Summary:

- Innovative Industrial Properties operates as a REIT catering to the cannabis market.

- Recent evidence of a slowdown in growth prompts a downgrade from ‘buy’ to ‘hold’.

- Despite stable cannabis prices and positive industry outlook, recent financial performance has been lackluster.

Morsa Images

Back in 2020, one company that I was fairly bullish about was Innovative Industrial Properties (NYSE:IIPR). For those not familiar with the business, it operates as a REIT that caters to the cannabis market. During its first few years in operation, the company achieved remarkable growth, both on its top line and on its bottom line. Recently, however, there has been evidence of a slowdown. To be clear, the long term outlook for legal cannabis consumption in the US is most certainly positive. And that should bode well for the company. In addition to this, of its major publicly traded tenants, financial performance has been improving as of late. But based on how shares are priced and the recent slowdown in expansion, I think that now is a good time to downgrade the company from the ‘buy’ I had it rated to a ‘hold’.

For the purpose of providing full transparency, my history with the company from a ratings perspective has been fairly successful. Even though shares are up only 57.5% since I last wrote about it in July of 2020, a return that falls short of the 77.3% move higher seen by the broader market, the picture looks different from when I first rated it a ‘buy’ in March of 2019. From that time through today, the stock has more than doubled, jumping 111.4%. That is marginally higher than the 100.5% move seen by the S&P 500 over the same timeframe.

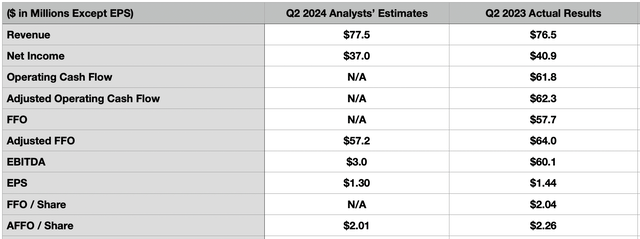

The picture could always change, and the best time for that to occur would be when financial results come out for the latest quarter. On August 5th, after the market closes, management is expected to come out with results for the second quarter of the company’s 2024 fiscal year. It would be wise for investors to understand what the expectations are and how those compare to prior year’s results.

Time for a downgrade

As I mentioned at the start of this article, Innovative Industrial Properties is a publicly traded REIT dedicated to servicing the cannabis market. Given some of the troubles the industry has faced (namely overinvestment) and with the push to grow rapidly while that overinvestment was occurring, the ability to engage in sale leaseback transactions became a very powerful tool of the cannabis industry. A sale leaseback is where a company that owns an asset sells that asset to another party in exchange for a chunk of cash. They then lease that asset back, often for several years, so that they can continue to use the asset in question.

While Innovative Industrial Properties has made third party acquisitions before, it has also been very active in the sale leaseback market. These leases are set up as triple-net leases. This means that the tenant that leases them is responsible for essentially all costs, including structural repairs, other maintenance, real estate taxes, insurance, and more. Of the properties that it has, most of the emphasis has been on the industrial side. These are assets that focus mostly on cannabis cultivation, processing, distribution, and more. In total, 92% of its properties fall under this category. However, another 2% of these assets are retail only, while the remaining 6% are a combination of the two.

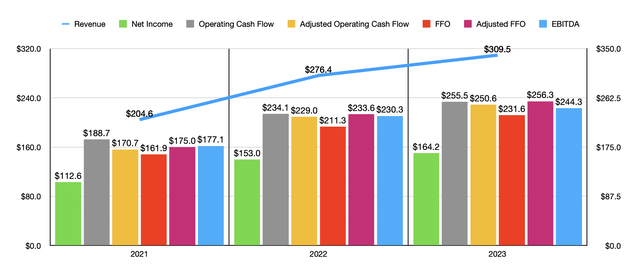

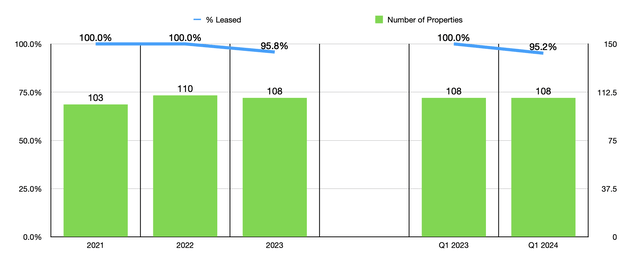

Tapping into this need for capital, Innovative Industrial Properties has achieved really attractive growth in recent years. From 2021 through 2023, revenue jumped from $204.6 million to $309.5 million. Part of this is because of an increase in the number of properties from 103 to 108, with the total square footage rent it out climbing from 7.7 million to 8.9 million. It is worth noting that there was a decline in occupancy. Usually, 100% of these properties are leased out. But after 2022, this number fell to 95.8%.

With revenue rising, profits and cash flows also expanded. Net income went from $112.6 million to $164.2 million. Operating cash flow expanded from $188.7 million to $255.5 million. If we adjust for changes in working capital, we would get an increase from $170.7 million to $250.6 million. Of course, there are other profitability metrics that we need to be paying attention to. FFO, or funds from operations, is one such example. This increased from $161.9 million to $231.6 million, while the adjusted figure for it grew from $175 million to $256.5 million. And finally, EBITDA for the company jumped from $177.1 million to $244.3 million.

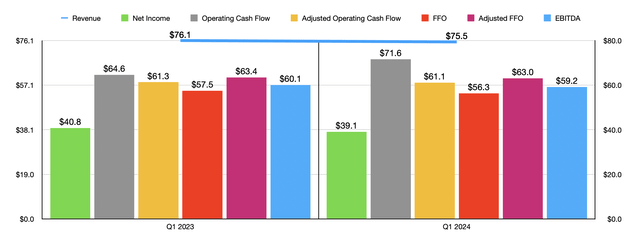

As great as this growth was, there has been some weakness as of late. In the first quarter of 2024, for instance, revenue for the company came in at $75.5 million. That’s actually down from the $76.1 million reported one year earlier. This decline was driven by a couple of factors. For starters, the company was hit by a $5.6 million drop in contractual rent and property management fees in the first quarter of this year because of properties that it took back possession of subsequent to the end of the first quarter of 2023. In addition to this, the firm saw a $1.3 million decline associated with two leases that it reclassified as sales type leases effective this year. Things would have been worse had it not been for a $6 million increase in contractual rent and property management fees because of improvement allowances and other factors.

With the drop in revenue also came a decline in profitability. Net income pulled back slightly from $40.8 million to $39.1 million. Other profitability metrics were mixed, but largely negative. It is true that operating cash flow grew from $64.6 million to $71.6 million. But on an adjusted basis, it was trimmed slightly from $61.3 million to $61.1 million. In the chart above, you can see other profitability metrics for the firm, with notable declines across FFO, adjusted FFO, and EBITDA.

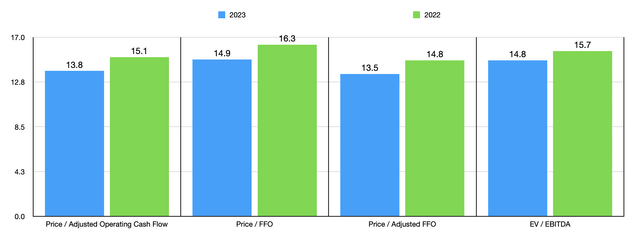

We don’t really know what to expect for the rest of this fiscal year. But even if we take results from 2022 and 2023, shares don’t look all that bad. In the chart above, you can see how I valued the enterprise against four different metrics. As part of my analysis, I then, in the table below, compared Innovative Industrial Properties to five other specialty REITs. I did this using two of the most important profitability metrics. And with two of the five firms trading cheaper than it in both cases, Innovative Industrial Properties is neither cheap nor expensive on a relative basis.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Innovative Industrial Properties | 13.8 | 14.8 |

| LXP Industrial Trust (LXP) | 13.9 | 55.6 |

| Plymouth Industrial REIT (PLYM) | 13.3 | 12.8 |

| NewLake Capital partners (OTCQX:NLCP) | 9.4 | 9.1 |

| Terreno Realty Corporation (TRNO) | 30.2 | 25.2 |

| Industrial Logistics Properties Trust (ILPT) | 23.6 | 15.4 |

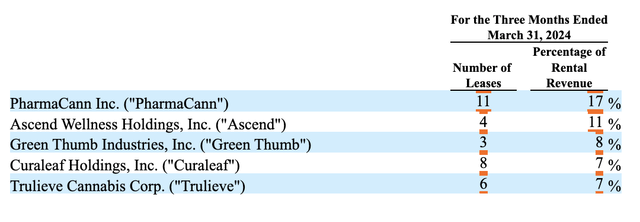

Even though the decline in revenue was largely the result of items that should be considered one time in nature, this doesn’t change the fact that, even at a minimum, the company is no longer growing at a rapid pace. This prompted me to work into some of the company’s largest tenants in order to see how they are performing. In the image below, you can see it’s five largest tenants. Four of these are publicly traded companies. So access to their data is easy to obtain.

Innovative Industrial Properties

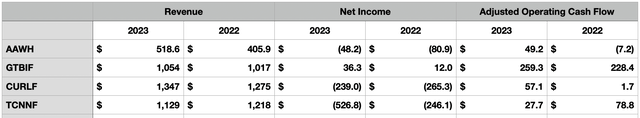

In all, the four publicly traded firms that sit in the top five largest tenants account for 21 of the company’s properties and for 33% of its annualized base rent. This makes them, collectively, significant to the business and its investors. In the table below, I decided to look at year over year changes in revenue, net profits, and adjusted operating cash flow, for each of these four firms. As you can see, three of the four businesses are still generating net losses. But all of them are now generating positive cash flows. In addition to this, three of the four saw year over year improvements in revenue, so that means that they are growing.

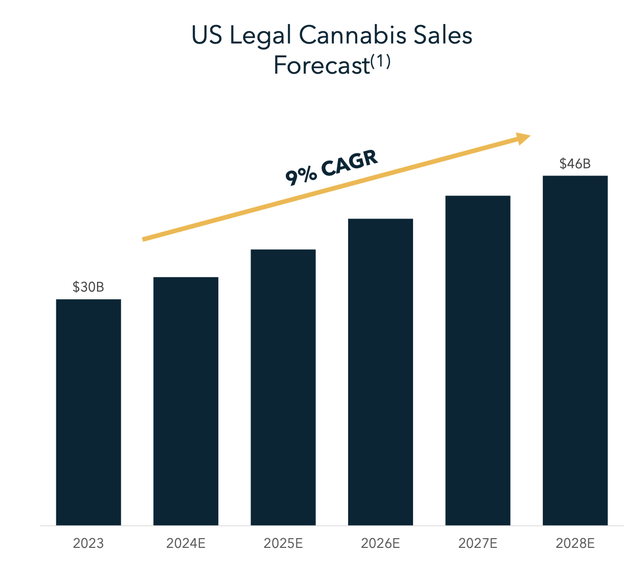

Even though the cannabis industry has faced problems in the past, it is worth noting that, at least for now, prices are pretty stable. For the last year, they have largely ranged between around $1,000 and $1,100 per pound on the spot market. In fact, on July 12th of this year, prices were approximately $1,003 per pound. That’s up from the $977 per pound reported one year earlier. Also, forecasts for this space suggest that there should be some pretty good growth over the next few years. Already, 68% of the US population lives in a state where Innovative Industrial Properties has a physical presence. General market growth, combined with continued legalization, is also expected to push The US legal cannabis market up to $46 billion by the year 2028. That’s up from $30 billion last year, which translates to a roughly 9% annualized growth rate.

Innovative Industrial Properties

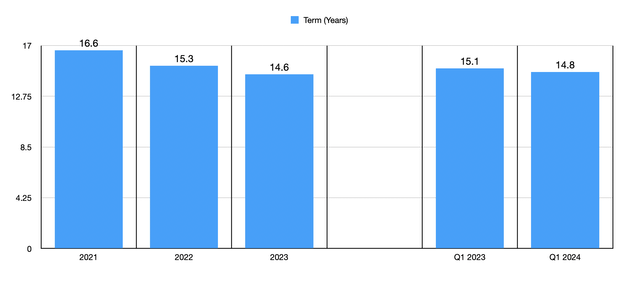

This is not to say that everything is great for the firm. As I pointed out already, the business started off this year on a bit of a rough note. In addition to this, there has been a bit of a concerning trend recently when it comes to the leases that it has control over. Back in 2021, the weighted average lease term remaining for the business was 16.6 years. That number dropped to 14.6 years by the end of last year. From the first quarter of 2023 to the first quarter of this year, the decline was from 15.1 years to 14.8 years. This is still a long time for the company to benefit from. But in an ideal world, you would want to see these lease contracts extending out as long as possible.

One of the most important traits that investors can have is flexibility in thinking. When new data comes out, it’s important that we reassess our positions accordingly. The good news is that, after the market closes on August 5th, management is expected to announce financial results covering the second quarter of the company’s 2024 fiscal year. Analysts expect revenue to rise slightly, rising from $76.5 million to $77.5 million. However, from a profitability perspective, the expectation is for some continued weakening. Earnings per share are forecasted to be around $1.30, translating to net income of $37 million. That would compare to $1.44, or $40.9 million, reported for the second quarter of 2023. Meanwhile, adjusted FFO per share should come in somewhere around $2.01. That would be a decline from the $2.26 per share reported the same time last year, and would translate to a drop in adjusted FFO from $62.3 million to $57.2 million. In the table below, you can also see other important profitability metrics that investors should be paying close attention to for when results do come out.

Takeaway

All things considered, Innovative Industrial Properties is a most interesting business that deserves the attention of investors. In the past, I have been bullish about the firm. But recently, financial performance has been a bit lackluster. Even when I wrote about the business previously, I said that it was a good play on high growth. But I don’t see that growth today. I wouldn’t say that shares are expensive by any means. And it is likely that revenue, profits, and cash flows, will continue to grow in the long run. But with how the stock is priced, I would say that a more neutral stance on the business is appropriate at this time. Because of this, I have decided to downgrade the firm to a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!