Summary:

- Intel Corporation has been losing market share to competitors like AMD and Nvidia in various markets.

- However, Intel is making significant strides in CPU, GPU, AI, and server markets and plans to increase chip production globally.

- Intel is building massive chip plants in Israel, Germany, and Ohio to meet the increasing global demand for chips.

- Intel should beat analysts’ estimates, leading to higher EPS, multiple expansion, and a higher stock price.

Justin Sullivan

Intel Corporation (NASDAQ:INTC) has been lagging its competition for years. Now, decades even! Intel’s top smaller and more agile competitors, like Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA), have taken significant market share from Intel in the highly lucrative CPU, GPU, server, gaming, and other market space. Intel’s market cap is only $200 billion, whereas Nvidia has a valuation of $1.17 trillion now. Even AMD has surpassed Intel with its $220 billion valuation despite having fewer than 50% of Intel’s sales.

Intel is cheap now. Moreover, Intel is underrated. At the same time, Intel has made significant strides in the CPU, GPU, AI, and server markets. Intel’s latest announcement of a massive $25 billion chip factory in Israel is part of its global effort to increase chip production in the future considerably. Intel is building huge chip plants globally as it plans to reassert itself as a dominant chip giant capable of posting growth. Intel’s revenues and profitability will likely increase more than anticipated, leading to multiple expansions, higher EPS, and a substantially higher stock price in future years.

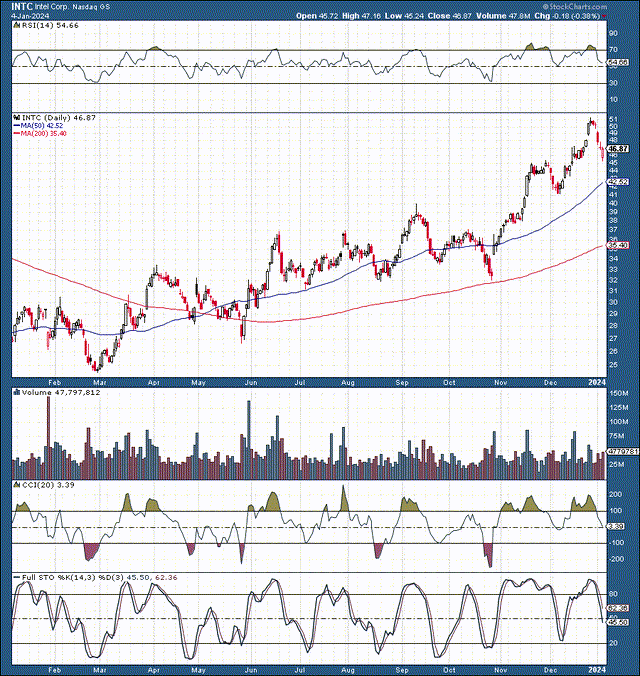

Technically – A New Bull Market Began

Intel’s bull market began after bottoming around $24 in late 2022. We saw a successful retest of $25 in late February last year. We’ve seen a robust and constructive uptrend established since then. We continue seeing higher highs and higher lows. Momentum continues improving. While Intel may be overheated technically in the near term, in the long term Intel stock likely has considerable upside ahead.

Israel $25 Billion Factory – Excellent Deal For Intel

Under the deal, Intel will receive a $3.2 billion grant from the Israeli government for its $25 billion chip facility. The Israeli government subsidizes nearly 13% of Intel’s plant costs, which is excellent for Intel. The expansion plan for its Kiryat Gat site is an instrumental segment of Intel’s plans to establish a more resilient global supply chain.

In addition to its vast Israeli chip facility, Intel is building massive European and American factories. In Germany, Intel plans to spend more than 30 billion euros ($33 billion) to develop two chipmaking plants. Berlin promises significant subsidies to make the development attractive for Intel. In 2022, Intel said it would invest up to $100 billion to build potentially the world’s largest chip-making complex in Ohio.

Why is Intel building these massive factories? Well, it’s not because Intel has excess capital lying around. Global demand for chips continues to increase, and Intel remains the most significant producer.

Intel Has A Lot Of Chips to Ship

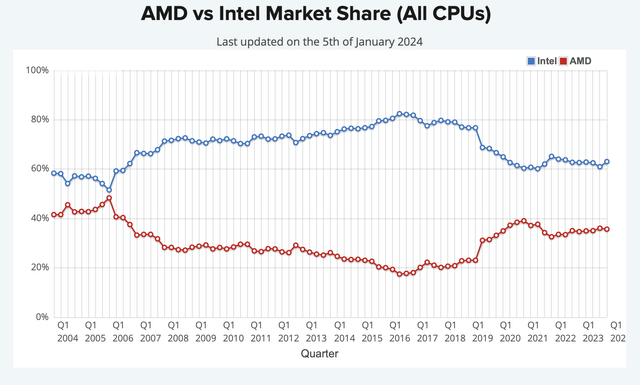

Intel has a 63% to 44% market share advantage over AMD across all CPU products. Moreover, Intel has about a 75% to 23% CPU lead in the lucrative laptop market. Intel’s colossal lead is in the server market, where it enjoys a 98% to 2% market share advantage over AMD.

Intel is known as the integrated GPU king, but it’s recently gained market share in the discrete GPU market. The discrete GPU market has been a duopoly dominated by AMD and Nvidia. While Nvidia continues dominating with about an 84% market share, Intel now has a 4% share in this highly lucrative market. Moreover, Intel can improve products and increase its share in the GPU space in future quarters.

Intel’s Increasing AI Potential

Intel was first considered one of the AI laggards, but being the most significant chip producer globally, Intel should become one of the most important beneficiaries of AI. Intel Labs is shaping the next generation of AI by pioneering advancements that will unlock the true potential of AI. It’s not surprising that Intel is emerging as one of the clear leaders of the AI revolution. Intel’s revenues are massive, and it has unrivaled R&D spending, much of it going to research and better implement AI.

Intel has one of the most extensive R&D budgets globally, with $12 billion spent on R&D in the first three quarters. Intel should spend about $16 billion on R&D for the full year, and it will have a similar budget for next year. Intel’s increased spending should enable it to emerge as one of the dominant chip players in the age of AI, effectively competing with AMD, Nvidia, and other top players in the AI race.

Intel’s AI research has enabled it to achieve significant feats in Novel AI systems, neuromorphic computing, cognitive AI, probabilistic computing, human-AI collaboration, natural language processing, graphic neural networks, automated machine learning, and more.

Intel Stock Is Still Cheap

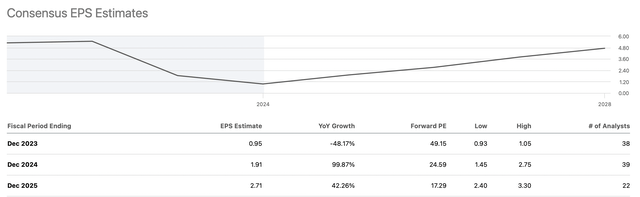

First, Intel has done an excellent job of surpassing consensus estimates in previous quarters. Last quarter, Intel beat revenue estimates by $560 million and crushed EPS projections, nearly doubling the forecast to $0.41. Its next earnings report is expected post-market on January 25th.

EPS Growth Likely to Improve

EPS estimates (SeekingAlpha.com)

Intel’s consensus EPS estimates suggest earnings should be around $2 per share this year. However, higher estimates imply Intel can hit the higher-end range of analysts’ estimates, potentially achieving $2.20-2.50 in EPS this year. Also, Intel can achieve the higher end of next year’s EPS estimates. Intel’s EPS should be around $3 next year, with significant, sustainable EPS growth potential after that. Due to improving and increasing sales, Intel’s EPS should continue improving, leading to multiple expansions and a considerably higher stock price as we advance.

Where Intel’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $62 | $70 | $77 | $84 | $91 | $99 | $107 |

| Revenue growth | 15% | 13% | 10% | 9% | 8% | 9% | 8% |

| EPS | $2.40 | $3.20 | $4 | $4.80 | $5.66 | $6.50 | $7.42 |

| EPS growth | 140% | 33% | 25% | 20% | 18% | 15% | 14% |

| Forward P/E | 20 | 22 | 20 | 21 | 19 | 18 | 17 |

| Stock price | $64 | $88 | $96 | $119 | $124 | $134 | $145 |

Source: The Financial Prophet.

Threats to Intel

Despite my bullish outlook, there are concerns regarding Intel. AMD and Nvidia are still the innovation and technology leaders in their respective industries. Therefore, while Intel participates in crucial markets, it doesn’t necessarily make it a leader in the space. Intel faces intense competition and must innovate more, especially given the company’s enormous R&D budget. Intel also needs to execute well and avoid future setbacks.

A crucial component of Intel’s success is its management team. Intel’s management has a high bar ahead and must manage effectively, leading the company to increase sales and profitability. Intel may be its own most significant risk. Investors should consider these and other risks before investing in Intel.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I manage a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!