Summary:

- Intel’s stock is down nearly 50% in the last year, and a new CEO is essential to restore investor confidence and drive a turnaround.

- Historical examples like Starbucks and GM show that new leadership can successfully revive struggling companies by shedding underperforming assets and focusing on core strengths.

- Intel should trim its bloated workforce, focus on its star products, and invest in new technologies and start-ups to drive future growth.

- Intel’s attractive valuation, potential positive impact from Trump’s policies, and developments in AI make it a compelling buy right now.

Kelvin Murray

Thesis Summary

Intel Corporation’s (NASDAQ:INTC) Pat Gelsinger is leaving, and the board is looking for his replacement as we speak.

Intel’s stock is down nearly 50% in the last year, and the company desperately needs a new vision in order to restore investor confidence.

A new CEO is the right step in the right direction. But is it enough?

In this article, I review past instances where new CEOs have managed to pull off epic turnarounds. I’ll then lay out the path Intel could take in order to reform its business and excel again.

Ultimately, at this price, both Intel and investors have little to lose, and I think this is a stock worth owning.

In my last article, I highlighted three reasons you might want to buy Intel but remained cautious with a Hold rating. However, we can now add a couple more reasons to buy, and I see a path of redemption for Intel, which is why I am upgrading to a Buy.

Can One Man Make A Difference?

That’s what everyone is wondering, as Pat Gelsinger has finally been ousted by the board, which has been dissatisfied with his ambitious turnaround plan.

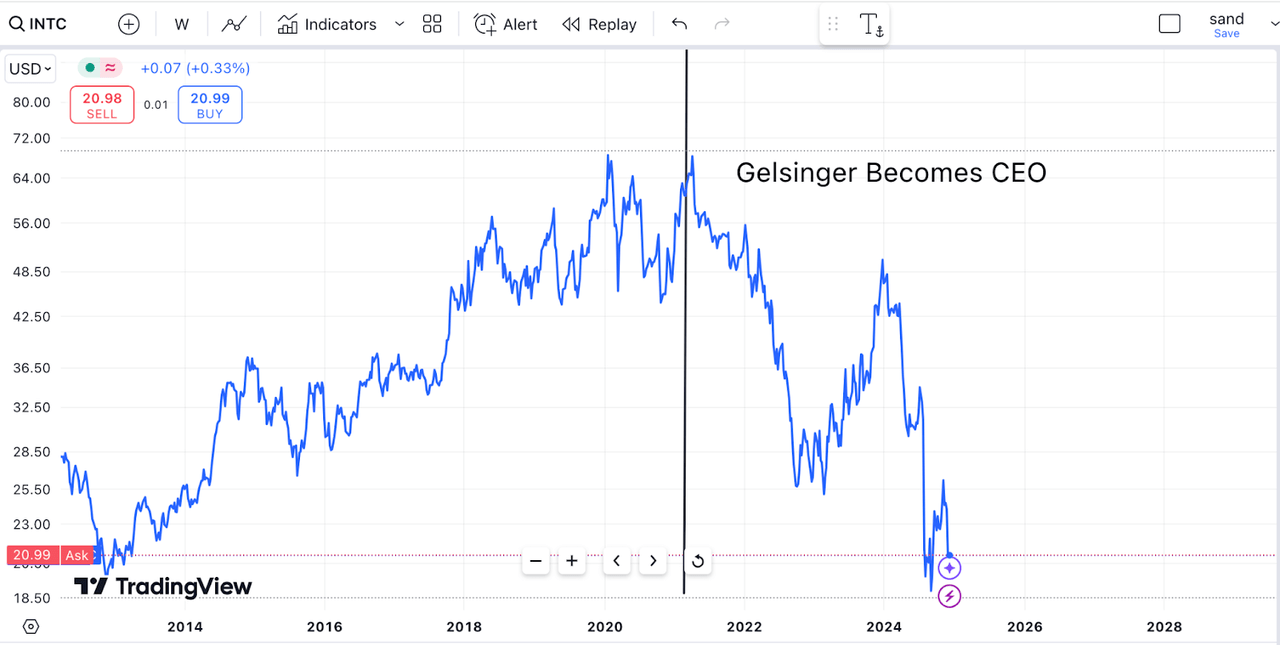

Intel price chart (TV)

Gelsinger took over as CEO back in February 2021. Interestingly, this was just around the peak in Intel’s stock.

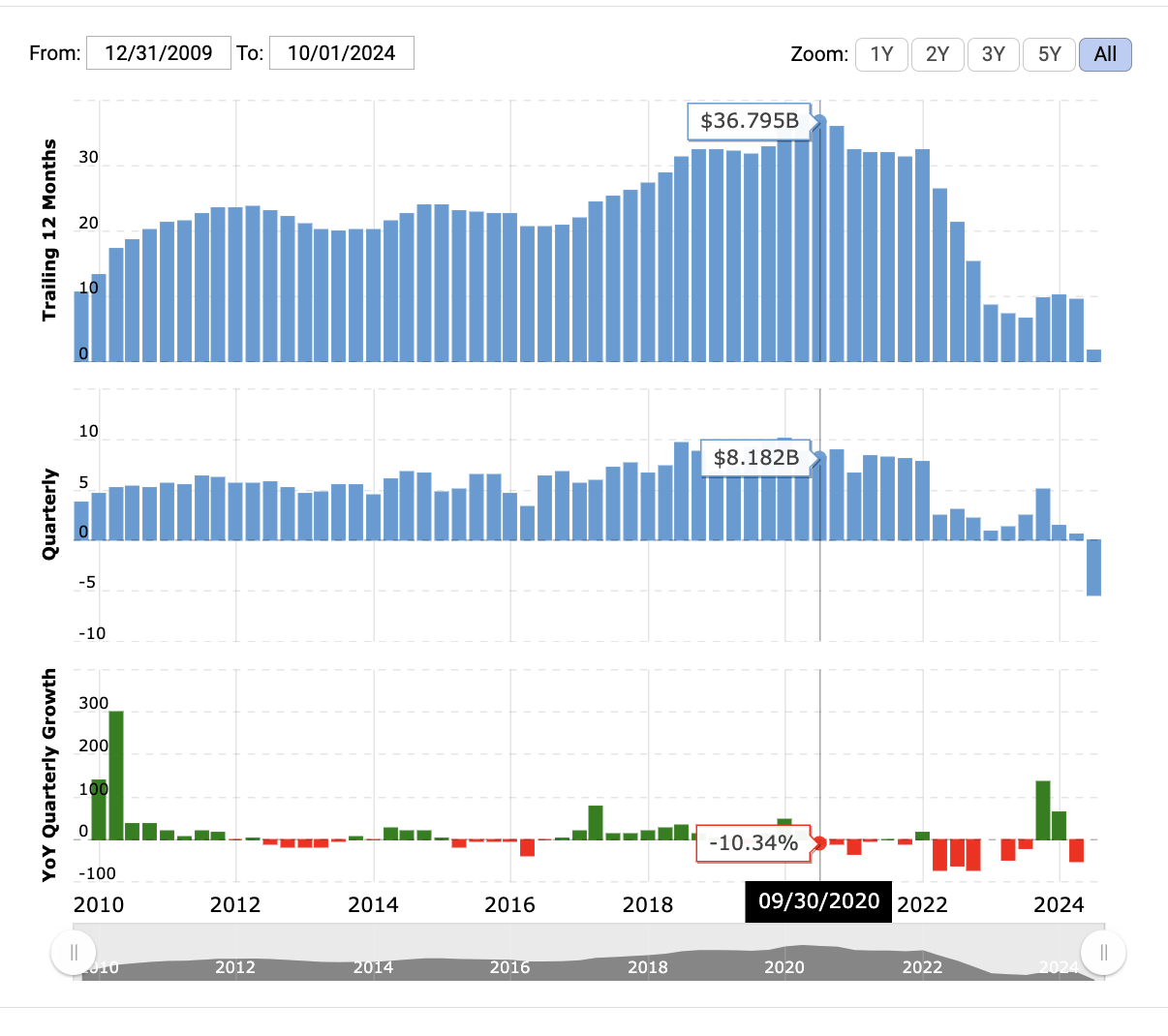

Since he took over, the stock has fallen over 50%. 2021 was around the time Intel’s revenues and earnings peaked too. We can see below the performance of EBITDA.

Intel EBITDA (Macrotrends)

But what happened to Intel can’t all be blamed on Gelsinger. For years prior Intel had been losing market share and falling behind on R&D.

Can One Man Change This?

One man can make a big difference in an organization, and a fresh CEO is definitely the right place to start.

There have been numerous occasions before where new CEOs have turned around failing public companies.

Howard Schultz, for example, famously took over Starbucks Corporation (SBUX) in 2008, after leaving in 2000. The stock had fallen 42%, but Schultz stepped in by closing underperforming locations and re-arranging the stores to enhance the smell of coffee. Starbucks stock more than doubled the following year.

Another great example of the change leadership can make is that of General Motors Company (GM) and Mary Barra, who took over the company as it was filing for bankruptcy. Barra’s early investments in Lyft and other key investments set the stage for GM’s comeback.

With that said, what would Intel’s recovery look like going forward?

What Intel Really Needs

Intel’s new focus has to be on shedding off underperforming assets, setting realistic goals and achieving them in order to recover investor confidence, and aggressively expand into new growth areas.

Intel can learn a lot from the turnaround executed by Starbucks, GM and even Twitter.

Lean And Mean

Through the years, Intel has become a large and bloated corporation, something which is hard to avoid.

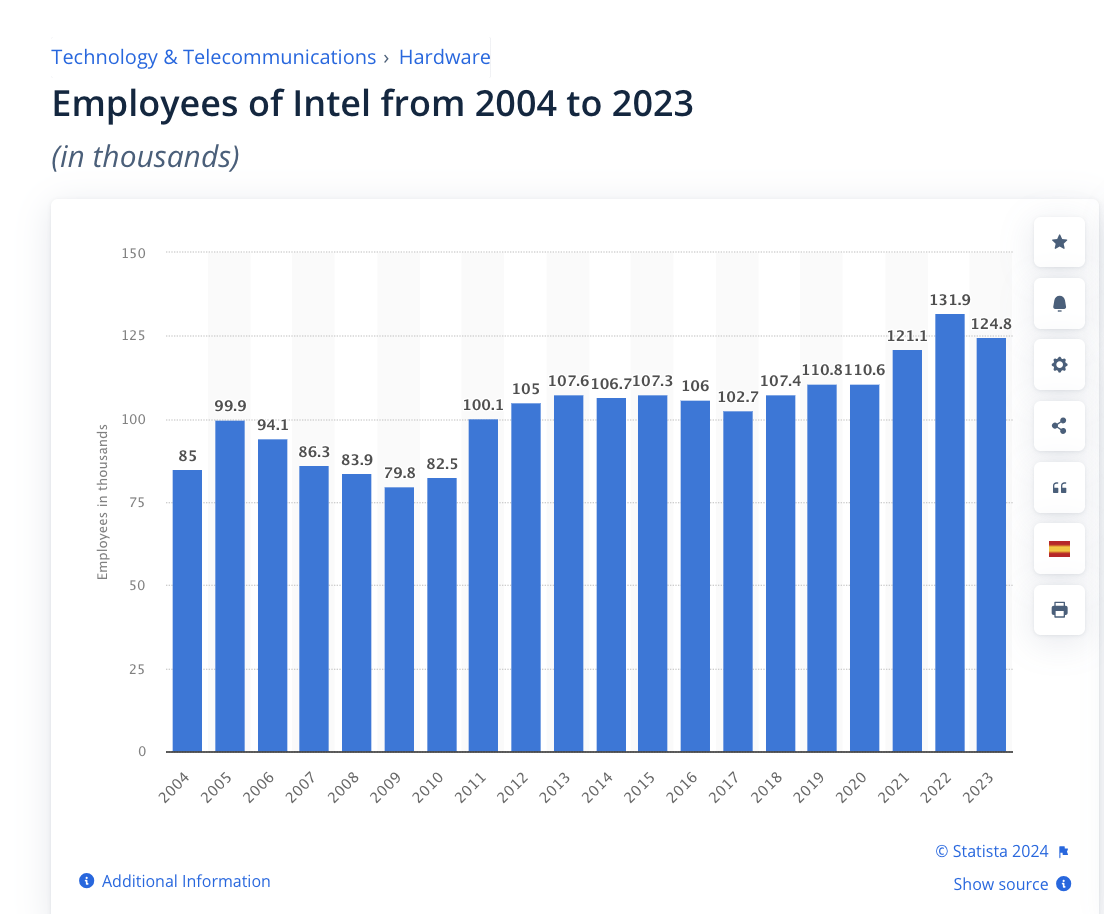

Intel headcount (Statista)

Even though revenues peaked in 2021 the headcount kept going up, and has only recently started descending.

This is the perfect time for Intel to execute a Musk-like reduction of headcount. Elon famously cut back 75% of Twitter’s workforce when he took over. This may be a bit ambitious for Intel, but I’m sure there’s plenty of fat there to trim.

18A And Fab Production

Intel’s focus should now be on its “star” products, and like Starbucks, should close down its underperforming locations.

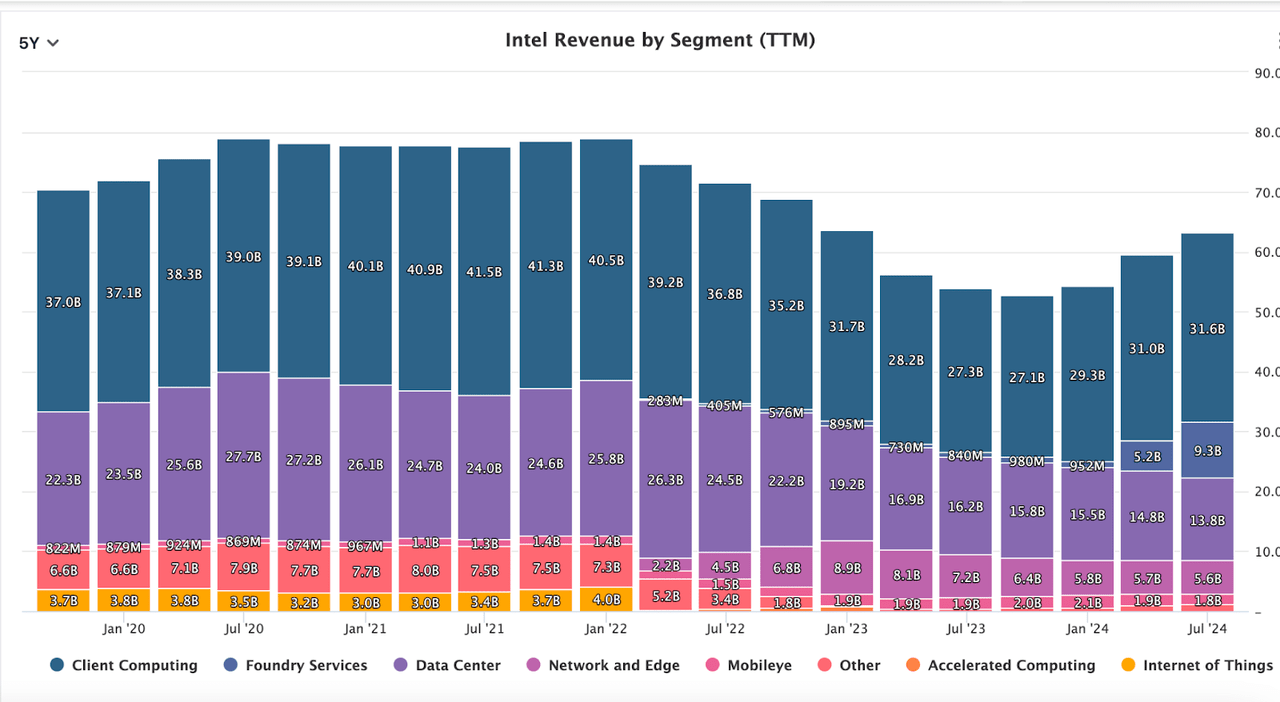

Intel Revenue by segment (Stock Analysis)

In this regard, Intel has to now focus on the segments it excels at.

Client computing took a big hit in 2022 but has seen a swift recovery. With the 18A showing promise, this is where Intel should focus its efforts.

And then we have the new Fab business. Beyond this, Intel should look to shed the fat wherever possible.

New And Exciting Investments

Where Intel can’t compete directly, it’s important that the company invest in new technologies and start-ups, just like GM has done. The company may lack the vision, but it can put their vast resources into the right hands. With the right investments, this could really add revenues to Intel’s bottom line over the next few years, especially as things in the AI market heat up.

I think Intel did a good job with Mobileye, and it should seek more investments like this.

Is Intel A Buy Right Now?

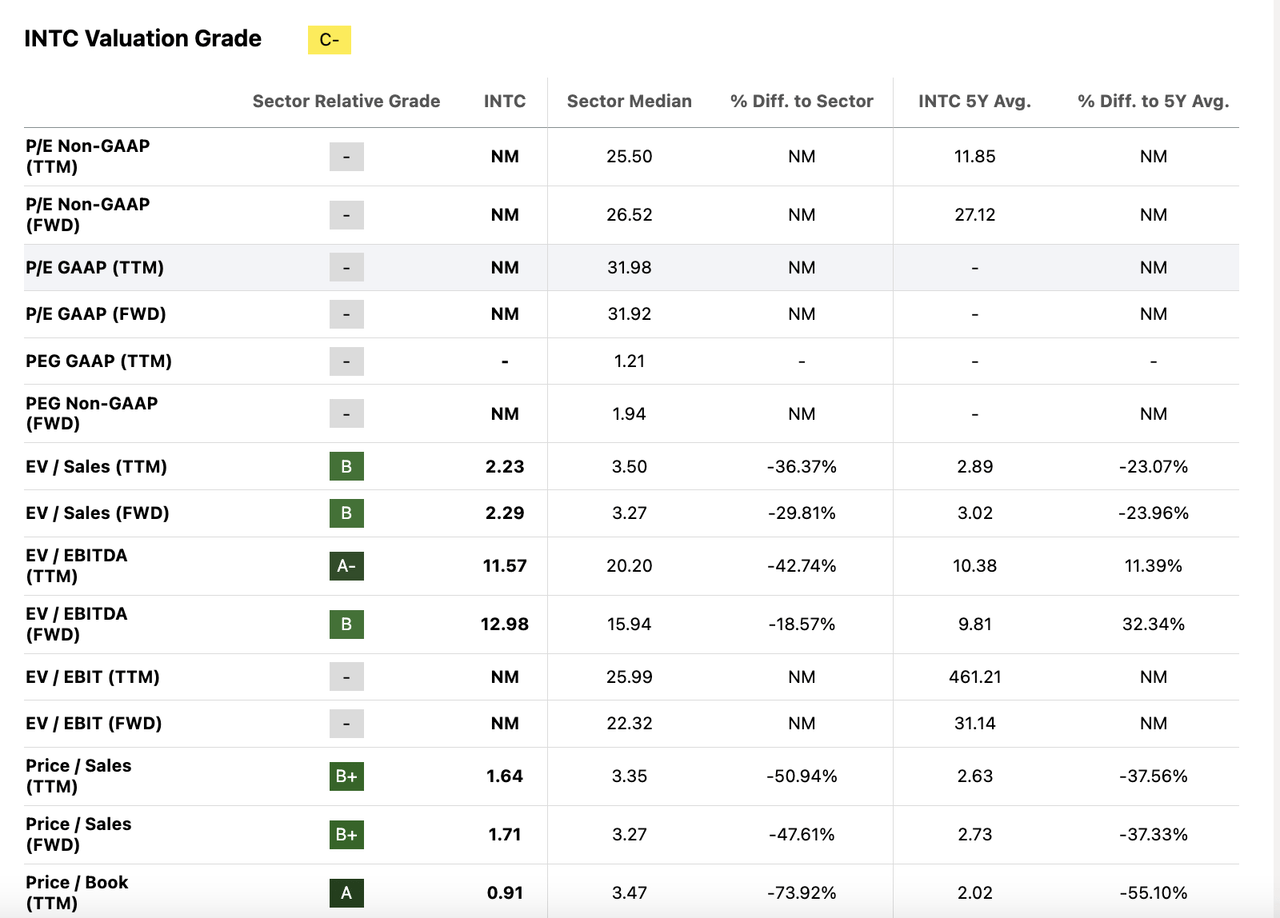

I highlighted Intel’s attractive valuation in my last article, and it continues to be just as cheap.

INTC valuation (SA)

The stock still trades below book value, which will rapidly change once cash flows return.

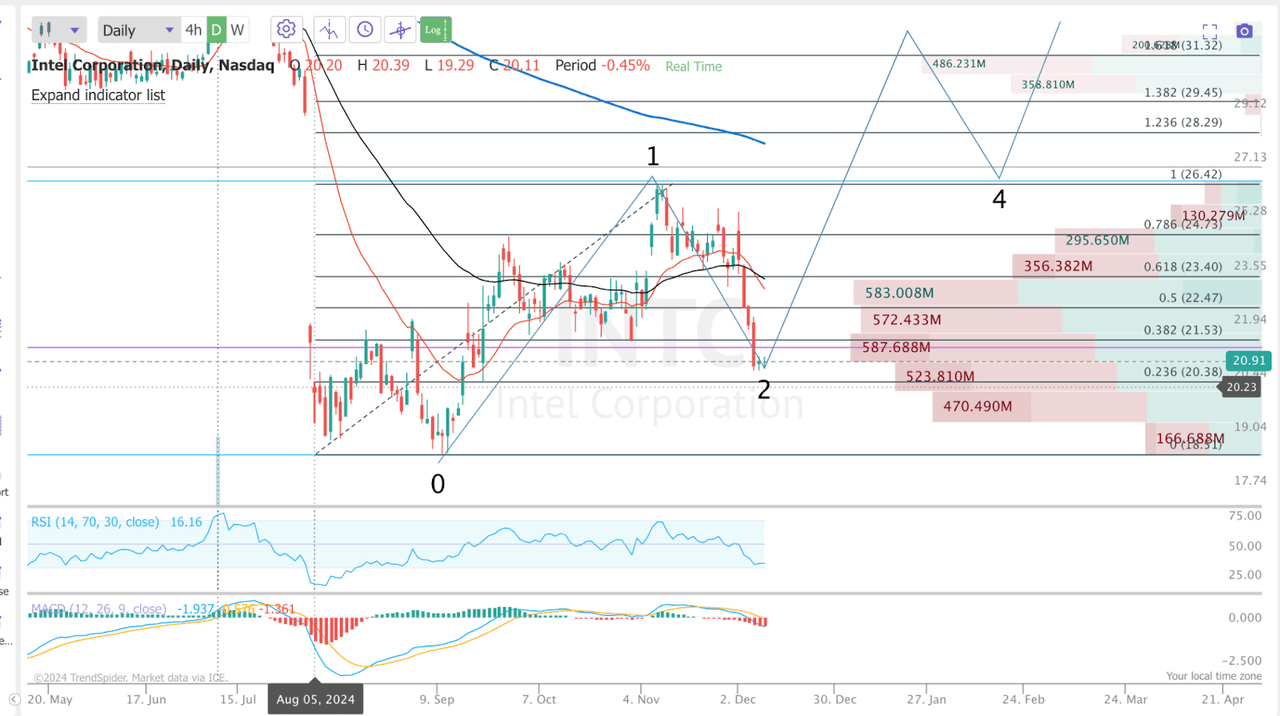

The technical outlook also supports a buy here.

INTC TA (Trendspider)

After an initial move-up, we are now finding support at the 78.6% retracement level, just above $20. This is an ideal 1-2 set-up in EW that could be followed by a strong wave 3 rally.

More importantly, though there are two more reasons Intel is a buy right now.

Firstly, I believe Trump coming into office will be an overall positive tailwind for Intel. The stock has positioned itself as a national champion, and Trump’s agenda of re-industrializing America and reducing Chinese dependency falls right into Intel’s development plan.

Secondly, we’ve also seen further developments in AI in the last month, which bode well for overall semiconductor demand. Meta Platforms, Inc.’s (META) recently launched Llama, which has a dramatically higher cost efficiency. Amazon.com, Inc. (AMZN) has also doubled down on AI.

Final Thoughts

A situation like Intel’s doesn’t happen often, and this could be a great opportunity for investors. With the right leadership, Intel could make a dramatic turnaround. The stock price, in my opinion, doesn’t reflect the potential upside currently, but it will soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Macro moves markets, and this is what I do at The Pragmatic Investor

Join today and enjoy:

– Weekly Macro Newsletter

– Access to our Portfolio

– Deep dive reports on stocks.

– Regular news updates

Start your free trial right now!