Summary:

- IIPR’s share have traded down since our last report, but we remain bearish due to its stretched valuation, which values the portfolio at a premium to higher qualty industrial REITs.

- While tenant credit quality has improved significantly, the SAFER Banking Act poses a risk to IIPR’s business model and premium valuation.

- We maintain our Sell rating for the common shares, but upgrade the preferred shares to a Hold on valuation and falling rates.

Morsa Images

Summary

We’ve been bearish on Innovative Industrial Properties (NYSE:IIPR) since our initial report in March. We find both the common and preferred shares overvalued and have had concerns about its tenants’ credit profiles. Our most recent report covered the DEA’s rescheduling of marijuana to Schedule III (from I). We concluded that, while potentially positive for cannabis producers (i.e., IIPR’s tenants) on the margin, the reclassification was not a sufficiently powerful catalyst to change our mind, and the stock’s rally in response to the news further stretched the valuation. For some time, it appeared the market disagreed with us as the share price reached a 1 year high of ~$136/share, ~27% higher than where we reiterated our Sell rating in May. However, the shares have since reversed all of those gains and are sitting ~13% below where we reiterated our Sell rating.

We have refreshed our views for the recent quarterly results. While the creditworthiness of the tenant base has improved markedly, with ~50% of tenants (by ABR) now FCF positive on an LTM basis (vs ~14% in our previous reports), we still see the risks posed by an easing regulatory environment (e.g., the SAFER Banking Act) and valuation as enough to maintain our rating.

Tenant Creditworthiness Improves

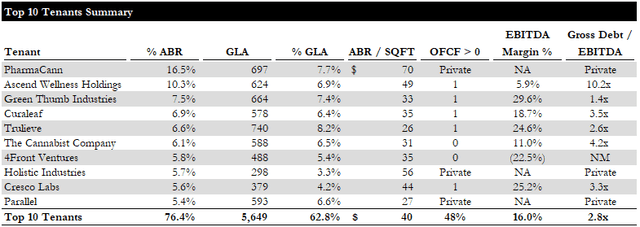

The table below shows IIPR’s top 10 tenants. These tenants represent ~76% of annualized base rent (“ABR”) and ~63% of the portfolio’s square footage. Three are private companies, meaning we cannot assess their financial profile; however, the remaining seven are public. Previously, only one of these companies was generating positive operating FCF. Now, five of the seven are FCF positive, and their weighted average leverage has decreased to ~2.8x from ~5.8x.

Top Tenants Summary (Empyrean; IIPR)

While we now feel much more comfortable with the tenant base, the cannabis production business is still fundamentally a highly competitive, thin-margin commodity business. For this reason, we still see IIPR’s portfolio/end market as intrinsically less attractive than the high-quality, traditional industrial REITs we will mention later.

Risk: SAFER Banking Act

With tenant credit quality no longer at the top of our minds, we can focus on a much higher magnitude medium-term risk: the SAFER Banking Act. Here is what we wrote about SAFER in our last article:

The SAFER Banking Act, pending in Congress, threatens IIPR’s business model and premium valuation. Even after marijuana’s reclassification to Schedule III, producers will not be able to access the mainstream banking system. The inability of growers to access traditional banking products, particularly loans/mortgages, has enabled IIPR to extract highly favorable lease terms. Again, from the AP:

“A Congressional Research Service report last year said about 675 financial institutions — a fraction of the banking industry — are doing business with cannabis companies.” (AP)

IIPR is essentially running a marijuana bank dressed up like an industrial REIT, in our opinion. It conducts sale-leaseback (“SLB”) transactions (a type of financing) with marijuana companies, pays the upfront tenant improvements/construction costs, and structures leases with extremely high lease rates. It can do this only because these companies cannot access traditional financing/capital sources, which would come at a much lower cost.

Should this Act, or another with the same goal, come into law, there would be an influx of capital into the space, driving prices (i.e., the cost of capital) down dramatically. This doesn’t mean that IIPR’s business would fully unravel, but it would significantly reduce its economic earnings and likely crush its valuation premium relative to the broader real estate space.

The Act has passed the House and is now before the Senate. With this milestone passed, we see this as the number one risk to watch for IIPR.

Valuation

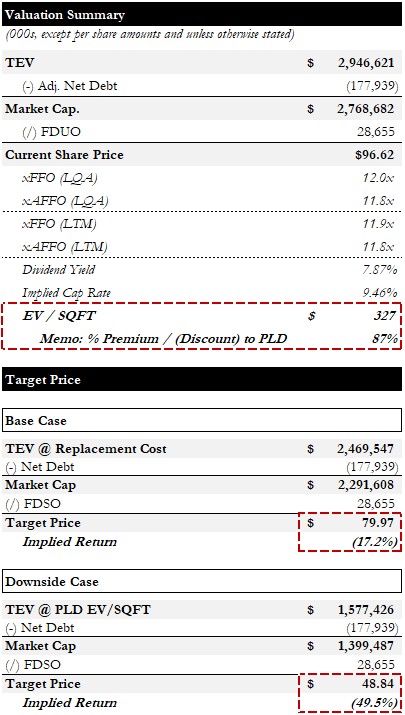

IIPR trades for ~12x FFO and AFFO, with a dividend yield of ~7.9% and an implied cap rate of ~9.5%. It is down ~12% from our last report and ~2% from our initial report.

Our Base Case target price is based on the portfolio’s replacement cost using the current invested/committed capital as a proxy. We believe this is the appropriate value for the company if it can no longer extract the “legal grey-zone premium” from tenants, and it implies a ~17% downside to the current price. IIPR’s cost basis is appropriate given the relatively young age of the portfolio. While our Base Case may be a bit too pessimistic, considering construction costs have increased since the time the properties were developed, we find it a useful case to anchor to. We also cannot quantify an appropriate risk premium for the tenant quality issues and prefer to be conservative in our valuation to account for this.

Valuation Summary (Empyrean)

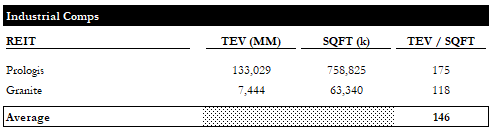

Our Downside Case price target values the company at Prologis’ (PLD) EV/SQFT multiple. PLD’s portfolio is superior to IIPR’s in many ways: (1) its tenants are among the most creditworthy in the world (e.g., Amazon, FedEx, Home Depot, etc.), (2) its buildings are located in prime markets and can be used by tenants in many different industries, and (3) it has built-in rent growth potential due to below-market lease rates. On the other hand, IIPR’s assets are single-purpose (growing marijuana, perhaps generic agriculture), and its tenants are on shaky footing. Despite this, IIPR trades at an EV/SQFT that is +80% higher than PLD. If IIPR were to trade in line with PLD on this metric, its shares would decline ~50%. This case would be even worse if we used the EV/SQFT of other smaller, lower-quality industrial REITs (e.g., Granite, see below).

TEV/SQFT Comps (Empyrean; CapIQ; Company Reports)

Preferred Stock

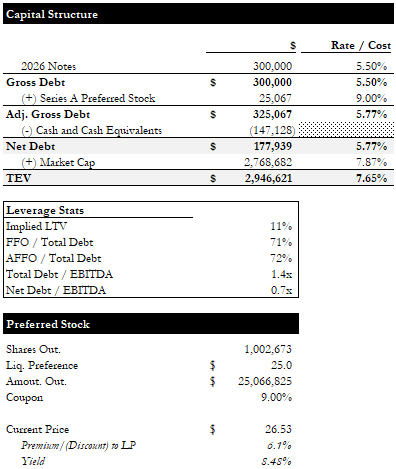

We had also been bearish on IIPR’s 9.0% preferred stock. We are upgrading the preferred stock to a Hold, considering the price has come down by ~$2/share / ~7% since March, pushing the yield to ~8.5% at a time when the Fed has begun cutting rates. Additionally, thanks to IIPR’s conservative balance sheet, its net debt balance (including the preferred stock) is ~14x covered by the portfolio’s cost.

Capital Structure (Empyrean; IIPR)

While we may have upgraded this to a Buy if we were primarily concerned with yield, we generally need to see some potential for capital appreciation to give a Buy rating. While rate cuts may drive a higher premium for the preferred, this is speculative and could be complicated by any bearish catalysts we identified for the common.

Conclusion

2024 has undoubtedly been a big year for the cannabis industry, with several historic developments (i.e., DEA reclassification, SAFER Banking Act). Despite these positive developments, we remain bearish on IIPR. The potential impact of the SAFER Banking Act, which threatens to give cannabis companies access to the mainstream banking system and would essentially destroy IIPR’s business model of charging producers exorbitant rents to finance their production sites, weighs heavily on our sentiment. The stock also continues to trade at a significant premium to traditional industrial real estate REITs. We maintain our Sell rating and upgrade the preferred to a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.