Summary:

- Intel shares surged after reports of Qualcomm’s takeover interest, amid Intel’s financial struggles and restructuring efforts.

- Qualcomm’s acquisition of Intel’s chip design business could boost Qualcomm’s revenue and earnings, especially in PC and server markets.

- Anti-trust concerns exist but may be manageable, particularly if the foundry business is spun off as planned.

tupungato

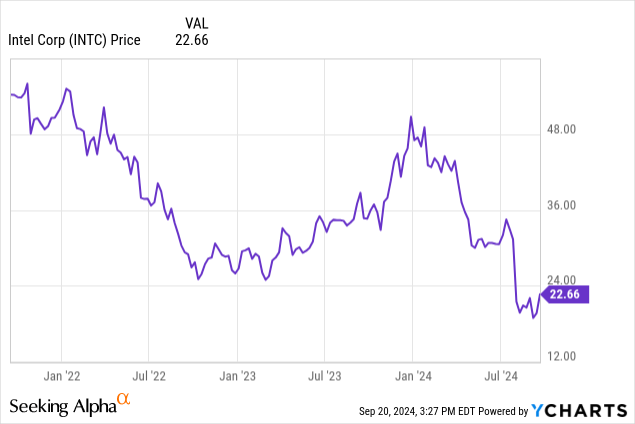

Intel Corporation (NASDAQ:INTC) shares jumped Friday towards the end of the day after a report from the Wall Street Journal that QUALCOMM Incorporated (NASDAQ:QCOM) has approached it with a takeover offer, citing people familiar with the matter. This comes at a time when Intel is attempting to turn around its foundry business and is facing substantial financial struggles. Let’s discuss the pros and cons of such a deal.

The headlines just keep on coming for Intel. According to the WSJ, Qualcomm has begun discussions with Intel on a possible takeover bid as the latter’s stock has cratered following the announcement of a significant restructuring and ambitious turnaround plan. While there aren’t many details out yet, I figured it’d be useful to discuss the pros and cons of such a deal.

To be clear, this isn’t the first we’ve heard of Qualcomm’s interest in Intel: just a couple of weeks ago, there were multiple reports that Qualcomm was interested in potentially purchasing Intel’s chip design division, specifically for PC processors. The server and foundry businesses wouldn’t have made much sense due to a lack of synergies between those segments and Qualcomm’s core business, but now with reports of a potential acquisition, the game changes a bit.

Realistically, there’s almost a zero percent chance that a potential deal between Qualcomm and Intel includes the foundry: it’s bleeding cash, is on its way towards a spin-off down the road anyway, and Qualcomm has been a happy Taiwan Semiconductor Manufacturing Company Limited (TSM) customer for years. Should an acquisition come to fruition, I imagine it will speed up Intel management’s timeline for the spin-off to perhaps sooner than they were expecting. Another possibility is that interest from Qualcomm was already expressed before the emergency shareholder meeting, where Intel decided to make the foundry an independent subsidiary. In that case, that decision might have been setting the stage for an eventual acquisition + carve-out.

As for Intel’s design business, that would be an interesting play here for Qualcomm, which mostly focuses on mobile processors. Intel’s PC chip design is still top-notch, and is a profit center for the company, and would be accretive to Qualcomm’s top and bottom line. This would get a little hairy with the likelihood that some manufacturing would need to be locked into Intel’s foundry in the event of a spin-off. However, this could be successfully navigated, especially if Intel’s 18A node turns out to be as successful as early signs indicate.

The server chip design business is also intriguing. Qualcomm has been attempting to break into the server market for some time now, with middling success. Intel’s server business is also a profit center and with the AI boom well underway with more room to run, I could definitely see Qualcomm being interested in making the leap and reaping the potential benefits.

There is, of course, also the question of antitrust risk. Qualcomm has a market cap of around $193.7 billion, and Intel is worth around $90.9 billion, which would be a significant merger and garner lots of attention. On the one hand, the US government wants Intel to succeed, as evidenced by the $3 billion in CHIPS funding the company has received, so would be inclined to allow Qualcomm to swoop in and provide resources to turn it around. However, if the structure of the takeover de-emphasizes the foundry or puts it at risk, I could see the US authorities demanding concessions or guarantees to keep it chugging along.

Generally, though, an Intel-Qualcomm merger would create a company with its hands in plenty of different pies, but wouldn’t increase its share in a single market to alarming levels from a monopolistic perspective, in my opinion. So I do think a potential merger would be able to get over the antitrust line, assuming the foundry concerns are addressed.

Investor Takeaway

While I favor an Intel turnaround, an acquisition by Qualcomm would also be a solid option for shareholders, pending details on the takeover price, of course. Qualcomm’s and Intel’s business complement nicely and, while I think Intel has the means and resources to succeed going forward, Qualcomm is a well-run and efficient company. Intel investors should be content with shares in QCOM as a part of an eventual takeover deal.

From Qualcomm’s perspective, Intel’s design business would be accretive to revenue and earnings and open up new markets that have been tough to break into. The foundry business is the albatross hanging over the whole deal, but there are certain paths for this to be beneficial to shareholders of both companies.

Do I think this takeover is realistic? Considering Intel’s struggles, I wouldn’t be surprised if this was seriously considered by management. Whether shareholders will accept it is another matter entirely, but from a strictly business perspective, I think there are potential mutual benefits.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.