Summary:

- Intel’s 2Q24 earnings caused a 26.1% drop in stock, missing guidance and cutting dividend.

- Panic selling of Intel stock not justified, oversold based on Relative Strength Index.

- Intel’s reorganization and cost cuts could lead to rebound, potential value unlock through separating businesses or divesting Intel Foundry.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA) released nasty 2Q24 earnings last week that delivered a serious blow to the company’s shareholders last week.

On Friday, Intel nose-dived 26.1% after investors, the worst drop in decades for the chip company. Intel missed quarterly guidance figures by a big margin, scrapped its dividend and said it would embark on a new round of cost cuts, furthering the perception that Intel will continue to struggle while NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) are both cashing in from burgeoning demand for graphics processing units.

With that said, though, the kind of panic selling we witnessed on Friday is not justified, in my view, and Intel has a good chance to see a rebound in its operations in due time.

While Intel’s reorganization will take more time and requires investors to be patient for longer, Intel’s stock is heavily oversold based on the Relative Strength Index, suggesting that investors are overly panicky.

My Rating History

I doubled down on Intel in April and I explained why in my article Intel: Poised For A Recovery (Upgrade) The main reason was that Intel was gearing up in the battle for graphics processing unit market share by finally launching the AI accelerator Gaudi®3 which was lauded as an H100 challenger.

The reorganization that is set to take place will see Intel reduce its spending, which should have a positive margin effect next year. From a technical perspective, Intel’s stock is also oversold and now seriously cheap.

Intel’s Terrible 2Q24 Creates Big Sell-Off

This quarter will not be remembered kindly by investors. Intel delivered a nightmarish earnings release for its 2Q that signaled persistent pain for the chip company. To add insult to injury: Intel’s problems come at a time when its peers in the data center market are smashing estimates and producing record results for their shareholders.

Intel is a bit of a different story, however, for a number of reasons.

First, Intel is trying to reinvent itself as an all-around chip company that does everything from dabbling in the data center market, to selling processors for gamers and is now seeking to transition into becoming a chip foundry. As such, Intel is set to compete against the likes of Samsung (OTCPK:SSNLF) or Taiwan Semiconductor Manufacturing Corporation (TSM). While there are good reasons to be foundry company, Intel’s multipronged strategy has led to some confusion among shareholders.

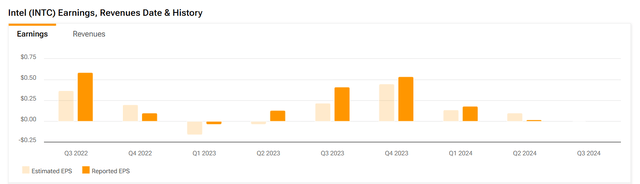

Intel widely missed profit estimates for the second quarter as it had only $0.02 per share, adjusted, in earnings in 2Q24. The market anticipated $0.10 per share. But this wasn’t even the worst: Intel’s sales actually fell QoQ, by 1% to $12.8 billion.

Earnings And Revenues (TipRanks)

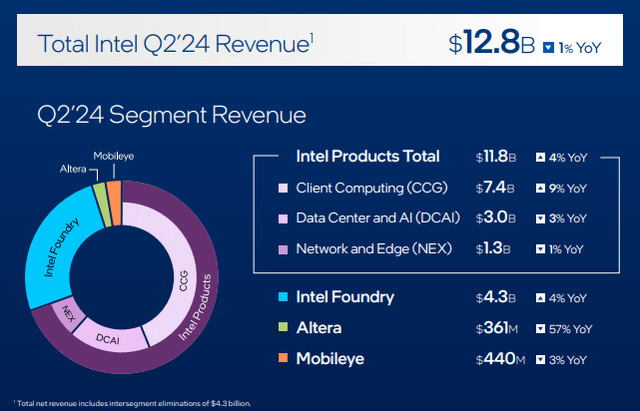

Intel Products, which include Client Computing, Data Center, AI, and Network/Edge, produced only 4% YoY growth and total sales of $11.8 billion.

AMD reported sales growth of 9% YoY for its second quarter, but a whopping 115% growth in data centers. Intel, however, barely made an impact with its data center business: It only produced 3% YoY growth and $3.0 billion in sales.

The forecast for 3Q24 was equally depressing, with Intel further lowering its sales expectations. Intel now anticipates $12.5-13.5 billion in sales, reflecting a decrease of $1.2 billion YoY.

Total Intel Q2-24 Revenue (Intel Corporation)

How Intel Could Potentially Unlock Value

Intel is running two businesses here that are kind of distinct from each other: The Intel Products Group, which includes Intel’s main businesses and the Intel Foundry segment.

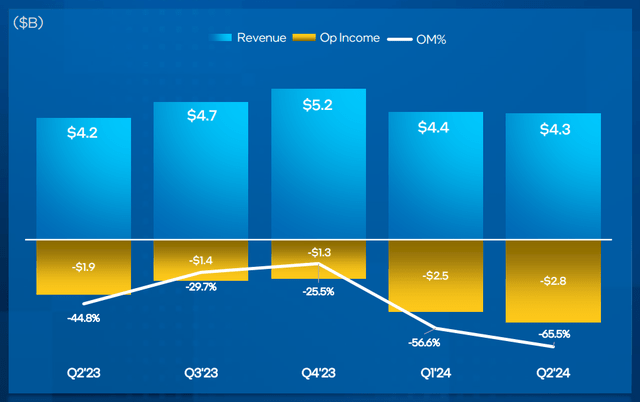

In the foundry business, Intel seeks to become independent of contract manufacturers, but building a competitive foundry platform is capital expensive. Intel Foundry is not surprisingly the segment that produces the biggest loss for Intel and has been responsible for the chip company missing profit estimates in 2Q24.

Intel Foundry lost $2.8 billion in operating income in the second quarter, which was the equivalent of the entire operating income in Intel’s Client Computing and Data Center segments.

Operating Income (Intel Corporation)

A way for Intel to unlock value here might be to separate its two main businesses, Intel Products and Intel Foundry, and possible spin off the latter. Large segment losses are nothing new for Intel Foundry, as total operating income losses in the last year totaled a whopping $8.0 billion.

A strategic divestment of Intel Foundry is also a potential escape hatch for the chip company and I could definitely see other companies in the sector, like TSMC or Samsung, being interested in acquiring foundry capacity.

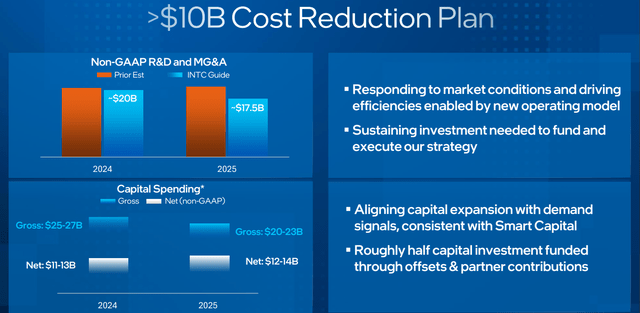

Furthermore, Intel, in the position it is in, is turning to cost cuts to save the day and aid its reorganization. Intel is planning to cut $10 billion in expenses and investment spending in 2025, which should provide a boost to margins and improve Intel’s operating income profile.

Cost Reduction Plan (Intel Corporation)

Technical Analysis

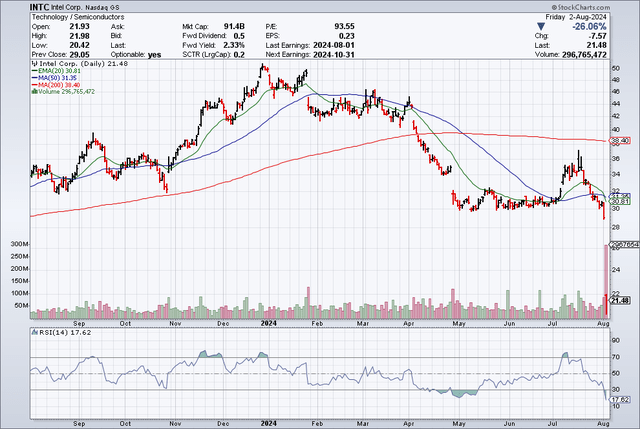

A big gap opened up after Intel’s 2Q24, and the short-term chart picture is distressingly bearish. The RSI, which is used as a sentiment indicator, has fallen to 17.60 which makes the stock extremely oversold and indicates that investors may overreact to Intel’s 2Q24 earnings.

Furthermore, even before 2Q24 earnings, Intel crashed through the 20-day and 50-day moving average lines (the 200-day moving average line was left way behind back in April 2024) which complicates the chart picture as well. In the short-term, sentiment alone will probably speak against an investment in Intel.

With that said, though, Intel should not be counted out of the game yet, and the chip company has moved swiftly to announce wide-ranging cost and capital expenditure realignments that are poised to have a positive margin effect next year.

Moving Averages (StockCharts.com)

Intel’s Valuation Is Extraordinarily Cheap

Intel has been lagging its peers in terms of GPU chip presence in the data center market and has been losing a lot of money in the Intel Foundry segment.

Foundries operate on a contract manufacturing basis for the most part and are extremely capital intensive, with the cost of modern chip manufacturing plants running in the billions. The easiest way for Intel to drastically and immediately improve its profit prospects would be to separate itself from Intel Foundry, which is a strategic option that management has at its disposal.

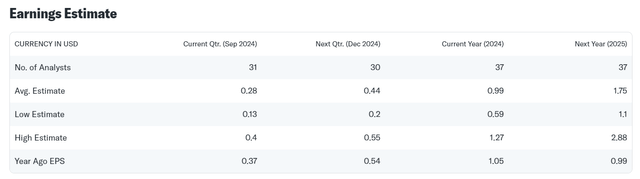

The market presently models $1.75 per share in profits for next year, reflecting 77% YoY profit growth. Taking into account Intel’s shockingly bad 2Q24, I think we are going to see some corrections here in the next couple of weeks and present estimates might not be reliable. I also think that Intel might not be in a particularly strong position to grow its profits at all next year.

Based on today’s estimates for next year, Intel is selling for a profit multiple of 12.3x. Advanced Micro Devices is selling for 26.7x next year’s profits and Nvidia for 31.3x. Both Advanced Micro Devices have a key advantage over Intel, which is their data center segments are seeing considerable upside growth momentum.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Pan Out

I was clearly mistaken in my last call on Intel, as I previously also bought the 52-week lows in Intel’s stock. In addition to obvious reorganization risks, Intel might see ongoing selling pressure in the short term as funds holding dividend-paying stocks will have to sell their Intel holdings.

A lack of a clear strategic action plan for Intel’s Foundry business might also weigh on Intel’s profit prospects, as would a failure to turn the chip company’s operating income situation around in 2025.

My Conclusion

The best time to come out as an aggressive buyer is at times when the market is panicking and investors are selling into the weakness.

Yes, Intel’s 2Q24 was bad in more ways than just one (weak guidance, poor results, steep profit miss, dividend cut), but the chip company is deeply oversold based on the Relative Strength Index and the stock is now selling at such a low profit multiple that there is actually a solid margin of safety embedded in Intel’s valuation.

The chip company also has options such as divesting of its loss-making Intel Foundry business. If it does so, and manages to grow its margins next year, Intel’s stock could be a winner.

Though Intel is now widely out of favor with investors, the best time to buy is, as the saying goes, exactly when the blood is flowing in the streets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.