Summary:

- Intel once again reported horrible first quarter results with declining revenues and a bottom line loss.

- Despite short-term challenges – including a recession on the horizon – I believe in Intel as long-term investment.

- Not only will the underlying market grow with a high pace, but I also assume Intel’s investments in its foundry service will pay off in the years to come.

- And returning to previous free cash flow levels is more than enough to make Intel a bargain at this point.

kynny

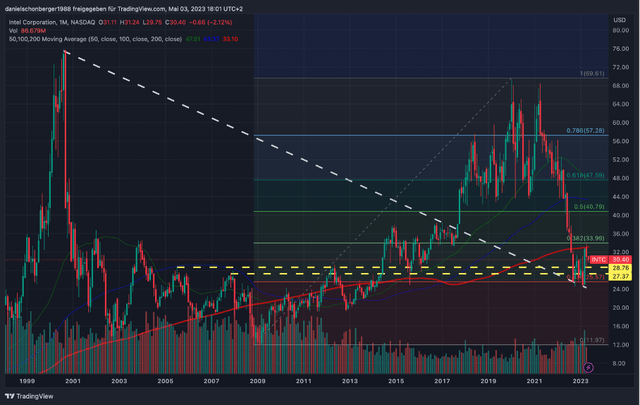

In my last few articles about Intel (NASDAQ:INTC), I was always bullish, and I must admit that did not work out great so far. My first article was published in June 2021 when Intel was trading for $56 and obviously investors did not have a lot of fun in the two years since then. My last article about Intel was published at the beginning of February and I assumed the strong support level around $25 would hold for Intel – a thesis that worked out so far. And although I am still confident the support level will hold, one can get doubtful when looking at the results Intel is reporting.

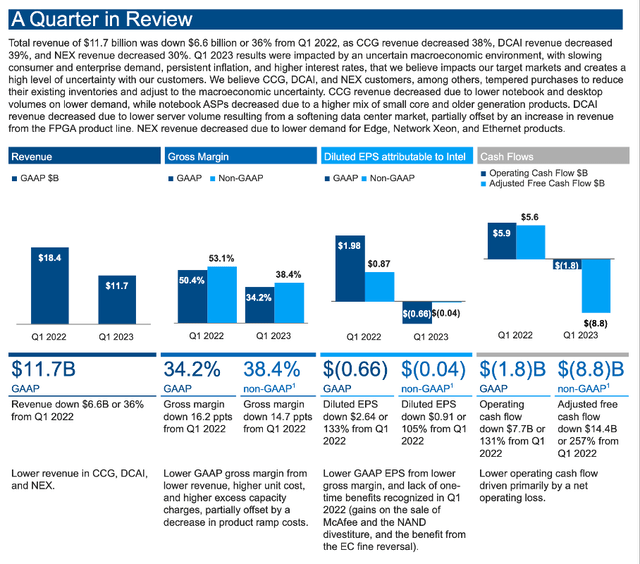

Income Statement

At the end of April 2023, Intel reported first quarter results and the numbers were horrible once again. Revenue declined extremely steep from $18,353 million in the same quarter last year to $11,715 million this quarter – resulting in a decline of 36.2% year-over-year. And instead of an operating income of $4,341 million in Q1/22, the company now had to report an operating loss of $1,468 million in Q1/23. For the bottom line the picture was similar: Instead of diluted earnings per share of $1.98 in Q1/22, the company had to report a diluted loss per share of $0.66 in Q1/23.

And even when looking at non-GAAP numbers, Intel had to report a loss per share of $0.04 in the current quarter (compared to $0.87 in earnings per share in the same quarter last year).

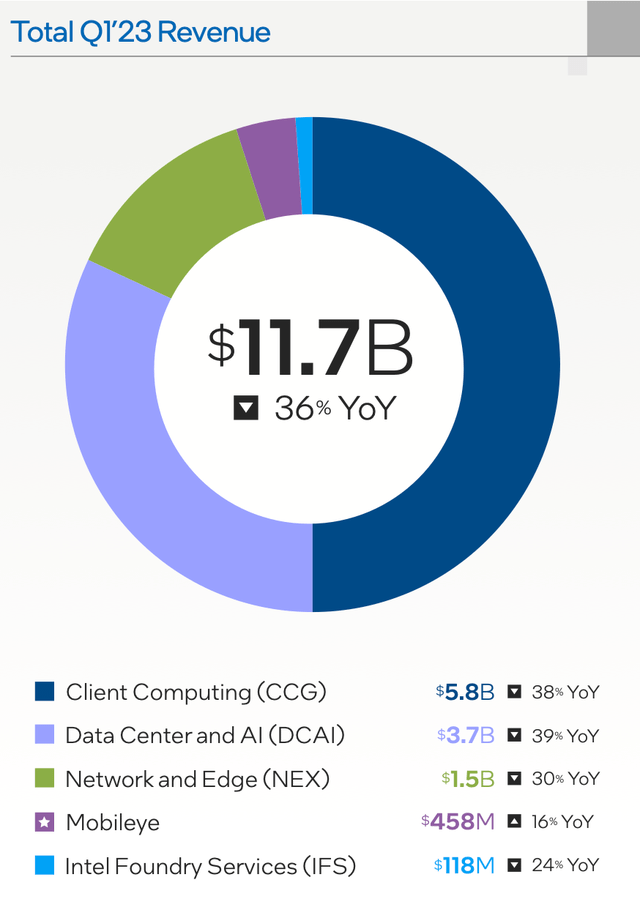

When looking at the different segments, almost all contributed to the declining top line. Only for Mobileye revenue increased from $394 million in Q1/22 to $458 million in Q1/23. But especially the two major segments, that are responsible for the biggest part of revenue (and operating income) had to report huge declines. Revenue for “Client Computing” declined 38% from $9,322 million in the same quarter last year to $5,767 million this quarter and revenue for “Data Center and AI” declined 39% from $6,074 million in the same quarter last year to $3,718 million this quarter. And the “Network and Edge” segment also saw revenue declining from $2,139 million in Q1/22 to $1,489 million in Q1/23 – resulting in a decline of 30%.

Balance Sheet

Aside from looking at the income statement we should also look at the balance sheet that got worse over the last few quarters. While total assets increased slightly, total stockholder’s equity declined slightly. But the bigger problem is the increasing debt. On April 1, 2023, Intel had $1,437 million in short-term debt as well as $48,836 million in long-term debt on its balance sheet. As a result, total debt increased from $42,051 million one quarter earlier to $50,237 million.

This still results in a debt-equity ratio of 0.50, which is acceptable. Usually, I would compare total debt to the operating income of the last twelve months. However, with that number being negative a comparison doesn’t make much sense. When looking at previous years, Intel was able to generate at least $20 billion in operating income and when assuming Intel will reach similar levels again, it would take about 2.5 years to repay the outstanding debt – also an acceptable metric.

And not only did total debt increase, but total current assets also declined – especially the highly liquid short-term investments and cash on the balance sheet. Nevertheless, Intel still has $8,232 million in cash and cash equivalents as well as $19,302 million in short-term investments on its balance sheet. This is enough to repay more than half of the company’s outstanding debt right away and only about $23 billion in debt would remain.

It is not great that debt levels increased, and the balance sheet can be seen as a little problematic as the business is not performing well and the combination of rather high debt levels and a business not being profitable and reporting negative free cash flow is a potential danger. But assuming that Intel is able to improve its business again and generate similar profits as before, the balance sheet by itself is also not a problem.

Problem: Recession

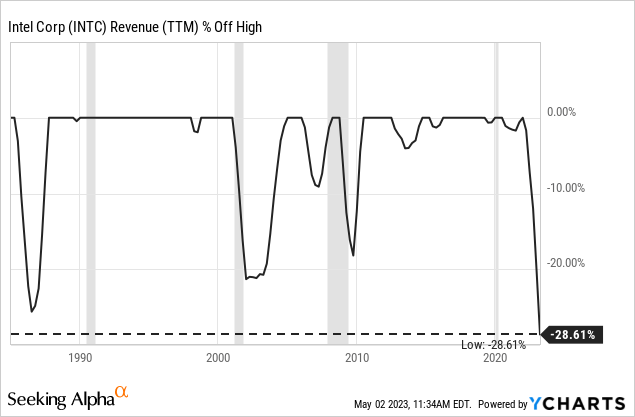

Despite the horrible results, I remain long-term rather bullish about Intel as I am confident it can turn around and generate higher revenue again. But I must also admit that I am looking rather worried at the steeply declining revenue Intel had to report in the last few quarters. When looking at the trailing twelve-month results, this is the steepest revenue decline Intel had to report at least since the mid-1980s (I don’t have older data).

We saw similar declines in the past – for example in the early 2000s or in 2009. However, for these steep declines the reason was mostly the previous recession. Now, Intel is already declining extremely steep before the economy entered a recession and as I expect another recession to hit the United States (and many other countries around the world) in 2023, I see the risk of another negative impact on Intel’s business and even lower revenue. In my opinion, Intel is not experiencing the full negative effects of a recession just yet and the risk of even lower sales in the coming quarters is rather high. Another possible scenario would be that Intel’s sales will not decline lower, but it might take several more quarters before Intel can recover as the recession will keep revenues at the current low level. This is also implying that Intel might remain unprofitable for several more quarters.

Support Level At $25

And as I have mentioned above (and in past articles), I see the support level around $25 as very strong, but I don’t want to make a huge bet on Intel being able to defend that support level. I see it as likely that Intel will hold that level as the stock is already cheap. But considering the already horrible results and expecting these results to continue for several more quarters I don’t want to rule out investors panicking and selling shares increasing the selling pressure dramatically.

But during the earnings call, Pat Geisinger was cautiously optimistic that the PC market might have reached its bottom, while the server and networking markets were still in decline:

As the industry continues to navigate through multiple global challenges and headwinds, we remain cautious on the macro outlook, even as we expect some modest recovery in the second half. We are seeing increasing stability in the PC market with inventory corrections largely proceeding as we had expected.

However, the server and networking markets have yet to reach their bottoms as Cloud and Enterprise remain weak. As a result, our Q2 revenue guide embeds continued inventory corrections in our core markets and a range of normal seasonal to better-than-seasonal growth off depressed Q1 revenue levels.

And this cautiously optimistic outlook can be seen as an argument for the support level around $25 holding. From current price levels, Intel can drop around 20% again without falling below that support level.

Long-Term Strategy

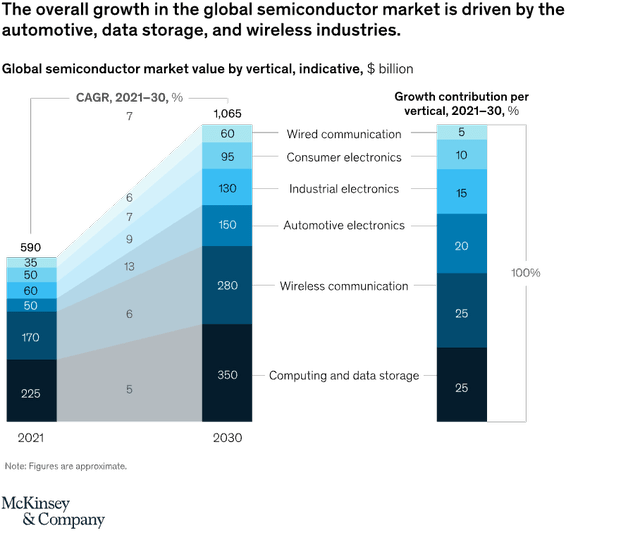

Over the next few quarters, I don’t want to make predictions how the stock will perform, and it is also difficult to say if Intel might see further declining revenues or if the bottom is reached. As long-term investors I also don’t care much about the performance in the next few quarters – I am rather interested in the company’s long-term strategy. And while fully acknowledging that Intel is a cyclical business, Pat Geisinger is seeing significant growth in the semiconductor industry until 2030:

While the semiconductor industry is cyclical by nature, we continue to accelerate our transformation and position ourselves to capture the significant market growth in semis expected over the next decade, nearly doubling to more than $1 trillion by 2030. Combined with the need for globally balanced and resilient supply chains and a foundry market expected to be roughly $200 billion by 2030, we are well-positioned to capitalize on multiple vectors of growth.

And these are not only the optimistic assumptions by the Intel CEO. In an article published about a year ago, McKinsey authors called this the semiconductor decade and are expecting a trillion dollar industry. In the article they are writing:

In many ways, our world is “built” on semiconductors. With chip demand set to rise over the coming decade, semiconductor manufacturing and design companies would benefit now from a deep analysis of where the market is headed and what will drive demand over the long term.

And going on:

Drilling down into individual subsegments, about 70 percent of growth is predicted to be driven by just three industries: automotive, computation and data storage, and wireless.

And in total, McKinsey is expecting the semiconductor market to grow with a CAGR of 6.8%.

This is backed up but other studies and statistics expecting similar growth rates. On the other hand, we also find studies expecting a CAGR around 12% for that market until 2030.

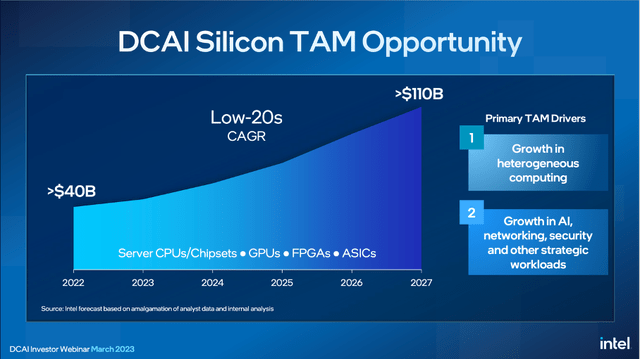

For the PC market, Geisinger is seeing supportive signs for a longer-term PC total addressable market of 300 million units. And while the PC market is expected to remain stable, Intel sees a huge market (and especially growth potential) for its “Data Center and AI” segment. The total addressable market is expected to grow from around $40 billion in 2022 to $110 billion in 2027 with two main drivers of growth: Heterogenous computing on the one side and growth in AI, networking, security, and other strategic workloads on the other side.

DCAI Business Update Presentation (Intel Investor Seminar)

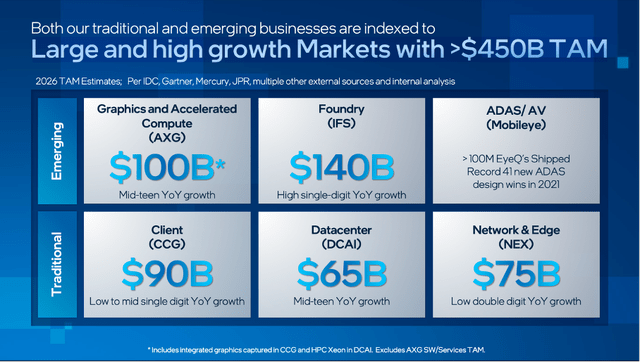

Of course, these two – Client Computing (CC) and Data Center and AI (DCAI) – are responsible for the biggest part of revenue and operating income (yes, not in the recent quarters) and therefore particularly important for Intel. But we should not forget Intel’s emerging business segments, which could be drivers of growth in the years to come. And during the last earnings call, Pat Geisinger also pointed out that the three emerging business segments are on track towards long-term growth:

In contrast, PSG, IFS, and Mobileye continue on a strong growth trajectory and we see the collection of these businesses in total growing year-on-year in calendar year ’23, much better than third-party expectations for a mid-single-digits decline in the semiconductor market ex-memory.

And aside from Mobileye, on which high growth expectations are relying, the IFS segment (Intel Foundry Service) could be one of the biggest contributors for revenue growth. It is also the segment mostly responsible for the extremely high capital expenditures. Intel has the goal to become the second biggest semiconductor foundry by 2030. Right now, the spot is held by Samsung with an annual revenue around $20 billion. Intel is seeing the total addressable market for its IFS segment around $140 billion in 2026.

Intel 2022 Investor Day Presentation

Of course, Intel must fight for market share as other companies will also try to get as much from this growing market as possible – and especially in the last few years Intel rather struggled to gain or keep market share. But Intel considers itself well positioned and it is claiming that it is delivering a broad and compelling portfolio.

Intrinsic Value Calculation

We can’t report a P/E ratio or a P/FCF ratio right now as Intel could neither report an earnings per share (only a loss) and also no positive free cash flow. And this is already a bad sign and should not happen for a great business with a wide economic moat around. At this point we can only use the non-GAAP earnings per share estimates for fiscal 2023, which are $0.42 right now to calculate a forward-P/E ratio. A forward P/E ratio of 74 however is anything but great. And so far, the earnings revision trend is still negative, and we are constantly seeing lower EPS estimates for the coming years – also not a great sign.

Intel: Earnings estimates trend (Seeking Alpha)

It is also worth pointing out that according to this data, Intel will generate a huge loss in 2023 and not $0.42 in earnings per share as written above (probably GAAP vs. non-GAAP assumptions).

In my last article, I calculated an intrinsic value of $60 for Intel and don’t see much reason to provide an update. Of course, this is rather an optimistic assumption – at least when looking at the results in the last few quarters and the expectations for the coming quarters – but when taking a long-term perspective, it seems reasonable (in my opinion).

Conclusion

In theory, Intel certainly has the potential for growth (to be more precise: high growth). Several of the markets Intel is operating in will most likely grow over the next ten years and Intel can profit from that underlying growth. Of course, Intel must gain (or at least hold) market shares as competitors will also try to profit from this growing market. But in my opinion, the long-term bet on its foundry services and investing heavily today might pay off in the years to come.

And when expecting Intel to return to previous revenue and free cash flow levels, the stock is really undervalued. To generate a 10% annual return for investors, Intel must generate about $12-13 billion in annual free cash flow. Looking at the last few quarters, $12 billion in FCF seems like an unreachable amount, but when looking at the last 10 years, such an amount is not only reasonable, but Intel should easily be able to exceed it – unless its growth strategy will fail completely.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.