Innovative Industrial Properties: We’re Not Ready To Reclassify

Summary:

- We initiated IIPR at a Sell due to concerns over tenants’ credit profiles and stretched valuation.

- The recent DEA announcement to reschedule marijuana to Schedule III has caused short-lived rallies for producers but more stable gains for IIPR.

- The SAFER Banking Act poses a risk to IIPR’s business model and premium valuation, as it could allow producers to access mainstream banking and reduce IIPR’s economic earnings.

- Valuation remains highly stretched and we maintain our Sell rating.

Jordan Siemens/DigitalVision via Getty Images

Summary

Our initial report on Innovative Industrial Properties (NYSE:IIPR) gave a Sell rating to the common and preferred shares on concerns over its tenants’ credit profiles and the stretched valuation relative to the portfolio’s replacement cost and tier 1 industrial peers. The recent announcement of the DEA’s intention to reschedule marijuana to Schedule III (from I) has caused major moves across marijuana names. These moves have been largely short-lived for producers but have been milder and more stable for IIPR. The improvement in tenant profitability as a result of the DEA’s move eased some of our bearish concerns. However, the stock’s rally has further stretched valuation, so we maintain our Sell rating.

DEA Rescheduling

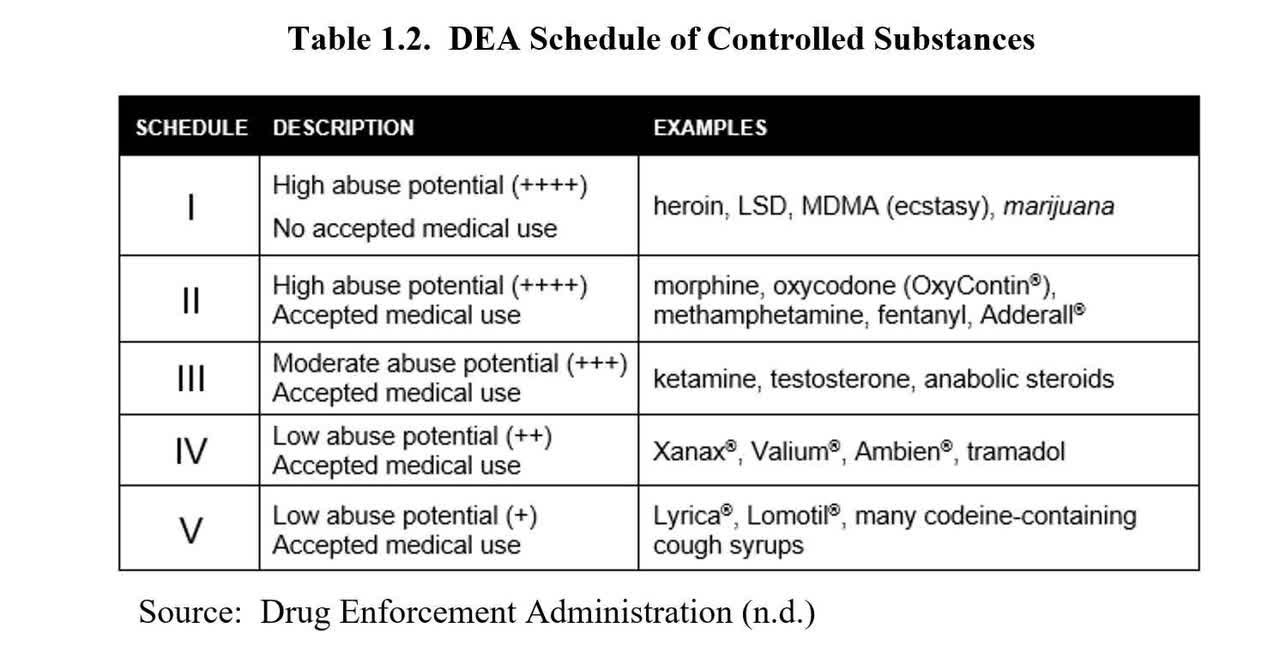

On April 30, it was announced that the DEA will be rescheduling marijuana from Schedule I to Schedule III. While the drug will remain illegal, the move is a major (and long overdue) recognition of its lower risk potential and legitimate medical value.

DEA Drug Schedule (WSU)

This historic move caused an immediate, albeit short-lived rally for producers’ shares (i.e., IIPR’s tenants) and modest but longer-lived strength for IIPR.

Despite the fact that the rescheduling does not address producers’ challenges with accessing the mainstream banking system, it does bring positive implications for IIPR. The company, as a provider of triple-net (‘NNN ‘) finance, benefits from the capital supply/demand imbalance. As reported by the AP:

The Biden administration’s move to reclassify cannabis as a less dangerous but still controlled drug was hailed as a monumental step in reshaping national policy. But it might do little to ease a longstanding problem in the cannabis industry — a lack of loans, chequing accounts and banking services that other businesses take for granted.

“As far as financial institutions, I don’t necessarily think it’s going to have a demonstrable effect” on how they deal with cannabis operators, said Morgan Fox, political director for the National Organization for the Reform of Marijuana Laws, or NORML.

Similarly, a banking trade group expected no shift in the legal landscape with the proposed change. (AP)

However, the move will enable producers to claim tax deductions for their expenses, significantly reducing their tax burden. This is clearly a positive for IIPR’s tenant quality.

Risk: SAFER Banking Act

The SAFER Banking Act, pending in Congress, threatens IIPR’s business model and premium valuation. Even after marijuana’s reclassification to Schedule III, producers will not be able to access the mainstream banking system. The inability of growers to access traditional banking products, particularly loans/mortgages, has enabled IIPR to extract highly favorable lease terms. Again, from the AP:

A Congressional Research Service report last year said about 675 financial institutions — a fraction of the banking industry — are doing business with cannabis companies. (AP)

IIPR is essentially running a marijuana bank dressed up like an industrial REIT, in our opinion. It conducts sale-leaseback (“SLB”) transactions (a type of financing) with marijuana companies, pays the upfront tenant improvements/construction costs, and structures leases with extremely high lease rates. It can do this only because these companies cannot access traditional financing/capital sources, which would come at a much lower cost.

Should this Act, or another with the same goal, come into law, there would be an influx of capital into the space, driving prices (i.e., the cost of capital) down dramatically. This doesn’t mean that IIPR’s business would fully unravel, but it would significantly reduce its economic earnings and likely crush its valuation premium relative to the broader real estate space.

Valuation

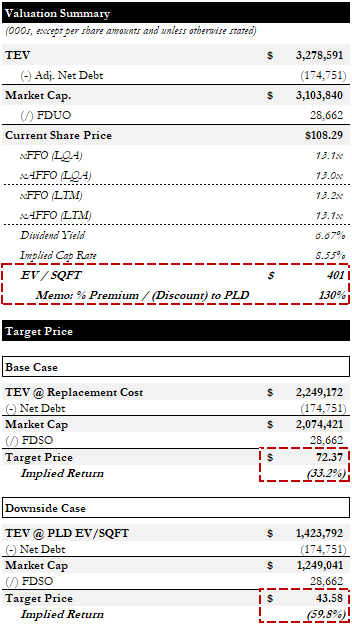

IIPR is trading for ~13x FFO and AFFO with a dividend yield of ~6.7% and an implied cap rate of ~8.6%.

Valuation Summary (Empyrean)

Our base target price is based on an estimate of the portfolio’s replacement cost using the current invested/committed capital balance as a proxy. Theoretically, this is where the shares should be valued if it could no longer extract a “legal grey-zone premium” from tenants, and implies ~33% downside. This is likely a bit too bearish, as construction costs have risen since some of the company’s earlier investments should have been made (i.e., true replacement cost should be higher), and many REITs trade at premiums to replacement cost. However, we find it a useful case to anchor to.

We derive our downside target price by assuming an EV/SQFT multiple equivalent to Prologis’ (PLD). One could argue very well that PLD’s portfolio is vastly superior in many ways. Its tenants are among the most creditworthy in the world (e.g., Amazon, FedEx, Home Depot, etc.), its buildings are located in prime markets and can be used by tenants in many different industries, and it has built-in rent growth potential due to below-market leases. On the other hand, IIPR’s assets are single-purpose (growing marijuana, perhaps generic agriculture), and its tenants are on shaky footing (refer to our original report linked above). This case implies ~60% downside risk.

Both cases implicitly assume that the banking regulations change and that capital supply/demand balances out. Nobody knows if or when this will happen, so we are not expecting an imminent share price collapse. Rather, we see this as a risk not adequately priced in.

Conclusion

Despite the recent positive news for the marijuana industry, we remain cold on IIPR. The DEA’s rescheduling addresses some of our concerns about tenant quality; however, the market’s reaction has driven valuation to an even more unpalatable level. The potential for new legislation to open up mainstream banking to marijuana companies presents a major bearish catalyst to our share price targets. We maintain our Sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.