Summary:

- Innovative Industrial Properties is a cannabis REIT that leases facilities to major cannabis operators in the US.

- Factors attracting investor interest include a high dividend yield, reasonable valuation, and bullish catalysts.

- Despite the rescheduling of cannabis to Schedule III, the stock price has barely moved, and the SAFER Banking Act poses a risk to IIPR’s business model.

Hinterhaus Productions

Dear readers,

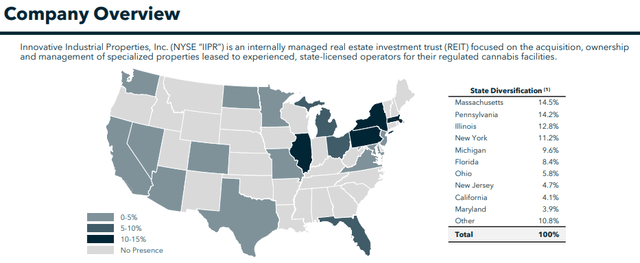

Innovative Industrial Properties (NYSE:IIPR) is a cannabis REIT which specializes in acquiring and leasing cultivation and retail facilities to major cannabis operators in the US.

Recently, the REIT has seen increased interest from investors, because of three main factors.

- a high 7% dividend yield,

- a reasonable valuation at an implied cap rate of 8%,

- and significant bullish catalysts that are likely to play-out in the near future.

Last time I wrote about the stock, in early April, I issued a BUY rating at $102 per share, because I expected that cannabis would likely get rescheduled to a Schedule III substance this year. My expectation was that the event, which would significantly lower taxes for cannabis operators, would be a major bullish catalyst for the stock, and could result in solid double-digit upside when the multiple re-rates higher to reflect higher tenant credit quality.

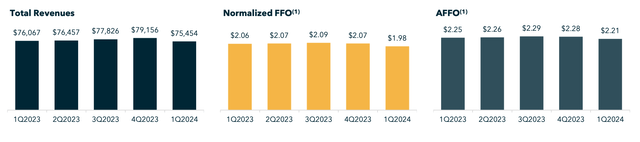

Since that article, there has been a major development in that the DEA has finally approved the rescheduling, but to my surprise, the stock price has barely moved and now stands just 1.5% higher. Moreover, the company has reported an additional quarter of earnings (Q1 2024) last week, which showed solid progress in leasing, but also made me realize that the SAFER Banking Act, discussed extensively in my previous pieces, may actually be a net negative and pose significant risk to IIPR’s business model. With these new developments in mind I downgrade IIPR to a HOLD here at $102 per share.

Rescheduling of cannabis to Schedule III

President Joe Biden has been calling for cannabis to be rescheduled to a less harmful substance than currently indicated for a while. Currently cannabis is classified as a Schedule I substance, alongside heroin and LSD, and the plan is to reschedule it to Schedule III where you typically find less dangerous forms of drugs such as ketamine or anabolic steroids.

In October 2022 President Biden called for a review of the federal marijuana law, and recently in March, he made a rare mention of cannabis in his State of the Union speech. At the President’s request the Health and Human Services Department (‘HHS’) has blessed the change in classification. And now the Drug Enforcement Agency (‘DEA’) has approved it.

The DEA approval clears the last major hurdle for this policy as it now only needs to be signed by the White House Office of Management and Budget, after which their will be a public comment period, before the change takes effect. With significant support from the President, it now seems almost certain that the reclassification will take place this year.

The change will help cannabis operators (i.e. IIPR’s tenants) substantially because it will eliminate the Section 280E tax. As a result, it is expected that operators could save an additional 20% of their gross profit each year, which will increase their profitability and consequently credit worthiness and rent coverage. Overall, I see the change as a big positive for cannabis REITs.

Recent Earnings

First quarter results have been solid, in line with historical numbers and underpinned by solid leasing of troubled properties.

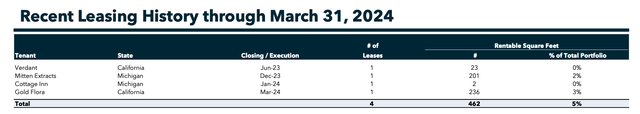

Year-to-date the REIT has executed four leases, two in California and two in Michigan. In California, two properties (19th Avenue and McLane Street – both previously occupied by Kings Garden) were newly leased to Gold Flora (an existing tenant). In Michigan, the Harvest Park facility (previously leased to Green Peak) is now under an LOI, prior to the move-out the Green Peak, and will be newly leased to Lume Cannabis Company – one of the biggest operators in Michigan.

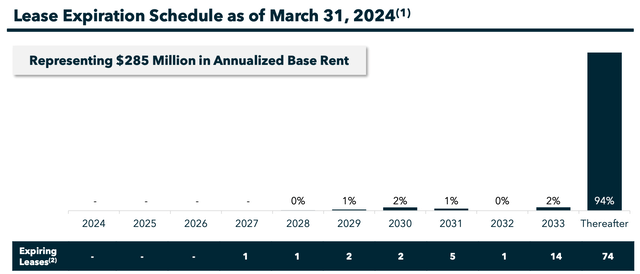

With these lease, the REIT enjoys a very long weighted average unexpired lease term of 10+ years with only 6% of leases expiring before 2034. Keep this in mind as it will be important when discussing risks below.

During the first quarter, the REIT has maintained a healthy balance sheet with a single loan of $300 Million due in 2026 and roughly $150 Million in cash. In addition, the revolving line of credit has been recently upsized from $30 Million to $50 Million providing more liquidity should they need it. Despite the fact the company does not currently have an S&P Global rating, I view their balance sheet as very safe because IIPR has one of lowest levels of debt in the sector.

The business model and risks

Now let’s turn to the business model, because this will, in my opinion, determine future earnings potential. IIPR’s states on their website:

We act as a source of capital to these state-licensed operators by acquiring and leasing back their real estate across all product types: cultivation, processing, distribution, and retail. These transactions allow for the opportunity to redeploy the proceeds into core operations, yielding a higher return than they would otherwise get from owning real estate.

Therefore, in effect IIPR acts as a bank to cannabis operators that have a hard time accessing traditional sources of financing. Currently, only about 10% of banks and 5% of credit unions provide financing for cannabis-related businesses and almost always include high fees to offset increased compliance costs. As a result, the REIT is able to get away with very landlord-friendly terms, in a form of low property acquisition prices and high rents. Because cannabis operators often don’t have a financing alternative, they overpay significantly.

But here’s the thing. The SAFER Banking Act which is currently circulating in the government is meant to significantly ease financing conditions for cannabis operators. The bill has made it through the Senate and although it seems unlikely that it will be signed into law before the election, it’s quite likely that eventually it will. In that case, cannabis operators will gain much better access to traditional financing options, at a fraction of the current cost. This poses a major risk for IIPR and similar REITs.

Currently, IIPR’s yearly rents average $39/sft. And although their properties do have some additional technology (watering, HVAC and light systems) compared to traditional net lease or warehouse space, these hardly justify the stark difference in rent.

IIPR IR – example of a property

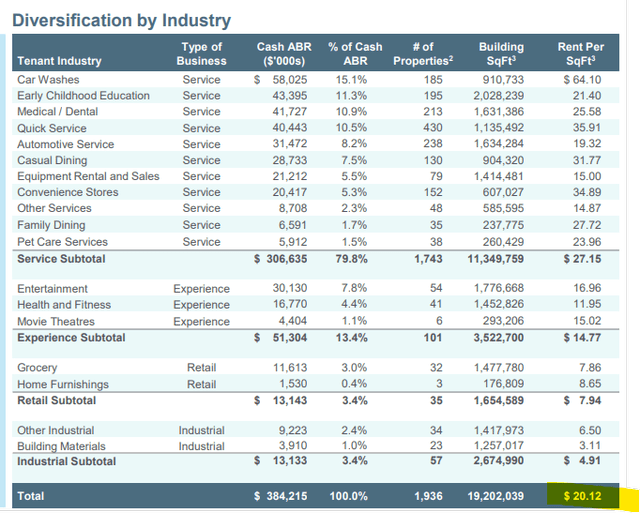

For comparison, consider that Essential Properties Realty Trust (EPRT) which focuses on net lease properties averages just $20/sft in annual rent.

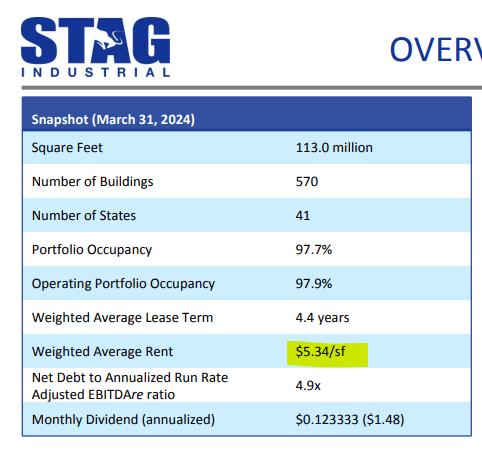

And a pure warehouse REIT, such as STAG Industrial (STAG) only gets $5.34/sft, on average.

STAG IR

I’m not familiar with the exact cost of the cannabis-related technology that is present in IIPR’s properties, but I do think that a large part of the difference in rent is simply a result of the tenants’ inability to obtain financing elsewhere. Consequently, if/when the SAFER Banking Act passes, I expect significant rent reductions when leases expire, and potentially even sooner if operators try to get out of their expensive leases via defaults.

Bottom Line

DEA’s approval of cannabis as a Schedule III substance has not resulted in as much upside as I had though. The REIT has continued to operate well and remains well positioned for what’s to come with a very low net debt level of <1x EBITDA and solid leasing during Q1. But the SAFER Banking Act represents a major threat to the business model which has likely been taking advantage of the fact that tenants had few financing alternatives other than to agree to IIPR’s sale-leaseback terms. I doubt that the REIT will be able to maintain average rents double that of quality net lease REITs and 7x those of warehouse space. As a result, I downgrade IIPR to a HOLD here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.