Summary:

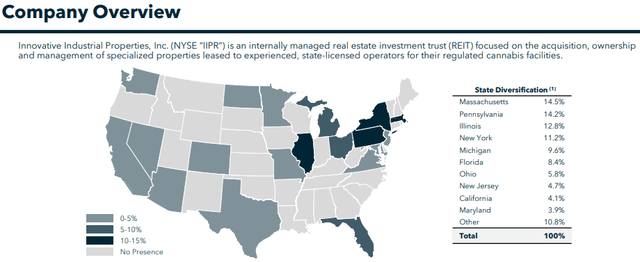

- Innovative Industrial Properties is a leading cannabis REIT in the U.S., leasing to state-licensed cannabis operators.

- IIPR offers advantages like a high dividend yield of 6.5%, cheaper valuation, and high average rents compared to traditional net lease REITs.

- Legislative risks, including the SAFER Banking Act and blocked rescheduling of cannabis, may impact IIPR’s business and stock performance.

tampatra

Dear readers,

Innovative Industrial Properties (NYSE:IIPR) is one of the largest cannabis REITs in the U.S. and owns cultivation properties, as well as dispensaries across the country with a focus on leasing to strong state-licensed cannabis operators.

IIPR IR

What makes cannabis REITs different

The REIT enjoys a number of advantages compared to traditional net lease REITs such as Realty Income (O) or Agree Realty Corporation (ADC) which is why it has been on many investors’ radar recently. In particular, it enjoys (1) a higher dividend yield of 6.5%, (2) a cheaper valuation of 12.8x FFO, and (3) high average rents of almost $40 per sft, which is double the average rent of traditional net lease REITs.

Part of the reason for higher rents is that the space comes with relatively costly technology needed to grow cannabis (mostly lighting and heating systems), but also it is a result of the fact that cannabis operators have not had an easy time accessing traditional sources of capital, because of how controversial the business has been, which forced many of them to close sale-leaseback transactions with REITs to get capital in exchange for above average rent payments.

This has, obviously, benefited IIPR in the past, but with the introduction of the SAFER Banking Act, operators now may gain better access to other sources of capital, which could reduce their willingness to continue to do new sale-leaseback transactions. This may have a negative long-term effect on IIPR’s business, as the REIT may find it difficult to (1) re-lease its space at such high rents and (2) may have a harder time finding new acquisitions at terms that we have got accustomed to.

IIPR IR

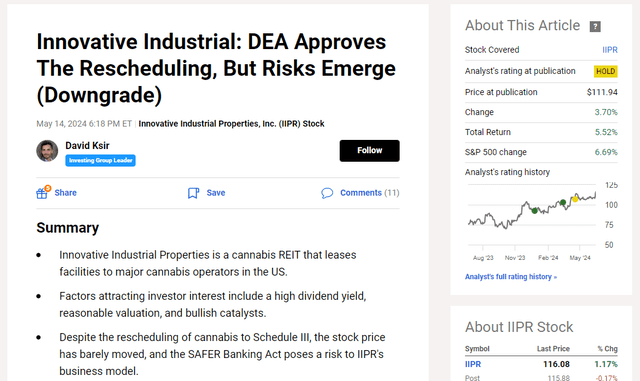

I discussed this risk in detail in my last article called DEA Approved The Rescheduling, But Risks Emerge. As the name suggests, I also touched on the well-televised approval to reschedule cannabis to a Schedule 3 substance, which would be a major positive for the industry as it would significantly lower taxation of cannabis operators and therefore increase their creditworthiness.

Recent progress on the legislative front

Since my last article, the DEA’s decision has been under a 60-day public comment period and has received over twenty thousand (mostly positive) comments. Unfortunately, House Lawmakers have very recently passed legislation to block the rescheduling for now by preventing the Department of Justice from spending any federal funds to reschedule the substance. I expect this decision to be overturned eventually, but combined with the aforementioned risks that may emerge from the SAFER Banking Act and an upcoming election, it is a major blow to the bull thesis.

I downgraded the stock to a HOLD back in May at $112 per share. Since then, the stock has traded almost sideways and returned an RoR of 5.5%, only marginally below the S&P 500 with an RoR of 6.7%, largely validating my call.

David Ksir

Some good news

But it has not all been bad.

Sure, the rescheduling is taking longer than expected, and the SAFER Banking Act may have an effect on incremental new acquisitions, but the stock has recently raised its dividend by 4.4%, which significantly increases the probability that Q2 results will be good.

More importantly, the macroeconomic landscape, especially surrounding inflation and interest rates, has changed quite a bit. And that is likely to be the most important driver, REIT prices.

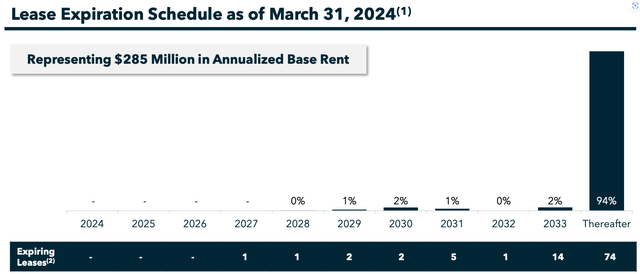

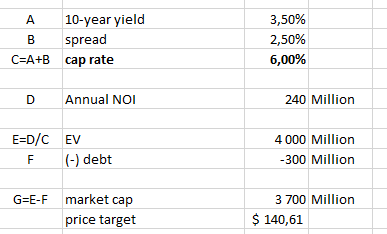

IIPR generates roughly $60 Million in NOI per quarter. That is $240 Million annualized, and corresponds to an implied cap rate of 6.7%. As the 10-year yield stands at 4.2% today, that represents a 250 bps spread to long-term yields. Most quality REITs trade at a spread of <200 bps, but given the fact that IIPR is relatively small (market cap of $3.6 Billion) and operates in a controversial industry, I see the spread as fair.

IIPR IR

But here’s the thing.

I expect yields to decline over the rest of this year and into 2025 which should unlock substantial upside in IIPR and other REITs.

I covered my expectations regarding inflation, interest rates, and the effect on REIT prices in an article called A Bet On Interest Rates I Am Willing To Make. In short, I see the currently reported level of inflation (3% in June) as overstated, due to a significant lag in two major CPI components – shelter and auto insurance. Using real-time data for these variables, inflation would already be well below the Fed’s 2% target. This makes me believe that the market is currently underestimating the probabilities of rate cuts, and therefore yields (especially at the long end of the curve) are overstated.

Assuming a decline in the 10-year yield from the current 4.2% to 3.5% and keeping all else constant, there is about 12% of upside to a price target of $140 per share likely to be realized over the next 24 months, so.

David Ksir

Combined with a high dividend yield, if all goes well, investors can expect to make a total annual return of up to 12% per year.

Risks to the base case

Apart from the already discussed legislative risks, the most obvious risk is that inflation proves to be more stubborn than expected, which would most likely result in the Fed holding interest rates higher for longer, and perhaps (if inflation reaccelerates) even raising them above the current level. This scenario would be quite bearish for REITs valuations across the board would most definitely decline significantly. Since there is no indication of inflation reaccelerating at the moment, a more real risk is that one or more of IIPR’s tenants runs into trouble and won’t be able to make the (relatively high) rent payments. This already happened to a close peer of IIPR – Newlake Capital Partners (OTCQX:NLCP). Depending on the size of that tenant, this could easily threaten the dividend, which is already tightly covered. And a dividend cut would obviously be bad news for a high dividend stock.

Bottom Line

IIPR raised its dividend by 4.4% last month, which signals that Q2 results are likely to be good. But dividend coverage is tight and there isn’t a whole lot of upside left. Even if my expectations play out and long-term yields decline to 3.5%, investors’ upside is likely capped at 12% per year. That is not enough, in my opinion, to justify the uncertainty coming from the two mentioned legislative risks – the SAFER Banking Act and the now blocked rescheduling of cannabis as a Schedule 3 substance. For these reason, I reiterate my HOLD rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.