Summary:

- Intel cut its quarterly dividend, which will save nearly $4 billion in cash per year, to focus on growth initiatives.

- Fundamentals remain positive including an outlook for ongoing profitability.

- Despite near-term challenges, Intel benefits from a leadership position in segments with significant long-term opportunities.

Justin Sullivan

Intel Corp. (NASDAQ:INTC) finally announced what many investors had been expecting, the dreaded dividend cut. The company is slashing the quarterly payout to $0.125 per share from the old rate of $0.365 a share. This was the first decrease in the company’s 30-year history of making regular payments and also rolls back an 8-year streak of dividend hikes.

In many ways, the step here was necessary considering some major shifts in the competitive environment, alongside challenging macro headwinds. Intel had a poor 2022, with falling sales and lower earnings, sort of forcing some hard choices. Still, it would be disingenuous to only cite market conditions with management likely also deserving some blame for missteps over the past several years. Shares of INTC are down more than 60% from their peak in 2021.

That being said, there are several reasons to look up. Intel has a turnaround strategy in place, and the potential that it succeeds can ultimately generate new shareholder value. By this measure, we’re believers, and see the latest selloff as a new buying opportunity for what remains a high-quality market leader with significant growth opportunities. With a sense that the reset of valuation has already incorporated a lower base of expectations, the setup here opens the door with risks tilted to the upside.

Is Intel a Good Stock?

The first point here is to brush aside concerns that Intel is facing some sort of liquidity crisis or solvency issues. Sure, the latest development is a setback, but the fundamentals are overall fine.

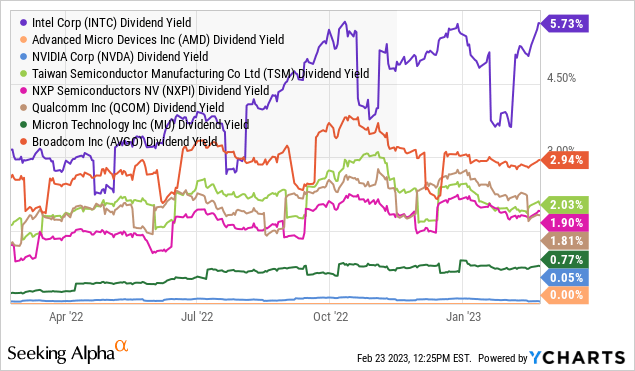

The ability to raise cash through a dividend cut is a luxury many other companies simply don’t have. Intel was paying out $6 billion annually, which was one of the largest distributions in the tech sector. This is in contrast to competitors like Advanced Micro Devices Inc. (AMD) which doesn’t even pay a dividend or the marginal payout from NVIDIA Corp. (NVDA) which yields just 0.1%.

Intel’s new quarterly rate implies a forward yield of 2.0% and places it more in line with other chip stocks like Taiwan Semiconductor Manufacturing Co. (TSM), NXP Semiconductors N.V. (NXPI), and Qualcomm Inc. (QCOM) at a similar level. INTC is still offering a yield component, but investors should be more excited about the potential for capital appreciation going forward.

Intel’s dividend cut effort is expected to save nearly $4 billion annually from the dividend expense which helps to balance the capital allocation strategy with a renewed focus on investments in areas of growth. Considering the company reported a negative adjusted free cash flow of $4.1 billion for 2022, the dividend cut alone would have covered that amount if implemented last year.

Here we can bring up that despite 2022 sales declining by 20%, leading to a -60% drop in earnings next to the record 2021, Intel remains profitable with 2022 EPS of $1.94. Even the latest consensus estimates for 2023 see the company reaching positive adjusted EPS this year amid the restructuring. Again, there is some operating weakness and financial difficulties, but this is hardly the picture of a sinking ship.

The major theme in recent quarters has been a deeper-than-expected slowdown across the core “Client Computing Group”, which includes the consumer PC market, along with a slowdown in the “Data Center” business. These areas outweighed the stronger trends in high-growth areas like the “Mobileye” group, “Network and Edge” products, and foundry services initiatives that have required higher spending.

Beyond the dividend, other cost-control steps including reducing headcount while refocusing the investment priorities are expected to generate between $8 and $10 billion in annualized savings by 2025. This will help to further strengthen the balance sheet and add to CAPEX flexibility.

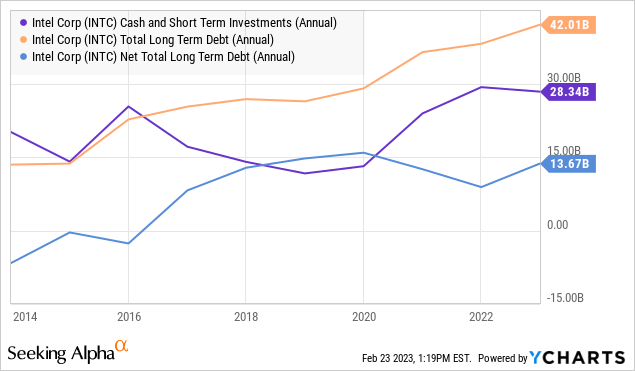

For context, while Intel ended the year at a near-record $28.3 billion in cash and short-term investments, total debt has also been climbing, reaching $42 billion in 2022, up from $29 billion in 2019 as a pre-pandemic benchmark.

The point here is to say that the latest dividend cut was on the proactive side, if anything else, to set some priorities straight ahead of what are expected to be major investments moving toward an internal foundry model, to ensure the company can maintain its leadership status and secure its long-term future.

Several announced products in the pipeline, including milestones of innovation, now have better visibility to move forward without the weight of the excess dividend payout as a crutch on cash flows.

1. Intel Remains the PC and Server CPU Market Leader

A big part of the story explaining the weakness of Intel over the past several years has been the market share gains rival AMD has made in x86 architecture CPUs, which is the standard for desktops, laptops, and servers. The latest indicators suggest Intel controls around 60% of the market, down from levels above 80% in 2018.

We can give AMD credit for offering price-competitive alternatives, with good performance as their value proposition, but we’re a long way from seeing the table completely reverse.

On this point, it has been widely reported that the latest generation of Intel’s “Raptor Lake” series CPU has essentially closed the gap AMD Ryzen chips had in terms of their pricing advantage relative to performance. The quote from the industry publication “Tom’s Hardware” when reviewing the latest from Intel sums it up well:

These chips are game-changers, upsetting AMD’s product stack and offering a better value at every price point.

It’s encouraging to see that Intel address its weaknesses and launched a product that made it more competitive. By this measure, we expect the market share trends to at least stabilize from here.

We can also bring up the move by Apple Inc (AAPL) to introduce its own line of chips within its Macbooks as part of the disruption in recent years. At the same time, let’s recognize that the broader PC market is significantly larger and will continue to grow. Apple controls just 14% of the global PC market focusing more on the premium side while Intel CPU still dominates overall. The underlying brand momentum with customer loyalty are important intangibles within the investment outlook.

2. Intel Has a Technology Advantage

The point we alluded to by bringing up the CPU market comes down to what we believe is Intel’s cutting-edge leadership, particularly in the segment of high-performance consumer applications.

It’s not often when two companies go head-to-head and there is a quantifiable metric demonstrating how one product is superior to another. In this case, we’re referring to Intel’s “iCore i9-13900KS” which is recognized as the fastest CPU on the market, beating out AMD across several benchmarks.

At a time when microprocessors are becoming more and more commoditized, the ability to innovate and produce something differentiated, ahead of the competition counts. While that top-end level of performance is not necessary for many applications, it serves as a capstone that can be carried into other segments across the product lines.

One of the most exciting corners of the business is targeting the next generation of specialty supercomputer chips tasked with managing data-intensive aspects of artificial intelligence, and ultimately simulations of virtual economies. Everything suggests Intel will play a role in that future.

3. A Roadmap To Earnings Growth

Putting it all together, 2023 is set to be a transition year for Intel where it attempts to move through internal restructuring and the macro storms. The outlook looks more favorable into next year where the market forecast is for sales to reclaim growth while EPS rebound toward $1.85. This is consistent with the most recent company guidance suggesting stronger trends starting in the second half of this year as a tailwind of momentum by 2024.

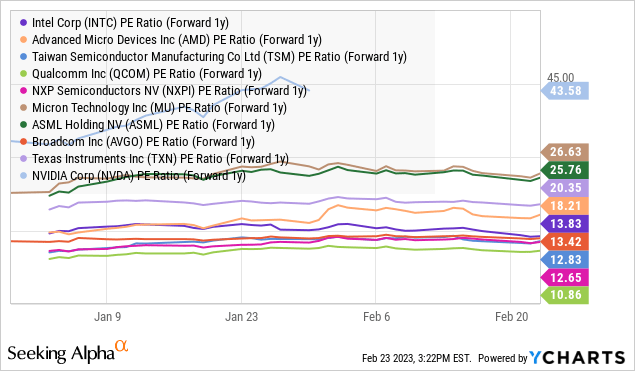

In terms of valuation, that 1-year forward P/E multiple under 14x begins to look attractive next to an expectation for 16% revenue growth and earnings more than tripling from the 2023 forecast. Going back to the broader semiconductor industry, which is diverse with different companies focusing on various segments, INTC would appear undervalued assuming those estimates for 2024 and 2025 can play out.

INTC Stock Price Forecast

We rate INTC as a Buy with a price target for the year ahead at $32.50, representing a 17.5x multiple on the current consensus 2024 EPS of $1.85. The way we get there would be through a solid execution over the next few quarters, confirming the financial improvement is taking shape with cash flows and margins as key monitoring points. In a scenario where global economic activity remains resilient, providing a boost on the demand side, the bullish case also has room for sales to outperform expectations.

The dividend cut may mark a “bottom” for the stock, as an important corporate reset. It will be important for shares to hold the recent low as a first step to rebuilding investor confidence. All that being said, the risk here is that the top-line sales simply fail to stabilize leading to deeper recurring losses. A deterioration of the macro outlook would also open the door for another leg lower in the stock.

Disclosure: I/we have a beneficial long position in the shares of INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.