Summary:

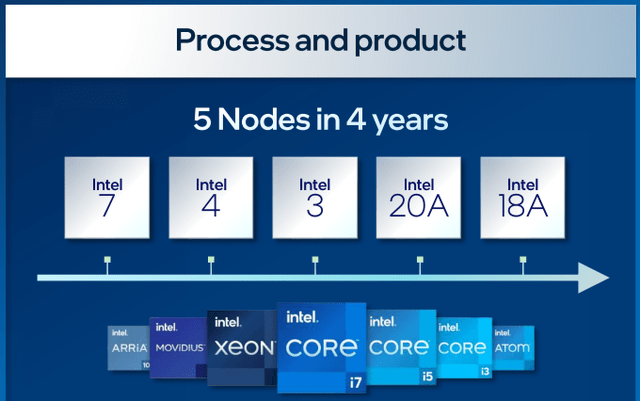

- Intel aims to become the second-largest external foundry by 2030, promising to deliver five new nodes in four years.

- CEO Pat Gelsinger’s strategy revolves around IFS, planning to open fabrication plants to other chip designers to drive revenue and improve operational efficiency.

- Despite market skepticism, if Intel’s turnaround strategy is successful, its revenues are projected to reach around $166 billion by 2032, making its stocks potentially undervalued by 50%.

William_Potter

Investment Thesis

A few weeks ago, Intel (NASDAQ:INTC) held a special call with its shareholders, to clarify the company’s intent to become an IDM 2.0.

During the call, the management reaffirmed its willingness to deliver 5 new nodes in 4 years and to become the second-largest external foundry by 2030. However, despite Intel being very confident in delivering convincing results, the market is well aware of Intel’s problems with keeping its word.

Market uncertainty about the actual realization of Intel’s road map has contributed to the fall of the company’s share price to the point it became a hot pic among old-school value investors questioning if the stocks could offer a profit opportunity from a possible turnaround.

And the short answer to this question is yes it can.

Business Model

Unlike more popular semiconductors stocks AMD (AMD) and Nvidia (NVDA) – which only design their integrated circuits – Intel manufactures its chips in its own fabrication plants, called foundries or Fabs for short.

While in the past being an integrated device manufacturer was the gold standard, nowadays many chip designers have switched to Fabless business models, outsourcing the manufacturing process to pure-play foundries like TSMC (TSM).

The major problem of Intel, and IDMs in general, is the difficulty to keep up with the technological advancements in chip design and fabrication processes, at the same time, and with limited resources.

Following Intel co-founder Gordon Moore’s law of miniaturization, stating that the size of the transistors on chips shrinks every two years as the number of transistors doubles, the rate at which companies must innovate to remain competitive is incredibly high.

While chip designers compete on the performance and efficiency of their integrated circuits, foundries compete on the node miniaturization achieved.

The node represents the level of miniaturization and performance achieved in the manufacturing process, and following Moore’s law, nodes should diminish in size almost every two years. However, is easier said than done due to the billions of dollars needed to develop and set up advanced nodes.

Intel’s problems began with its failure to deliver a well-performing 10nm node in time and continued with the 7nm one.

Not only Intel is losing ground against Fab competitors like TSMC and Samsung – which currently operate 3nm nodes – but due to the lack of manufacturing capabilities, it got surpassed by Fabless competitors, like AMD, which relied on TSMC’s nodes to manufacture more advanced CPUs.

This “bump in the road” caused Intel’s market share in the CPU segment to decline from 82% in 2016 to 63% by the end of 2022. While we must praise AMD for its rise to success, it’s also Intel’s fault to have let it happen.

Instead of aggressively reinvesting to develop new technologies, Intel preferred to copiously reward its shareholders with massive dividends and share buybacks which other than creating a short-term wealth increase, ended up destroying value in the long run.

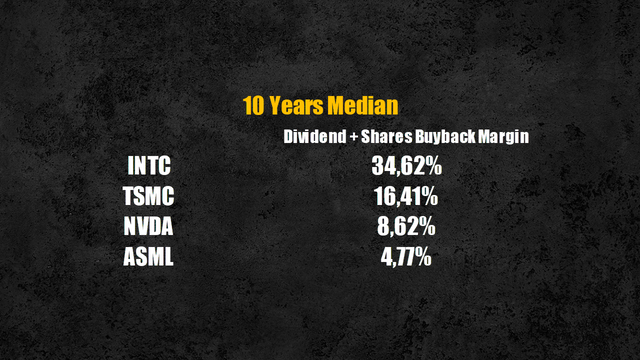

Looking at Intel’s percentage of revenues used to reward shareholders, in the last decade the median value was equal to 34% compared to TSMC’s 16%, Nvidia’s 8%, and ASML’s 14% – the only supplier of EUV lithography machines. What the latter three companies have in common is that they currently possess the most advanced technologies in their field, while Intel is playing catch-up.

Shareholders reward initiatives (Personal Data)

Turnaround Strategy

CEO Pat Gelsinger’s strategy to revive the company revolves around the Intel Foundry Services (‘IFS’) business line. He plans to deliver 5 new nodes in 4 years, with the 20A and 18A nodes as crucial turning points to take the lead against TSMC and Samsung foundry’s capabilities making IFS the second-largest external foundry by 2030.

Amid the chip shortage of 2021/2022 – and the government acts to support the industry – Intel saw the opportunity to open its fabrication plants to other chip designers, driving greater revenues and improving operational efficiency.

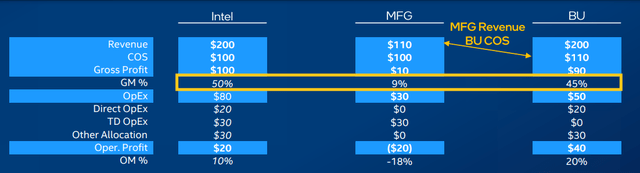

The IFS line and the traditional chip design line – rebranded Business Unit (‘BU’) – will be reported separately to better assess which business model is driving growth and profit and which instead is destroying value.

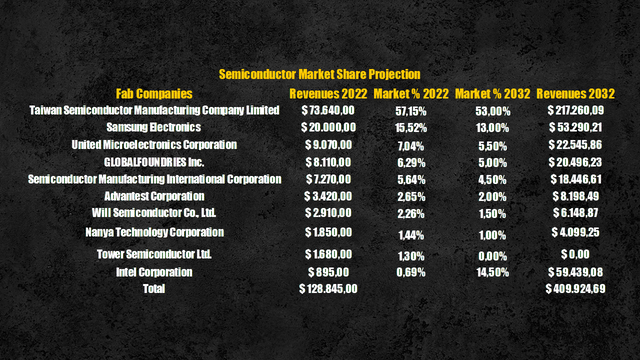

Now, vowing to be the second-largest foundry is a bold statement when you currently account for only 2% of the Fab segment combining IFS’s revenues of $895 million and Tower Semiconductor’s revenues of $1.68 billion – as Intel agreed to acquire the chip manufacturer for $5.4 billion.

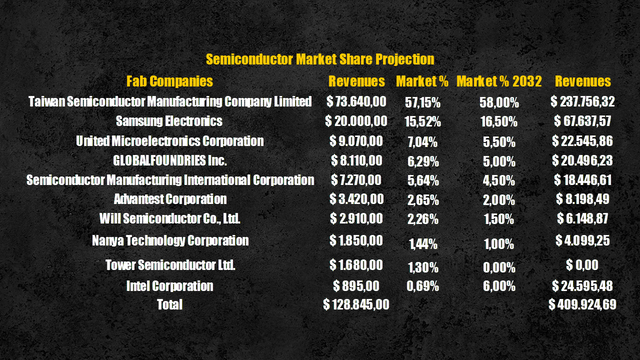

Currently, the runner-up is Samsung Foundries with an estimated $20 billion in revenues and a 15.5% market share. However, assuming the US chip maker keeps its promise, ten years from now we can expect it to have a market share of around 14%.

Fabs market share (Personal Data )

To get from ninth to second, Intel will have to loot its competitors of their shares, especially Samsung, which would have to settle for the bronze medal. Intel’s 20A and 18A nodes are comparable with TSMC and Samsung’s 2nm nodes currently under development, however, the company expects to start production during 2024, while its Asian competitors are said to be ready by 2025/2026.

The temporary technological lead may allow Intel to gain market shares.

Revenues Projection

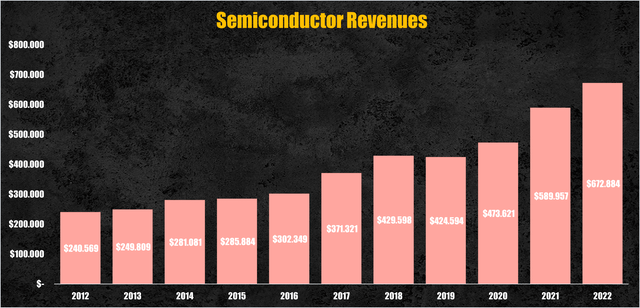

Semiconductor foundries generated $128 billion in revenues last year, accounting for 19% of total industry revenues equal to $672 billion.

Semiconductor revenues (Personal Data)

In my recent analysis of the industry, I projected the semiconductors revenues to reach $2.7 trillion by 2032, growing at a CAGR of 12.27%, basing my assumption on how much and how well, collectively, semiconductor companies have reinvested for future growth.

Assuming the percentage of revenues from the Fabs segment to remain constant, pure-play foundry companies are expected to generate $409 billion by 2032.

Semiconductor revenues projection (Personal Data)

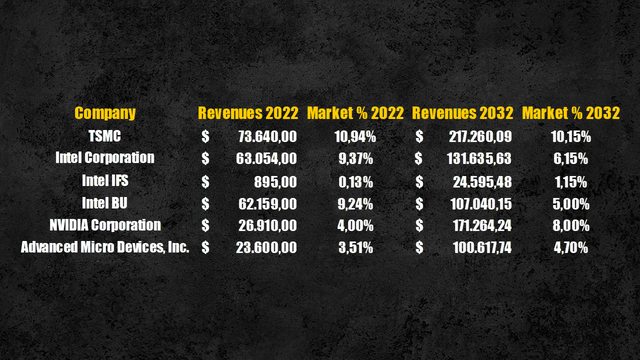

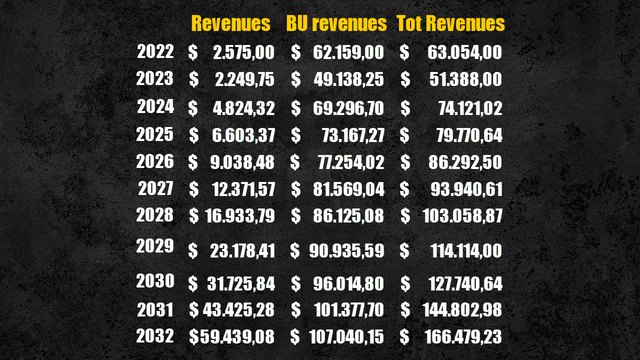

As the second largest external Fabs with a market share of around 14%, Intel would generate almost $60 billion by the IFS unit, almost equal to its 2022 total revenues of $63 billion.

However, Intel’s main business model is designing and selling its own chips. Currently, the Business Unit accounts for 9% of the total semiconductor industry, but as competition is rising, I expect it to decline to 5% by 2032, which translates into $107 billion generated by the sale of integrated chips to OEM.

Business Unit revenues (Personal Data)

As Intel has to invest heavily in both chip and node development, it’s hard to believe it will maintain a dominant position against its Fabless competitors which have access to resources on par with Intel’s, but solely focus on one task. In addition to that, the CPUs market is threatened by the increasing adoption of GPUs – like Nvidia’s ones – especially for data centres and AI needs, given their better suitability for advanced computing needs.

With that said, in a successful turnaround scenario, Intel’s revenues are expected to sit around $166 billion by 2032.

Intel total revenues projection (Personal Data)

Efficiency & Profitability

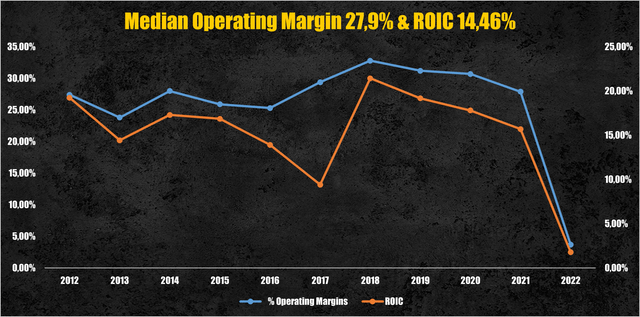

Moving on to efficiency and profitability, as the new strategy started to be implemented – pouring billions into R&D and capital expenditures – the operating margin and the return on invested capital (ROIC) tumbled. The operating margin dropped from a median value of 28% to 3.7% in 2022, while the ROIC from 14% to 3.5%.

Intel operating margin & ROIC (Personal Data)

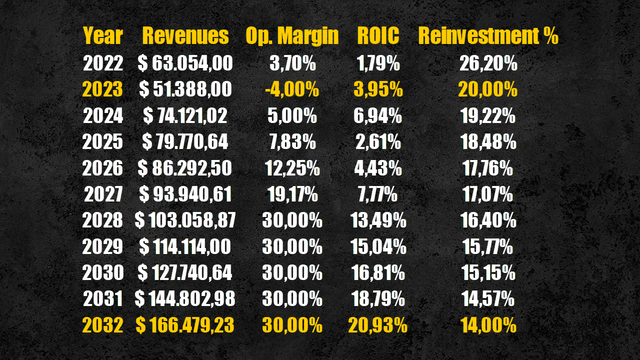

The story I’m telling sees Intel forced to keep investing billions in the coming years if it wants to gain ground with its competitors, with an operating margin remaining well below its historical values. However, as we are implying Intel manages to turn around, I expect the company to recover an operating margin of 30% by 2032.

The reinvestment margin, which shows what percentage of revenues a company is reinvesting for growth, will remain higher than its median value of 17%, as with no reinvestments there’s no way Intel can become the number two foundry in the world. Again, as it approaches maturity is plausible the reinvestment margin will decline a little, but I still expect it to remain around 14% as the semiconductor industry requires never-ending innovation.

With these assumptions, the ROIC is expected to remain lower than its 10-year median value, close to nearly 21%.

Intel future efficiency and profitability (Personal Data)

Cash Flows Projection

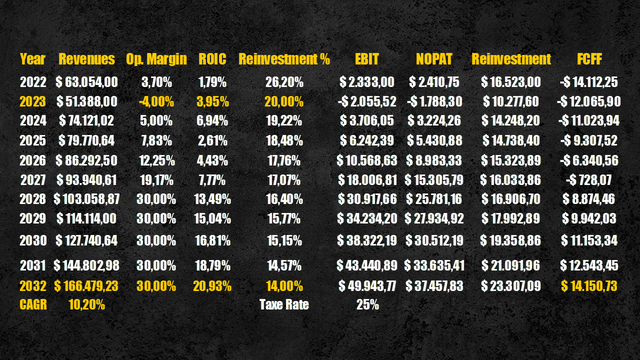

Investing for growth won’t come cheap. Intel’s free cash flows to the firm (FCFF) are expected to remain negative for many years to come as capital expenditures and R&D will burn all the operating income generated by the company.

That’s the price to pay for having slept while the competition was innovating. In a turnaround hypothesis, by the time it enters the steady state, we can assume Intel will regain its competitiveness and return to deliver big FCFF expected to reach $14 billion by 2032.

Intel cash flows projection (Personal Data)

Valuation

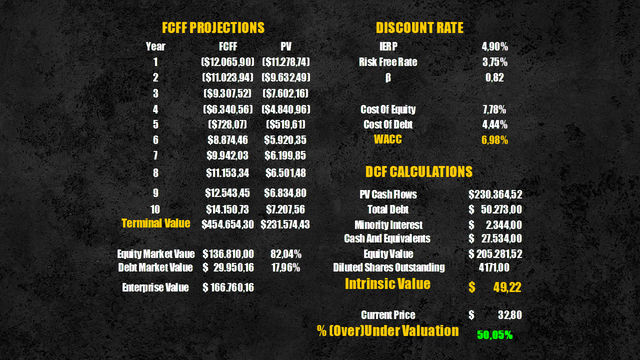

Applying a discount rate of 6.98%, calculated using the WACC, we obtain that the present value of these cash flows is equal to $205 billion or $49 per share.

Compared to the current prices, Intel’s stocks result undervalued by 50%.

best case scenario (Personal Data)

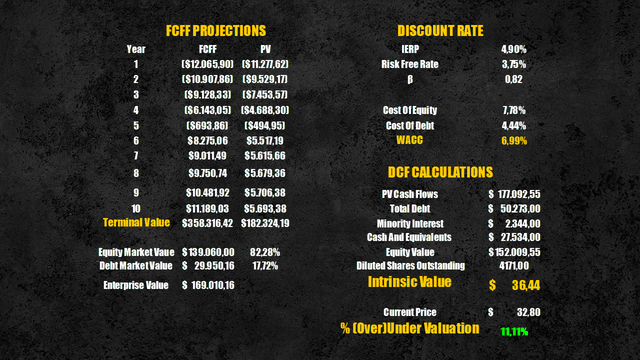

However, this was the scenario where the turnaround strategy succeeded. I wrote another narrative for Intel where it fails to become the second-largest external foundry by 2030.

In this scenario, instead of assuming Intel to achieve a 14.5% market share, I assumed it to conquer only the 6% of the Fabs segment, placing third, but with a far lower portion of the market. Worth to be mentioned that, if Intel fails with its strategy, other foundries like TSMC – which I recently analysed – would benefit a lot.

Intel worst case market share (Personal Data)

IFS revenues would be equal to $24 billion, while total revenue would amount to $131 billion by 2032, assuming the Business Unit segment remains the same as in the first scenario.

Intel would still have negative FCFF in the coming years, and by 2032 they would sit at around $11 billion.

With these assumptions, Intel’s intrinsic value is $152 billion or $36.4 per share, very close to its stocks’ current market price.

worst case scenario (Personal Data )

Conclusion

It’s clear that the market has not much faith in Intel keeping its word and turning around the situation. However, the market is so pessimistic right now that, even assuming the Fabs business to be a failure, Intel still results undervalued by 11%.

There are several risks involving the company, among all, the deserved lack of trust in the company to deliver the promised results, but if you believe that Intel will be able to deliver what it has promised Intel’s stocks can represent an interesting turnaround play at today’s prices.

If you’re looking for in-depth analysis of stocks and detailed industry reports, follow me and turn on the notification button to avoid missing any new updates.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.