Summary:

- Innovative Industrial Properties is the only cannabis-related REIT listed on the NYSE.

- IIPR operates within a unique sector, acquiring specialized properties leased to state-licensed cannabis operators.

- The Company will benefit greatly from multiple growth catalysts and value drivers accompanying its property sector.

- IIPR showcases strong results, a ‘sleep sound’ balance sheet, high, well-covered dividends, and multiple growth catalysts, making it a worth considering addition to a well-structured portfolio.

anilakkus/iStock via Getty Images

Innovative Industrial Properties (NYSE:IIPR) is the only cannabis-related REIT listed on the New York Stock Exchange. It is a triple net lease REIT operating within a unique sector, concentrating on acquiring and managing specialized properties leased to state-licensed cannabis operators. The acquisitions are realised mainly as sale-leaseback transactions or third-party deals.

For those unacquainted with the ‘triple-net lease’ term, it’s a highly favourable type of agreement (from the landlord’s perspective), as it involves the tenant in covering costs related to operating and maintaining the property (incl. insurance, taxes, repairs, etc.). It is especially attractive when combined with contractual rent escalators, which IIPR embeds within its agreements. They typically amount to low single-digit percentages but tend to add up over time and heavily impact the bottom line.

As many investors start or concentrate their REIT journeys within the retail/service-oriented property sector, let’s briefly summarize the unique value drivers accompanying IIPR’s property sector to set the stage for a deeper analysis of its business.

Unique value drivers accompany the cannabis property sector

- the assets are mission-critical to their tenants. Moreover, their ability to switch locations is limited due to differences in state regulations and licences tied to properties. That’s a similar characteristic to, for example, VICI Properties’ (VICI) gaming properties

- cultivation facilities are supported by demand resulting from regulatory restrictions regarding transporting cannabis across states, which is illegal

- multiple growth catalysts, incl. proceeding rescheduling of cannabis from Schedule I to Schedule III, as well as more states lightening the policies regarding cannabis use

- materialization of the above catalysts could result in stronger tenants quality, as their tax obligations would decrease, larger total addressable market, better supply-to-demand relationship, and enhanced expansion capabilities of IIPRs’ tenants

Investment Thesis

I recently covered NewLake Capital Partners (OTCQX:NLCP) and assigned it a ‘strong buy’ rating. I have a position built in NLCP and recognise the similarities in the value proposition between both REITs. However, the valuation makes NLCP more compelling from my perspective. Should you be interested in my views on NLCP, please refer to the link below:

NewLake Capital Partners: Join Before The Green Train Leaves The Station, Here’s Why

Nobody has a magic ball that can predict Mr. Markets’ mood swings. Therefore, following Benjamin Graham’s advice, I do my best to approach investments, even in great companies, with a certain margin of safety that could help me stay patient and resilient on my buy-and-hold journey should I miss Mr. Market’s timing.

Nevertheless, Innovative Industrial Properties showcases:

- strong performance reflected within solid metrics across the REIT sector

- ‘sleep sound’ balance sheet with its only debt maturing in 2026

- high, well-covered, and growing dividends

- multiple growth catalysts and value drivers accompanying its unique property sector

Combined with a reasonable valuation, IIPR is a ‘buy’ for me. In the case of any noticeable pullback, I would reassign it to ‘strong buy’ should its multiple improve. I am bullish on IIPR.

Value Drivers And Growth Catalysts Of The Cannabis Property Sector

The ever-growing bottom-up demand and support

As mentioned earlier, IIPR operates within a specific property sector, which is driven by unparalleled dynamics. Before we dive into state and federal law updates, let’s briefly summarize key data providing clear evidence of growing support for the adoption of adult use of cannabis:

- 88% of US adults support some degree of marijuana legalisation

- 9% US legal cannabis sales CAGR through 2028

- 74% of Americans live in somewhat (either medical or recreational) legal marijuana use state

State-level and large-scale growth catalysts

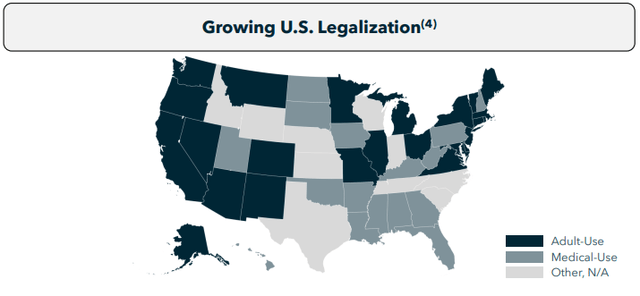

The regulatory environment heavily influences the potential development of cannabis operators and, as a result, of cannabis REITs. The regulations keep on loosening, which is favourable for the above entities. For instance, Florida will vote on the adult use of cannabis in November 2024, and Ohio introduced adult sales on August 6th, 2024.

Looking at a broader picture, the process of rescheduling marijuana from Schedule I to Schedule III keeps on moving forward. The comment period for the Notice of Proposed Rulemaking ended on July 22nd, and the DEA received over 43,000 comments. While NLCP, IIPR, and all interested parties have their eyes on this matter, there’s still uncertainty regarding ‘if’ and ‘when’ the rescheduling will happen. Nevertheless, IIPR remains optimistic about the ‘if’ question:

While we remain optimistic on rescheduling, they remain some very significant hurdles, and if rescheduling occurs, there’s a great deal of uncertainty as to when that may actually happen.

Let me also quote NLCP’s management’s comment on this matter, painting a solid picture of the potential rescheduling impact on the business:

A final rule rescheduling to Schedule III would instantly improve the credit quality and cash flow position for our entire tenant portfolio by reducing the taxes they pay. Additionally, as the financial profile of our tenants improve, we would expect valuations for the sector to improve, setting the stage for companies to consider recapitalizing their balance sheets, thus resulting in further credit improvement for both the industry and our portfolio. We estimate that elimination of 280E would save our tenants a collective $500 million annually.

Federal law remains intact, leaving plenty of room to capitalize on

The important aspect to consider when analysing IIPR’s property sector is its ability to source attractive investments. Federal law currently heavily limits market players’ ability to acquire traditional financing, allowing the likes of IIPR or NLCP to fill the gap by providing sale-leaseback opportunities or other transaction structures. It’s a win-win, as cannabis operators gain liquidity and capital to expand their businesses while IIPR acquires attractive tenants with growth prospects and capital sources to materialize them.

IIPR’s smaller peer, NLCP, commented on the federal law being intact within its recent 10-Q filing:

Although moving marijuana to Schedule III should facilitate medical research and should provide a financial boost to the cannabis industry, it will leave federal law essentially untouched.

Naturally, that may change, but such changes would be a double-edged sword, as:

- better access to capital sources would improve the tenants’ financial stance

- it would impose more competition in the transactional and sourcing market for IIPR

Nevertheless, such changes take time, leaving IIPR plenty of room to capitalize on the current market environment further.

You Can Sleep Sound With These Metrics

Leading, strong negotiating position reflected in business metrics

IIPR’s operating portfolio included 104 of 108 properties it owned as of June 30, 2024, excluding four properties under development/redevelopment (two pre-leased). The Company improved its occupancy rate by 40 basis points from 95.2% in Q1 2024 to 95.6% in Q2 2024 (calculated based on its operating portfolio). While I have no major concerns regarding IIPR’s occupancy rate, it’s worth pointing out that NLCP achieved 100% occupancy as of June 2024.

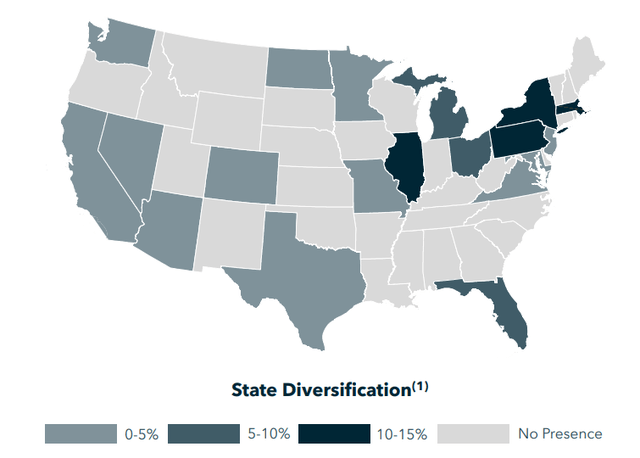

Its properties are located across 19 states, with double-digit share in IIPR’s ABR derived from:

- Pennsylvania (14.2%)

- Massachusetts (13.5%)

- Illinois (13.0%)

- New York (11.2%)

IIRP secures well-structured, typically 100% triple net leases subject to parent company guarantees and generally have initial terms ranging from 15 to 20 years. Its approach regarding lease terms ensures cash flow stability and predictability, as the Company’s WALT was equal to 14.4 years as of June 2024.

A direct translation into the ‘sleep sound’ balance sheet, growing AFFO and DPS

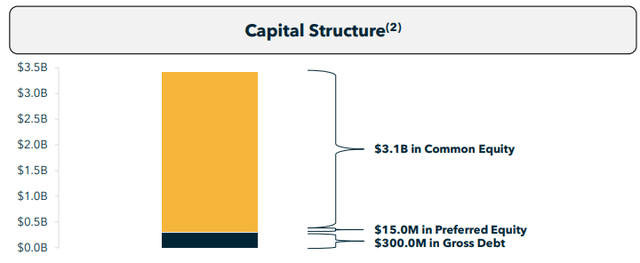

Starting from IIPR’s financing structure, the Company has a very conservative balance sheet showcasing:

- an 11% debt-to-gross assets ratio

- a 17x debt service coverage

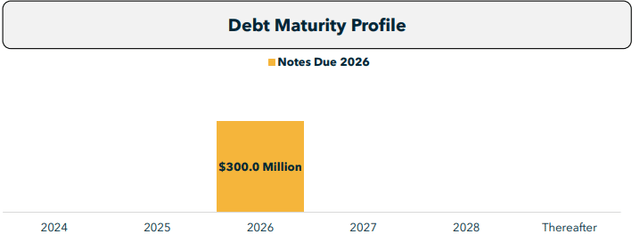

- no debt maturities until 2026 (with its only debt ($300m) maturing then)

- BBB+ credit rating

- $50m of undrawn revolving credit facility

IIPR’s Investor Presentation IIPR’s Investor Presentation

Due to its fixed-rate-oriented debt structure and no maturities until May 2026, IIPR’s cost structure remains immune to the high-interest rate environment. Its RCF is undrawn, and there are no refinancing needs in the upcoming quarters.

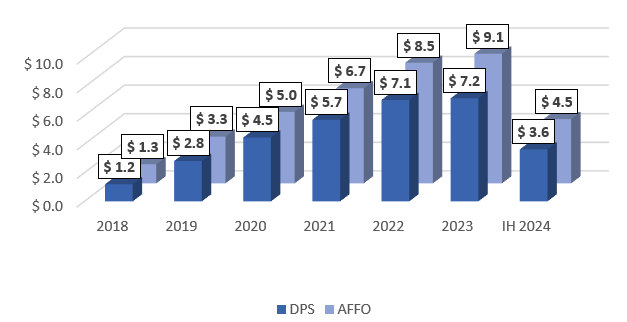

On the AFFO per share and distribution front, IIPR delivered outstanding AFFO per share and DPS CAGR during the 2019 – 2023 period, amounting to 46.6% and 43.2%, respectively. Naturally, the growth dynamic decreased with time, and the Company recorded 7% and 1.7% AFFO per share and DPS growth, respectively, in 2023. Its DPS is likely to showcase 3% growth year-over-year in 2024. Its dividends remain well-covered with an AFFO payout ratio of ~80%, supported by a safe balance sheet. IIPR is a cash-flow machine, as during the six months ended in June 2024, the Company generated $135.8m worth of cash from operating activities, which supported its dividend payments of ~$104m. Please review the chart below for details regarding IIPR’s DPS and AFFO per share.

Author based on IIPR

What May Go Wrong?

Naturally, no stock market investment is risk-free. For retail/service-oriented REITs’ enjoyers, IIPR certainly lies on the riskier side of the REIT sector. However, if you are familiarized with the REIT sector and went beyond the likes of Realty Income (O), NNN REIT (NNN) or Agree Realty (ADC), I believe you will consider (like myself) IIPR a solid risk-to-reward opportunity.

Nevertheless, some risk factors have to be mentioned:

- Growth: the DPS and AFFO growth dynamic decreased in the last couple of quarters

- Occupancy: IIPR’s occupancy rate is slightly over 95%, meaning it doesn’t realise its full potential. For instance, NLCP recorded a 100% occupancy

- Transactional market: although high interest rate environment has little impact on IIPR’s financial stance due to negligible debt position at fixed rate, it impacts the transactional market. The gap between the buyers’ and sellers’ expectations is relatively high

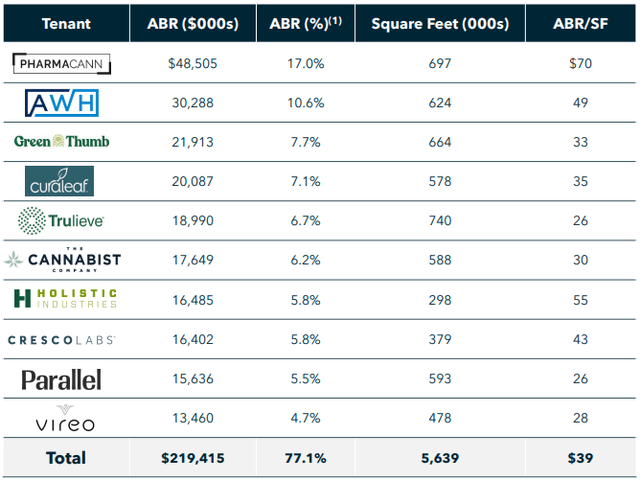

- Tenant concentration: as for any REIT, there’s a risk of potential tenant issues, which translate into the landlord’s financial situation. This is especially true for IIPR, as the Company has a highly concentrated tenant structure. For example, NLCP has recently announced some liquidity issues with one of its tenants, leading to a lack of rent coverage. Luckily, this tenant’s share in NLCP’s ABR isn’t substantial, but that may be the case for larger tenants as well

- Regulatory environment: there’s uncertainty surrounding the likelihood and the timing of such changes to proceed

- Transactional market competition: should the federal law loosen regarding the cannabis operators, IIPR would face larger competition in the transactional market from more traditional financing providers, potentially decreasing its negotiating position

Valuation Outlook and The Bottom Line

As an M&A advisor, I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

With that said, the forward-looking P/FFO stood at:

- 14.7x for IIPR

- 9.9x for NLCP

For transparency, I believe the upside resulting from multiple expansion is limited for IIPR when compared to NLCP, as the multiple gap is substantial. Nevertheless, I claim that there is room for multiple appreciation, and 16x P/FFO is a conservative scenario for such a quality REIT with multiple growth catalysts like IIPR.

To conclude, despite the risk factors mentioned earlier, I consider IIPR a ‘buy’, as the Company showcases:

- strong performance reflected within solid metrics across the REIT sector

- ‘sleep sound’ balance sheet with its only debt maturing in 2026

- high, well-covered, and growing dividends

- multiple growth catalysts and value drivers accompanying its unique property sector

- room for multiple expansion and further DPS and AFFO growth, resulting in double-digit total return potential with an attractive risk-to-reward ratio. I am bullish on IIPR.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NLCP, VICI, NNN, ADC, O either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

I'm going to initiate a position in IIPR in the upcoming week. I'll update if anything changes on this front.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.