Summary:

- Intel, with the United States government and EU help, is investing over $100 billion into semiconductor chip fabrication and aims to become 2nd to TSMC for chip production by 2030.

- Intel estimates that global semiconductor production will double by 2030. $15 billion worth of semiconductor business has signed on with Intel by large names such as Microsoft.

- Concerning GPUs, Intel is readying a new GPU called “Battlemage”.

- If Intel sticks with GPUs for several generations and many years, it could bring some limited pain to Nvidia. Yet, rumors whisper of Nvidia and Intel working together.

- Intel is currently a turnaround story and unloved and undervalued in our opinion. We view them as a long-term buy.

Robert Way

Some time back, I wrote about Intel (NASDAQ:INTC) and its discrete GPU effort called Arc. I was very impressed that Intel actually had the fortitude to wade into the discrete graphics market to face GPU titan Nvidia (NVDA) and to a much lesser extent AMD (AMD). In this article, we will explore how Arc did and then take a guess as to what GPU generation #2 from Intel called “Battlemage” might bring. Could it bring some actual competition to the GPU market? We are also going to explore Intel’s foundry program in the context of GPU’s and producing other companies’ semiconductors. Think of this as two parallel ideas feeding off of each other.

I Was There Gandalf; I Was There Three Thousand Years Ago

I was around when the first discrete GPUs arrived. It was an exciting time. 3DFX was the absolute leader with its SLI technology, which linked two graphics cards together. Other contenders arrived too such as ATI (which AMD later bought), S3, Matrox, and a small company called Nvidia. Quickly many fell to their wayside and only 3 were left that really could fight it out (3DFX, ATI, and Nvidia). Intel was, of course, around making integrated graphics that no gamer really wanted. The competition was good and innovation was fast back in those days. Now things seem a bit sluggish on the innovation side. Frankly, Nvidia does not have any real competition, and this is evident when you look at discrete GPU market share.

The State of The GPU Union

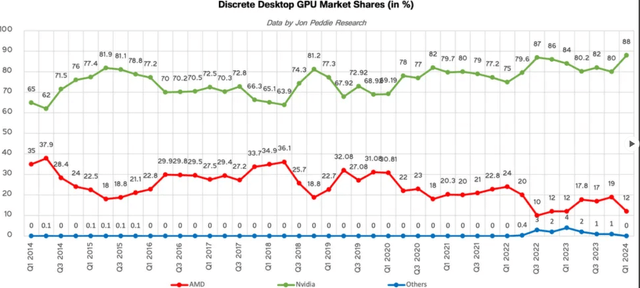

Looking at the GPU market per JPR via Tomshardware, we see Nvidia commanding 88% of the consumer discrete GPU market, while AMD sports a mere 12% and Intel has nothing to report.

Nvidia Dominance (JPL data per Tomshardware)

Here is what Tomshardware had to say as of June 6th, 2024:

Nvidia solidified its dominance with an 88% market share, growing by a whopping 8% from the previous quarter. Shipments of Nvidia’s GPUs for desktops totaled 7.66 million units, up from 7.6 million in Q4 2023 and around 5.26 million in Q1 2023.

By contrast, AMD saw a 7% decrease in market share quarter-over-quarter but a modest increase in its yearly market share as the company’s shipments fell by 41% from the previous quarter, but rose by 39% compared to the previous year. The company shipped around 1.04 million desktop discrete GPUs in Q1 2024, down from 1.81 million in the previous quarter and up from 0.75 million in the same quarter a year ago.”

Looking at the above graphic, we can see that Intel’s GPU called Ark took 4% market share at one point. Granted, Ark had a lot of growing pains but it still gives one hope that a 3rd contender could enter the GPU market and offer true competition eventually.

The Importance Of Drivers

I run a mixture of GPU’s. I own an AMD 6700 XT, an AMD 6650, and lastly an Nvidia 3060 Ti. The only reason I bought the Nvidia card was because AMD put out a new driver that broke a remastered game called “Command & Conquer: Red Alert”. I contacted EA and AMD about this and nothing was done. Gamers that played this game were forced to go to team Nvidia. It is small things like this that give AMD a reputation for questionable drivers in some games. I realize this is a rare example and so far, no other game I own suffers from problems, yet this is one of a multitude of reasons why AMD only commands 12% market share in my view. The rest were decisions by AMD to prioritize funding the CPU division and the console division. These were correct decisions, but it does not make it any less painful. Hopefully, AMD can restructure the GPU division and put out products that can clawback market share. I am skeptical AMD can do it, but I hope they can. Meanwhile, I look at Intel and I think “What if”?

Could Intel Bring the Pain To Nvidia?

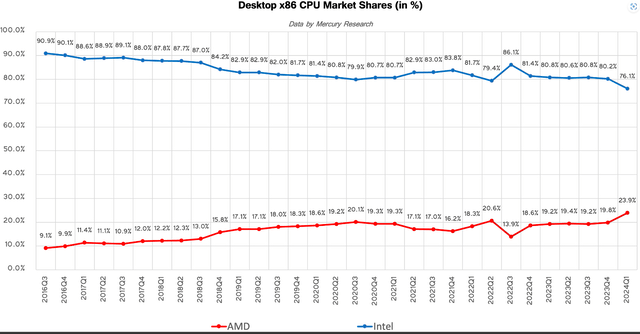

I think it is a possibility but it is going to take a lot of time. Much like it took AMD years to claw back market share in the CPU market, it could take Intel several years and several generations of GPU’s to obtain a respectable market share and bring some pain to Nvidia. Per AnandTech we can see how long it took AMD to win over some x86 CPU market share:

AMD vs Intel CPU Market Share (Anandtech)

The Foundation To Beating Nvidia

Intel has one key advantage and it comes back to Intel owning its own chip fabrication plants. Fabs require obscene outlays of capital to keep them competitive and cutting edge but Intel owning its own fabs gives them an edge per vertical integration. What I find most interesting though is the Federal government is pushing tens of billions to various chip producers in a bid to diversify chip production away from Taiwan. TSMC (TSM) is working on a fab in Arizona but they have also stated that cutting-edge fab tech will remain in Taiwan.

China, Taiwan and Geopolitical Risk Of Fabs

As I have often commented, China and the U.S. are in a cold war of sorts, at least in my opinion. Of course, some of my friends will disagree with me and that is fine. Many will say that China will not do anything to disrupt economics and trade. That could be true. It may not be true. If you read the writings of the Chinese, they are patient, if anything. Taiwan is a generational problem from the Chinese view point. Thus, at some unknown future point in time, it is possible this issue of forced reunification comes into play. Thus, the U.S. is in the process of improving supply chains, be it critical minerals or improving domestic chip production. Which brings us back to domestic fabs and semiconductor chip production.

Real Men Have Fabs

Intel, running its own fabs, arguably gives it an advantage over fabless companies. Now fabless companies have been pushed in the media for ages as superior, but as AMD founder Jerry Sanders said “Real men have fabs.” I think this quote has some truth to it as owning a fab is a form of vertical integration and secures the supply chain for Intel.

On the flip side, fabs require obscene amounts of capital to keep them cutting edge (or near cutting edge). One might argue that going fabless frees up capital so a company can focus on design rather than design and manufacturing. I think either way can work, of course, and that is evidenced by Intel and Nvidia both being successful companies. Yet if Intel can grow its customer list and increase chip fabrication volume, we might see a future situation where Intel has so much fabrication volume it reduces costs of keeping them up and gives Intel a further cost advantage in producing its own x86 and GPU chips.

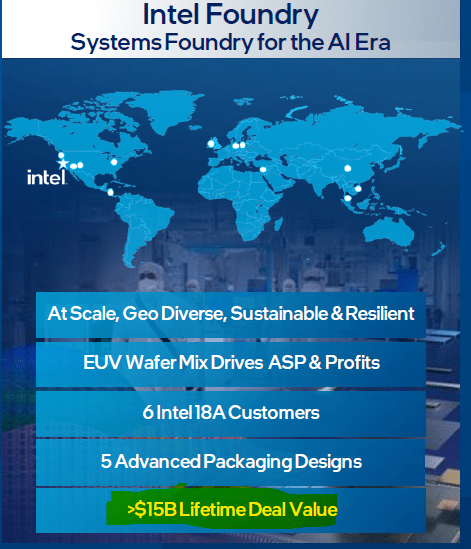

Intel Wins Foundry Business

We are already seeing Intel win some business that amounts to $15 billion so far. Some of this comes from Microsoft (MSFT) and its plans to use Intel foundry for its next semiconductor chip and they are not alone. Intel also has signed up:

U.S. Department of Defense – For an unknown chip.

Ericsson (ERIC)- For a data center chip.

Amazon (AMZN) – Data center system-in-packages for AWS.

Faraday – An ARM (ARM) based chip.

$15 Billion Deal (Intel)

Global Semiconductor Market To Double In 5 Years

On June the 4th, 2024, Intel announced that Apollo Funds invested $11 billion to acquire a 49% equity interest in a JV for Intel’s Fab 34 in Ireland. It is a rather interesting move as it will allow Intel to reinvest in its fabs across the world. It might cost Intel a little in the long term, but right now, the focus is getting the Fab business profitable and expanding it. The below comments from Intel’s CFO David Zinsner were rather interesting.

Intel’s agreement with Apollo gives us additional flexibility to execute our strategy as we invest to create the world’s most resilient and sustainable semiconductor supply chain. Our investments in leading-edge capacity in the U.S. and Europe will be critical to meet the growing demand for silicon, with the global semiconductor market poised to double over the next five years.” – Source: Intel.com

Now, isn’t that riveting? The CFO of Intel thinks the semiconductor market is going to double in 5 years. That bodes well for the Fab strategy if Intel can execute. With $11 billion from Apollo Funds this could be a start.

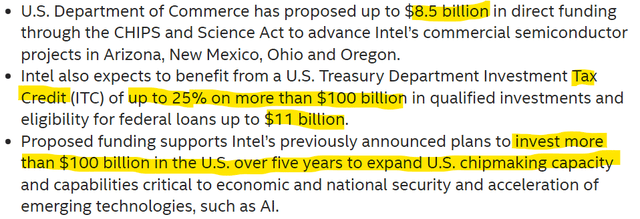

Intel Is Investing $100 Billion In Fabs

Reading over an Intel PR from March 20th, 2024 we see the following quote below. That is a massive commitment to regain fab standing.

$100 Billion Investment By Intel (Intel) |

A Long-Term View of Intel and GPU

All of the above brings us back to Intel and GPUs. Imagine a future where Intel fabs cost is offset by customers. Just imagine Intel as being equal or near equal to TSMC in the future. Mix in several generations of GPUs from Intel. Ponder market share growing and AMD also being forced to ramp up investments in GPUs. We could see a future situation where Nvidia commands a far lower market share from its current 88%. Could it be less than 50%? If we pull up historical charts from the old days of Nvidia vs ATI it was about 50 / 50. Mix in 3 contenders and a lot of time, and who knows. It really just depends on how determined Intel is to bring competition back to the GPU market and how AMD responds too.

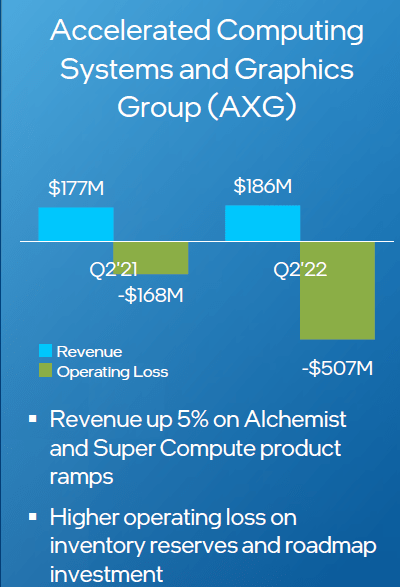

In the short term, I have read that Intel is going to use TSMC for its GPU fabrication. If Intel could get its foundry up to speed, then maybe at some future date they could produce GPU’s in house and cut costs. Yet, Intel has to be committed to this GPU path. Looking over the Q2, 2021 and Q2, 2022 numbers from the now not reported AXG (graphics) group, we see back in those days graphics was a losing proposition. Again, Intel is going to have to do some soul searching and determine if they want to get serious about GPUs and execute on proper timetables, with mature drivers, and superior price points. We can see in the below graphic that Intel was losing money in graphic before they merged that group and stopped reporting them alone.

Graphics Bleeding in 2022 (Intel)

The Risk To Intel

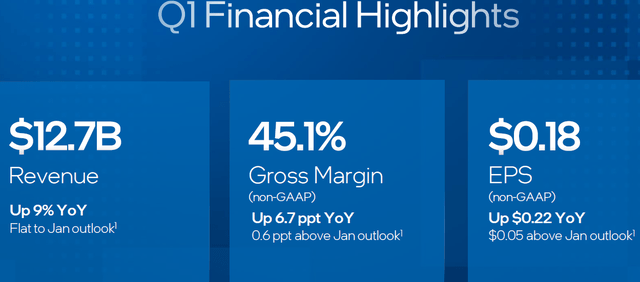

The biggest risk is obviously that Intel fails at improving Fab nodes while the competition such as TSMC keeps pressing forward. The GPU effort could fail as well and if that happens then Intel could remain a sleepy unloved stock. Yet, from a financial perspective, they appear to be turning things around.

Intel Financial Highlights (Intel)

Rumors Of Nvidia Joining Forces With Intel

I was also pondering that maybe Nvidia works with Intel. It appears that Nvidia’s CEO Jensen Huang (back in 2022) was thinking that more foundry options is a good thing and it is. I would not want the bulk of my manufacturing tied into one source. It would be better from a pricing standpoint to have additional competition. Per Reuters from March 2022 we see:

“They’re interested in us using their foundries. We’re very interested in exploring it,” Huang said. But he added that foundry discussions take a long time as it’s about integrating supply chains.”

Intel CEO Pat Gelsinger told Reuters after a U.S. Senate hearing on Wednesday that his company is:

“Thrilled for their interest in using our foundry capabilities.” He said he had “No particular timeline.”

Now 2022 was some time back but we also see chatter from 2024 per a Tomshardware interview with Stu Pann, head of Intel Foundry:

Paul Alcorn: Can you address the persistent rumors that IFS is doing packaging work with Nvidia, or for Nvidia?

Stu Pann: I can’t. I am aware of the rumor. In this business, especially now, our customers are asking for confidentiality; they don’t want to disclose. They will decide when and where they want to disclose and what they’ll disclose. I’m not speaking with Nvidia in mind, but just generically – all the customers feel that way. When they’re ready to talk, they will talk, and they will let us know when they’re going to talk. I would love to be more visible, but I also have to respect what they want.

Now how does that all play out if Intel reenters the GPU market? Would Nvidia really use Intel if Intel were in the GPU market? Frankly, I do not know, so just consider it a wild card.

Conclusion

Could Intel bring some pain to Nvidia in the GPU segment? Yes, I think so if they were to deeply commit for years and many product generations. They might even consider a JV with AMD concerning graphics to combat Nvidia. As strange as it seems some years back Intel and AMD did pair up for a CPU project, but conversely, we might see Nvidia team up with Intel’s foundry service. As foundry increases in internal and external semiconductor volume, this will help offset costs. With the Federal government supporting domestic semiconductor production, I view Intel as a good long-term play that one can sell covered calls against to generate income while they wait for the company to execute its foundry strategy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.