Summary:

- Intel stock jumps after beating analyst estimates and guiding for a better-than-expected second half of 2023.

- The company’s Q2 results show a recovery in margins and progress in addressing financial strain.

- Intel’s CEO expresses confidence in the company’s strategic priorities and expects sustained recovery in the PC market.

- I am raising my EPS targets through 2025 and now advocate a $45.54/ share target price for INTC.

Justin Sullivan

In late May I upgraded Intel (NASDAQ:INTC) stock to a ‘Hold’, after multiple ‘Sell’ ratings, arguing that I see tailwinds from an improving demand backdrop supporting Q2. Now, after Intel reported results for the July quarter, there should be little doubt left that Intel’s economic fundamentals are indeed improving.

Intel stock jumped close to 7% on the trading day post earnings release, after the chipmaker beat analyst consensus estimates on both topline and bottom line, as well as guided for a better-than-expected 2H 2023.

While Intel still has “structural problems”, most of which are anchored on competitive pressures, I revise my EPS projections for INTC through 2025; and I now calculate a fair implied target price of $45.54/ share.

For reference, Intel stock is outperforming the broader market YTD by almost 2x: Since the start of 2023, INTC shares are up close to 38%, versus a gain of approximately 20% for the S&P 500 (SPY).

Q2 Beat Supports Turnaround Thesis

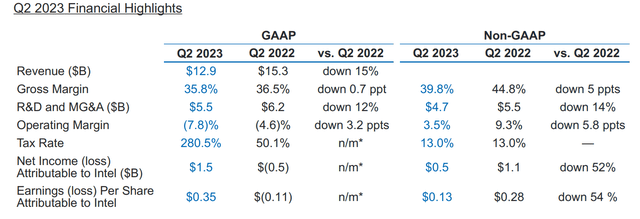

On Thursday 27th after market close, Intel reported its Q2 2023 results, surprising analysts with regards to both topline, as well as a faster-than-expected return to profitability. During the period from April to the end of July, the chipmaker generated total consolidated group revenues of $12.9 billion, down from $15.3 billion for the same period in 2022 (~15% YoY contraction), but materially above the $12.05 billion expected by analysts (~$850 million beat according to data compiled by Refinitiv).

With regards to profitability, Intel delivered a sharp recovery in its margins: Intel’s Non-GAAP gross margin and operating profit margin came in at 39.8% and 3.5% respectively; Post-tax profit was reported at $0.5 billion ($0.13/ share), down about 54% YoY, but beating analysts’ estimates by ~$0.55 billion (~$0.13/ share) at midpoint consensus.

Furthermore, in Q2 Intel made progress in addressing some of the financial strain that resulted in negative free cash flow of over $9 billion in the first quarter. Through lower capital spending and better working capital management, the cash outflow in Q2 has been reduced to under $3 billion.

Reflecting on a strong FY23 Q2 reporting, Intel’s CEO Pat Gelsinger commented:

Our Q2 results exceeded the high end of our guidance as we continue to execute on our strategic priorities, including building momentum with our foundry business and delivering on our product and process roadmaps … We are also well-positioned to capitalize on the significant growth across the AI continuum by championing an open ecosystem and silicon solutions that optimize performance, cost and security to democratize AI from cloud to enterprise, edge, and client.

Specifically, I would like to point investors’ attention to the “Client Computing” segment (CCS), which is Intel’s flagship PC chip business. In Q2 2023, CCS generated $6.78 billion in sales, as compared to $5.8 billion in Q1, up an astonishing 17% QoQ, and as compared to $6.1 billion estimated by analysts, implying a ~$600 million expectations beat.

A Look into Q3 2023

Looking ahead, the PC market (Intel’s CCP) will likely continue to improve and support Intel’s financials. In that context, CEO Pat Gelsinger commented that inventories of major clients/ buyers are now back to “normal” levels, suggesting that customers are soon to enter a restocking cycle. Accordingly, Intel expects a sustained recovery in 2023’s final six months.

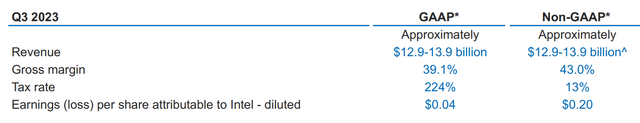

With that frame of reference, Intel guided for a Q3 above expectations: In financial terms, management expects to deliver revenues in the range of $12.9-$13.9 billion, suggesting QoQ topline expansion even at the lower end of guidance. Non-GAAP gross margin is expected to be around 43%, a close to 300 basis point jump vs. Q2. And EPS is estimated at $0.2.

Still Work To Do

Despite the positive Q2 report, investors should not forget that Intel management still has work to do, as the company remains in the early stages of a turnaround. But the latest data is encouraging.

During Q2, Intel made progress towards its strategic objectives, including the pursuit of achieving five nodes within a four-year timeframe and securing leadership in transistor performance and power by 2025:

- Intel introduced the PowerVia, a technology aimed at boosting performance and efficiency in their Intel 20A offering.

- Intel unveiled the Arc Pro GPUs, adding to their portfolio of graphics processing units.

- Intel attracted blue-chip customers such as Boeing and Northrop Grumman to join the RAMP-C program.

- Google Cloud adopted Intel’s 4th Gen Xeon Scalable processors for their AI applications.

- Intel’s signed a collaboration with Microsoft on an AI initiative.

- In networking, Intel signed partnerships with Ericsson and HPE to work on 5G infrastructure optimization based on Intel Xeon technology.

In addition, Intel remains committed to strategic investments in manufacturing capacity as part of its IDM 2.0 (Integrated Device Manufacturing) strategy. During the quarter, Intel communicated the commitment to build a semiconductor assembly and test facility in Wrocław, Poland potentially investing as much as $4.6 billion into the facility. Furthermore, Intel has solidified its plans with the German federal government to build a wafer fabrication site in Magdeburg, Germany. According to a revised letter of intent, Intel could invest as much as $30 billion, while being supported by the German government with various financial incentives (more details to follow).

Valuation Update – Raise Target Price

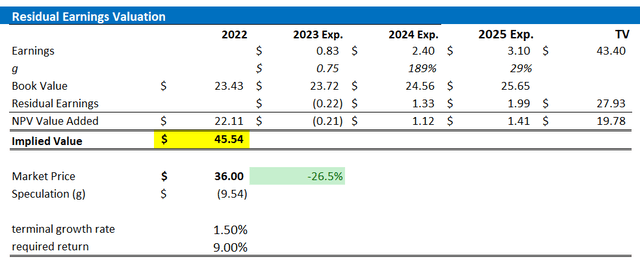

Accounting for Intel’s Q2 earnings beat and strong management commentary, I update my EPS expectations for INTC through 2025: I now estimate that the chipmaker’s EPS in 2023 will likely end up somewhere between $0.8 and 0.85, as compared to $0.75 estimated prior. Moreover, I also adjust and raise my EPS expectations for 2024 and 2025, to $2.4 and $3.1, respectively.

I continue to anchor on a 9% cost of equity, which I deem conservative, while I raise my terminal growth rate projection by 50 basis points, to 1.5% (still below nominal GDP growth, and still risk-averse, given Intel’s restructuring efforts).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for Intel Platforms equal to $45.54/ share.

Author’s Estimates & Calculation

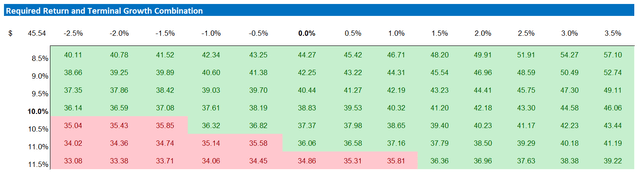

Below also the updated sensitivity table.

Author’s Estimates & Calculation

Conclusion

Intel stock jumped after the company announced Q2 2023 results, and communicated to markets a likely end to the PC slump. Through various statements, the chipmaker expressed confidence that its long-awaited comeback is finally gaining momentum, and, there might be even more upside in 2H of 2023.

Accordingly, going into Q3, management guided for topline and earnings ahead of expectations, suggesting that the chipmaker may soon be able to deliver “shareholder value” once again. With that frame of reference, I am once more raising my EPS targets through 2025; And I now see an implied target price of $45.54/ share as fair and reasonable.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.