Summary:

- Intel might potentially invest in Arm’s IPO, according to recent media reports.

- Arm is a key AI play, so there are good reasons for Intel to invest in Arm from a financial angle, and to boost the prospects of its foundry business.

- I maintain my Buy rating for INTC considering its near-term prospects and the opportunity for value creation via good capital allocation moves like an investment in Arm.

Justin Sullivan

Elevator Pitch

My rating for Intel Corporation’s (NASDAQ:INTC) shares is a Buy. I previously noted that INTC has a good chance of witnessing a meaningful stock price recovery due to its favorable revenue and cost guidance as per my prior write-up.

Recent news flow relating to INTC potentially becoming one of Arm Holdings’ (ARMHF) IPO investors has prompted me to publish an update on Intel. Assuming that INTC does eventually invest in Arm, this could act as a re-rating catalyst for Intel. Specifically, Intel might benefit from both Arm’s post-IPO share price outperformance (as a financial investor) and increased business for its foundry segment (due to a stronger relationship with Arm) as an anchor investor for Arm’s listing.

Intel Could Be A Potential Anchor Investor For Arm’s Public Listing

Seeking Alpha News reported earlier on Tuesday June 13, 2023 that “chip designer Arm is in discussions with potential strategic investors, including Intel, to be an anchor investor” for its proposed US IPO. It is worthy of note that Japanese conglomerate SoftBank (OTCPK:SFTBY) is Arm’s parent.

This isn’t the first time that Intel or its key peers have been linked with partnerships or investments associated with Arm.

Earlier in the year, INTC disclosed that the company’s foundry business will collaborate with Arm to “manufacture the next-generation of mobile chips” as highlighted in an April 13, 2023 Seeking Alpha News article. At its Q1 2023 earnings briefing on April 27, Intel referred to the co-operation with Arm as “a strong ecosystem statement for our foundry offerings”, and INTC stressed that it expects to “have a broader play over time.” As such, INTC is likely to be interested in having a stake in Arm with an eye on further collaborations in the future.

Separately, NVIDIA Corporation (NVDA) had an interest in acquiring Arm starting in 2020, but NVDA eventually gave up on such plans last year due to regulatory hurdles. At the end of the last month, NVIDIA Corporation and Softbank revealed that they are working together “on a platform for generative AI” using the Arm-based “NVIDIA GH200 Grace Hopper Superchip.” This brings us to the topic of the next section: Intel’s interest in Arm might be driven by the desire to capitalize on AI-related growth opportunities.

The Rise Of AI Shines The Spotlight On Arm

Intel’s CFO David Zinsner emphasized at the recent TD Cowen’s TMT Conference on May 31, 2023 that INTC can “ride the wave of AI” on both “the product side”, and “on the foundry side by providing wafers to those customers that have products that address the AI market.” INTC’s CFO was probably thinking of Arm when he was making that statement at TD Cowen’s investor event last month, considering the foundry business’ April 2023 announcement referred to in the preceding section.

On its corporate website, Arm highlighted that 85% of “premium smartphones” are “running ML (Machine Learning) on the Arm CPU or a CPU/GPU combination.” At its Q4 FY 2023 earnings call on May 12, Softbank stressed that “Arm’s chip is essential to AI” and mentioned that Arm holds the key to the SFTBY “taking a leadership position in AI.” Arm’s market share gains in recent years and its key AI applications are presented in the charts below.

Arm’s Market Shares In Various Segments For 2016 And 2021

| Arm’s Market Share | 2016 | 2021 |

| Mobile | 90% | 95% |

| IoT (Internet of Things) | 30% | 63% |

| Automotive | 10% | 24% |

| Cloud | 0% | 5% |

Source: Softbank’s Q3 FY 2023 Earnings Call On February 7

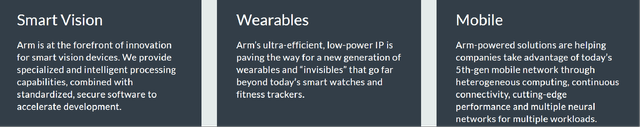

Arm’s Key AI Applications

Based on the metrics and management commentary presented above, it is pretty clear that Arm is a play on AI. Therefore, it makes sense for Intel to participate in Arm’s IPO as both a pure financial investment and a means of strengthening the ties between INTC’s foundry business and Arm.

INTC’s Capital Allocation Moves Draw Attention

Prior to the news of Intel possibly becoming an anchor investor for Arm’s public listing, there was another corporate development that should have caught the attention of INTC’s shareholders.

On June 8, 2023, Mobileye Global (MBLY) announced that Intel is putting up around 38.5 million of MBLY’s shares for sale at $42.00 apiece. Mobileye is an automotive technology company whose shares were listed on Nasdaq in October last year. MBLY’s shares have risen sharply from its IPO price of $21 to trade above $40 for a large part of the last one month, so it appears to be a wise decision for Intel to “take some money off the table” and monetize part of the company’s investment in Mobileye.

Intel could have realized divestment proceeds of approximately $1.6 billion from the sale of part of its equity interest in Mobileye. Apart from financing capital expenditures and other growth plans, it will be reasonable to assume that a potential investment in Arm is one area where Intel’s divestiture proceeds associated with MBLY can be put to good use. As highlighted above, participating in Arm’s IPO as an anchor investor will enable Intel to benefit from the AI wave.

Closing Thoughts

I remain bullish on Intel due to its improving outlook, and this is evidenced by the company’s expectations of reaching the high end of its second quarter top line guidance as indicated at a recent investor conference in end-May. The recent news report on INTC’s potential investment in Arm suggests that there are opportunities for Intel to create value via accretive capital allocation initiatives such as investing in Arm. Taking into account potential catalysts relating to results beats and capital allocation moves, I stick with a Buy rating for INTC.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!