Summary:

- Intel is looking to report a quarterly revenue bottom.

- Free cash flow needs to turn higher for the dividend to rebound.

- Short interest hit 52-week highs, albeit at a low percentage.

JasonDoiy

One of the most disappointing names in big cap tech land in recent quarters has been Intel (NASDAQ:INTC). The chip giant has lost some business to competitors, and it also struggled thanks to global economic worries. Falling revenues and cash burn last year caused the dividend to be slashed a few months back, but there are hopes now that the worst of it might be in the rear-view mirror.

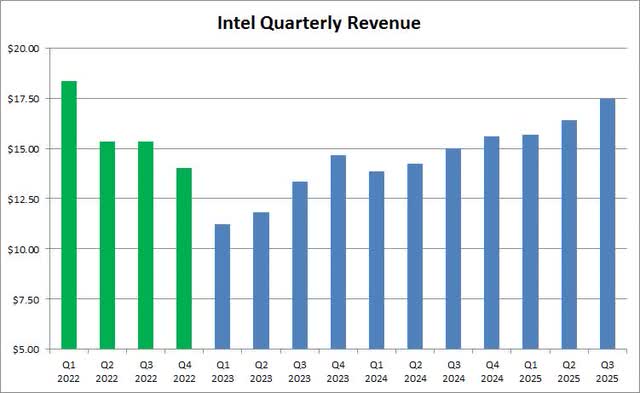

If you didn’t watch Intel in 2022, you certainly missed a lot. Revenues ended up peaking in the first quarter of the year, which usually is the period of the year where business is softest. In just three quarters, the company’s top line fell by more than $4 billion, with management then providing awful guidance for Q1 2023 that implied another roughly $3 billion sequential decline. The chart below shows where Intel revenues were last year, in green, with current analyst estimates moving forward in blue.

Intel Revenue Picture (Seeking Alpha)

While the chip business can certainly be cyclical, this is not exactly supposed to be a “V” picture where things rebound as fast as they fell. Intel is trying to catch up to competitors, especially Nvidia (NVDA) in the AI space and Advanced Micro Devices (AMD) in the data center space. Intel had launched an aggressive capital spending plan to launch several new products in the next couple of years, which resulted in free cash flow going negative last year.

Intel is slated to report Q1 results on Thursday, April 27th. Analysts are calling for revenues to plunge by nearly 39%. However, as the chart above showed, this is expected to mark a sales bottom, and it is also supposed to be the largest percentage drop for the top line in this cycle. Adjusted earnings per share are forecast to be a loss of about 14 cents, which is a swing of more than a dollar per share from the year ago period. The street sees Intel getting back to adjusted profits in Q2 of this year, but we’ve seen a lot of guidance disappointments from the company lately so we’ll see if things can actually get back into the green this soon.

Intel finished 2022 in a net debt position of around $14 billion (when excluding long term investments), and the company was expected to burn more cash in the first half of this year. When management borrowed some more funds earlier this year, it looked like the dividend would be safe. However, the payout ended up being slashed by nearly two-thirds as the board decided that capital preservation was the best strategy. Management expects to get back to meaningful free cash flow generation in 2025 and beyond, as discussed in last year’s Investor Meeting. Investors are hoping that if the cash flow situation improves over the next year or so, perhaps the dividend can be raised a little as we get through 2024.

One interesting item recently is short interest. Intel is not a heavily shorted stock on a percentage basis, with less than 2% of outstanding shares currently short. However, short interest has recently risen to a new 52-week high at more than 80 million shares. As the graphic below shows, that’s up more than 43% from the end of August 2022. Intel isn’t one of those names that you’re likely to see a short squeeze in, but this item is interesting to watch as it can show how sentiment in the name is faring in the short term.

In the last month, Intel shares have done quite well, rallying more than 28% from their lows. It looks like investors are seeing the light at the end of the tunnel, but the company has to show that a revenue bottom is truly in. The average price target on the street is under $29 right now, so analysts actually believe the stock has about 12% downside from Friday’s close. This latest leg higher has allowed the 50-day moving average to start rising again, so that technical line could be one of support if shares do pull back a little.

After a couple of really bad quarters recently, Intel is looking for its chance at redemption this month. If the company can show that a revenue bottom is in and that the cash flow situation will improve rather soon, investors might be willing to jump back on this train. The significant dividend cut was not a welcome development, but it probably will turn out to be the right financial decision in the end. It may take the company a few years to get back to the revenue levels we saw throughout 2022, but that would certainly be better than the alternative.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.