Summary:

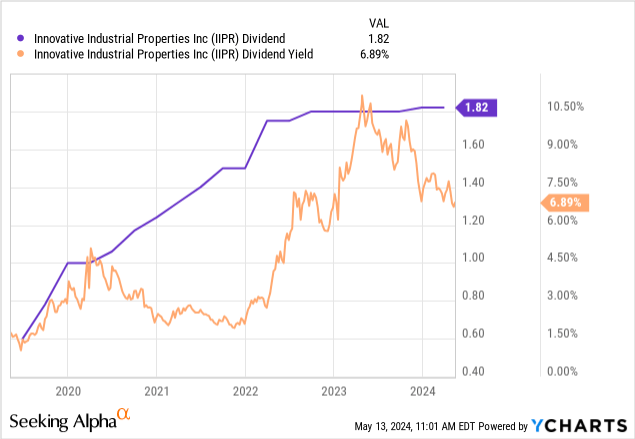

- Innovative Industrial Properties raised its dividend in December and currently offers a 7% dividend yield.

- The dividend is 121% covered by fiscal 2024 first quarter adjusted FFO that dipped by 16 cents sequentially.

- IIPR faces no maturing debt until 2026 and has a weighted average remaining lease term of approximately 14.8 years.

South_agency/E+ via Getty Images

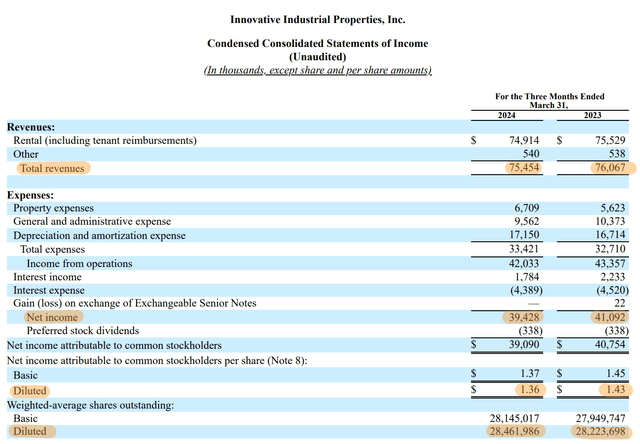

Innovative Industrial Properties, Inc.’s (NYSE:IIPR) stock price has been on a tear. The cannabis REIT also last declared a quarterly cash dividend of $1.82 per share, kept unchanged sequentially and $7.28 per share when annualized for a roughly 7% dividend yield. IIPR hiked the dividend by 1.1% in December, a remarkable feat against broader industry angst, higher interest rates, and tenant issues that had cratered investor sentiment in the only cannabis REIT not trading over the counter. IIPR reported a fiscal 2024 first quarter adjusted funds from operations (“AFFO”) of $2.21 per share beating consensus by $0.16 but down from $2.28 per share in the prior fourth quarter.

Critically, IIPR is covering its dividend by an extremely comfortable 121.4%, a roughly 82.4% payout ratio. The REIT forms a buy against the safety of the current dividend yield even with the common shares up 45% over the last year. IIPR has moved up markedly since I last covered the ticker, with the internally managed cannabis REIT now trading hands for 11.9x times its fiscal 2024 AFFO guidance. Admittedly, my prior coverage of IIPR has meandered from bearish to bullish but the REIT fundamentally forms a safer way to play the highly fragmented US cannabis industry.

Portfolio, Tenants, Debt Maturities, And Reclassification

Innovative Industrial Properties Fiscal 2024 First Quarter Form 10-Q

US cannabis companies are chasing the possible reclassification of cannabis from a Schedule I to the lower-risk Schedule III category. This would form a milestone and source of renewed euphoria for the industry. The core benefit of the reclassification would be the opening up of a broader range of banking services for cannabis firms as well as allowing operators to take standard tax deductions which are currently prohibited for businesses that generate revenue from Schedule I drugs. However, the road to reclassification remains unclear with most respondents to a recent Seeking Alpha survey on cannabis rescheduling stating they expect this to take longer than a year.

Innovative Industrial Properties Fiscal 2024 First Quarter Presentation

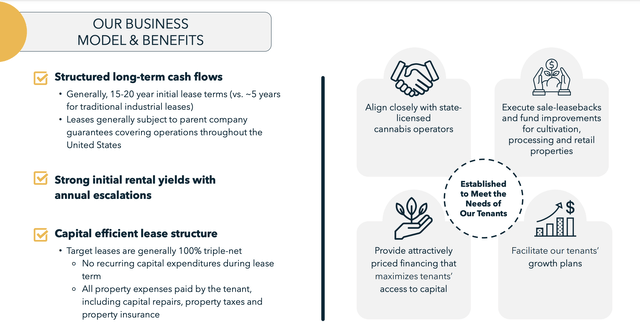

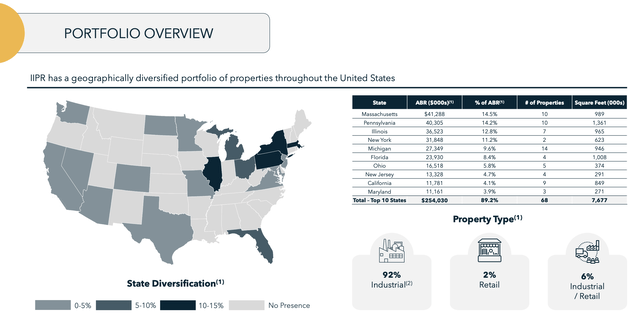

IIPR is a triple-net lease REIT with quite long-dated leases with annual rent escalators built in. The REIT owned 108 properties leased to 30 tenants and spread across 8.9 million rentable square feet in 19 states as of the end of the first quarter. The operating portfolio was 95.2% leased, with a remarkable weighted average remaining lease term of approximately 14.8 years. IIPR’s portfolio is highly concentrated with a 92% allocation to industrial cannabis properties with retail forming 2% and a hybrid of both property types forming 6%. Industrial cannabis properties are used for the cultivation, processing, and manufacturing of cannabis.

Innovative Industrial Properties Fiscal 2024 First Quarter Presentation

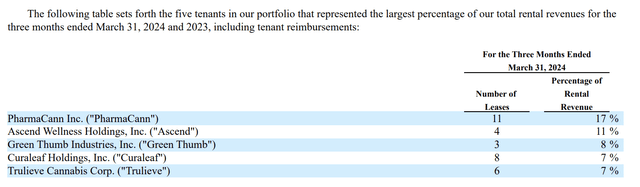

IIPR breaks down its top five tenants with private multi-state operator PharmaCann its largest tenant with 11 leases which form 17% of rental revenue. The MSO is one of the largest in the US, recently opening a dispensary in Philadelphia, and occupies a strong market position with a balance sheet that recently supported $130 million in capital expenditure.

Innovative Industrial Properties Fiscal 2024 First Quarter Form 10-Q

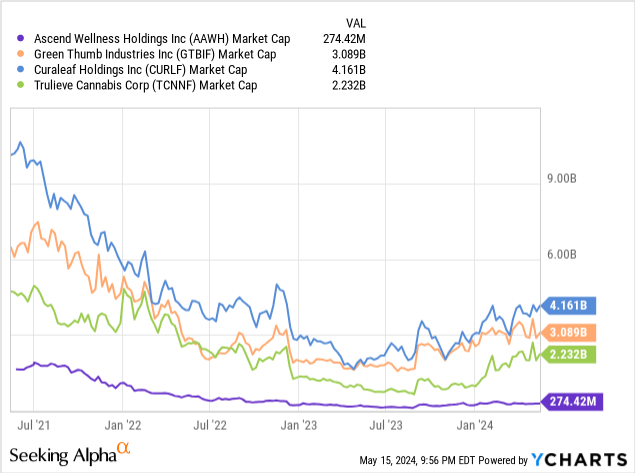

Public-listed Ascend Wellness Holdings, Inc. (OTCQX:AAWH), Green Thumb Industries Inc. (OTCQX:GTBIF), Curaleaf Holdings, Inc. (OTCPK:CURLF), and Trulieve Cannabis Corp. (OTCQX:TCNNF) form the other four largest tenants for an aggregate of 33% of rental revenue. The over-the-counter trading of these MSOs has been defined by extreme volatility. Still, they’re all trading up materially over the last 1 year, buoyed by the enthusiasm around reclassification driving a recovery from lows. The rally means respite for all-time lows and allows capital raising to be easier to inject more liquidity into the sector.

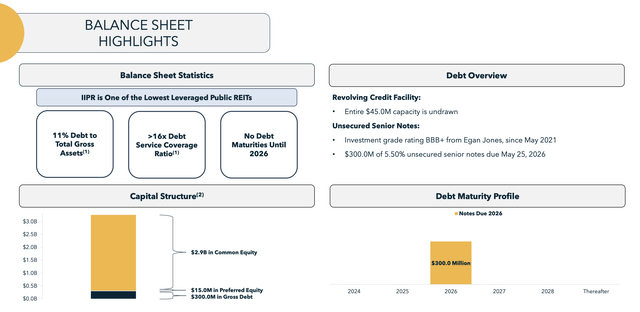

This improving backdrop for the industry comes with IIPR’s extremely attractive debt maturity profile. IIPR has one of the least worrisome debt maturities in the entire listed equity REIT space with zero debt maturing in 2024 and 2025 and one of the lowest-levered balance sheets at 11% debt to total gross assets and no variable-rate debt. Total debt stood at $300 million at the end of the first quarter and is set for maturity on May 2026. The combination of extremely long-dated leases, low leverage, and healthy dividend coverage means IIPR offers a de-risked individual investment profile within one of the most high-risk and chaotic investable sectors in the stock market.

Innovative Industrial Properties Fiscal 2024 First Quarter Presentation

The REIT’s 9.00% Series A Preferreds Innovative Industrial Properties, Inc. 9% CUM PFD SER A (NYSE:IIPR.PR.A) have also dipped materially in response to the Fed’s fight with inflation due to the positive duration effect of higher interest rates. They’re currently trading roughly $2 per share above their $25 per share liquidation value with a yield on cost of 8.3%. IIPR generated revenue of $75.45 million during its first quarter, a small 1% dip versus a year ago due to the timing of new leases. The REIT also ended the quarter with cash and equivalents of $153 million with another $20 million available from short-term investments. IIPR is a buy at its current level with the dividend safe and the leverage low.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in IIPR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.