EPS came in at $5.15 per share versus expectations of $4.73 per share, and revenue beat analyst expectations of $38.3 billion comfortably and came in at $39.07 billion for the quarter and 22% up year over year from $32 billion. This was the fourth quarter in a row in which the company had revenue growth of over 20%, and I expect the same trend to continue into 3Q24 as the company sees momentum in its ad business.

Ad business –

I’m watching Meta’s position in the digital market after last quarter’s 22% year-over-year surge in ad revenue, while top competitor Alphabet was only up 11%, with YouTube short of estimates. With a more friendly rate-cut environment, I expect ad spending to rebound. According to Meta’s press release after the Meta Connect, the company is witnessing strong adoption of its AI ad tools, with over a million advertisers utilizing these tools and over 15 million ads created using them in the last month. What’s more impressive are the click rate numbers: on average, “ad campaigns using Meta’s generative AI ad features resulted in an 11% higher click-through rate and 7.6% higher conversion rate compared to campaigns that didn’t use the features.”

Next Quarter –

I believe the market also priced in the better-than-expected guidance for 3Q24; the company is now expecting revenue in the range of $38.5 billion- $41 billion against analysts’ expectations of $39.1 billion. Net income was up 73% year over year to $13.47 billion, from $7.7 billion in a year ago quarter. I don’t think I need to explain why that’s impressive. With its cost-cutting initiatives since 2022, the company is now down 21,000 in headcount, in my opinion, upping operating income 58% to $14.9 from a year ago quarter and operating margin to 38% versus 29% in the same period last year. The company canceled its premium headset and is showing discipline in AR investments as well. Meta has a spending problem, so further cost efficiency should push margins and better position the company to keep generating profits and, in turn, raise the stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.