Summary:

- Intel’s transformation into a foundry business has led to declining core business revenues and profitability, with no immediate catalysts for stock growth.

- Government funding will not solve the company’s problems; INTC’s future profitability remains uncertain, and the stock continues to underperform the broader market.

- The stock appears extremely cheap, trading below book value, but lacks the necessary catalysts to justify an investment.

- I maintain a “Hold” rating on Intel due to limited downside risk, significant opportunity costs, and uncertain future prospects.

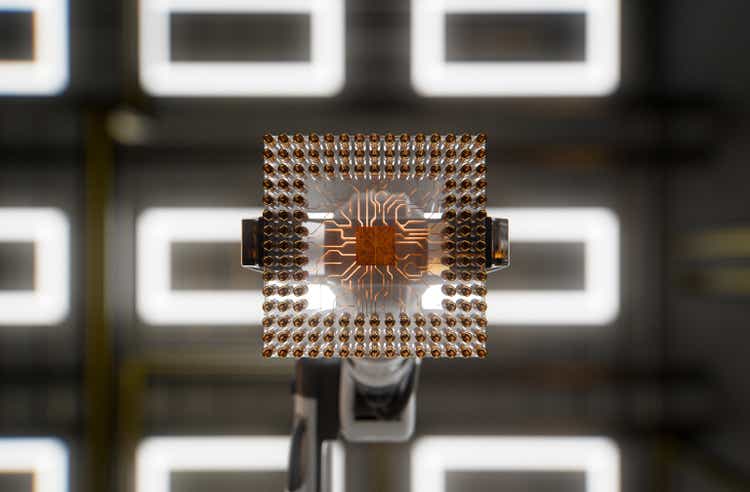

luza studios

Introduction

I am sad to see Intel (NASDAQ:INTC) where it is. Five years ago, it was one of the largest chip designers for consumer electronics and more. This business is still the largest part of the company, but it has been significantly deprioritized.

Intel is putting all its money (including suspended dividends) and effort into becoming one of the largest foundries in the world. While doing so, it has been seeing weakness in core segments and stagnant growth in the foundry business, which is unprofitable for now. This has reduced the overall profitability of the company significantly.

The stock performance reflects these realities. The company is struggling. Earnings and guidance have disappointed investors. Extra funding from the government will not help solve the company’s large issues.

Although the stock is extremely cheap after the recent decline and the downside risk is limited, I struggle to see a strong upside scenario. There are no catalysts in sight. Therefore, I reiterate my “Hold” (stay-away) rating for Intel.

Business Before And After IDM 2.0

The changing business model over time is a major part of this thesis. That is why it is important to understand. However, I will not repeat the business description in too much detail here, as I’ve already laid it out in my previous article. Please refer to that one for a more detailed description.

Intel‘s business can be separated into two: before and after IDM 2.0. This was an initiative introduced in 2021 to revitalize Intel’s manufacturing capabilities, effectively turning Intel into a foundry. Since 2021, Intel has been transforming from a designer of chips that outsourced production to a manufacturer of chips that other companies outsource their production to.

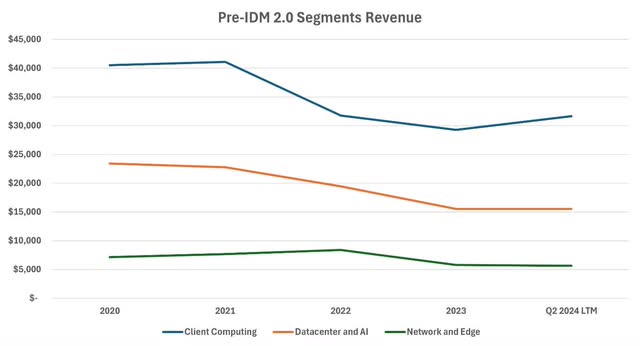

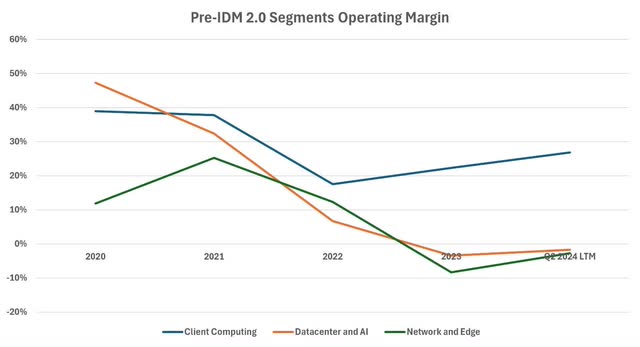

The pre-IDM 2.0 business had three main segments: client computing, data center and AI, and network and edge. Through these segments, the company designed and sold chips and processors for consumer electronics, networking products, and solutions for the Internet of Things, edge computing, 5G infrastructure, and more.

Although the market for these products grew thanks to technological developments, Intel has seen its revenue decline since 2020. Even the data center and AI segment, whose end market has been booming, experienced declining sales. Not only that, but the operating margins of these businesses declined considerably as well.

This was not without a reason. As explained, Intel decided to become a different business and focused all its efforts and investments on building that. These three segments were deprioritized.

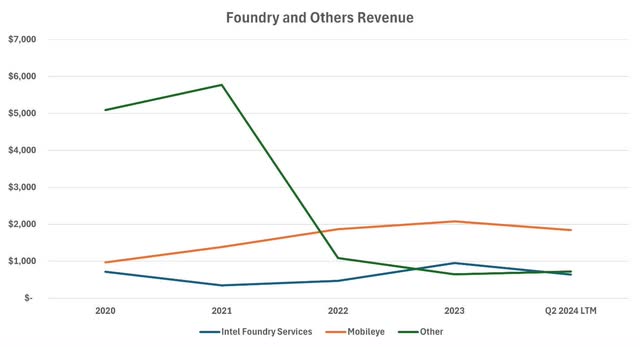

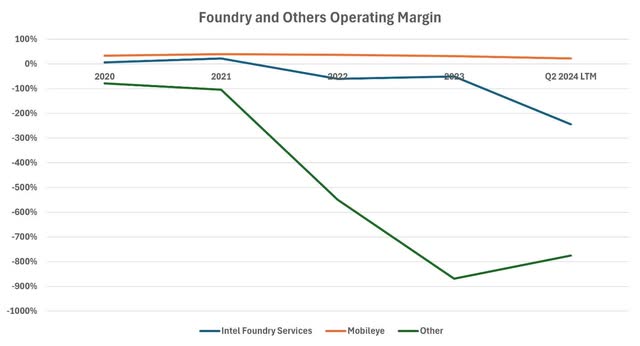

To build the foundry business, with the help of the CHIPS Act which aims to strengthen US semiconductor manufacturing, Intel started investing in its global foundry business. Even now, it is undertaking projects in Arizona, Ireland, Israel, Poland, Malaysia, and other regions of the world. The goal is to become the second-largest foundry in the world after Taiwan Semiconductor (TSM), and the largest in the Western Hemisphere.

This goal is nothing but easy. It requires substantial investments and a lot of time. The day when the transformation will be complete still seems in the distant future. The growth of the foundry business is small, and it is not yet profitable.

Below are the revenue and operating margin charts for the post-IDM 2.0 segments.

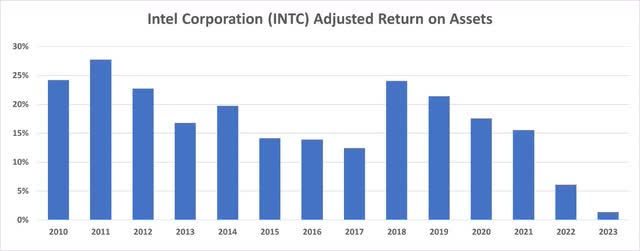

As explained, this transformation has not been easy, and the company is struggling. The core (or ex-core) business is experiencing declines both in revenue and profitability. It is difficult to finance new investments without strength in the core business. As these investments have not been profitable so far, the return on assets (“ROA”) of the company declined significantly.

Recent Performance

Investors of Intel seem to have mixed feelings about this transformation. Some like the idea and say that being the foundry of the Western Hemisphere means that the Western world doesn’t have to rely on the East anymore, instead using Intel’s foundry business to manufacture chips. Others find this goal difficult to achieve as it will take a long time, and even if successful, it is difficult to have cost advantages over established companies like TSMC.

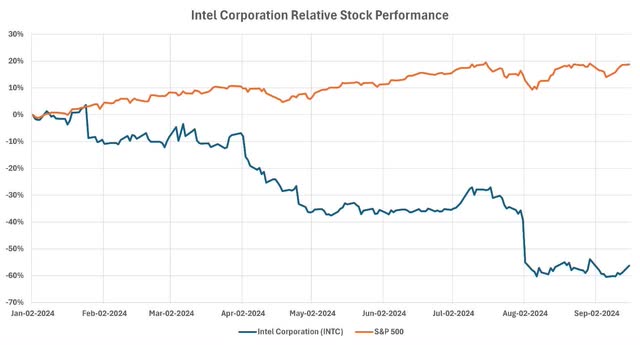

Overall investor sentiment seems to be worsening since the beginning of the year. Driven by disappointing earnings and revisions, Intel stock has massively underperformed the S&P 500 index. The stock declined by more than 50% year-to-date, while the broader index is up by around 20%.

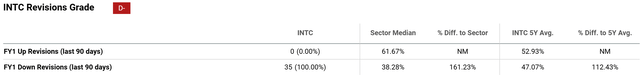

Intel receives a “D-” from Seeking Alpha as a revisions grade. Revisions downwards have been larger and more frequent than in the broader information technology sector, and compared to Intel’s 5-year average.

As an example of disappointing earnings, Intel missed revenue and missed estimates in Q2 and guided lower than expectations for Q3. In addition, the company said it would let go of 15% of its staff and suspend its dividend. This resulted in a large decline in stock price, as seen above.

Towards the end of August, news came out saying that Intel would spin off its foundry business. Shares gained nearly 9% in a day. This market reaction shows what investors want the company to do. Once a leader in consumer electronics chips, it is now disappointing investors with promises of distant and uncertain earnings.

Higher Funding From The CHIPS Act Doesn’t Solve Fundamental Problems

Recently, shares jumped after the company confirmed it would receive up to $3 billion in direct funding under the CHIPS and Science Act for the Secure Enclave program. The company was already set to receive $8.5 billion under the CHIPS Act before. This new fund brings the total up to $11.5 billion.

Although investors were happy with the announcement, I don’t think this allocation solves Intel’s problems. These projects still require a substantial amount of money. All this does is replace the shareholder equity that would have been used to fund the projects with taxpayer money. I believe the aim is that these projects will eventually benefit Americans, as Intel employs more people and decreases the West’s dependence on Eastern manufacturers. This remains to be seen, but this funding changes nothing for the company itself, although it means shareholders may retain more earnings in the short term.

Higher funding will not impact the profitability of any of the businesses. Intel is still investing in a business whose future profitability is uncertain. The core business will not benefit from this either. In general, I believe investors may be right to be happier as a part of CAPEX is funded with no cost of capital, but the long-term growth and profitability profile is unchanged.

Still Looking Cheap, But No Catalysts In Sight

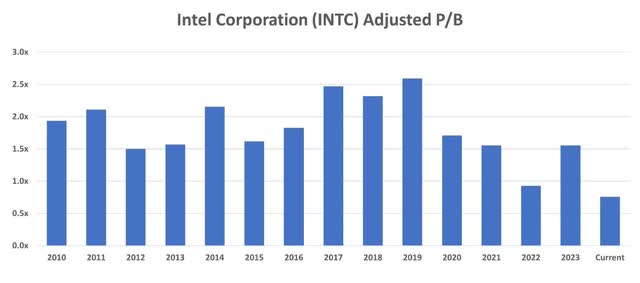

It might have been better to evaluate the stock price of Intel using the forward P/E multiple. However, that was before all the investments in this foundry transformation. As mentioned in my previous article, I believe it makes sense to use P/B for a company aiming to become the largest foundry in the Western Hemisphere.

Currently, the stock trades at the lowest adjusted P/B it has traded at since 2010, and potentially even earlier. The stock is significantly below the company’s book value and looks extremely cheap.

This is where I want to mention that investing is not only about finding the cheapest companies. I received many comments under my previous article saying that I was foolish to paint such a negative picture because the stock was cheap, and the company was investing in a new technology. While everyone is entitled to their own opinion, I believe this is not enough to justify investing in a company.

Calculating the fair value is not difficult. Anyone with a financial model can find a fair value. Even if the assumptions and calculations are 100% correct, that doesn’t mean that the stock is ever going to reach that fair price. That is why the concepts of opportunity cost and catalysts are extremely important.

If there are no developments in sight that would change investors’ opinions and make them buy the stock, inexpensiveness itself doesn’t provide an investment thesis. This is where I stand. I think Intel is going through one of the most difficult periods of its history with core business declining and investments being made the transform the business into one with an uncertain future. Right now, this is not a company I would like to own.

There are many other opportunities in the market, and although there is limited downside risk with Intel, you might incur significant opportunity costs by buying it and waiting.

Conclusion

Intel is actively transforming a successful business focused on consumer electronics chips into one with an uncertain future. The company allocates its resources to building the foundry business, however, earnings from that business seem in the distant future.

Investors are disappointed, the stock and fundamental momentum is negative, and the core business, which is still the largest part of the business by far, continues to decline. Extra funding from the government doesn’t change these.

The stock appears extremely cheap and is trading below the company’s book value. However, as explained above, an investment thesis requires more than “the stock is cheap” and while the downside risk is limited, I don’t see the catalysts that would drive this stock up.

Therefore, I reiterate my “Hold” (stay-away) rating on Intel.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.