Summary:

- On January 26, 2024, Intel Corp stock fell by almost 12 % following the publication of weak guidance for FY2024, while the rest of the market was rather neutral.

- The firm’s outlook raised concerns, especially compared to the optimistic outlook in the tech industry’s early stages of the generative AI revolution.

- Intel’s strategic focus for FY2024 includes multi-faceted execution, emphasizing catching up in data-center-based AI while maintaining a lead in on-device AI.

- The problem with INTC, in my opinion, is that while they just talk about their plans, other companies are simply doing their job and continuing to take market share.

- The market seems to be undervaluing the company based on the EPS forecasts, but I don’t expect this undervaluation to last long. I don’t advocate buying the INTC stock at the moment, nor do I see strong grounds for short selling. Hence, the neutral rating.

Leon Neal

Introduction

On January 26, 2024, Intel Corp (NASDAQ:INTC) stock fell by almost 12 % following the publication of weak guidance for FY2024, while the rest of the market was rather neutral – the S&P 500 Index (SPX) closed down slightly by 0.07%.

If you follow the company, you have probably already read some analysis articles about the past quarter (Q4 FY2023) and the infamous guidance for this year. I also decided not to stick around and try to assess how bad INTC’s setup is in terms of potential stock growth this year and beyond.

Q4 FY2023 Facts And Q1 FY2024 Guidance

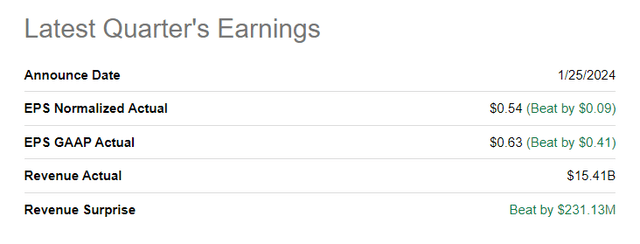

In the fourth quarter of 2023, Intel reported revenue of $15.4 billion, showing a 10% YoY increase and a 9% sequential increase, surpassing the consensus revenue estimate and exceeding the midpoint of its guidance range. Non-GAAP profit for the quarter was $0.54 per diluted share, a significant increase from the previous year (+440% YoY), which was also a solid beat to the consensus:

Seeking Alpha

However, Intel fell short of expectations in guiding for the first quarter of 2024. The firm’s outlook raised concerns, especially compared to the optimistic outlook in the tech industry’s early stages of the generative AI revolution. Intel faced challenges in the data center segment, lagging in the AI transformation of cloud and enterprise data centers. The guidance of $0.13 in Non-GAAP EPS in Q1 FY2024 looks like a great thing when we compare it to the loss of the past year, but as the Seeking Alpha News team noted, Wall Street analysts were anticipating 42 cents per share, so INTC missed by a factor of ~3.2x, which is a lot.

For 1Q24, Intel projects revenue of $12.2-$13.2 billion, which at the $12.7 billion midpoint would be up 9% from the prior year. It projects a non-GAAP gross margin of 44.5% and a non-GAAP profit of $0.13 per diluted share at the guidance midpoints. In the year-earlier quarter, Intel posted a non-GAAP loss of $0.04 per share.

Source: Argus Research’s note [proprietary source]

But if the company achieved a positive result in Q4 after losses, it wasn’t that bad, was it? According to the management’s earnings commentary, nothing bad actually happened to the company.

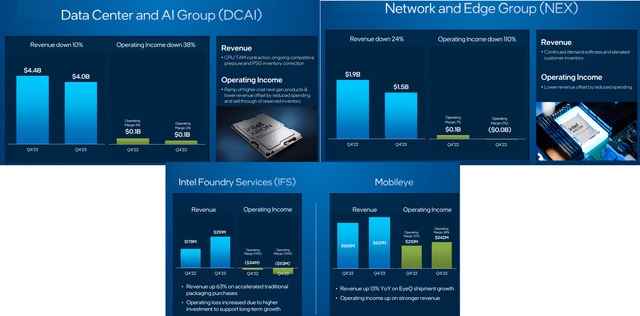

In terms of business segments, Client Computing showed strong performance in 4Q, with revenue of $8.8 billion, up 33% year-over-year. Yes, Data Center and AI Group (DCAI) faced challenges, with a decline in revenue to $4.0 billion. Network and edge revenue also declined, but the emerging business segments, including Mobileye, Intel Foundry Services, and Others, showed mixed results.

INTC’s IR materials, author’s compilation

CEO Pat Gelsinger highlighted Intel’s accomplishments in 2023, describing it as a year of “tremendous progress” toward the IDM 2.0 transformation. The second half of 2023 saw a notable momentum shift, particularly in Intel’s PC business, experiencing double-digit revenue growth in 4Q FY2023.

Intel’s strategic focus for FY2024 includes multi-faceted execution, emphasizing catching up in data-center-based AI while maintaining a lead in on-device AI. The company achieved a milestone in high-volume manufacturing of logic devices using extreme ultra-violet (EUV) lithography in 2023. Intel is aggressively advancing its processor technologies, with the Intel 3 nm process node on track, and plans to launch Sierra Forest and Granite Rapids in 1H FY2024. The company’s ambitious five nodes in four years strategy includes breaking into the Angstrom era with Intel 20A and Intel 18A, incorporating gate-all-around and backside power delivery. INTC aims to achieve manufacturing readiness for Intel 18A in 2H FY2024, marking a return to process leadership.

Intel is also investing in Intel Foundry Services (IFS) with aggressive plans, aiming to become the second-largest external foundry company by 2030. The company sees AI as a significant driver for IFS business, with commitments of up to $10 billion and expectations for acceleration in the latter half of the current decade. Just recently, Intel received a $3.2 billion grant from Israel for a semiconductor foundry and opened a fab in New Mexico. The company plans substantial investments in Germany and the U.S., demonstrating its commitment to growth and innovation.

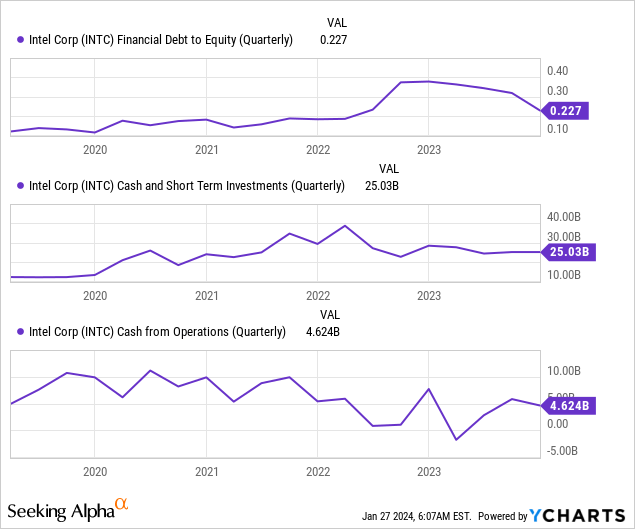

In general, the company seems to have sufficient liquidity to implement its plans and the debt-to-equity ratio indicates that there is some kind of reserve for future debt financing.

CEO Gelsinger outlined Intel’s commitment to AI, emphasizing an open ecosystem across various segments. The company hosted the ‘AI Everywhere’ launch event in December 2023, showcasing its AI product portfolio for the data center, cloud network, edge, and PC.

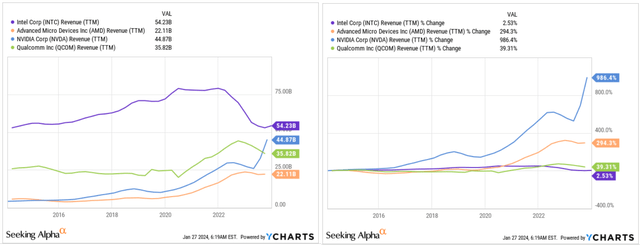

What can’t be ignored is the company’s plethora of plans to conquer the current trend in AI development. The problem with INTC, in my opinion, is exactly that: while they just talk about their plans, other companies are simply doing their job and continuing to take market share from Intel. The former industry leader has been catching up with younger and fast-growing companies for a few years now, but it seems as if INTC is simply unable to do that.

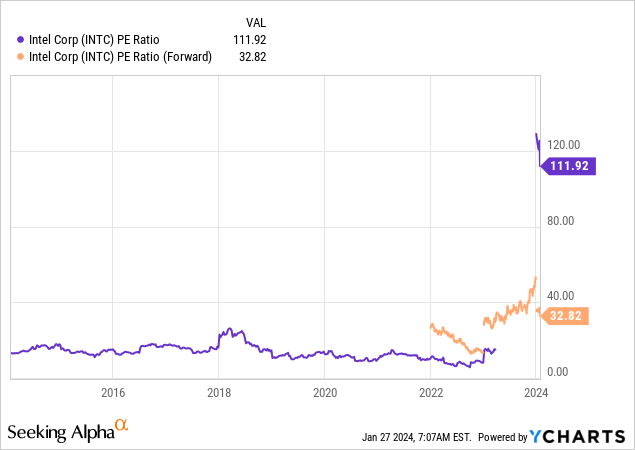

YCharts, author’s compilation

They keep working on the foundry business, but that is just now really getting going. The market allowed INTC to show its strength and rightly expected strong guidance from the company, which did not materialize – the embedded expectations, thanks to which INTC stock has risen 65.15% (excluding divs) since the beginning of 2023, were no longer justified. The company’s efforts to roll out artificial intelligence everywhere have mostly put the company in areas where the market is weakening, rather than where the industry is currently performing best, as was noted by the Earnings Whispes X account’s interpretation of INTC’s earnings call. And I couldn’t agree more.

Intel Is Cheap, But Likely Not For Long

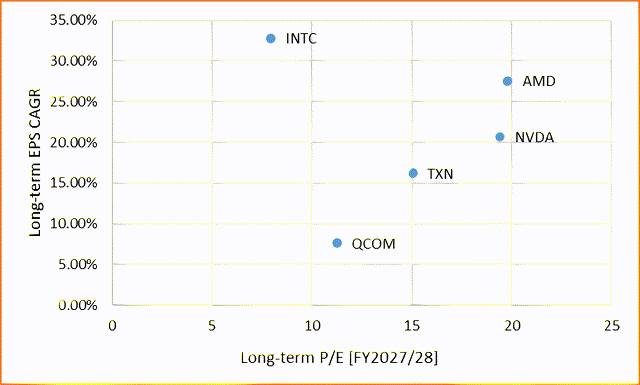

If you’ve perused my earlier articles, you’re likely acquainted with one of the valuation methodologies I consistently employ when assessing different companies. This approach involves juxtaposing companies’ EPS long-term growth rates with the implied P/E multiples in the final forecast year. Simply put, I endeavor to assess how ‘fairly’ a particular company is valued by gauging its expected growth rates and valuation.

Looking at Intel, the market seems to be undervaluing the company, mainly due to its priced-in ~33% EPS growth rate (CAGR) until 2028 and the relatively low FY2028 P/E of ~8x:

Author’s work, based on Seeking Alpha Premium data

However, it’s crucial to note that these assessments were based on expectations before Intel reported its 4th-quarter results. Analysts haven’t adjusted their forecasts yet, and I believe they should do so in the coming days.

I expect that Intel’s future growth rates will roll down way lower compared to what we see today, leading to a potential increase in the FY2028 P/E ratio and a decrease in long-term and medium-term growth rates in EPS (these 2 metrics are very related to each other, as you might have guessed without me). Essentially, the current undervaluation could shift to a fair valuation at best or even turn into an overvaluation, in my view.

The tailwind of AI development is set to drive industry growth, and it’s clear to me that Intel will likely experience an accelerated growth rate, but considering the company’s recent underperformance in contrast to its peers, especially in the last few quarters, I anticipate a notable decrease in its valuation. This decline is expected to outpace the currently implied multiple contraction, and when we examine historical norms, there appears to be “substantial room” so to speak for a decline in valuation ratios.

The Verdict

I’ve opted for a Neutral/Hold rating for the company this time because, despite the stock being cheaper than most competitors currently, its future hinges on management’s success post the 1st quarter of 2024. And that alone gives the market a great deal of uncertainty, which it generally exploits coldly and does not allow the stocks of such companies to grow.

In my view, investors might fall into the classic value investing trap. While Intel currently offers a discount compared to its peers, its growth rates aren’t particularly strong or stable. Some other companies may have lower absolute revenue figures but boast significantly higher growth rates, justifying their premium over Intel.

In my opinion, it’s prudent to await the next quarter’s results and management updates to gauge the short-term nature of the company’s current challenges. If the negatives persist, Intel’s decline might go deeper than observed on January 26th.

So I don’t advocate buying the INTC stock at the moment, nor do I see strong grounds for short selling. Hence, the neutral rating.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!