Summary:

- Intel’s partnership with AWS for its advanced 18A node sparks excitement, but the company’s financials remain a concern with $25 billion in net debt.

- Intel’s restructuring efforts, including cutting $10 billion in opex and shedding 15,000 jobs, cast doubt on its ability to reignite stable revenue growth.

- Despite the AWS partnership, Intel’s valuation at 2x this year’s sales and negative free cash flow until 2025 make it a risky investment.

- I recommend staying clear of INTC, as better investment opportunities exist elsewhere, given Intel’s uncertain growth prospects and significant long-term risks.

DNY59/E+ via Getty Images

Investment Thesis

Intel (NASDAQ:INTC) caught the news wave, with the announcement that Amazon (AMZN) will be partnering up with Intel for its advanced 18A node. The stock rallied up more than 8% after-hours as bargain hunters stepped in to catch what looks like from a well-orchestrated PR effort to be a bargain stock.

But then, the facts step in. We are looking at a business that is only expecting to be free cash flow positive in 2025. And on top of that, we have around $25 billion of net debt to tackle.

Yes, the stock is meaningfully lower in the past 6 months, the past year, and the past 5 years. But this isn’t a bargain investment that I recommend investors chase. Stay clear of INTC.

The Big News for Intel’s 18A

Intel’s partnership with AWS highlights a deepening collaboration. Intel will focus on developing custom chip designs to support AWS’s growing infrastructure needs.

Intel’s Foundry will produce AI fabric chips on its advanced 18A node. This builds upon their existing relationship, where Intel has been supplying AWS with Xeon Scalable processors.

The partnership is a multi-year agreement aiming to appease doubters that Intel is still able to sign up tier-1 cloud hyperscalers.

Also, yesterday’s press release discussed Intel’s plans to bolster its foundry business, as Intel plans to establish Intel Foundry as an independent subsidiary.

This move aims to provide greater operational transparency, financial flexibility, and clearer separation for external customers and suppliers. The new structure will also enable Intel Foundry to pursue independent funding opportunities and optimize its growth strategies.

While maintaining its leadership team, Intel Foundry’s transition is designed to enhance collaboration with Intel’s product division.

Does this line up the Intel Foundry business unit for a near-term spin-off? Possibly. Or perhaps, there could be a partial spin-off of Intel Foundry, where Intel remains the majority shareholder, holding 80% of the stock, simply to give investors a sense of the Intel Foundry business as being undervalued inside Intel’s total business.

With that update in mind, let’s now discuss its fundamentals.

Revenue Growth Rates Don’t Inspire Much Hope

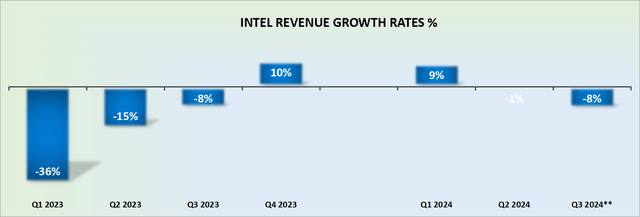

INTC Revenue Growth Rates — author’s work

Intel’s growth rates have a long while been dismal. This is not new news to anyone. The only question that investors has to ponder is, at what point in time will Intel be in a position where it can return to stable growth?

What’s more, given that Intel is now having to cut back around $10 billion of opex in its mass restructuring plan and to shed 15,000 from its workforce this year, I struggle to see a scenario where Intel can reignite its revenue growth rates on a stable and predictable basis.

With that in mind, let’s now discuss Intel’s valuation.

INTC Stock Valuation — 2x This Year’s Sales

As an Inflection investor, we must always think about the company’s financial footing. On this front, Intel, with approximately $25 billion of net debt, scores poorly. There’s no disguising this aspect.

And then, to complicate matters, for 2024 Intel expects adjusted free cash flow to be modestly negative, driven by restructuring payments and reduced capital spending, despite its best efforts to reduce capital investments.

And then, next year, by 2025 once the dust has settled, Intel anticipates achieving positive adjusted free cash flow, supported by operating expenses reduced to approximately $17.5 billion and net capital expenditures between $12 billion and $14 billion.

So, in sum, investors are having to think long and hard about whether it truly makes sense to back Intel at this stage. I don’t believe it does.

What is the most likely scenario is that investors will move to buy the dip, and then, in the coming days and weeks, as the stock fails to gain much traction, investors will sell at an even lower price point.

Altogether, I believe that there are much better investment opportunities elsewhere.

The Bottom Line

In conclusion, while Intel’s recent news about its AWS partnership might spark excitement, the reality of its financial situation remains concerning.

With approximately $25 billion in net debt and expectations to become free cash flow positive only by 2025, the long-term risk seems too significant for a BUY.

The company’s restructuring efforts, alongside uncertain growth prospects, paint a tough road ahead.

I believe Intel’s future performance will continue to fall short of expectations — this is a “sinking chip”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.