Summary:

- Innovative Industrial Properties remains profitable and well capitalized to sustain its rich AFFO Payout ratio of ~80% and forward dividend yields of ~8%.

- Its healthy balance sheet and stable dividend share count continue to demonstrate stellar management execution, despite the REIT industry’s typically dilutive nature.

- Combined with the improving tenant profile and 100% in rental collection through February 2024, we believe that IIPR is well positioned to weather the prolonged federal legalization.

Richard Drury

We previously covered Innovative Industrial Properties (NYSE:IIPR) in December 2023, discussing why we were finally re-rating the stock as a Buy after multiple coverage, mostly attributed to its tenants’ improving profitability, the expanding legalization of cannabis on the state level, and the healthier balance sheet.

Most importantly, the REIT’s dividends appeared to be safe, further demonstrated by the recent hike and established stock support level, implying its robust income investment thesis.

In this article, we shall discuss why we are maintaining our Buy rating, despite the YTD correction in IIPR’s stock prices and the underperformance compared to the wider market.

With the cannabis REIT continuing to deliver sustainable and profitable operations despite the uncertain federal legalization process and elevated interest rate environment, we believe that it remains well positioned to pay out rich dividends ahead.

This Cannabis REIT Investment Thesis Continues To Deliver, Despite The Inherent Headwinds

For now, IIPR reported a double beat FQ4’23 earnings call, with overall revenues of $79.12M and AFFO per share of $2.28 (-0.4% QoQ/ +7.5% YoY), with FY2023 numbers of $309.5M (+11.9% YoY) and $9.08 (+7.4% YoY), respectively.

Most importantly, despite the multiple tenant issues over the past few quarters, it appears that the REIT’s reversal is finally here, with the management reporting 100% rental collection in the latest quarter (+3 points QoQ/ +6 YoY) and 100% through February 2024 (+8 points YoY).

Despite the usually dilutive nature of REITs, it is apparent that IIPR is one that defies the mold as well, with a relatively stable share count of 27.27M (+0.01M QoQ/ +0.11M YoY).

The same prudence can also be observed in its balance sheet, with stable long-term debts of $312M (inline QoQ/ YoY) and growing cash/ equivalents of $140.24M (+19.8% QoQ/ +60.9% YoY). The robust execution allows the cannabis REIT to offer an impressive AFFO payout ratio of 80% (+1 points QoQ/ -5 YoY), compared to the sector median of 73.82%.

Despite so, IIPR’s dividend remains safe with a B+ grading, as it records TTM Interest Coverage of 9.63x and 3Y Dividend Growth Rate of +19.32%, compared to the sector median of 1.74x and +3.40%, respectively.

Combined with the latest dividend per share increase by +1.1% to an annualized sum of $7.28, it is unsurprising that the REIT’s investment thesis is very tempting here.

This is made further sweeter by the recent pullback, resulting in an expanded forward yield of 8.02%, compared to its 4Y average of 5.07% and sector median of 4.80%.

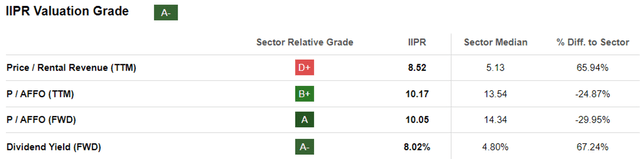

IIPR Valuations

Seeking Alpha

As a result of the promising factors discussed above, we believe that IIPR continues to trade at relatively reasonable valuations, with FWD Price/ Rental Revenues of 8.52x and FWD Price/ AFFO of 10.05x.

This is compared to its 1Y mean of 7.50x/ 9.21x, 3Y pre-pandemic mean of 14.82x/ 22.72x, and sector median of 5.13x/ 14.34x, respectively.

Most importantly, it is undeniable that the REIT has been to profitably monetize the unconventional cannabis market, while boasting minimal share dilution and debt reliance.

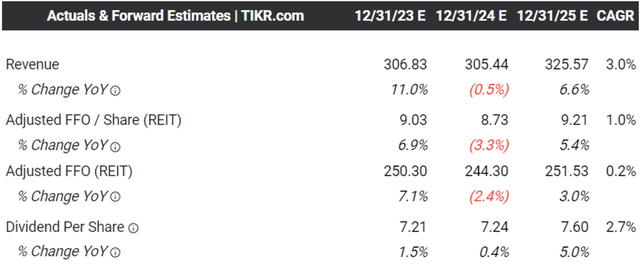

The Consensus Forward Estimates

Tikr Terminal

At the same time, the consensus has estimated that IIPR may be able to sustain its operations profitably moving forward, with its top/ bottom lines expected to expand at a CAGR of +3% and +1% through FY2025.

This is compared to the previous estimates of +0.4%/ +0.1%, with the deceleration from the historical growth of +61.9%/ +63.7% between FY2019 and FY2023 mostly attributed to the management’s moderated acquisition activities as the macroeconomic outlook remains uncertain.

However, readers need not fret, since IIPR continues to boast excellent portfolio performance thus far, with 95.8% of its portfolios leased at a weighted average remaining term of 14.6 years and the balance attributed to redevelopment, timing of lease transfers, and new acquisitions.

Combined with the “contractual rent escalations and amendments for higher base rents from improvement allowance,” we believe that the REIT remains well positioned to wait out the potential cannabis rescheduling and prospective passing of the SAFER Banking Act in the intermediate term, which are expected to “reinvigorate investment and growth in the sector.”

So, Is IIPR Stock A Buy, Sell, or Hold?

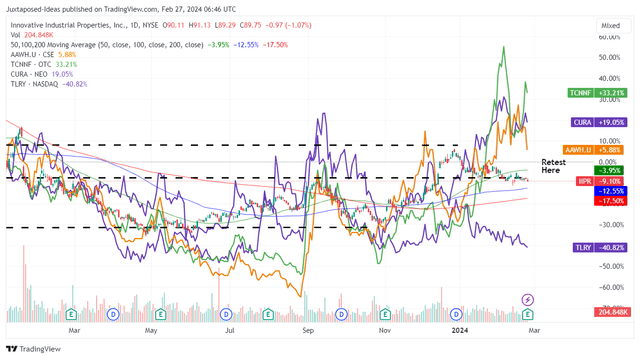

IIPR 1Y Stock Price

TradingView

For now, IIPR appears to be well-supported at the $90s, as more bullish support is also observed surrounding its tenants, namely Ascend Wellness Holdings, Inc. (OTCQX:AAWH), Curaleaf Holdings, Inc. (OTCPK:CURLF), Trulieve Cannabis Corp. (OTCQX:TCNNF), and other cannabis related stocks, such as Tilray (TLRY).

Even if cannabis rescheduling is eventually delayed, we are not overly concerned, since the REIT continues to be profitable on a sustainable basis no matter the headwinds.

Most importantly, with ~8% in dividend yields, IIPR investors are being paid to wait out the bumpy legalization process, with the yields also well exceeding the US Treasury Yields of between 4.28% and 5.37%.

With the Fed projected to pivot by H1’24 and the normalization process expected to be prolonged through Q4’26, we believe that IIPR offers a compelling income investment thesis over the next few years of transition.

As a result, we are maintaining our Buy rating on the IIPR stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.