Summary:

- Innovative Industrial Properties, Inc. is a speculative REIT in the cannabis space, recently becoming more attractive due to a price correction.

- IIPR faces risks from regulatory challenges and tenant concentration but offers a high dividend yield of over 7%.

- Despite recent earnings misses, IIPR’s AFFO payout ratio remains stable, and potential dividend increases going forward are still possible.

PM Images

Written by Nick Ackerman.

Innovative Industrial Properties, Inc. (NYSE:IIPR) is a more speculative real estate investment trust (“REIT”) focused on the regulated cannabis industry. With a swift correction in its share price more recently, it has become an interesting prospect for investors comfortable investing in the cannabis space.

They released their earnings recently, and they missed on both the top and bottom lines. FFO came in at $2.02, missing by a penny, while revenue came in at $76.53 million, which was a miss of less than a million. AFFO came in at $2.25, which was down around 1.7% from last year’s $2.29 AFFO.

However, they’ve been facing even more pressure than just softer-than-expected earnings.

The market had surged higher after the election, and REITs were heading the other way. This was after not only the broader market equities were heading higher, but also Treasury Rates were seen higher as well as investors sold them off. With higher risk-free rates, it can make REITs, which are typically income-oriented investors, become less attractive. With IIPR’s dividend yield pushing around 7.2% these days, I would categorize it as a high-yield-oriented investment.

For IIPR, this election cycle also brought further worse news in terms of recreational cannabis being legalized. There were three states, Florida, South Dakota and North Dakota, that shot down the efforts to legalize. That left the number of U.S. states at 24 that have legalized recreational marijuana and another 7 states that have decriminalized its use.

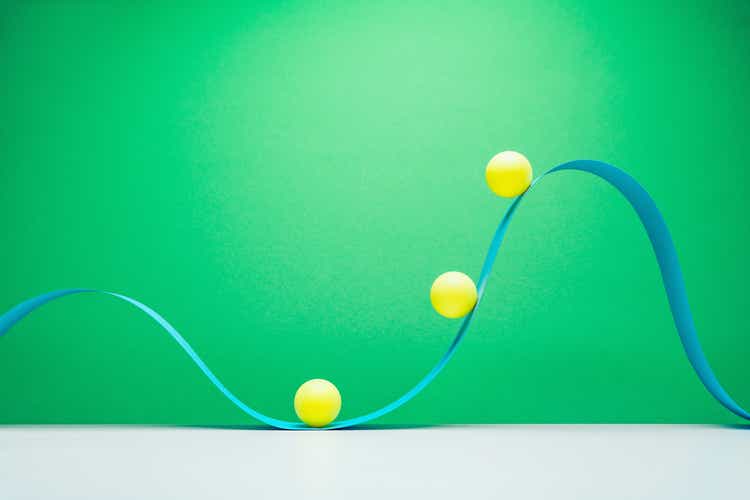

With that, the share price of IIPR fell much more sharply relative to the more orderly declines we saw from the real estate space as measured by the Real Estate Select Sector SPDR (XLRE). In fact, over the last month, XLRE has basically only moved to a flat price return level, with IIPR dropping almost 20%.

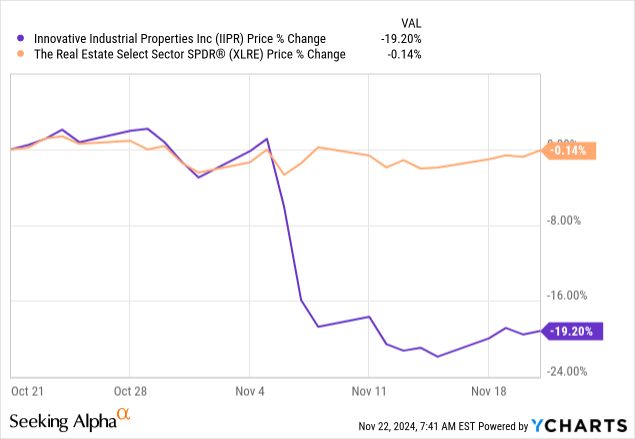

That said, on a YTD total return share price basis, we are seeing that IIPR has still held on to some otherwise decent gains. Real estate was starting to have an otherwise fairly strong recovery after seeing several years of pressure due to higher rates. This recovery was coming on the back of the expectation for Fed rate cuts, which we’ve got, but the Fed can’t control the long end, which has been trending higher once again.

A Look At The Tenants

While legalization could be considered a threat to IIPR due to the potential wider adoption, having more competition in the REIT space as access to capital could allow more players—the other side of this is it could strengthen the underlying tenants as they’ll have more access to capital. That could help these operations grow and stabilize their cash flows. That, in turn, could mean fewer questions about being able to keep up with rent payments.

In general, IIPR has been operating quite well and was initially growing quite rapidly. However, it is always the forward-looking expectations that drive the actual share price. In general, IIPR is considered riskier due to not only the specialized space they operate in, but also to operating a fairly tight number of facilities.

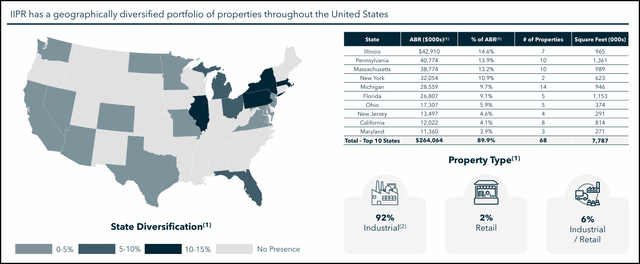

In total, they own 108 total properties—they are spread across the U.S. in 19 different states. So, geographically, they could be considered diversified, but overall, each property is a fairly large part of their operations.

The most concentrated locations are in Illinois, Pennsylvania, and Massachusetts. Overall, the top 10 states account for ~90% of the REIT’s annualized base rent.

IIPR Geographic Breakdown (Innovative Industrial Properties)

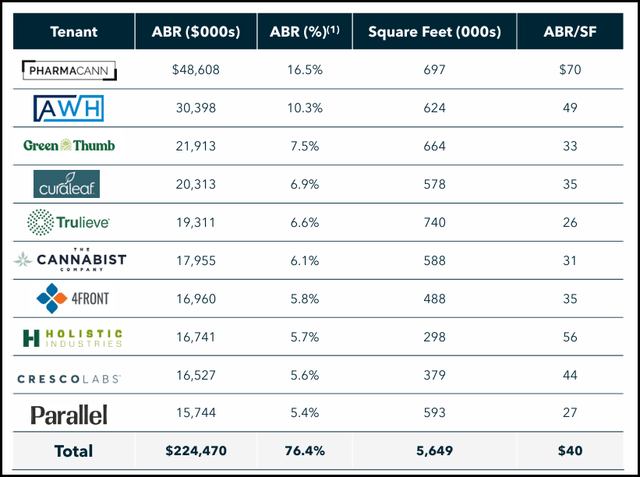

In looking more specifically at the tenant base, they have 30 tenants, but once again, it is skewed toward more concentration on the top of the list. The top ten account for 76.4% of annualized base rent, or ABR, with the top two alone responsible for nearly 27% of the ABR.

IIPR Top Tenants (Innovative Industrial Properties)

They were growing fairly quickly initially but have stalled over the last several years now. They listed 29 tenants in 2022, 30 in 2023, and the same 30 as we near the end of 2024.

Dividend and Forward Estimates

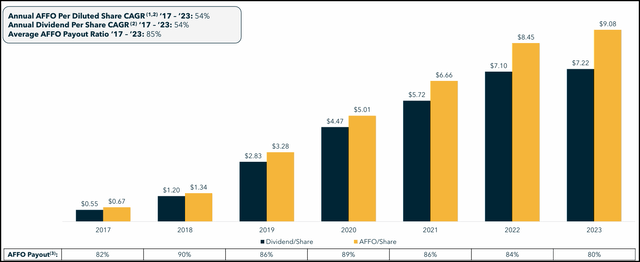

That initial rapid growth translated into AFFO growth and a rising dividend for shareholders. The AFFO payout ratio has remained relatively stable within the 80 to 90% range. It actually came in at the low end during 2023, when they stopped raising their payout so quickly. Which was for good reason, to protect their balance sheet and operations as growth started to taper off.

IIPR AFFO and Dividend Payout Ratio (Innovative Industrial Properties)

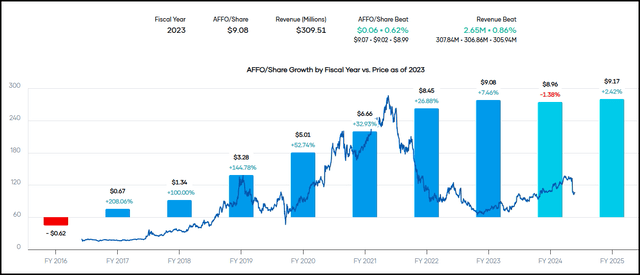

That said, they did increase the dividend earlier this year in 2024, lifting it to $1.90 from the $1.82 level. Against the latest AFFO, that would work out to the payout ratio pushing to 84.4%. Looking forward, AFFO is expected to be about flat to down slightly this year before seeing a slight lift heading into 2025.

Assuming they maintain the same dividend going forward, annualizing out to $7.60, and can hit those 2025 estimates—that would be putting the payout ratio for 2025 back down a touch to an ~83% level.

IIPR AFFO History and Estimates (Portfolio Insight)

However, if history is a guide, they would likely feel comfortable increasing their dividend sometime next year. I believe the AFFO numbers, if hit, would support it as it would still be well within the AFFO payout range we’ve seen from them. Given the 7.19% dividend yield that IIPR has fallen to more recently, that’s an interesting place to be in as a potential high-yield dividend growth opportunity.

Interest Rate Cuts Have Little Benefit

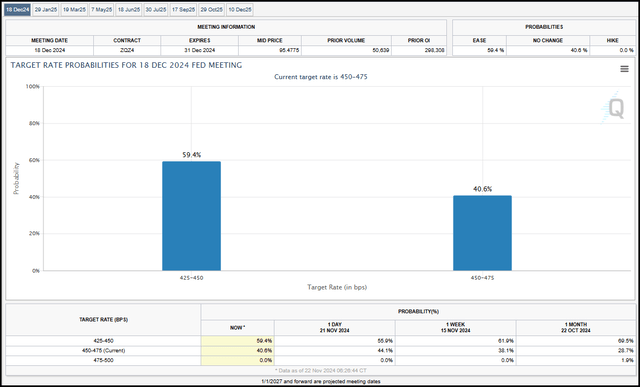

As we noted, the Fed has been cutting its benchmark rate. The initial aggressive 50 basis point cut in September and then followed up by November’s 25 basis point cut. The market is pricing in another 25 bp cut for December, with the probability at just over 59%. Initially, that was what the Fed was projecting themselves as well.

That said, the Fed wasn’t willing to provide any sort of guidance one way or another. It will depend on the data as it comes in over the next month or so. The chance of a cut in December has also come down quite significantly over the last month.

CME Fed Watch Tool (CME Group)

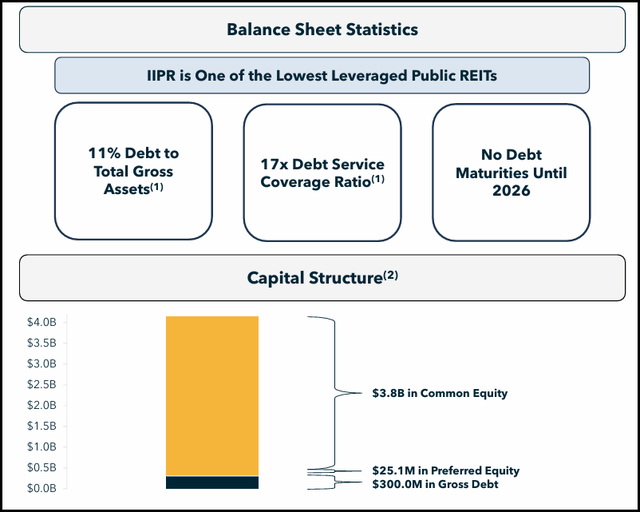

With that said, one other benefit that REITs would be seeing more recently with the Fed reducing rates is the potential for easing borrowing costs. That isn’t necessarily a direct benefit for IIPR as they operate with very little leverage overall.

The indirect benefit would be that the longer-term risk-free rates generally have a loose correlation with the Fed rate. However, with the Fed cutting and the United States 10-Year Bond Yield (US10Y) rising, that hasn’t been the case in the shorter term. What it has done is uninverted the yield curve, which isn’t a negative, but it just isn’t a benefit to IIPR.

With IIPR, they have 2026 notes worth $300 million where they are paying 5.5%. They noted that they have a credit facility of $50 million that remains undrawn.

IIPR Balance Sheet Quick Facts (Innovative Industrial Properties)

Conclusion

Innovative Industrial Properties, Inc. is a more speculative REIT that could be worth some attention lately as a potential add candidate to an investor’s portfolio based on the latest correction. However, the REIT is still up strongly from where it was and there are some real risks to be aware of here. This isn’t a highly leveraged REIT like some are, but it carries underlying tenant risk as it operates in more of a gray zone as an industrial REIT focused on cannabis. With that, they are more at the whims of regulatory overhangs with a rather concentrated portfolio rather than the albatross of debt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.