Summary:

- Since our first coverage, Innovative Industrial Properties has delivered an 88% total return, including dividends, significantly outperforming the broader market.

- As of Q2, 2024, IIPR’s portfolio had a 95.6% occupancy rate, ensuring stable cash flows.

- The portfolio’s weighted average remaining lease term is 14.4 years, minimizing lease rollover risk.

- 91% of IIPR’s properties are leased to multi-state operators and publicly traded cannabis companies, boosting rent stability.

- IIPR has raised dividends annually since 2016, showcasing financial strength and shareholder-friendly policies.

Justin Paget/DigitalVision via Getty Images

Investment Thesis

Since our buy rating last year, Innovative Industrial Properties (NYSE:IIPR) has delivered an 88% total return, including dividends, and 11% since our last coverage, outperforming the market. We maintain our bullish view due to IIPR’s strong fundamentals.

IIPR’s portfolio today is 95.6% leased, with a weighted average remaining lease term of 14.4 years, thus providing stable sources of cash flows. Lastly, 91% of its properties are leased to financially strong multi-state operators and publicly traded cannabis companies, which provide stability in rent. The fact that IIPR has consistently grown its dividend since 2016 further underlines its financial vitality, making it a very attractive long-term investment in the cannabis real estate market.

IIPR’s Winning Formula of High Occupancy and Solid Rent

Innovative Industrial constantly maintains high occupancy rates across its portfolio. As of Q2 2024, IIPR’s portfolio had 108 properties, 104 of which are in its operating portfolio. These 104 properties were 95.6% leased, marking the company’s capability to maintain high occupancy levels even in a down macro environment. The Company’s properties have a weighted average remaining lease term of 14.4 years, which minimizes lease rollover risk. In other words, this extended lease term provides predictable and stable cash flow.

Additionally, the company has solid relationships with multi-state operators (MSOs) and publicly traded cannabis companies. ~91% of its operating portfolio is leased to MSOs, and 62% is leased to publicly traded tenants. This high level of tenant quality adds stability to IIPR’s cash flow. These tenants are more financially secure than smaller privately owned operators.

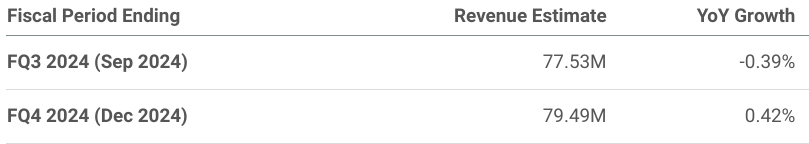

What supports IIPR’s top-line growth is its solid rent collection history during periods of market distress. Despite the ongoing challenges in the cannabis sector, like price compression and competition from illicit markets, IIPR collects rents effectively. This is reflected in Q2 revenue of $79.8M (4.36% Y/Y), which surpassed the street estimates by $2.53M. The company’s ability to collect rents and maintain high occupancy rates highlights the effectiveness of its tenant selection and lease management strategies. Moreover, the solid rent collection has enabled IIPR to sequentially increase its common stock dividend by 4.4% to $1.90 per share, continuing its track record of annual dividend increases since 2016 and +75% price return in the last 12 months.

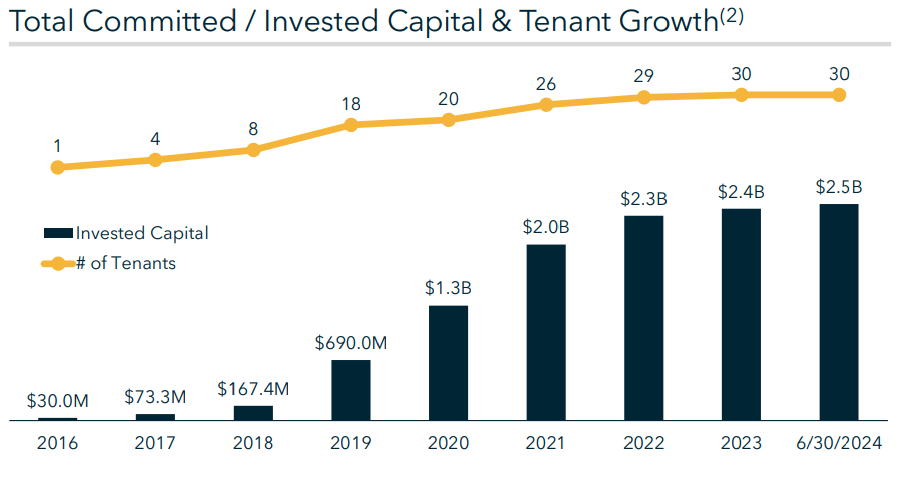

Since 2016 (its inception), IIPR has had considerable tenant growth. In 2016, the company had only one tenant. However, by H1 2024, the number had grown to 30. This tenant increase over eight years indicates that the company’s tenant growth aligns with the broader expansion of the US cannabis industry. The tenant base may continue to grow as more states legalize cannabis for recreational and medical use. This expansion is notable in emerging adult-use markets like New York, New Jersey, Florida, and Ohio. These states may derive considerable growth through 2028.

Moreover, the growth in tenants also signals IIPR’s lead in expanding its real estate footprint. As of Q2 2024, the company owns properties across 19 states that comprise 9 million rentable square feet, including 722K square feet under development and redevelopment with a focus on long-term partnerships with its tenants. For instance, IIPR’s newest acquisition (a property in Florida leased to AYR Wellness) marks an expansion of the company’s long-term relationship with the tenant that also operates an IIPR-leased property in Ohio. The continuous growth in tenants, properties, and the company’s portfolio may support rapid capitalization on the increasing demand for cannabis real estate.

IIPR Investor Presentation

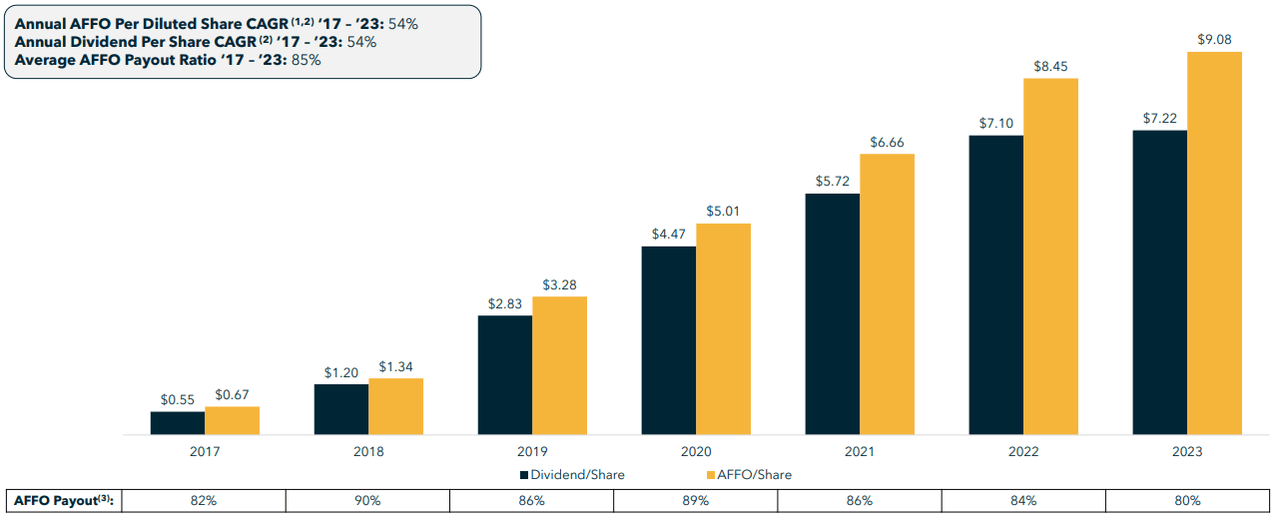

Further, Adjusted Funds From Operations (AFFO) and dividends consistently grow. From 2017 to 2023, the company’s AFFO per diluted and dividend per share grew at a compound annual rate of 54%. This consistent growth points to IIPR’s ability to increase operative cash flows. The company’s AFFO payout ratio averaged ~85% over the specified period and remained relatively stable (80% and 90% from 2017 to 2023).

In Q2, IIPR derived $2.29 in AFFO per share against adverse market conditions (Fed’s higher-for-longer). The AFFO growth is based on rent escalations in existing leases, acquisitions of new properties, and tenant improvements (that result in higher rental rates).

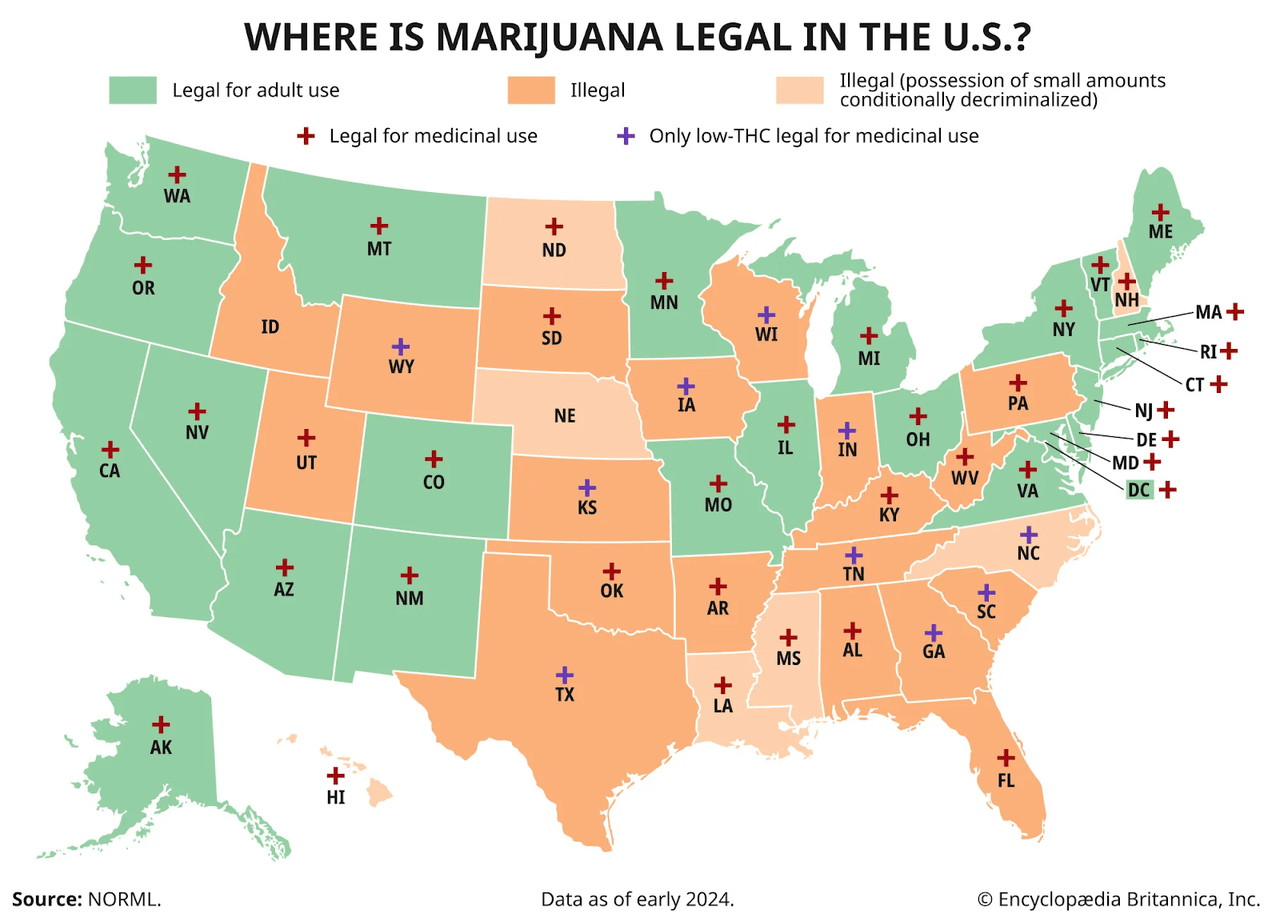

IIPR’s financial performance may benefit from the expansion trend in the US cannabis market. The market may grow to $46 billion by 2028. The pace may surpass the US spirits, beer, and wine markets, making cannabis one of the fastest-growing US industries. Assessing the addressable market, ~74% of Americans are living in states where marijuana is legal for either recreational or medical use.

Similarly, ~54% of Americans live in states with legal recreational use. As more states legalize cannabis, the demand for cultivation and production facilities will increase. This will give IIPR more room to expand its property portfolio. Finally, the emerging adult-use markets in states such as New York, New Jersey, Florida, and Ohio may derive growth in the long term.

Overall, IIPR’s stock valuation, based on the price-to-AFFO (forward) ratio, points to a 13.8% undervaluation against the sector median. Along with the market opportunity, there is a potential upside for the stock in the upcoming quarters, as consensus estimates did not integrate the possible top-line growth.

seekingalpha.com

Tenant Concentration: IIPR’s Hidden Risk Amid Cannabis Industry Uncertainty

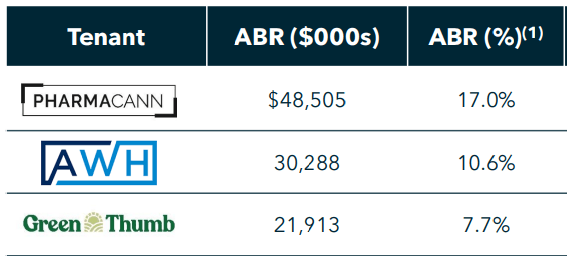

A critical issue for IIPR’s valuations and top-line growth lies in its tenant concentration, PharmaCann, Ascend Wellness Holdings (OTCQX:AAWH), and Green Thumb Industries (OTCQX:GTBIF) together account for a considerable portion of its Annual Base Rent (ABR). PharmaCann alone represents 17% of IIPR’s ABR, with AAWH contributing another 10.6% and GTI adding 7.7%. These three tenants comprise 35.3% of the company’s ABR. Such concentration increases risk because if any of these tenants default, face financial difficulty, or struggle to meet regulatory compliance, the impact on IIPR’s revenue streams could be substantial.

For instance, PharmaCann’s 17% share of ABR equates to roughly $13.6 million based on IIPR’s total revenue of $80 million in Q2 2024. This heavy reliance on a single tenant for such a large portion of rent revenues increases volatility and uncertainty in earnings, especially as the cannabis industry remains in a nascent and highly regulated state. In short, the ABR concentration suggests that IIPR’s portfolio is not as diversified as it might appear.

IIPR Investor Presentation

IIPR could see a prolonged period of slow growth due to its reliance on the cannabis industry’s regulatory developments. Additionally, the slow rollout of adult-use programs in major states like New York amplifies this uncertainty. While states like Maryland and Missouri have seen solid cannabis sales ($1.1 billion and $1.3 billion), the company still faces considerable hurdles in other vital markets like New York, with regulated sales remaining a fraction of projections.

The projected $4.2 billion annual revenue for New York’s cannabis industry contrasts sharply with the $260 million attained in H1 2024, marking the difficulty in scaling operations in certain regions. This discrepancy suggests that IIPR may not fully capitalize on opportunities in major markets due to reliance on state-by-state legislative changes that are compounded by federal indecision.

Additionally, the regulatory delays have direct implications for IIPR’s tenants. Cannabis operators are already facing issues with limited access to capital due to federal restrictions. The slow progress in legislation further intensifies this problem. For instance, the regulated cannabis cultivation and retail operators had a 40% drop in capital raises in YTD 2024 (July 19) against the 2023 period.

Finally, the declining level of M&A activity in the cannabis industry also shrinks IIPR’s fundamental capability to grow through new acquisitions and tenant relationships. YTD 2024 (July 19), the number of M&A transactions in the regulated cannabis sector has declined by 37%, Whereas the total dollar amount of such transactions has plummeted by 66% over the duration. This decline in M&A activity reflects broader adversities in the cannabis sector. As cannabis companies struggle to grow or consolidate, IIPR faces a shrinking pool of stable, creditworthy tenants, limiting growth prospects.

Takeaway

While IIPR does entail some risk factors, such as tenant concentration and a constantly changing regulatory environment, the company’s portfolio, along with its long-term leases and high-quality tenants, is sound and stable. Further legalization by states amidst growing momentum within the cannabis industry should continue to place IIPR in a good position for new opportunities. Diversification and close management of tenant relationships will be vital in maintaining its strong performance and navigating industry challenges for continued growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.