Summary:

- A recent IDC report highlighted that conditions in the PC market have not improved in Q1 2023.

- As a result, Intel Corporation is likely going to report weak Q1 2023 earnings later this month. The EPS revision trend is already very negative.

- Investors must expect Intel to fully suspend its dividend in FY 2023 if conditions in the PC market don’t improve.

Justin Sullivan

Chip maker Intel Corporation (NASDAQ:INTC) may be facing renewed downside pressure on its valuation after new PC shipment information from International Data Corporation (“IDC”) showed that the PC market extended its slump in the first-quarter. With volume shipments crashing yet another quarter, is it likely that Intel will report a very poor Q1’23 earnings card later this month as well (expected April 27 post-market).

Considering IDC’s preliminary estimates about worldwide PC shipments in the first-quarter, I also expect Intel’s EPS estimates to continue to fall before the company releases its earnings. I also believe that Intel’s guidance risk for FY 2023 has significantly increased, and I would not rule out that the chip maker will have to suspend its dividend completely!

IDC report raises serious concerns about Intel’s operational execution in the first quarter

Intel is looking back at a terrible year in FY 2022 in which revenues declined 20% to $63.1B and net income 60% to $8B due to a broad slowdown in consumer demand after the COVID-19 pandemic. Slowing demand has led to weaker end-market prices, resulted in higher device inventories as well as lower volume shipments, a trend that really accelerated in the second half of FY 2022. There seems to be no indication yet, however, that this trend is easing: according to the report from IDC, preliminary PC shipments for the first quarter indicate that the PC market overall remains in a very weak condition… and as a major chipmaker, Intel will likely have experienced the full force of this downturn in Q1 2023.

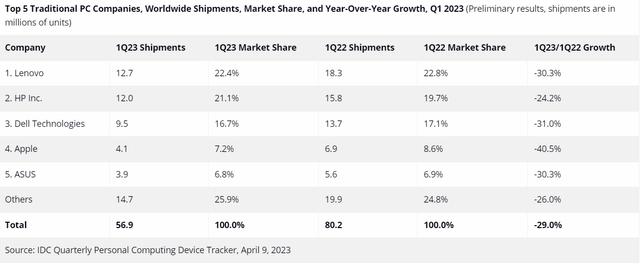

Total PC shipments in the first quarter declined a massive 29.0% compared to the same quarter in the year-earlier period. In the fourth quarter, also according to the IDC, worldwide PC shipments declined 28.1% year over year, so operating conditions in Q1’23 slightly deteriorated compared against an already very weak fourth quarter.

Apple Inc. (AAPL) is said to have seen the largest year-over-year decline in shipments with a more than 40% drop compared to the year-earlier period. However, the rapid decline in PC shipments has affected all major manufacturers as well with Asus, Lenovo, and Dell all seeing shipment drop-offs in excess of 30% in the first quarter.

The continual downturn in the PC market does not bode well for Intel’s core operating performance, especially in the Client Computing Group. This segment is responsible for about 50% of consolidated revenues, and Intel is likely, in my opinion, to disappoint mightily when it reports earnings later this month.

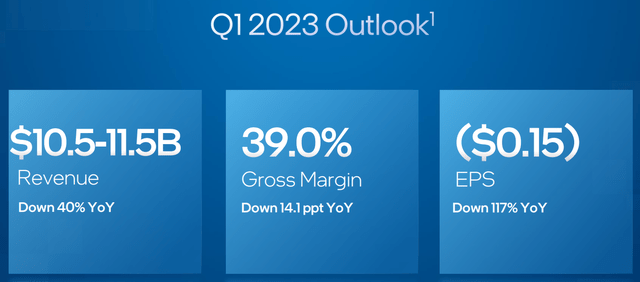

Although the chipmaker did not give full-year guidance for FY 2023 due to market and device shipment uncertainty, Intel’s outlook for Q1’23 was everything but great even before IDC’s preliminary estimates were reported. For Q1’23, Intel expects a 40% year-over-year decline in revenues and negative EPS.

EPS revision trend and valuation ahead of Intel’s Q1’23 earnings release

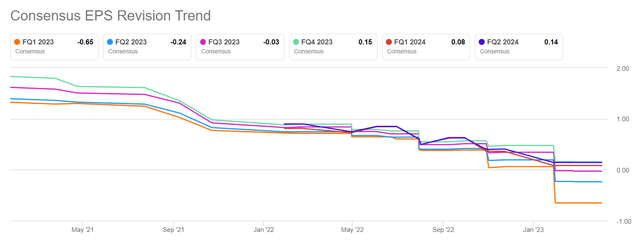

EPS estimates for Intel have trended down sharply in the second half of FY 2022, and continue to trend down. In the last 90 days, there were 29 downside EPS revisions compared to 0 upside revisions, and I believe after reading the IDC report on Q1’23 PC shipments, analysts have even more reason to downgrade Intel’s first-quarter EPS estimates ahead of the company’s earnings release. As mentioned, Intel is scheduled to report earnings for its fiscal first quarter later this month, on April 27, 2023.

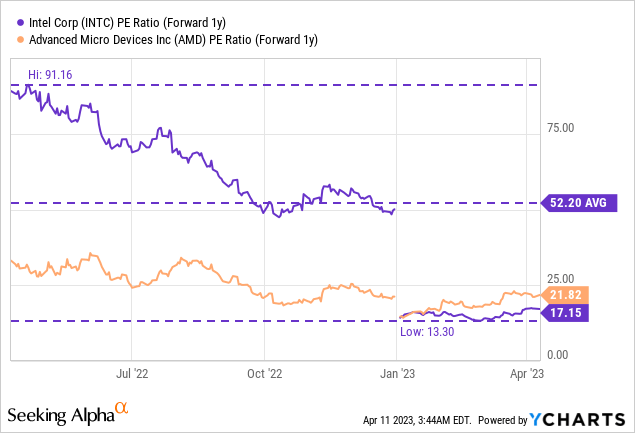

Based off of expected earnings for FY 2024, Intel may not be as cheap as the stock looks: the P/E ratio has reset to 17 X after the chipmaker disappointed the market with its FY 2022 results and announced it was adjusting its dividend payout. While other chip makers like Advanced Micro Devices, Inc. (AMD) have higher P/E ratios, I believe the risk/reward for Intel’s shares remains highly unfavorable in the short term due to the firm’s strong reliance on the consumer business (Client Computing Group)… and investors must expect the company to fully suspend its dividend payment if conditions in the PC market don’t improve in the near term. AMD has, and in my opinion deserves, a higher valuation than Intel because of the company’s strong momentum in Data Centers following the acquisition of Xilinx. AMD is also cashing in on the AI opportunity and the stock, in my opinion, is preferable to Intel despite a higher valuation multiplier.

Risks with Intel

I believe Intel has very few catalysts that could drive an upward re-valuation of its shares as long as the PC market remains in such a weak condition. The biggest risk that I see for Intel right now relates to the company’s dividend. Intel reset its dividend policy earlier this year and cut its dividend 66% in a bid to control cash flow and restructure its business. However, I believe it is entirely possible for Intel to completely suspend its dividend as long as the PC market hasn’t bottomed out. The dividend costs Intel approximately $520M each quarter, which is money that might be better spent on new product innovation and strengthening its Data Center business.

Final thoughts

Preliminary PC shipment figures for the first-quarter from IDC paint a bleak picture for Intel Corporation’s upcoming earnings release, which is expected for April 27, 2023. According to IDC figures, the PC market deteriorated further in Q1’23 due to weak consumer demand and high inventory levels in the industry as many consumers already upgraded their equipment during the COVID-19 pandemic. For Intel, this means that the earnings release for Q1’23 is likely going to be everything but great and the EPS revision trend confirms this. Additionally, the continual weakness of the PC market may result in Intel suspending its dividend altogether which may result in a retest of Intel’s lows. Since the risks seems to clearly outweigh the potential upside here, shares of Intel Corporation are best avoided before Q1’23 earnings!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.