Summary:

- Innovative Industrial Properties is a specialty REIT focused on the regulated cannabis industry, primarily owning industrial-scale greenhouses used for cannabis cultivation.

- The stock has seen a massive correction over the past 2 years due to concerns about tenant quality and valuation.

- EV per sqf is ~70% higher than Prologis, despite lower asset quality, and is ~30% higher than replacement cost.

Marco VDM

Summary

Innovative Industrial Properties (NYSE:IIPR) is a specialty REIT focused on the nascent regulated cannabis industry. Its name notwithstanding, IIPR is not a typical industrial REIT. Rather than logistics or distribution facilities, its portfolio consists mainly of industrial-scale greenhouses licensed operators use to grow cannabis. The business exists due to federal laws that prevent cannabis companies from accessing capital the way other corporations do. IIPR’s bread and butter growth strategy is to execute sale-leaseback transactions with cannabis companies, front the tenant improvements, and charge exceptionally high rents. The lack of traditional sources of institutional capital enables cannabis REITs, such as IIPR, to negotiate very landlord-friendly lease terms.

IIPR’s stock performed exceptionally well from 2018 to late 2021, rising from ~$20/share to a peak of ~$275/share. The era of easy money and a wave of positive developments on the cannabis legalization front enabled significant growth. Since then, financial conditions have tightened, and concerns about the financial sustainability of its tenants have driven a massive correction, with the shares now trading for ~$96.

While many investors appear to be tempted by the attractive ~7.5% yield on the common (and ~8.4% yield on the preferred) and exceptionally conservative balance sheet, we see several key risks that will keep us on the sidelines. We are rating IIPR and IIPR.PR.A as a Sell.

Company Overview

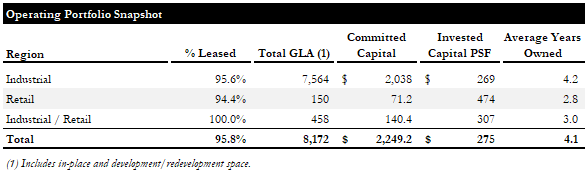

Over 90% of IIPR’s portfolio is considered “Industrial”. These properties consist of industrial-grade cannabis cultivation facilities (think high-tech greenhouses). It also owns a small number of retail and mixed industrial/retail properties. The Company has invested or committed ~$2.25Bn in the acquisition and construction of its portfolio, or ~$275 psf.

Portfolio Snapshot (Empyrean; IIPR)

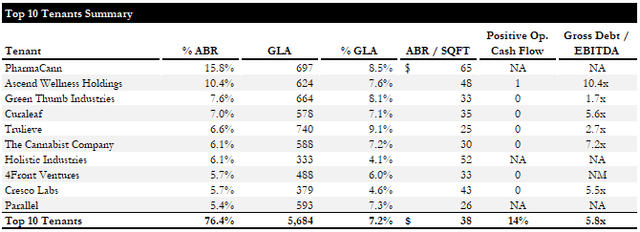

Its top 10 tenants represent ~76% of annualized base rent (“ABR”), a relatively high degree of tenant concentration, especially considering the tenants’ poor credit profile. Seven of the top 10 are public companies listed on minor exchanges, and none of the top tenants are rated. By ABR, only ~14% have posted positive operating cash flow in the LTM despite having an average ~6x total leverage ratio.

Tenant Summary (Empyrean; IIPR)

Despite historically strong rent collections, we see the concentration and poor credit profile of IIPR’s tenants as significant risks. We only have to look to Power REIT (PW) as a cautionary tale of what can happen to a cannabis REIT when tenants can’t pay.

Power REIT Share Price (Empyrean; IIPR)

Although PW took on more debt than IIPR currently carries, it is important to understand just how bad things can go in this burgeoning sector.

Recent Performance

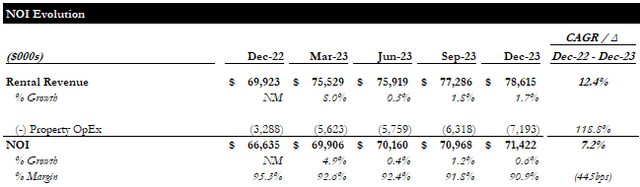

Financially, IIPR has performed quite well, considering the issues noted above. Rental revenue has grown ~12% and NOI has grown ~7%. While the NOI growth is solid, we want to call attention to the consistent margin compression we’ve seen over the last several quarters. While management described this as a timing issue (i.e., tax and insurance inflation exceeding tenant reimbursements in the period) on the Q4 call, this could become a quasi-working capital drag if inflationary pressures persist.

NOI Evolution (Empyrean; IIPR)

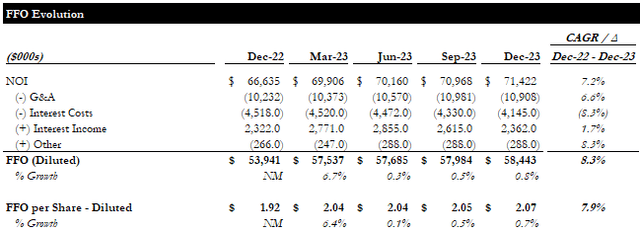

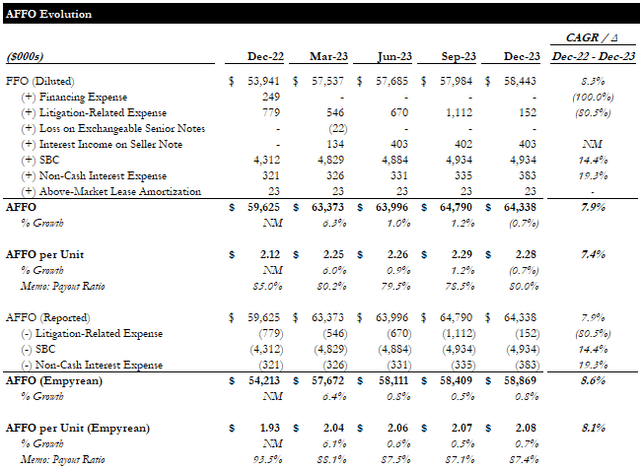

Diluted FFO grew 8.3%, or 7.9% on a per share basis. We note that IIPR’s low leverage profile has enabled it to avoid the interest drag we are seeing in most other REITs.

FFO Evolution (Empyrean; IIPR)

AFFO grew at a similar pace and has been higher than FFO. This is due to many addbacks that we do not accept (e.g., litigation expense, stock-based comp, and non-cash interest expense) and the absence of any capex deductions due to the triple-net structure of its leases. After removing these adjustments, we derive an AFFO per share that is ~$0.2/share lower than the reported figure, which implies a payout ratio of ~87%.

AFFO Evolution (Empyrean; IIPR)

While the growth in FFO and AFFO per share has been quite strong, we see the high payout ratio as a risk, given the tenant issues discussed earlier. If the largest tenant were to default on its leases, we estimate FFO and AFFO would decrease by ~12%, pushing the payout ratio to ~100%.

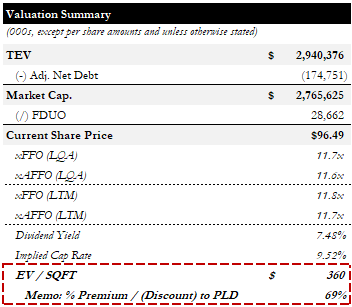

Valuation

IIPR is trading for ~12x FFO and AFFO per share, offering a ~7.5% yield and a ~9.5% implied cap rate (n.b., based on LQA NOI). What is striking to us is the implied EV per sqft of ~$360, ~70% higher than Prologis (PLD), a leading owner of the highest-quality real industrial properties. With IIPR’s implied net rent per sqf being only ~13% higher than PLD’s, we see this as a significant mispricing.

Valuation Summary (Empyrean; IIPR)

We chose not to provide an NAV estimate for IIPR as this asset class is not widely traded and has little institutional participation. Given the lower quality of the tenant base and the difficulty (if not infeasibility) of repurposing the assets, they cannot be valued at regular way industrial cap rates, and any estimate of an appropriate cap rate for this portfolio would be a wild guess, in our opinion.

Another way to consider IIPR’s valuation is the replacement cost of its portfolio, which the Company conveniently provides. At its average cost of ~$275 psf, we can estimate an NAV of ~$70/share, implying a ~27% downside.

Catalyst: Favorable Regulatory Changes

A DEA rescheduling of cannabis could be a boon for IIPR’s tenants, mitigating the concerns we raised earlier and unlocking a new phase of turbo growth.

While we believe this, and further cannabis-friendly regulatory changes, are inevitable, we are not positioned to make a bet on when. Furthermore, such a move could bring new capital into the space. This would be a double-edged sword. We would likely see an institutional market develop for these properties, allowing for price discovery and likely leading to cap rate compression. Unfortunately, this would erode the supply/demand imbalance on which IIPR has been built. These facilities are relatively easy to build, only requiring ~$170-190 psf to build, excluding land (n.b., ~40% of IIPR’s portfolio cost basis is related to land), which could bring lease rates down over the long term.

We see this as the primary bull thesis for the stock; however, it is difficult, if not impossible, to assess if, when, and what effect these developments could have on IIPR. Faced with the possibility, if not high likelihood, of a significant value impairment due to tenant default, we will not be holding our breath waiting for this catalyst to play out.

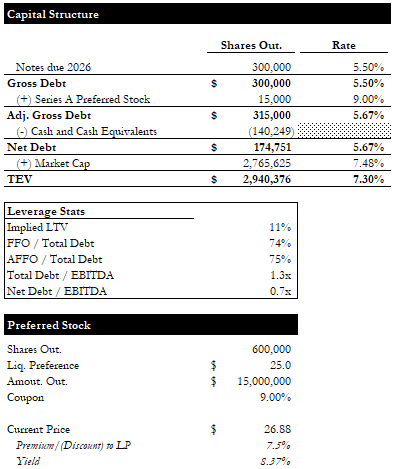

Preferred Stock

We also looked at IIPR’s preferred stock and came to a similar negative conclusion. Despite IIPR’s conservative leverage profile, we are not enticed by the ~8.4% yield.

Capital Structure (Empyrean; IIPR)

Trading ~8% above the $25/share redemption price and being freely redeemable at any time (n.b., redemption date was in 2022), IIPR would have to not redeem the preferred for at least 1 year for you to walk away with a positive return. Even then, your total return would be reduced by ~8% when redeemed. For example, if you bought the preferred today, and the Company redeemed it in 2 years, you would net a ~8% total return, ~4% annualized.

Conclusion

We were initially interested in IIPR for its low leverage, relatively strong operating performance, and depressed share price. We were aware of the risks inherent in this niche subsector, having followed the Power REIT saga for some time. We were hopeful that IIPR’s low leverage could be a saving grace. On further inspection, we concluded that neither the common nor the preferred appeared attractive. We are concerned about IIPR’s tenant quality, and its rich valuation relative to high-quality industrial peers and portfolio replacement cost (or the redemption price, in the case of the preferred). While positive regulatory developments could be a powerful catalyst for the company and its stock, the timing and net impact of such developments are impossible to predict. We are giving the common and preferred Sell ratings based on these concerns. We are not considering a short position, given the high cost to borrow and carry, and potential bullish catalyst. We simply see a meaningful possibility of permanent value impairment (a la Power REIT) and no reason to hold a long position. There are plenty of other REITs offering comparable or superior value (and yield, if that’s what you’re after) with a much more manageable risk profile.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.