Summary:

- The Intel Corporation turnaround story is now on shaky ground.

- The Intel Q4 headline results were strong, but there were mixed results in key segments.

- The Intel Q1 guidance was very disappointing, with far lower revenue and adjusted EPS than expected.

- Is this a bump in the road or portending a weak year for Intel Corporation?

Ales_Utovko/iStock via Getty Images

Well, Intel Corporation (NASDAQ:INTC) just reported Q4 earnings. Is the turnaround story intact? These results suggest that it is on shaky ground. We had anticipated that the company was under-promising and would over-deliver, and the results show they did. But there is no way to sugarcoat it. Versus what we expected, it is a disaster guide. It is not good, at all.

The guidance comes despite the headline results for Q4 being very strong. It is an overall disappointment from our perspective. Is it a blip in the road, or is the return to growth story petering out? Let us discuss.

Intel delivered its Q4 earnings a short time ago, and it is hard to call this overdelivering, even with a top and bottom line beat. Make no mistake, the guidance was disappointing. However, we stand by the assertion that better days are ahead, and the company has certainly seen a trough in performance following its worst quarter in history in Q1 2023, and has slowly been grinding back.

Intel had missed results relative to many of our expectations. We are seeing an ongoing recovery in PCs. We saw progress on Foundry. And while we saw beats on the headline results, we told you it would be all about that guidance. That is where we saw better results as likely, but it was disappointing. Zinsner, Intel CFO, stated in the press release:

“We continued to drive operational efficiencies in the fourth quarter, and comfortably achieved our commitment to deliver $3 billion in cost savings in 2023. We expect to unlock further efficiencies in 2024 and beyond as we implement our new internal foundry model, which is designed to drive greater transparency and accountability and higher returns on our owners’ capital.”

Pat Gelsinger, Intel CEO, added:

“We delivered strong Q4 results, surpassing expectations for the fourth consecutive quarter with revenue at the higher end of our guidance.

Here is the deal. The company is still controlling what it can control by slashing costs where it is able to through its cost savings plans, while investing to buildout its foundry model, which is going well and still progressing with IDM 2.0. With that said, the results were better than we had expected. So they did overdeliver, at least for Q4 overall.

The company beat estimates on the top and bottom lines and handily did so.

Here were our major expectations:

We are looking for revenue of $15.0-$15.6 billion, significantly higher than the midpoint of management’s guide. We are also looking for 46.6-47.0% adjusted margins, which would be further margin expansion sequentially. On the EPS front, we expect earnings of $0.45-$0.48 per share in the quarter as well.

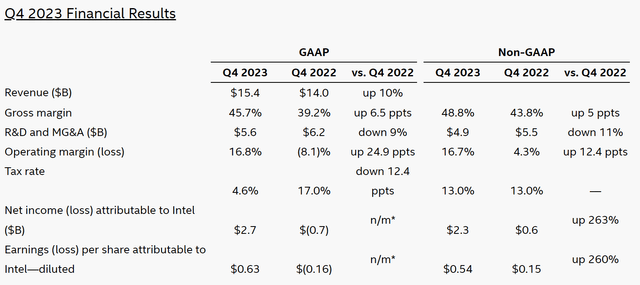

While better than expected, the comps with Q4 2022 show across-the-board improvement. Intel’s revenue was up 10% from a year ago. We saw $15.4 billion of earnings, a nice beat, and it came toward the higher end of our laid-out expectations, which were more bullish than consensus. This came as adjusted gross margins blew out our expectations at 48.8%, a big win, and up from 43.8% a year ago. Operating margins were up as well to 16.7%. And, thanks to strong operating margin, net income was up year-over-year, rising 263% from last year’s earnings. Outstanding performance, really.

With the return to some positive metrics, we will see further improvement in the valuation metrics here as well, as we are swinging further into positive returns. Cash from operations is strong. Intel generated $4.6 billion in cash from operations and paid dividends of just $0.5 billion. Now, not every segment is growing. We are still seeing declines, but the foundry progress was another home run.

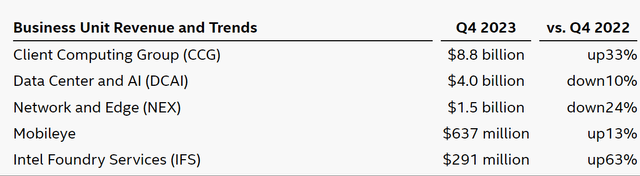

Client computing was strong, with revenue rising 33% to $8.8 billion, while Mobileye (MBLY) revenue rose 13%. We saw real strength in the Foundry Services, rising 63% from a year ago. However, Data Center and AI was down 10% from a year, despite the massive boom in AI demand. This suggests competition is winning to some degree here. Network and Edge also sunk 24% from a year ago. However, as a whole, it was a good report. But guidance was disappointing.

Q1 2024 outlook

Look, the Q4 results largely did overdeliver. We got that right. But this Q1 guidance was a disaster following the last two quarters of performance. We were looking for sales guidance of $13.9-$14.7 billion. However, Intel only forecast Q12024 revenue of $12.2 billion to $13.2 billion, or $12.7 billion at the midpoint. We were even more bullish than the $14.2 billion consensus. This is disappointing. Further, adjusted EPS is seen at $0.13. We were looking for $0.30-$0.40. That is just painful. We believe this stems from pressures in data center and AI largely. While this segment is the source of massive future growth, the market may have gotten ahead of itself bidding shares up, doubling off the lows.

Now, the revenue guide is way up from last year’s Q1 of $11.7 billion, but not nearly close to what we expected. We expect margins in the high 40% range again, up from 38% a year ago, and of course, the $0.13 guide for EPS is still a major turnaround from a loss of $0.04 last year, but so much more was expected.

We expect Intel Corporation shares to get hit on this Q4 report. Whether it is a one-off or portends a weak year, remains to be seen. If you have trading gains, it may be best to sell and move on. We remain neutral overall but do expect shares to take a short-term hit.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Welcome 2024! Pay yourself dividends with outsized returns and income

Get more with our playbook to advance your savings and retirement timeline by embracing a blended trading and investing approach at our one-stop shop.

Our prices are rising in 2024, but take 10% off NOW with our New Year Special

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). There’s also a light version of BAD BEAT, on sale for 55 cents a day with great benefits too. Come take the next step! Start WINNING