Summary:

- IIPR remains a compelling Buy for growth/ dividend oriented investors, thanks to its inherent undervaluation and rich forward yields.

- The upcoming cannabis federal reclassification will also trigger new growth opportunities for MSOs and REITs alike, further aided by the SAFER Banking Act.

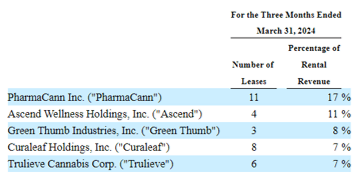

- This is especially since IIPR calls the three largest US Multi-State Operators by Market Cap as its core tenants, namely Curaleaf, Trulieve, and Green Thumb.

- In the mean time, the management continues to deliver profitable operations along with healthier balance sheet and sustained investment growths, with minimal share dilution.

- Combined with the growing bullish support observed in IIPR’s stock prices and valuations, we continue to reiterate our Buy rating here.

Yarygin

We previously covered Innovative Industrial Properties (NYSE:IIPR) in February 2024, discussing why we had maintained our Buy rating, despite the YTD correction in its stock prices and the underperformance compared to the wider market.

With the cannabis REIT continuing to deliver sustainable and profitable operations despite the uncertain federal legalization process and elevated interest rate environment, we believed that it remained well positioned to pay out rich dividends ahead.

Since then, IIPR has already recovered by another +7.4% well outperforming the wider market at +6.8%. Even so, we are maintaining our Buy rating, with the cannabis REIT continuing to report robust performance metrics while raising its quarterly dividends.

This is on top of the promising tailwinds observed in the federal reclassification of cannabis, triggering further growth opportunities for cannabis MSO and REITs alike.

Combined with the growing bullish support observed in IIPR’s stock prices and valuations, we continue to reiterate our Buy rating here.

Cannabis Reclassification May Be Coming Sooner Than Expected

For context, state level cannabis legalization for recreational uses have expanded to 32 states and medical uses to 45 states as of June 06, 2024, up drastically from the 22 and 16 observed as of November 2022, respectively.

At the same time, the President has recommended the federal rescheduling of cannabis from Schedule I to Schedule III of the Controlled Substances Act in October 2022, as similarly recommended by the Secretary of Health and Human Services in August 2023.

It appears that there has been further progress on the federal level since then, with the US Justice Department aiming to announce the long awaited reclassification sometime in the near future.

This is with the added potential of other announcements, such as the SAFER Banking Act (provides protections for federally regulated financial institutions that serve state-sanctioned marijuana businesses) and the Cannabis Administration and Opportunity Act (decriminalizes cannabis and removes it from scheduling under the Controlled Substances Act).

These developments mean that we may see the cannabis market grow even faster moving forward thanks to the improved liquidity/ lending opportunities, while potentially reducing the tax costs related to the business, resulting in new growth possibilities for cannabis REITs, such as IIPR.

IIPR’s Largest Tenants

Seeking Alpha

This is especially since IIPR calls the three largest US Multi-State Operators by Market Cap as its core tenants, namely Curaleaf Holdings, Inc. (OTCPK:CURLF), Trulieve Cannabis Corp. (OTCQX:TCNNF), and Green Thumb Industries Inc. (OTCQX:GTBIF), further underscoring the REIT’s massive potential for success once federal reclassification occurs.

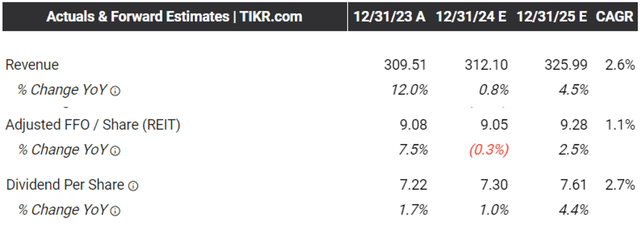

The second most important thing about IIPR is that, it has been able to generate stable financial performance as observed in FQ1’24, at total revenues of $75.45M (-4.6% QoQ/ inline YoY), AFFO of $62.99M (-2% QoQ/ inline YoY), and AFFO per share of $2.21 (-3% QoQ/ -1.7% YoY).

This is despite the lack of federal legalization, minimal bank funding, and elevated interest rate environment, with minimal dilutive capital raises as observed in the stable share count at 28.46M (+0.19M QoQ/ +0.24M YoY).

Despite the uncertain macroeconomic outlook, IIPR continues to generate growth as well, as observed in the recently completed investment worth $43M in AYR Wellness Inc, including $13M in property purchase and $30M in reimbursement.

At the same time, with its long-term debts of $296.79M only due by 2026, we believe that the REIT remains well positioned to generate strategic growth prior to federal reclassification and the normalization in borrowing costs, aided by the growing total liquidity on balance sheet at $203.5M (+14.8% QoQ/ inline YoY).

The same has been observed in IIPR’s robust Interest Coverage ratio of 10.14x, which allows the management to pay out extremely rich AFFO payout ratio of 80.58%, compared to the sector median of 1.82x and 73.81%, respectively.

So, Is IIPR Stock A Buy, Sell, or Hold?

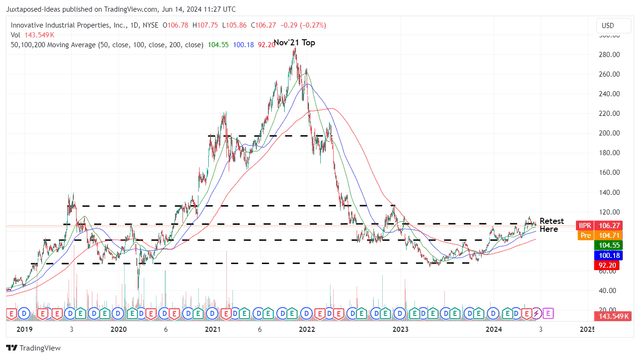

IIPR 5Y Stock Price

For now, the same optimism has already been embedded in IIPR’s stock prices, with it continuing to chart higher highs and higher lows over the past eight months, while recording a tremendous rally by +53.8% since the 52 weeks bottom of $69.08.

Despite so, the REIT continues to offer relatively rich forward dividend yields of 7.1%, compared to the sector median of 4.66% and the US Treasury Yields at between 4.22% and 5.38%.

This is on top of the recently raised quarterly dividends per share by +4.3% to $1.90, building upon the highly impressive 5Y Dividend Growth CAGR of +38.9%.

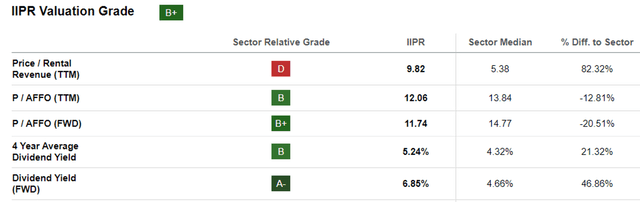

IIPR Valuations

At the same time, IIPR now trades at FWD Price/ AFFO valuations of 11.74x, consistently upgraded from its 1Y low of 7.51x and the previous article at 10.05x, though still discounted compared to the sector median of 14.77x and its 3Y pre-pandemic mean of 22.74x.

The growing bullish support observed in its stock prices and valuations is highly encouraging indeed, since the same has also been observed in its cannabis REIT peers, such as NewLake Capital Partners Inc (OTCQX:NLCP) at FWD AFFO/ Per Share valuation of 9.40x and AFC Gamma (AFCG) at 5.06x, compared to their 1Y lows of 6.11x/ 4.28x, respectively.

IIPR’s Consensus Forward Estimates

While we have not offered a long-term price target in our previous article, it appears that there is a promising upside potential of +28.9% to our bull-case price target of $137, based on the upgraded IIPR’s FWD Price/ AFFO valuations nearer to the sector median of 14.77x and the consensus FY2025 AFFO per share estimates of $9.28.

This projection is not overly ambitious as well, based on the very likely reclassification of cannabis from Schedule 1 to Schedule 3 drug and the eventual SAFER Banking Act, as discussed above.

As a result of the dual pronged prospective returns through dividend incomes and capital appreciation, we are reiterating our Buy rating for the IIPR stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.